Local weather-tech VC Satgana has reached a ultimate shut of its first fund, which targets to again as much as 30 early-stage startups in Africa and Europe.

The VC agency reached a ultimate shut of £8 million ($8.6 million) following commitments from household workplaces and high-net-worth people, together with Maurice Lévy of the Publicis Groupe, and Again Market co-founder Thibaud Hug de Larauze.

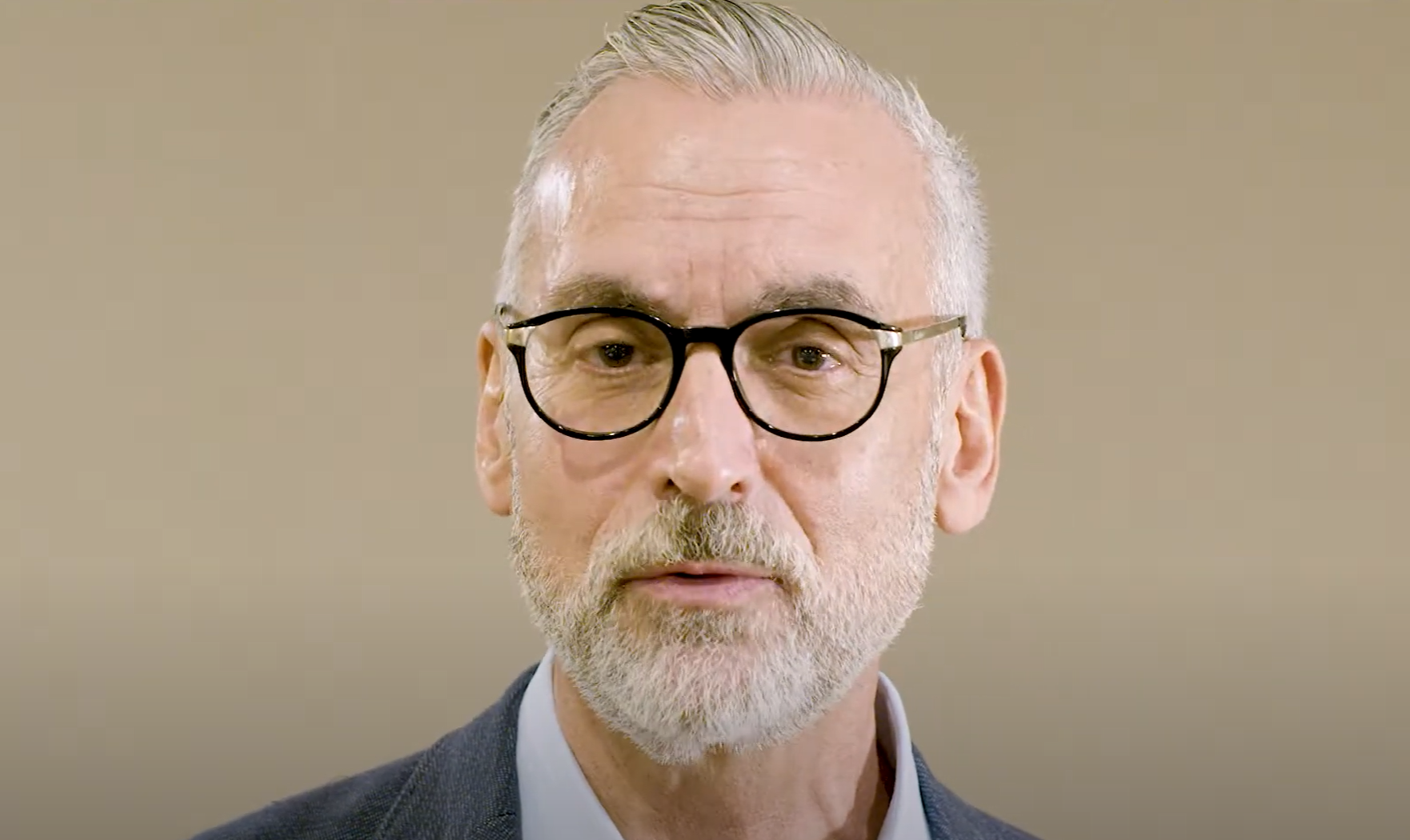

Satgana founder and Common Accomplice, Romain Diaz, instructed TechCrunch that the agency determined to shut the fund early and under the initial target owing to the troublesome fundraising atmosphere, which is worse for first-time fund managers, and to concentrate on investing and supporting portfolio corporations.

“We launched the fund mid-2022, and we have raised in the most challenging time since 2015. We have managed to make 13 investments and we know that with the current capital commitments, we can execute upon our strategy of investing in 30 companies in this first fund, including follow-on investments,” mentioned Diaz.

“This also paves the way for a new fund in a few years, and it’s likely that we launch different funds with different strategies, maybe one for Europe and another for Africa – but that will come in later; for now, we are really focused on getting this fund right,” he mentioned.

The VC agency invests as much as €300,000 ($325,000) in early-stage startups engaged on mitigating and constructing resilience to local weather change, with a bias for mobility, meals and agriculture, vitality, business, buildings and the round economic system sub-sectors.

Its investees in Africa embody Amini, a startup bridging the environmental knowledge hole in Africa, Mazi Mobility, a Kenyan mobility-as-a-service startup working to develop a community of battery-swapping infrastructure; Kubik, which upcycles plastic and has operations in Ethiopia; and Revivo, a B2B market promoting digital spare elements giving merchandise like telephones a brand new lease of life. In Europe, Satgana has invested in Insurgent Tech, Orbio Earth, Yeasty, Loewi, Arda, Fullsoon and Fermify.

Diaz based the VC agency after a decade of expertise within the enterprise area in a number of African nations together with Morocco and South Africa, the place he co-founded and ran a enterprise studio.

“I ran it for like five years, and about six years ago I started to really have the awakening to the extent of climate change. That’s where I decided to channel all the knowledge from my previous experience, but on a bigger scale, while focusing solely on investing in climate tech founders,” he mentioned.

Diaz launched the VC agency upon shifting to Europe, the place he mentioned there are ample funding networks, particularly these centered on investments concentrating on founders on the pre-seed stage.

Satgana’s concentrate on Africa was additionally pushed by the very fact that it’s the most susceptible continent regardless of contributing the least greenhouse fuel emissions. They just lately appointed Anil Maguru as partner to drive their Africa technique.

“We are entering the continent to pursue green growth objectives; so deploying renewable energy, low carbon buildings, mobility solutions and so on. But we are also keen on investments driving adaptation to climate change, because unfortunately, the reality is that climate change is upon us, and we require solutions already. This is especially for people on the frontline, who are often vulnerable communities, mainly women, people of color and low-income communities that are more exposed to the effects of climate change,” mentioned Diaz.

“From an impact perspective, it’s important for us to invest in solutions, which [traditionally] receive only a tiny fraction of VC money,” he mentioned.

Satgana is among the many new funds which might be devoted to the African local weather tech sector. These funds embody Africa People + Planet Fund by Novastar Ventures, Equator’s fund and the Catalyst Fund.