The foremost US inventory indices are opening a decrease led by the NASDAQ index. Yesterday, the NASDAQ index fell -0.84% outpacing the declines by the S&P of -0.54% and the Dow industrial common of -0.11%.

The foremost indices are up for five consecutive weeks, however with declines for the primary 2 buying and selling days of the week, that streak could also be in jeopardy.

A snapshot of the market at the moment reveals:

- Dow industrial common is down -89 factors or -0.25% at 36116

- S&P index is down -14.3 factors or -0.32% at 4555.56

- NASDAQ index down -54.0 factors or -0.38% at 14133

Trying on the US debt market, yields are decrease throughout the yield curve:

- 2-year yield 4.624% -3.4 foundation factors

- 5-year yield 4.185% -5.2 foundation factors

- 10-year yield 4.214% -7.1 foundation factors

- 30-year yield 4.364% -7.3 foundation factors

different markets:

- Crude oil is rebounding and trades up $0.55 or 0.75% at $73.60. The low value reached $72.17 earlier than rebounding

- Gold is down -$4.90 or -0.25% at $2023.90. Gold reached an all-time excessive yesterday at $2146.79.

- Silver is down 12% or -0.50% at $24.35.

- Bitcoin is buying and selling above $42,000 at $42,050

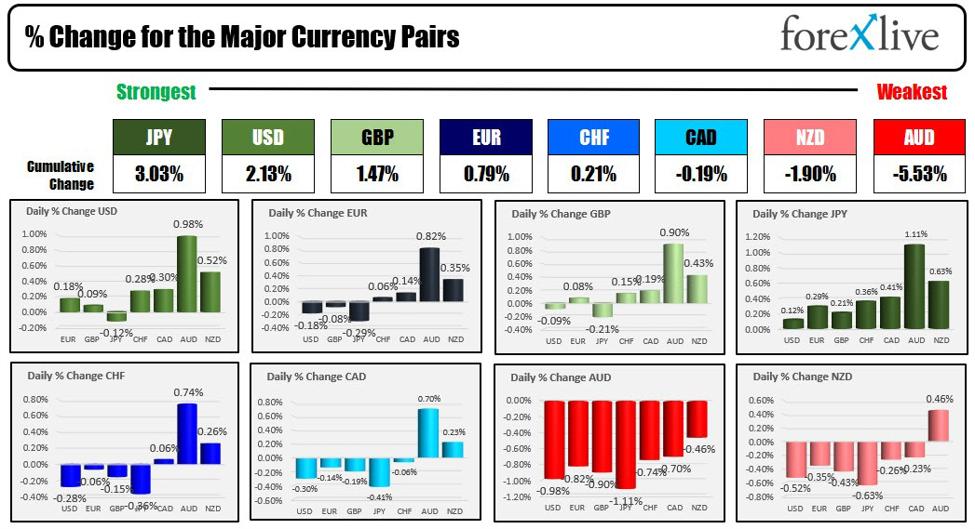

The JPY stays the strongest of the most important currencies whereas the AUD stays the weakest.

The strongest to the weakest of the most important currencies

The S&P international composite index for November might be launched at 9:45 AM ET. The preliminary composite determine got here in at 50.7 with the servicespreliminary coming at 50.8.

At 10 AM, the ISM PMI information for November might be launched with expectations of 52.0 versus 51.8 final month.

Additionally at 10 AM, the JOLTs job openings for October are anticipated at 9,300,000 versus 9,553,000 final month