wildpixel

Investment thesis

This health care company has no revenue and no earnings, and it doesn’t expect any for a couple of years.

Despite that, investors have pushed up the price of Tyra Biosciences, Inc. (NASDAQ:TYRA) shares 32.68% in the past year, while Wall Street analysts and the Quant system have Strong Buy and Buy ratings.

I’m less bullish. Without the key fundamentals, I consider this a speculative play, even though there are bullish signals. There is future promise, though, so I rate Tyra a Hold.

About Tyra

The company calls itself “a clinical-stage biotechnology company focused on developing next-generation precision medicines that target large opportunities in Fibroblast Growth Factor Receptor (FGFR) biology.”, in its 10-K for 2023.

On its website, it offers this description, “A proprietary in-house discovery platform enables us to see the real-world interaction between drug and target in rapid, sequential, structural SNÅPshots. With each SNÅP, we bring speed, clarity, and focus to structure-based drug design.”

Its precision medicine platform allows it to quickly and precisely design drugs that help predict genetic alternations. The starting applications are therapies in “targeted oncology” and genetically defined conditions.

On the oncology side, it aims to develop innovative products that limit off-target toxicities and acquired drug resistance. On the genetic alterations side, it is focused on skeletal dysplasias, including achondroplasia, or ACH, (dwarfism).

Tyra provided updates on its initiatives in the first-quarter 2024 earnings release. CEO Todd Harris wrote, “In oncology, the TYRA-300 clinical profile continues to mature in SURF301, and our clinical team is focused on Part B dose expansion to evaluate multiple dosing regimens of TYRA-300.”

Regarding skeletal dysplasias, the company wrote, “Phase 2 Achondroplasia (ACH) Study Planning Continued to Advance. TYRA remains on track to submit an Investigational New Drug application (IND) to the FDA in the second half of 2024 for the initiation of a Phase 2 clinical trial testing multiple doses of TYRA-300 to support children with achondroplasia.” (FDA refers to the U.S. Federal Food and Drug Administration).

Tyra was founded in 2015 and received its first round of funding from venture capital investors in 2017. It began preclinical studies in 2020 and clinical trials in 2021.

At the close on July 22, 2024, it traded at $20.81 and it had a market cap of $1.04 billion.

Competition and competitive advantages

Tyra reported in the 10-K that the pharmaceutical and biotechnology industries are experiencing quickly moving technologies and intense competition, while proprietary products are increasingly important.

Sources of competition include pharma and biotech companies, universities, government agencies, and public and private research institutions.

Regarding competitive advantages, it stated that its technology, technical experience, and drug development experience give it an edge.

While its bigger competitors have greater scale and depth of drug development experience, a small firm such as Tyra has a couple of underdog edges.

One of those is its designation as an emerging growth company, meaning it has reduced reporting requirements and receives an extended transition period for complying with new or revised accounting standards.

As a smaller reporting company under the Exchange Act, it can “take advantage of certain of these scaled disclosures” until the value of its voting and non-voting common stock held by non-affiliates reaches $250 million.

On another competitive front, it received Orphan Drug Designation and Rare Pediatric Disease Designation for its TYRA-300 treatment for ACH, according to the 10-K. That entitles it to several financial incentives, including grant funding toward clinical trial costs, tax benefits, and user-fee waivers. And if it receives the first FDA approval for the disease, then the FDA may not approve any other applications for seven years.

Tyra does not yet have any revenue or earnings, so we cannot judge its competitive status by its margin or return ratios.

Most recent financial report

Released on May 9, 2024, the Q1 income statement showed (compared to Q1-2023):

- No revenue or net income/earnings from operations.

- Interest and other income increased to $4.130 million from $2.454 million.

- R&D increased to $17.203 million from $10.408 million.

- General and administrative expenses increased to $5.119 million from $3.926 million.

- A net loss of $18.2 million versus $11.9 million.

On the balance sheet:

- Cash and cash equivalents increased to $382.462 million from $203.469 million.

- Working capital was the same as cash and cash equivalents.

- Total assets rose to $404.741 million from $225.857 million.

- Accumulated deficit grew to $183.022 million from $164.830 million.

- Total stockholders’ equity rose to $389.879 million from $$204.262 million.

The uptick in cash and working capital came from a $200 million private placement that closed in February.

Management also reported that its current cash and liquid assets provide enough liquidity to get it through to at least 2026.

Its second quarter results are expected between August 8 and August 12. When they arrive, watch for the completion of trials, management comments on trials or other non-financial gains or losses, and whether it still maintains a healthy amount of working capital.

Comments: Tyra is doing well for a company with no revenue and no earnings. It appears to be self-sufficient for at least a year and a half, thanks to its issuance of equity. However, each new issuance dilutes the equity of existing shareholders, making their shares worth less. It also reduces earnings per share when it begins to have positive earnings.

Management and strategy

CEO Todd Harris also co-founded Tyra in 2018, according to the People section of its website. Before that, he started Sienna Biopharmaceuticals, Inc. (OTC:SNNAQ) a clinical-stage biopharmaceutical company, and he began his career in McKinsey & Company’s Health Care Practice Division. He has degrees in electrical engineering and bioengineering, as well as a Ph.D. in Medical Engineering and Medical Physics.

Alan Fuhrman, the Chief Financial Officer, has had extensive experience in the biotechnology industry. Before joining Tyra, he held top positions at Checkmate Pharmaceuticals, Inc., Amplyx Pharmaceuticals, Inc. and Mirna Therapeutics. Earlier in his career, he practiced as a certified public accountant with Coopers & Lybrand.

Strategy: in its 10-K, the company explained, “At Tyra, we do not accept that cancer patients with acquired drug resistance should be left with the devastating reality of limited or no treatment options or that people with genetically defined conditions should not have treatment options providing meaningful medical benefit.”

To achieve those goals, it has four main tactics:

- Move forward with next-generation precision medicines, which it plans to do through clinical development and regulatory approvals.

- Use the power of its SNÅP platform to quickly develop those next-generation precision therapies.

- Make the most of recent innovations in precision medicine to potentially speed up FDA approvals.

- Use the SNÅP platform to expand into adjacent therapies, “We will consider entering into compound, target or geographic specific strategic partnerships on an opportunistic basis if we believe that such a partnership can accelerate the development and/or maximize the market potential of a product candidate.”

Comments: the two senior officers appear to have the expertise and experience needed to drive the company’s drug development and business development forward.

The four tactics of its strategy show the firm plans to build on its existing assets and competence to both deepen and broaden its business.

Growth

So far, the company has supported itself with equity financing, but in the future should begin earning revenue through drug development, product sales, licensing of intellectual property, and partnerships.

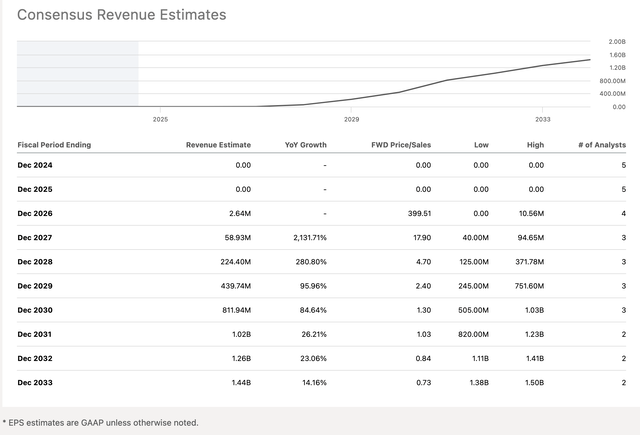

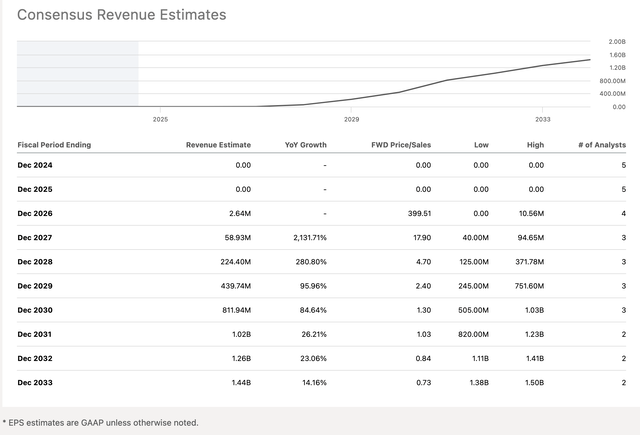

Wall Street analysts expect no revenue this year or next year, but expect a small dab in 2026, $2.64 million, and then a material amount in subsequent years:

TYRA Revenue estimates table and chart (Seeking Alpha )

To sum up the key element of this chart, the revenue forecast calls for zero to a billion in less than a decade.

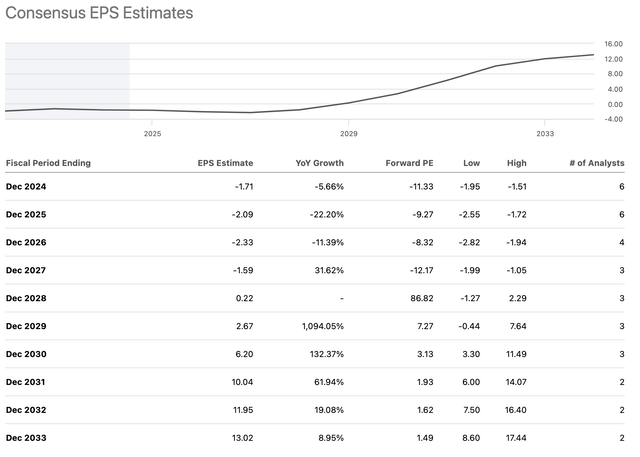

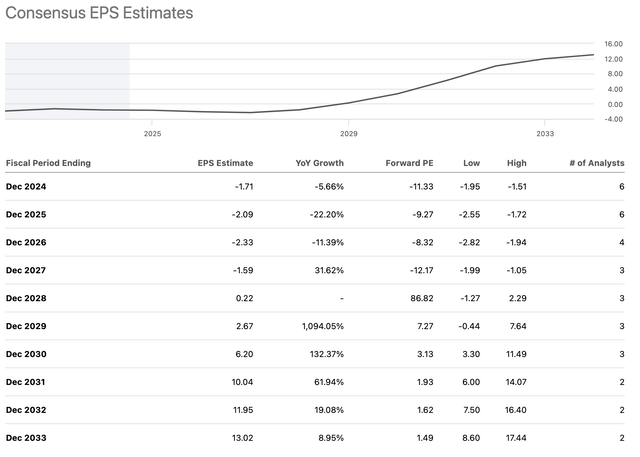

The analysts also see lots of earnings growth, for those who wait:

TYRA EPS chart and estimates (Seeking Alpha )

To summarize the table, the analysts see ongoing losses through 2027, breakeven in 2028, and a surge in profitability in 2029. After that, it’s three more years of rapid growth.

This scenario is based on the idea that one or more of its products will receive FDA approvals, and that it can also bring in revenue from adjacent areas such as licensing and partnerships.

Valuation

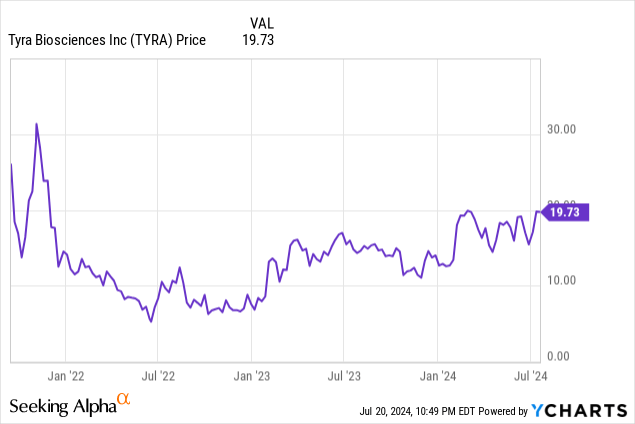

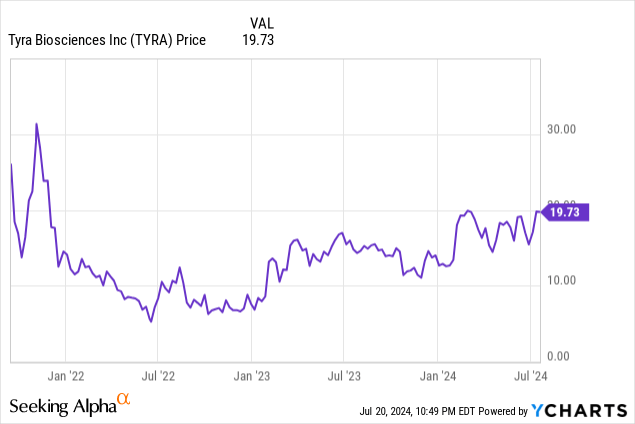

Despite a net income chart line that looks like a toboggan slide, investors seem to be positioning themselves for rewards a few years down the road. In the past year, the share price has risen by 33.49%, to $19.73.

Tyra began trading on September 15, 2021 at $29.90, slipped down until November 2022, and then turned upward.

The Seeking Alpha system gives the stock a B grade for valuation, which sounds good, but is based on only one metric, Price/Book [TTM]. With no revenue or earnings, none of the 17 other valuation ratios are available.

And since those fundamentals are not expected for at least a couple of years, I believe Tyra shares are overvalued. All I can buy at the moment is hope.

But others are more bullish, and quite bullish in some cases. Backing up the optimistic case are the earnings revisions over the past 90 days. Five analysts have offered up revisions, while one has provided a Down.

Wall Street ratings also make a bull case, with four providing Strong Buy ratings, one rating Tyra a Buy and one giving it a Hold. Presumably, the Quant system sees something in the air, as well; it has given Tyra one of its rare Buy ratings. No other Seeking Alpha analysts have rated it in the past 90 days.

As noted, I find it hard to get interested in a stock with no revenue or earnings expected for a couple of years. Not only are there practically no valuation ratings available, but buying now would be speculation.

On the other hand, quantitative and qualitative analyses by others produce Buy and Strong Buy ratings. So, I will compromise and rate Tyra a Hold.

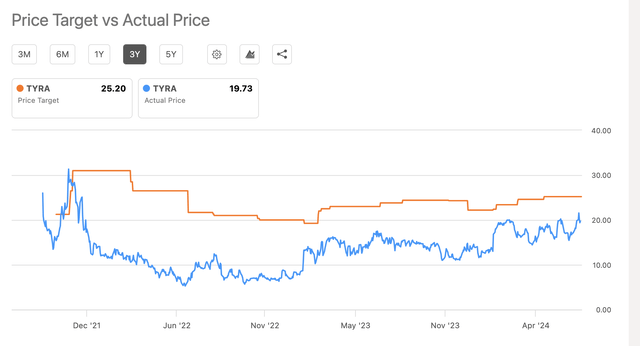

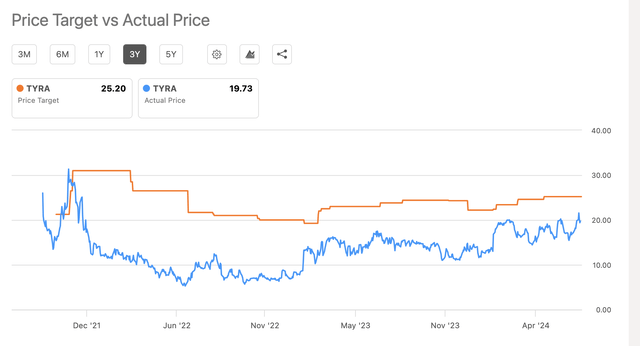

The six Wall Street analysts who have weighed in on Tyra have an average one-year price target of $25.20, which would be an increase of 21.39% over the July 22 price. Yet, they have a history of setting their targets too high:

TYRA-Target versus actual price chart (Seeking Alpha )

Given the consistent overvaluation estimates, I will base my one-year target on the current price, $20.81 at the close on July 22.

Note that the actual price chart shows a saw tooth pattern, demonstrating high volatility (which may be a consequence of too few fundamentals). Prices rise and fall quite quickly, and therefore the actual price could be a few dollars less or more than my target. As Mark Twain purportedly said, “If you don’t like the weather, wait a few minutes”.

Risk factors

Tyra is an early-stage company, with no revenue and earnings so far, which makes it difficult to value confidently. Investing at this point must necessarily be speculative, and likely will continue to be so for at least another couple of years.

There are no assurances that any of its products will receive FDA approvals, and failures of that kind would likely lead to a loss of confidence among investors and serious dips in the share price.

The firm noted in its 10-K that it will need “substantial additional financing”, which means it will have to take on debt or issue new shares. The former would add more financial strain, while the latter would mean dilution of existing shareholder value. That’s offset somewhat by the February 2024 placement that should get it through to at least 2026.

There is significant competition in its industry, which raises the possibility another firm may develop new and better drug solutions in its treatment areas.

Clinical trials are challenges for many drug developers, and risks include enrolling enough candidates, unexpected side effects, and more. Until a trial is completed, there are many potential pitfalls.

Industry players face a wide range of regulations, and compliance can be costly and time-consuming.

Conclusion

While the Wall Street analysts and Quant system forecast significant price growth, I don’t see any compelling reason to buy now. Yes, it’s likely good things are ahead; an FDA approval would certainly generate investor excitement and a higher stock price, but there’s nothing certain about those possibilities now.

I want to see key fundamentals, revenue and earnings, as well as completion of at least one clinical trial and one FDA approval before I buy. With these caveats, I have a one-year price target of $20.00 and a Hold rating.