Ken Ishii/Getty Pictures Information

With Japan aggressively increasing its navy funds to counter threats from China, Taiwan, North Korea, and Russia, I imagine Lockheed Martin (NYSE:LMT) is completely positioned to capitalize on over $8 billion in new protection contracts. I’m bullish on Lockheed inventory as these geopolitical tensions escalate, and I imagine there’s extra upside to its inventory worth than present estimates suggest.

For these causes, I price Lockheed Martin as a compelling “Buy” in mild of those developments, and I imagine that the perfect is but to return for long-term buyers.

Japan’s Protection Coverage Shift

Japan’s authorities has accredited a record defense budget of seven.95 trillion yen ($55.9 billion) for 2024, representing a considerable 16.5% improve from the present fiscal yr. This marks the tenth consecutive yr of elevated protection spending and is a part of Japan’s complete Protection Buildup Program, which outlines an expansive $302 billion in protection expenditure over the 5 years via FY2027.

This important improve in protection spending is pushed largely by Japan’s issues over the area’s increasingly volatile atmosphere, significantly in mild of the navy actions and assertive postures of China, North Korea, and Russia. This protection funds addresses what Tokyo perceives as “the most severe and complex security situation since the end of World War II.”

Japan’s major safety focus, as outlined in its 2023 protection whitepaper, facilities on China’s place relating to Taiwan. Being a significant non-NATO ally of the US, Japan is anticipated to be a crucial player in the defense of Taiwan within the occasion of a battle, doubtlessly as a part of a US-led coalition that might additionally embody the Philippines and different allies. Attributable to Japan’s proximity to Taiwan (simply 1,300 miles from Tokyo to Taipei), Japan’s involvement can be important within the state of affairs of a Chinese language invasion.

China is conscious of the potential for Japan’s involvement in Taiwan’s protection and has issued stark threats ought to Japan intervene. Most just lately, in his New 12 months deal with, Chinese language chief Xi Jinping’s assertion declaring the reunification with Taiwan as a “historical inevitability” has put the U.S. and her allies on excessive alert.

I imagine the continuing hostilities in East Asia will intensify – even when it doesn’t result in an outright battle. However a flashpoint is inevitable. This pressure is rooted in China’s longstanding vow to reclaim Taiwan, a dedication relationship again to 1949 when the Chinese language Kuomintang nationalists fled to the island. The primary Taiwan Strait skirmish adopted shortly after, in the end resulting in the Sino-American Mutual Defense Treaty. Nonetheless, China’s window to behave on Taiwan is narrowing on account of inner and exterior components. These embody China’s demographic challenges, reminiscent of its ageing inhabitants and the repercussions of the one-child coverage, and a strengthening impartial Taiwanese id that makes reunification by voluntary means more and more much less doubtless. These components counsel a fomentating backdrop of escalating tensions, which I imagine can have ripple results throughout Asia.

I anticipate that Japan’s progressive rearmament will catalyze a widespread improve in navy preparedness throughout the area. This development is anticipated to incorporate U.S. allies just like the Philippines and historically impartial nations grappling with their very own points with China, reminiscent of India, Malaysia, Vietnam, Indonesia, and all others involved about their safety standing within the South China Sea. I anticipate these nations will improve their navy budgets and capabilities in preparation for a possible battle, which may result in one of the tough, in depth, and harmful amphibious invasions in historical past.

Japan’s method is centered on deterrence, aiming to make any potential aggression towards it unappealing from a cost-benefit perspective. This stance is rooted in Japan’s post-World Battle II pacifist structure, particularly Article 9, which technically prohibits the nation from sustaining a standing military (for this reason Japan’s navy is known as the Japan Self-Protection Forces) or proudly owning offensive navy weapons, reminiscent of plane carriers or nuclear weapons. Nonetheless, in apply, Japanese courts and politicians have interpreted this text to incorporate the “collective self-defense” of its allies, which might pointedly prolong to the US and ship Japan again to the Pacific theatre as soon as extra.

Lockheed Martin’s Increasing Position in Japan’s Protection Sector

Japan is poised to change into the foremost operator of F-35 fighter jets exterior the US. Its formidable plan includes buying 147 F-35s, comprising 105 F-35A and 42 F-35B fashions. Japan has already begun receiving its F-35As and is scheduled to get its first F-35B in 2025. Earlier than its newest fiscal yr 2024 funds request, Japan had contracts for 63 F-35As and 20 F-35Bs. The 2024 funds request allocates substantial funding for these jets: $739.3 million for eight F-35As and $862.3 million for seven F-35Bs.

This important funding in F-35 jets is anticipated to be a significant income supply for Lockheed Martin.

One other key space of progress for the corporate in Japan is within the realm of missiles and hypersonic weapons. Japan’s protection funds contains funding for creating and producing varied missile methods, specializing in advancing hypersonic weapon expertise. This encompasses ongoing analysis into the Type 12 missile, a land-based system launched from vans, and efforts to accumulate superior standoff weapons from worldwide sources. This contains the AGM-158 Joint Air-to-Floor Standoff Missile, additionally produced by Lockheed Martin.

For a complete understanding, I’ve compiled a desk that outlines Japan’s military budget specifics, which will likely be helpful in highlighting Lockheed Martin’s contributions and roles inside varied funds segments.

| Finances Merchandise | Quantity in Yen | Quantity in USD (approx.) |

|---|---|---|

| Complete Protection Finances for FY 2024 | 7.95 trillion | $54.97 billion |

| Spare Elements and Battle Readiness | 2 trillion | $13.83 billion |

| Ammunition Reserves | 930 billion | $6.43 billion |

| Upkeep of Self-Protection Forces’ Amenities | 800 billion | $5.53 billion |

| Building of ‘Aegis’ Warship | 380 billion | $2.63 billion |

| Improvement of Subsequent-Era Fighter Jets | 640 billion | $4.42 billion |

| Cell Touchdown Craft and Transport Helicopters | 400 billion | $2.77 billion |

Lockheed Martin is anticipated to generate important new income from Japan’s protection funds allocations, significantly in Spare Elements, Battle Readiness, and Ammunition Reserves. Whereas these particular funds objects did not point out Lockheed Martin, Japan’s emphasis on enhancing its long-range weapon capabilities is a key indicator. This enhancement contains the procurement of Lockheed Martin’s Tomahawk Land Assault Missiles and Joint Air-to-Floor Standoff Missiles, which aligns with Japan’s strategic protection targets.

Moreover, Lockheed Martin’s established partnership with the Japan Maritime Self-Protection Forces suggests a broader function encompassing areas reminiscent of offering spare components and ammunition reserves.

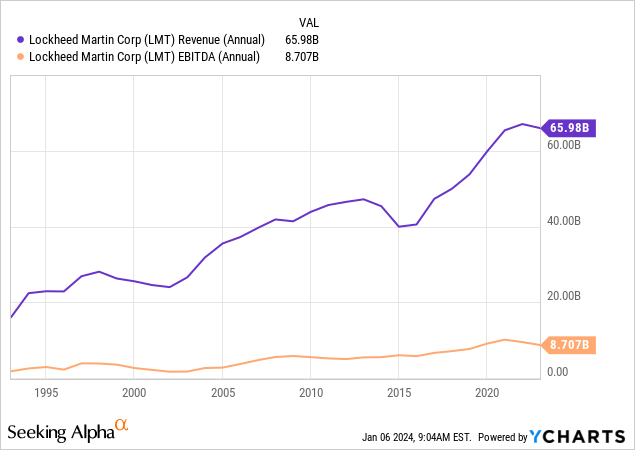

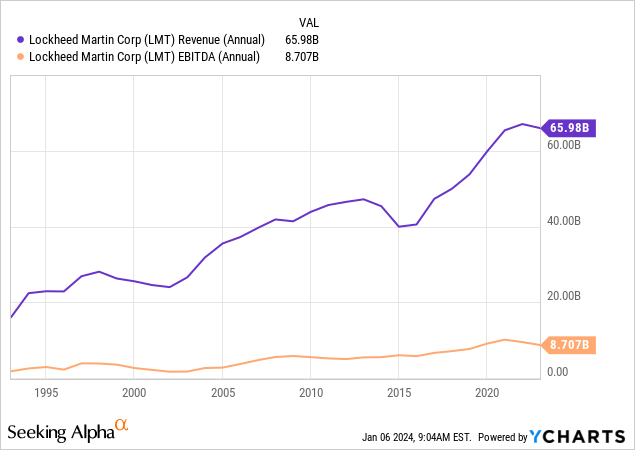

Valuation

To offer a conservative estimate of how Japan’s protection spending may affect Lockheed Martin’s valuation, we give attention to two key areas: the F-35 Fighter Jet program and the Spare Elements and Battle Readiness, together with Ammunition Reserves, which embody missile methods. Moreover, Lockheed Martin’s established protection partnerships with Japan are thought-about.

First, Japan has a plan to accumulate 147 F-35 jets in whole. With contracts for 83 jets already in place earlier than FY 2024, 64 jets stay to be acquired. The preliminary 15 jets (eight F-35As and 7 F-35Bs) price round $1.60 billion.

Though the precise monetary particulars for missiles and hypersonic weapons usually are not absolutely specified, Lockheed Martin is notably concerned on this sector. For a conservative estimate, we are able to assume Lockheed Martin would possibly safe about 10% of the allotted funds for Spare Elements, Battle Readiness, and Ammunition Reserves. The overall funds for these sectors is roughly $20.26 billion.

I estimate that Lockheed Martin will doubtless generate roughly $8 billion in top-line income solely from its contracts with Japan. Assuming a historic EBITDA margin of about 15% would translate to an EBITDA of $1.2 billion. This income and related EBITDA are anticipated to be realized incrementally for a number of years, a few of which have already been realized via the supply of its gear to Japan.

To place these numbers into perspective, that is round 8% of Lockheed Martin’s whole income for 2022 and 13% of its EBITDA for a similar yr.

There are a number of the explanation why I imagine that the projected EBITDA has not but been factored into analyst’s forecasts and, extra pointedly, LMT’s inventory worth:

- Japan’s protection funds announcement occurred in December after the newest analyst scores had been issued in October. This timing hole suggests these forecasts may very well be outdated.

- The potential monetary profit for LMT largely is determined by deciphering Japan’s protection spending plans. This connection is summary and never apparent, requiring evaluation past easy contracts.

- The precise affect on LMT’s financials, together with EBITDA, stays speculative, doubtlessly resulting in underestimation in present valuations.

So, I imagine that the extra EBITDA stays accretive for Lockheed, regardless of the exact affect being an unknown and the truth that a few of these earnings could have already been realized.

I additional anticipate that different East Asian nations will observe Japan’s ongoing shift away from its conventional pacifist stance and, in response, will doubtless improve their protection capabilities. Many of those nations know or use Lockheed Martin’s navy {hardware}, such because the F-16 and F-35 fighter jets, and have established protection partnerships with the corporate.

Extrapolating the Japan development throughout different key Asia Pacific nations suggests a considerable additional upside. Nonetheless, for this evaluation, I’ll focus solely on the expansion drivers from Japan.

Taking a cumulative view, this leads to the next calculation and valuation sensitivity desk estimate for Lockheed are:

-

Lockheed Martin Present Market Cap: $113.31 billion

- Lockheed Martin Enterprise Worth: $127.09 billion

-

2024 EBITDA Estimate: $9.8 billion

-

Highest Incremental EBITDA from Current Japan Contracts: $1.2 billion

- 5-year median EV/EBITDA a number of: 12.68x

| Incremental EBITDA (Billion $) | Complete EBITDA (Billion $) | EV/EBITDA Valuation (Billion $) | EV/EBITDA Upside Potential (%) |

|---|---|---|---|

| 0.0 | 9.8 | 124.26 | -2.22 |

| 0.3 | 10.1 | 128.07 | 0.77 |

| 0.6 | 10.4 | 131.87 | 3.76 |

| 0.9 | 10.7 | 135.68 | 6.76 |

| 1.2 | 11.0 | 139.48 | 9.75 |

The valuation evaluation reveals a median upside potential of 16.38% for Lockheed Martin. Essentially the most optimistic state of affairs predicts a 9.73% rise in Enterprise Worth with an incremental EBITDA of $1.2 billion, aligned with the 5-year median EV/EBITDA a number of of 12.68x.

To additional set up its valuation, Lockheed Martin’s trade friends embody Northrop Grumman (NOC), Raytheon Applied sciences (RTX), and Normal Dynamics (GD).

| Firm Title | Enterprise Worth (EV) | Income Progress (Ahead) | EPS Progress Diluted (Ahead) | P/E GAAP (Ahead) | P/E GAAP (TTM) | Worth/Gross sales (TTM) | Internet Revenue Margin | Return on Fairness (ROE) | Complete Debt to Fairness | Dividend Yield | Dividend Progress 5 12 months (CAGR) | Consecutive Years of Dividend Progress |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Lockheed Martin (LMT) | 127.43B | 0.80% | 5.55% | 16.78 | 16.71 | 1.71 | 10.29% | 65.59% | 187.50% | 2.75% | 8.18% | 21 Years |

| Northrop Grumman (NOC) | 85.26B | 4.83% | -1.83% | 21.13 | 15.65 | 1.88 | 12.07% | 31.27% | 97.90% | 1.57% | 9.33% | 20 Years |

| Raytheon Applied sciences (RTX) | 155.64B | 7.13% | 7.41% | 39.54 | 39.33 | 1.86 | 4.76% | 4.72% | 51.63% | 2.76% | 5.39% | 30 Years |

| Normal Dynamics (GD) | 77.92B | 6.12% | 8.98% | 20.55 | 20.93 | 1.65 | 7.97% | 17.56% | 55.10% | 2.11% | 7.54% | 29 Years |

| Common | 111.56B | 4.72% | 5.03% | – | – | – | 8.77% | 29.78% | 98.03% | 2.30% | 7.61% | 25 Years |

| Median | 106.34B | 5.48% | 6.48% | 20.84 | 18.82 | 1.785 | 9.13% | 24.42% | 76.50% | 2.43% | 7.86% | 25 Years |

Lockheed excels in profitability with a web earnings margin of 10.29% and a formidable Return on Fairness (‘ROE’) of 65.59%, surpassing its peer common.

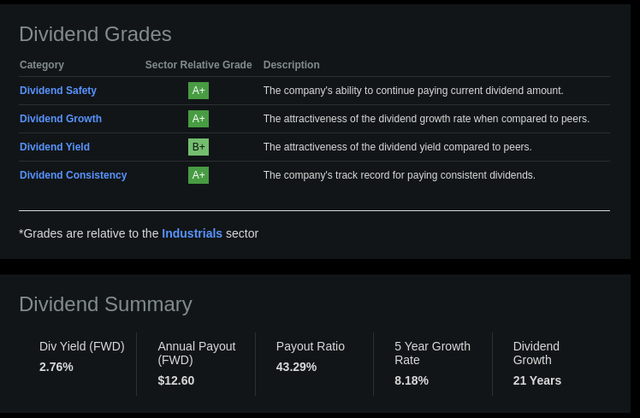

However what stands out to me is its dividend power. With over 30 years earlier than retirement, my core portfolio consists of dividend progress firms. Subsequently, I am a lot much less involved about my quick dividend yield than I’m about dividend progress because the compounding impact has extra time to run.

I intend to make Lockheed Martin a big a part of my portfolio. A big purpose why will be seen beneath: it has a 2.76% ahead yield, a $12.60 annual payout, a 43.29% payout ratio, an 8.18% progress price over 5 years, and a 21-year historical past of dividend progress. All of those components, aside from one, are distinctive bar its dividend yield, however that is much less essential for buyers chasing dividend progress and never quick earnings.

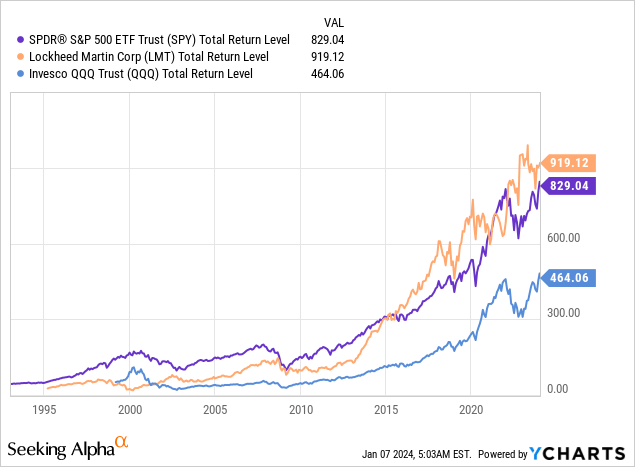

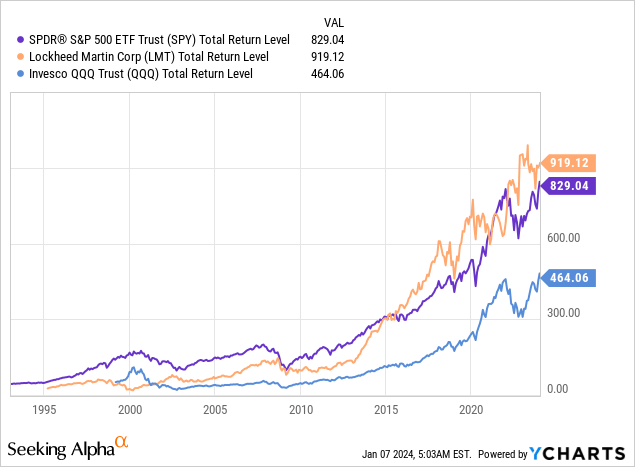

Nonetheless, capital appreciation is equally essential for long-term dividend progress buyers, which Lockheed Martin has confirmed convincingly. Because it went public, its whole return degree considerably outperformed the SPDR S&P 500 ETF Belief and Invesco QQQ Belief. It then provides DGI buyers that uncommon mix between earnings progress and capital appreciation, a large aggressive moat, and an increasing backdrop of geopolitical tensions to maintain its merchandise turning over.

In the meantime, the expansion and returns continued to stream to buyers final quarter. The corporate licensed a fourth-quarter dividend of $3.15 per share, up from $3.00 within the third quarter. The corporate board additionally licensed an extra $6 billion for the share repurchase program, which was along with the $7 billion remaining that was beforehand licensed.

Its order backlog on the finish of the quarter was $156 billion. This displays robust ongoing demand for its merchandise, significantly its plane. The overall backlog quantity stood at 391 plane ready to be delivered.

A part of its attractiveness to me is that about 75% of whole gross sales got here from the U.S. Authorities final quarter. Having such a financially secure buyer means money flows have a tendency to carry up even in difficult instances. Its contracts with different developed nations additionally give it glorious stability.

The corporate is positioning itself in enticing, high-growth areas reminiscent of cybersecurity and superior applied sciences. These progress drivers will make it an much more compelling choose, and I imagine we are able to anticipate the features seen to proceed flowing again to shareholders.

Dangers

Though unlikely, the reliance on geopolitical uncertainties presents dangers. Ought to regional tensions de-escalate or diplomatic options achieve traction, the anticipated enhance in protection spending and procurement may soften, doubtlessly impacting Lockheed Martin’s projected revenues from this market.

One other important threat issue is the potential disruption to Lockheed Martin’s huge provide chain. The corporate depends on 1000’s of home and worldwide suppliers and subcontractors. Geopolitical conflicts, commerce disputes, or manufacturing points may trigger delays or shortages, impacting Lockheed’s potential to satisfy supply timelines.

Conclusion

Given the substantial income progress potential from Japan’s rising protection investments and escalating geopolitical tensions, I preserve my constructive stance and “Buy” advice for Lockheed Martin inventory, as initially said in my introduction.

Contemplating East Asia’s unstable and tense scenario, I imagine that Lockheed Martin’s inventory worth will recognize extra quickly than the overall analyst consensus suggests.

Additionally, I really feel the potential features from Japan’s protection contracts usually are not absolutely mirrored in Lockheed Martin’s present valuation. Moreover, the emergence of recent battle zones and potential hotspots worldwide will drive demand additional, contributing to the corporate’s rising worth.