Justin Sullivan/Getty Photographs Information

My thesis and article replace

Two months in the past, I performed an in-depth analysis of Lululemon’s (NASDAQ:LULU) development, enterprise, and valuation. Since then, the inventory has surged by 18%, attributed to the November-December market rally. Upon reflection, I imagine my preliminary valuation could have been overly optimistic.

Within the forthcoming article, I’ll present an up to date valuation, incorporating current developments. Moreover, I’ll share essential details about the corporate, together with Q3 outcomes, my evaluation of administration, and insights into their incentives.

As a preview, I need to disclose that I’m downgrading my score from “buy” to “hold.” For my part, contemplating the current rally, it is likely to be prudent to capitalize on some earnings.

Q3

Lululemon delivered a powerful performance in Q3. Gross sales witnessed a sturdy YoY development of 19%, accompanied by a exceptional 27% enhance in earnings per share. The notable 9% development in comparable gross sales underscores the model’s resilience, demonstrating robust shopper demand even in difficult financial situations.

Worldwide enlargement was a standout, with a staggering 49% enhance. These figures are actually excellent. Nevertheless, the crux of the matter lies within the sustainability of this development over the following few years. Whereas I do not take into account it unattainable, I do discover it unlikely. As the corporate continues to develop and broaden its market share, a pure deceleration in development turns into anticipated.

Administration incentives

Calvin McDonald has been on the helm of Lululemon since 2018, delivering exceptional outcomes with over 200% development within the prime line. With approximately 260,000 shares in numerous fairness varieties, I guess this constitutes a good portion of his whole web price, making it a significant incentive. Notably, McDonald’s background consists of serving as the pinnacle of Sephora, a enterprise inside the LVMH group (OTCPK:LVMHF), showcasing his experience in managing profitable ventures.

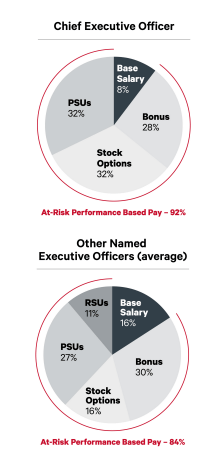

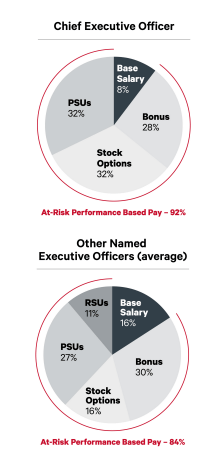

Analyzing his govt compensation, it is constructive to notice that greater than 90% is performance-based, with over 60% tied to fairness. Nevertheless, the efficiency metrics primarily deal with top-line and EBIT development. Whereas appreciating the emphasis on these components, the inclusion of metrics similar to ROC (Return on Capital) and free money stream may improve the general analysis.

compensation construction (LULU proxy)

Different key executives, together with the CFO and CPO, obtain over 50% of their compensation in fairness. Share-based compensation (SBC) bills, at round 7% of working money stream, are acceptable, particularly in the event that they contribute to the long-term perspective of shareholders.

Dennis Wilson, the founder, holds an 8% stake within the firm however at present would not play a major function within the enterprise or on the board.

Furthermore, it is price investigating if there’s any insider shopping for past inventory awards. The final purchase occurred in June by one of many administrators, albeit at a significantly lower cost.

Up to date Valuation

I’m reassessing the low cost charge and adjusting it from 8% to 10%. It is vital to notice the dynamic and doubtlessly inaccurate nature of calculating the price of capital, which is topic to alter. Anticipating a possible discount in rates of interest subsequent yr will change the image.

wacc (writer)

I preserve a terminal development charge of three% to account for worldwide enlargement. I enter a free money stream margin of 12% primarily based on the trailing twelve months margin.

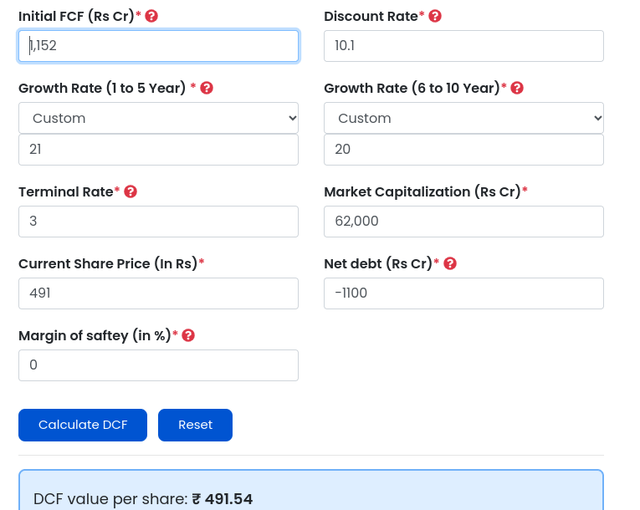

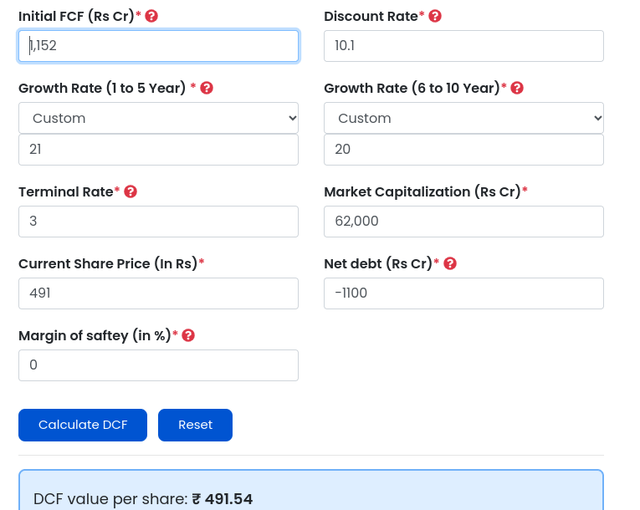

The present inventory worth of $490 tells us that the inventory might want to develop at a 20% charge within the following years. Earlier than I proceed with this valuation, I need to word that I am not a fan of discounted money flows because it’s filled with assumptions, which is likely to be realized and may not. I choose simply to pay an affordable worth for a high-quality firm, and you may merely decide if a worth is affordable or not by multiples in a single kind or one other. Combining these multiples with a sober DCF provides you with a protected vary. Furthermore, I am certain that 5 years in the past there have been loads of DCFs concluding that Lululemon was too costly, and since then, the inventory is up 300%.

DCF (finology)

The corporate’s previous success in reaching a 20% CAGR within the prime line over the past 5 years is a constructive indicator. Nevertheless, I doubt that it’s sustainable for the long run, significantly because the enterprise matures and captures extra international market share. Analysts’ projections for the following couple of years are decrease than 20% development in earnings per share (EPS), however Lulu does have a monitor report of peculiar analysts’ estimates.

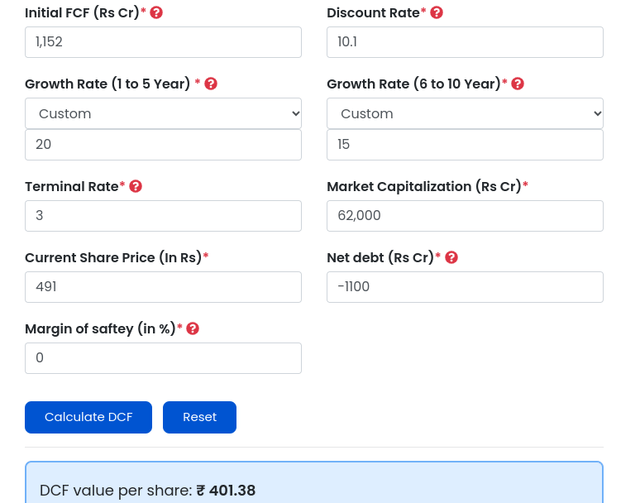

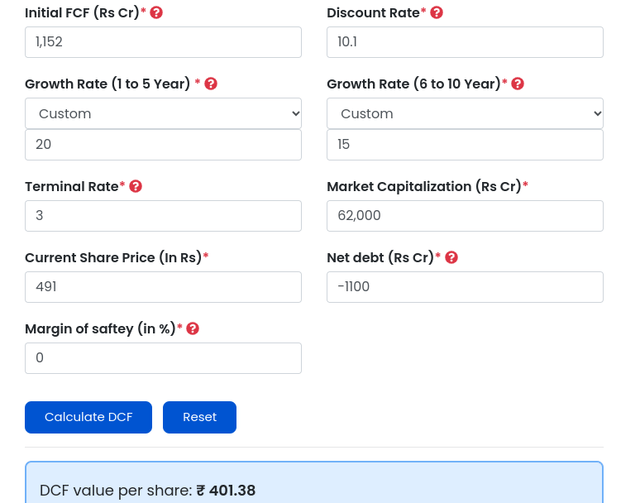

If we assume a 20% annual development within the first 5 years, and after that, 15% because the agency continues to mature, we get an overvalued inventory by 22%, and people assumptions should not significantly conservative.

DCF (finology)

When it comes to multiples, paying a 39 ahead earnings is at all times arduous, and it’s essential to be certain of the enterprise path ahead and the dangers it has. Now, not like different high-multiple companies, Lululemon has the chance of dropping relevance or going out of trend, and, after all, it has immense competitors from different new manufacturers and in addition giants like Nike (NKE). Nevertheless, it does commerce beneath its five-year a number of common, however it’s additionally vital to notice that these averages have been impacted by the zero-interest-rate coverage (ZIRP) period, and now the financial setting is a bit completely different and impacts these averages downward.

When it comes to FCF, paying a 2% FCF yield is a bit increased for me.

Conclusions and Dangers

The vital factor to watch going ahead for Lululemon, in my opinion, is the energy of its model. I need to see it firmly established within the minds of customers and increasing globally. Backside-line development beneath 20% will make me cautious. One other essential issue to keep watch over is the growing affect of different manufacturers. Regardless of Lulu’s longstanding model energy, the panorama is evolving. I am going to proceed to watch polls on model consciousness to gauge Lulu’s place. A drawdown in these polls can be a warning signal for me.

After the worth surge, I am downgrading from BUY to HOLD. I imagine costs round $400 can be truthful worth if the inventory ever drops there once more.

What are your ideas on Lululemon proper now?

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.