Howard Lutnick is moving to strengthen his alliance with one of the most important and controversial names in the digital-asset business: Tether Holdings Ltd.

Lutnick is in talks to deepen the financial ties between his businesses and the company behind the world’s largest stablecoin, according to people familiar with the matter.

Cantor Fitzgerald LP is discussing receiving support from Tether for its planned multibillion-dollar program to lend dollars to clients who put up Bitcoin as collateral, said the people, who asked not to be named as they were not authorized to speak publicly.

Funding for the program will start at $2 billion and is expected to eventually reach into the tens of billions, a separate person told Bloomberg.

Tether currently uses Cantor’s custody business to hold the billions of dollars of US Treasuries that support the value of its dominant USDT stablecoin. That custody relationship earns Cantor tens of millions of dollars a year, according to people familiar with the matter.

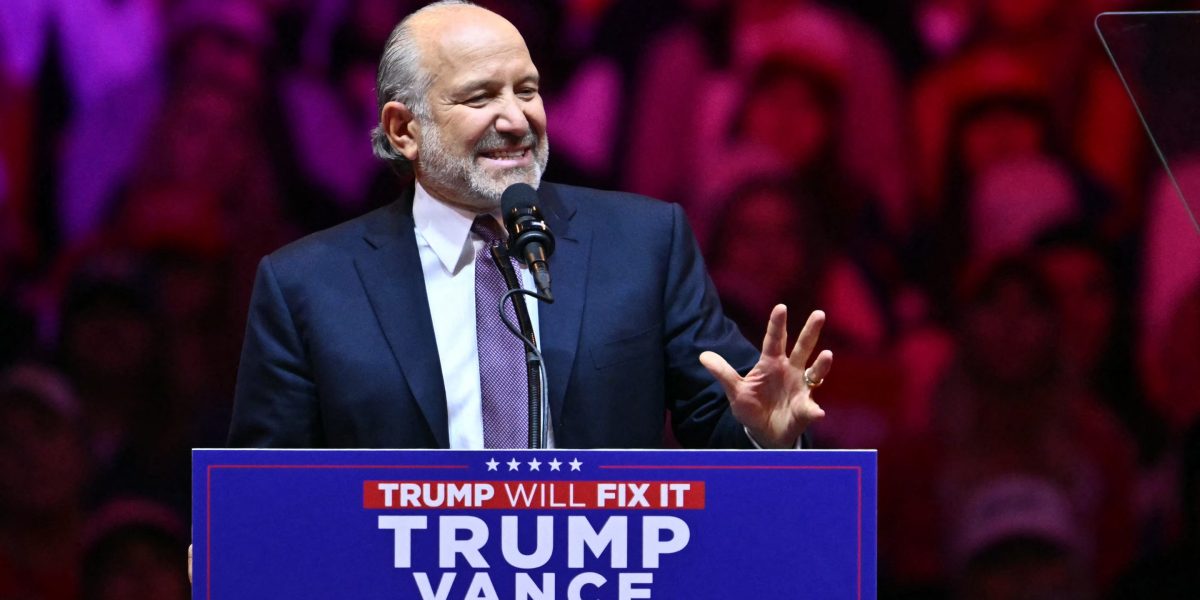

Lutnick is co-chair of president-elect Donald Trump’s transition team and Trump’s pick to run the Commerce Department.

Trump has been a recent and vocal proponent of digital assets like Bitcoin, and has promoted a crypto project associated with his sons called World Liberty Financial. The Trump transition team is mulling whether to create a new White House post for crypto policy, Bloomberg reported previously.

While Cantor has been trying to hire staff to launch the program, it hasn’t formally started lending. If Tether takes part, the crypto firm would likely be one of multiple financial contributors, one of the people said.

A spokeswoman for Cantor declined to comment. Executives at Tether could not be immediately reached for comment outside of normal business hours.

Read More: Cantor Fitzgerald’s Lutnick Says Tether’s Reserves Do Exist

Tether has faced scrutiny from governments including the US for possible violations of sanctions and anti-money laundering rules. The company has denied the claims.

Lutnick’s firm has also struck a deal to invest in Tether, the Wall Street Journal reported on Saturday, adding that Cantor’s stake has been valued at as much as $600 million and amounts to about a 5% ownership interest.

As Lutnick moves to run the Commerce Department, he is preparing to hand over his firm’s relationship with Tether, which he largely controls, to colleagues, according to two people briefed on the matter. His son, Brandon Lutnick, works at Cantor as a trader and previously interned with Tether in Lugano, Switzerland.