BrianAJackson/iStock by way of Getty Photographs

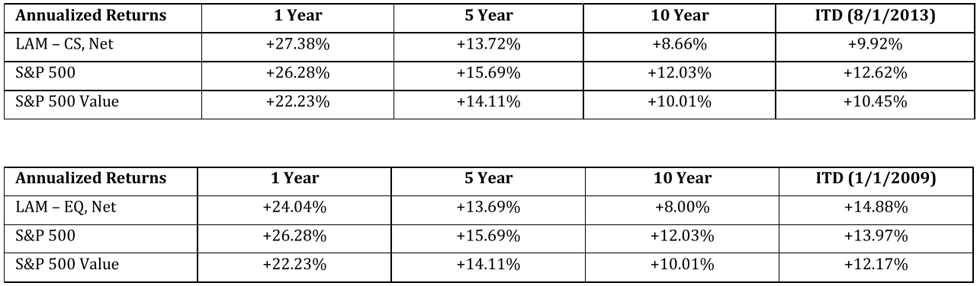

2023 was one other good yr for Lyrical. Our CS composite returned 27.2%, outperforming the S&P 500 (SP500, SPX) by 90 bps. It was a very tough yr to outperform given the outsized efficiency contribution of the Magnificent Seven mega-cap development shares. We, as worth traders, don’t personal any of the Magnificent Seven, however thankfully we did personal different robust performers that greater than made up for it. 2023 is now the third calendar yr in a row our CS composite has outperformed the S&P 500.

In comparison with our type benchmark of the S&P 500 Worth, it was an excellent higher yr. Our CS composite soundly outperformed it by 500 bps, though that index additionally vastly benefited from mega-cap development shares. In contrast with different worth indices that have been extra style-pure, our outperformance margin was even wider. In 2023, we outperformed the U.S. large-cap worth indices from Russell, MSCI, and FT Wilshire by greater than 1,500 bps.

After a yr of such robust returns, it’s pure for traders to be involved about valuation. With the S&P 500 ahead P/E at practically 20x at year-end, we share that valuation concern in regards to the market, however with our CS composite at simply 11x, we’ve no valuation issues about our personal portfolio. The truth is, we proceed to see important upside potential.

THREE YEARS IN A ROW

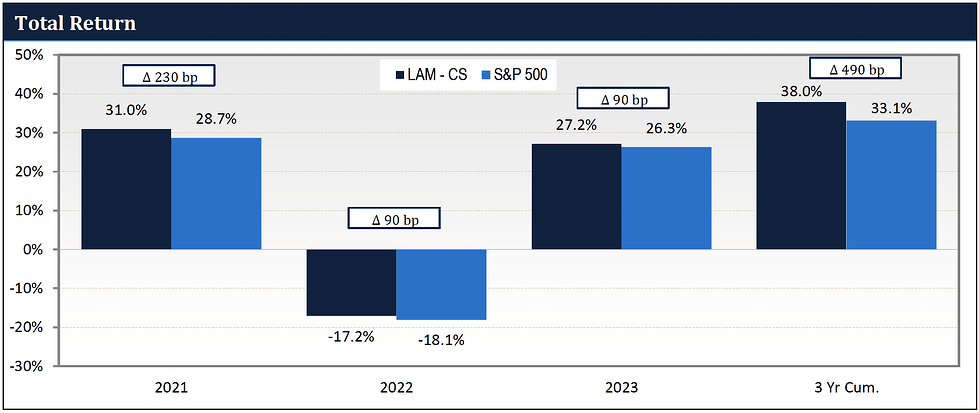

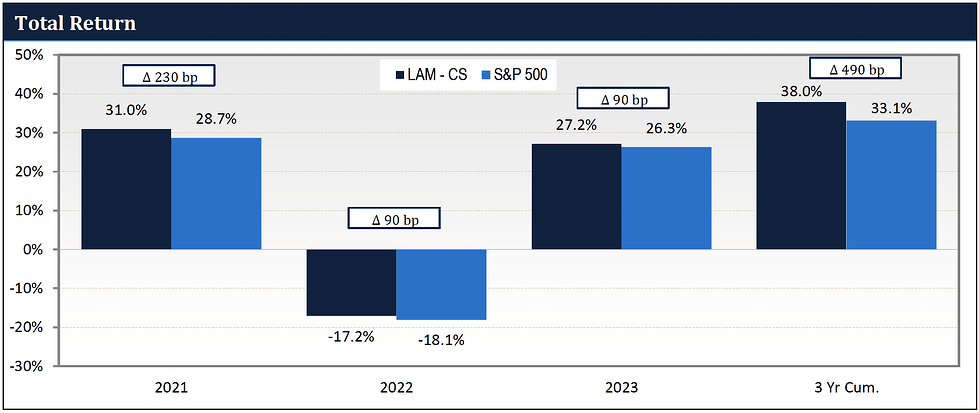

Lyrical’s CS composite has outperformed the S&P 500 in every of the final three calendar years. As you possibly can see within the graph under, in 2021 we outperformed by 230 bps, in 2022 by 90 bps, and now in 2023 by 90 bps once more.

Supply: FactSet, Lyrical Analytics

We’re very happy with these outcomes. Usually, we might not take delight in modest outperformance, as we aspire to ship way more than what we produced on this interval. Nevertheless, the market backdrop over these previous three years has included: recession fears, inflation, robust sector crosscurrents, a banking disaster, AI mania, and the Magnificent Seven. Contemplating all that, we do take delight in these outcomes, and nonetheless imagine a lot better outperformance lies forward given the expansion traits of our portfolio and the huge valuation unfold relative to the S&P 500.

THE MAGNIFICENT SEVEN

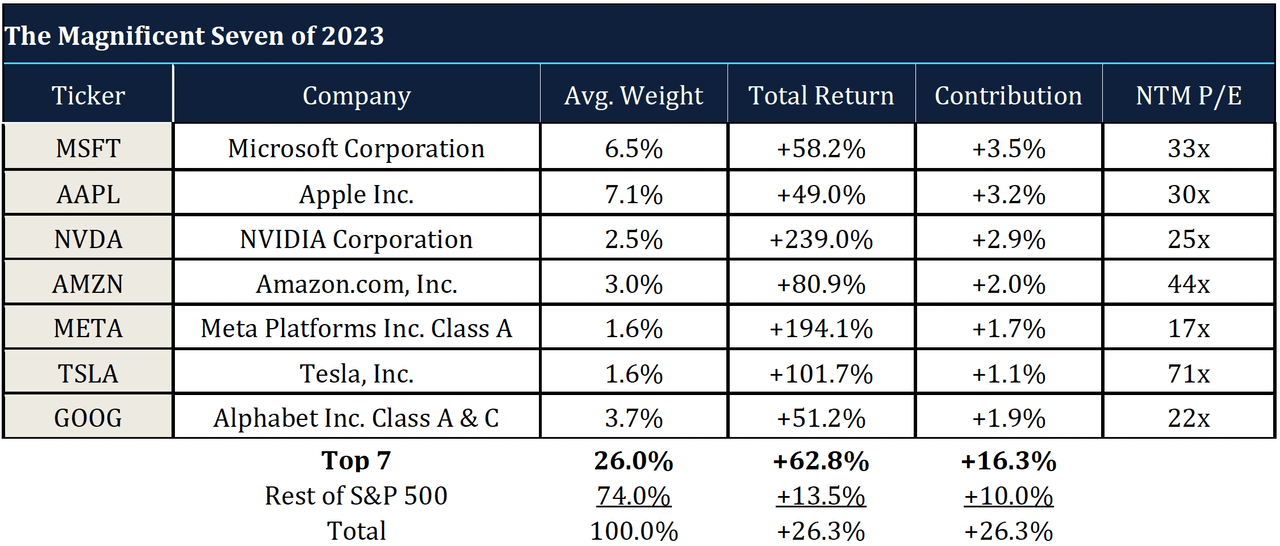

The Magnificent Seven is the favored nickname for the seven mega-cap development shares that drove a lot of the returns of the S&P 500 in 2023. Particularly, the seven are: Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), Amazon (AMZN), META, Tesla (TSLA), and Alphabet (GOOG,GOOGL).

We now have not owned any of the Magnificent Seven, which is smart on condition that we’re disciplined worth traders. As you possibly can see by the P/Es within the desk under, these shares don’t match within the worth class. The priciest of the seven are Tesla at over 70x ahead earnings and Amazon at 44x. Microsoft and Apple have P/Es within the 30s, and NVIDIA and Alphabet have P/Es within the 20s. META at 17x is the one one with a P/E under the S&P 500’s, however it’s nonetheless greater than 50% pricier than our CS Composite P/E of 11x.

Whereas we’ve seen FANG shares propel the S&P 500 during the last decade, their influence on the return of the S&P 500 in any of these years pales compared to what the Magnificent Seven did in 2023. With a weighted common return of 62.8% and a mixed common index weight of 26%, these seven shares contributed an astounding 16.3 proportion factors of the 26.3% index return.

The remainder of the S&P 500, what we name the “S&P 493,” returned 13.5%, which is almost 50 proportion factors decrease. (Notice: the S&P 493 return may be very near the 13.9% return of the S&P 500 Equal Weight index.)

Whereas our CS composite outperformed the complete S&P 500 by simply 90 bps, it outperformed the S&P 493 by 1,370 bps, and the S&P 500 Equal Weight by 1,330 bps.

GROWTH STOCKS IN THE VALUE INDEX

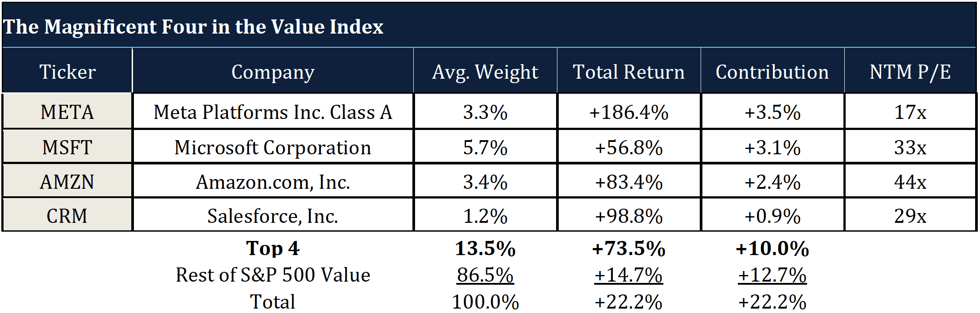

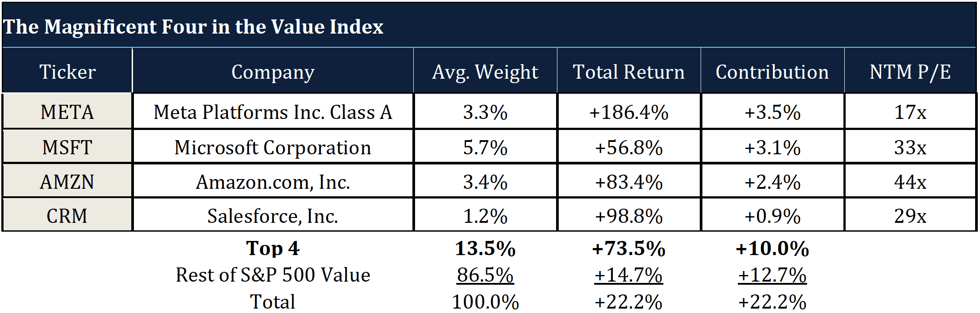

Surprisingly, the S&P 500 Worth index return was additionally considerably impacted by mega-cap development shares, regardless of the phrase “value” in its identify. The 4 largest contributors to the S&P 500 Worth index return have been Meta, Microsoft, Amazon, and Salesforce, which you’ll be able to see within the desk under. These shares had a median index weight of 13.5%, and had a rare common return of 73.5%, contributing 10 proportion factors of the 22.2% index return. With out these 4 mega-cap development shares, the index would have had a 14.7% return, 750 bps much less.

Supply: FactSet

Even with the S&P 500 Worth vastly benefiting from these 4 mega-cap development shares, our CS composite outperformed it by 500 bps, and excluding these 4 shares it outperformed by 1,250 bps.

OUR UNCOMMON COMBINATION

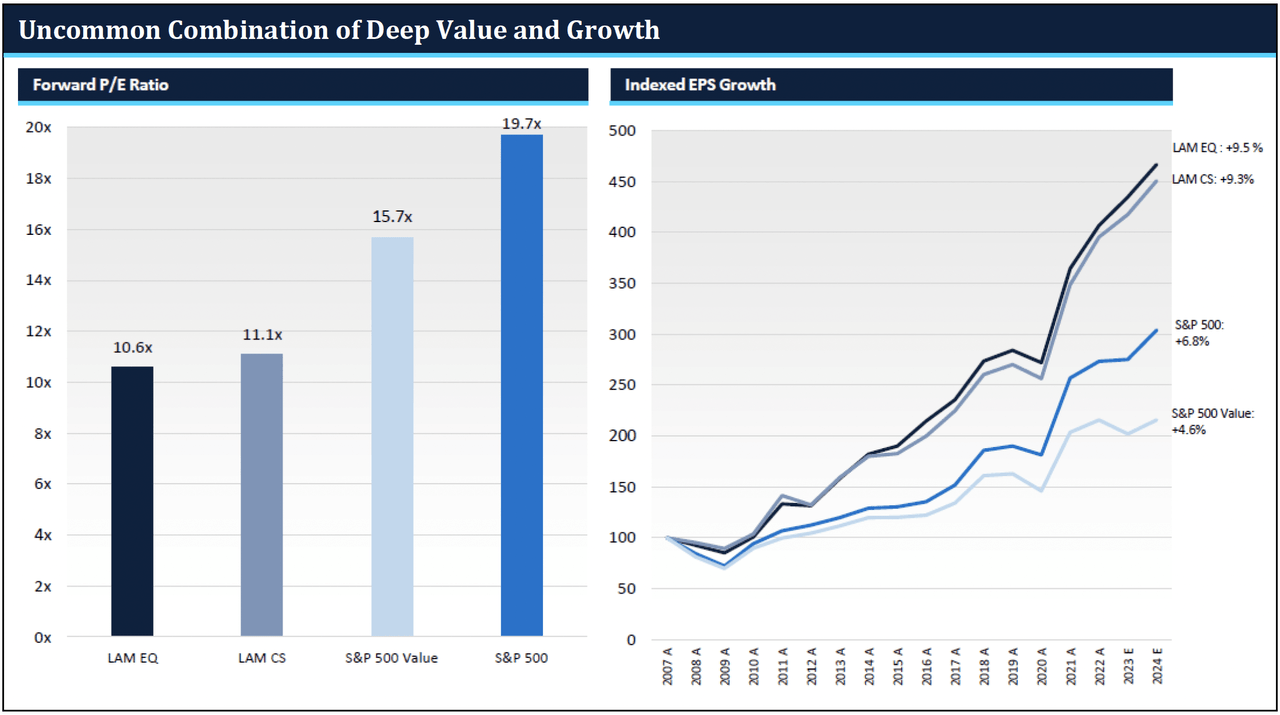

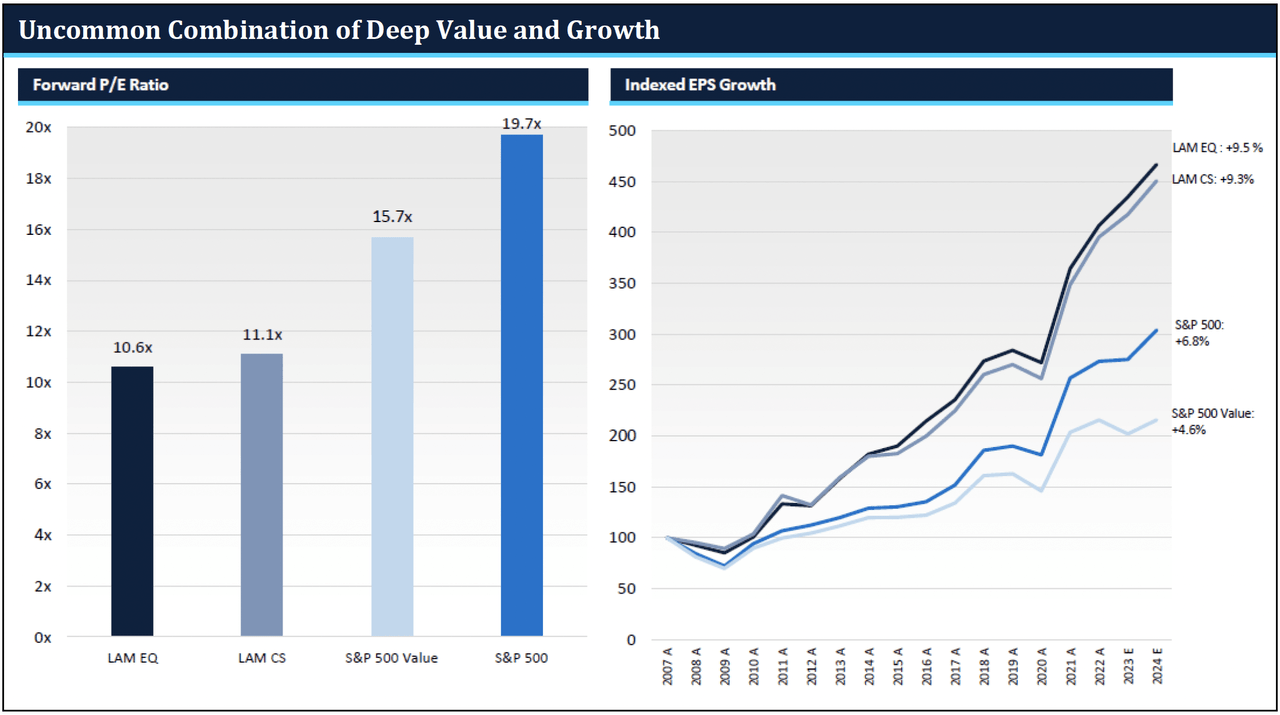

All through our agency historical past, our portfolios have had a decrease ahead P/E than the S&P 500 with comparable development. At present, we don’t simply have comparable development, however superior development, as you possibly can see within the line graph under.

The shares in our portfolios have a development historical past of over 9% each year going again to 2007, in comparison with lower than 6.8% for the S&P 500. Moreover, the earnings historical past of our portfolio has exhibited much less financial sensitivity than both the S&P 500 or the S&P 500 Worth, with much less earnings influence through the COVID shutdowns of 2020 and through the World Monetary Disaster of 2008-09.

Supply: FactSet, See Notes under.

Within the bar chart above, you possibly can see the valuation of our portfolios in comparison with the S&P 500. Even after a 27.2% return, our CS composite ended 2023 with a ahead P/E of 11.1x. This unusual mixture of each deep worth and enticing development is the signature attribute of Lyrical’s funding strategy.

VALUATION SPREAD STILL EXTREMELY WIDE

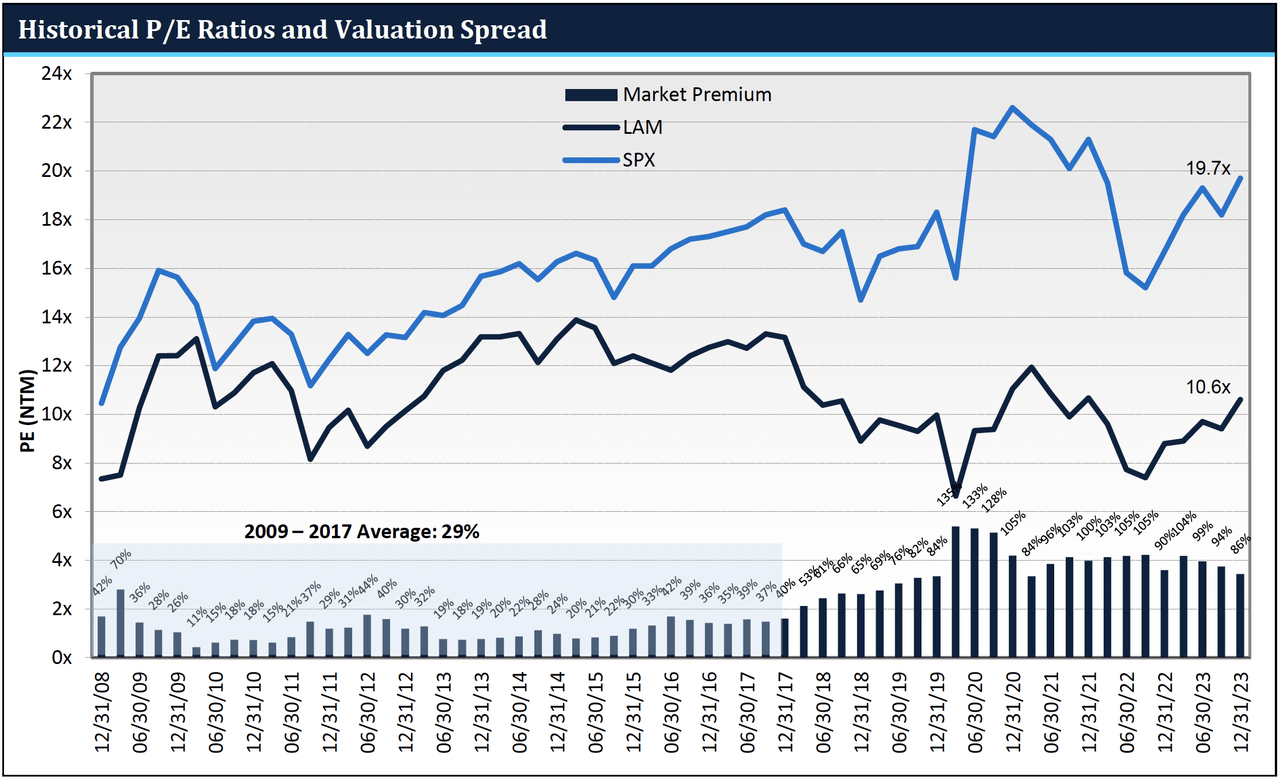

The S&P 500 ended 2023 with a ahead P/E of 19.7x, which is greater than 25% above its 15-year common. In contrast, our CS composite ahead P/E isn’t above, however truly barely under our 15-year common.

Introduced on the graph under are our present and historic portfolio P/E ratios and the P/E of the S&P 500, with the bars on the backside displaying the valuation unfold between the 2. (Notice: On this graph we use our EQ composite which has an extended historical past than CS). The valuation unfold of our portfolio relative to the S&P 500 stays extraordinarily huge at 86%, and it’s over 90% pro-forma for our latest exit of Broadcom.

We proceed to count on sooner or later this unfold will revert to the pre-2018 common of about 30%, however we’ve no solution to know when it’d occur. Admittedly, the valuation unfold has been stubbornly excessive for over three years now, but when we’re proper and the unfold does revert from ~90% to ~30%, it might drive ~50 proportion factors of cumulative extra return, seemingly unfold out over a number of years.

CONCLUSION

Total, 2023 was an excellent yr. Our CS composite generated robust absolute returns of 27.2%, which outperformed the S&P 500 by 90 bps and our type benchmark of the S&P 500 Worth by 500 bps. We achieved this outperformance regardless of not proudly owning any of the Magnificent Seven development shares that considerably boosted the returns of each these indices. Excluding the influence of these mega-cap development shares would improve our outperformance to 1,370 bps vs. the S&P 500 and 1,250 bps vs. the S&P 500 Worth.

Whereas it’s wise to have valuation issues in regards to the S&P 500, we’ve no such issues about our personal portfolio, as our portfolio P/E is barely under our 15-year common. We imagine we personal an awesome assortment of resilient, rising firms at deeply discounted valuations, and thus proceed to see important upside potential.

The valuation unfold between our portfolio and the S&P 500 stays extraordinarily huge at 86% (90%+ proforma for our latest exit of Broadcom). In some unspecified time in the future, we count on that unfold to revert to the place it was up to now, and within the course of drive substantial outperformance.

We now have been ready a number of years now for this to occur, and we nonetheless have no idea how way more ready is likely to be required. The wait has been frustratingly lengthy, however however, it has not been all that dangerous both. Whereas we’ve not generated the magnitude of outperformance we goal, we’ve nonetheless outperformed the S&P 500 in every of the final three calendar years.

Outperforming by a bit is a reasonably good solution to go the time whereas ready to outperform by quite a bit.

Andrew Wellington, Managing Companion, Chief Funding Officer

|

THIS IS NOT AN OFFERING OR THE SOLICITATION OF AN OFFER TO INVEST IN THE STRATEGY PRESENTED. ANY SUCH OFFERING CAN ONLY BE MADE FOLLOWING A ONE-ON-ONE PRESENTATION, AND ONLY TO QUALIFIED INVESTORS IN THOSE JURISDICTIONS WHERE PERMITTED BY LAW. THERE IS NO GUARANTEE THAT THE INVESTMENT OBJECTIVE OF THE STRATEGY WILL BE ACHIEVED. RISKS OF AN INVESTMENT IN THIS STRATEGY INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS OF INVESTING IN EQUITY SECURITIES GENERALLY, AND IN A VALUE INVESTING APPROACH. PLEASE SEE WWW.LYRICALAM.COM/NOTES FOR A DISCUSSION OF CERTAIN MATERIAL RISKS OF AN INVESTMENT IN LYRICAL’S STRATEGIES. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. LAM – CS RESULTS ARE UNAUDITED AND SUBJECT TO REVISION, ARE FOR A COMPOSITE OF ALL ACCOUNTS. NET RETURNS INCLUDE A 0.75% BASE FEE. LAM – EQ RESULTS ARE UNAUDITED AND SUBJECT TO REVISION, ARE FOR A COMPOSITE OF ALL ACCOUNTS, AND SHOW ALL PERIODS BEGINNING WITH THE FIRST FULL MONTH IN WHICH THE ADVISOR MANAGED ITS FIRST FEE-PAYING ACCOUNT. NET RETURNS INCLUDE A 0.75% BASE FEE AND 20% INCENTIVE ALLOCATION ON RETURNS OVER THE S&P 500 VALUE®, SUBJECT TO A HIGH WATER MARK PROVISION.

THE S&P 500® IS WIDELY REGARDED AS THE BEST SINGLE GAUGE OF LARGE-CAP U.S. EQUITIES. THE INDEX THE INDEX INCLUDES 500 LEADING COMPANIES AND COVERS APPROXIMATELY 80% OF AVAILABLE MARKET CAPITALIZATION. THE S&P 500® VALUE DRAWS CONSTITUENTS FROM THE S&P 500®. S&P MEASURES VALUE USING THREE FACTORS: THE RATIO OF BOOK VALUE, EARNINGS, AND SALES TO PRICE. S&P STYLE INDICES DIVIDE THE COMPLETE MARKET CAPITALIZATION OF EACH PARENT INDEX INTO GROWTH AND VALUE SEGMENTS. NOTES: ALL MARKET DATA IS COURTESY OF FACTSET. INDEXED EPS GROWTH DEPICTS THE HISTORICAL CHANGE IN EARNINGS PER SHARE OF THE COMPANIES IN THE LAM U.S. VALUE EQUITY STRATEGIES USING WEIGHTS IN THE LAM-EQ COMPOSITE AS OF DECEMBER 31, 2022. ACTUAL HOLDINGS, AND THEIR WEIGHTS, VARIED OVER TIME. EARNINGS PER SHARE IS COMPUTED USING CONSENSUS EARNINGS DATA PER FACTSET, WHICH INCLUDE CERTAIN ADJUSTMENTS FROM REPORTED, GAAP EARNINGS. PERIODS MARKED WITH AN “E” INCLUDE ESTIMATED EARNINGS PER SHARE. THE HISTORICAL PORTFOLIO P/E (NTM) CHART COMPARES THE WEIGHTED AVERAGE NEXT TWELVE MONTHS P/E RATIOS AS OF THE BEGINNING OF EACH QUARTER FOR THE LAM-EQ COMPOSITE AND THE S&P 500 INDEX. ACTUAL BEGINNING OF QUARTER LAM-EQ COMPOSITE WEIGHTS ARE USED. |

Editor’s Notice: The abstract bullets for this text have been chosen by Looking for Alpha editors.