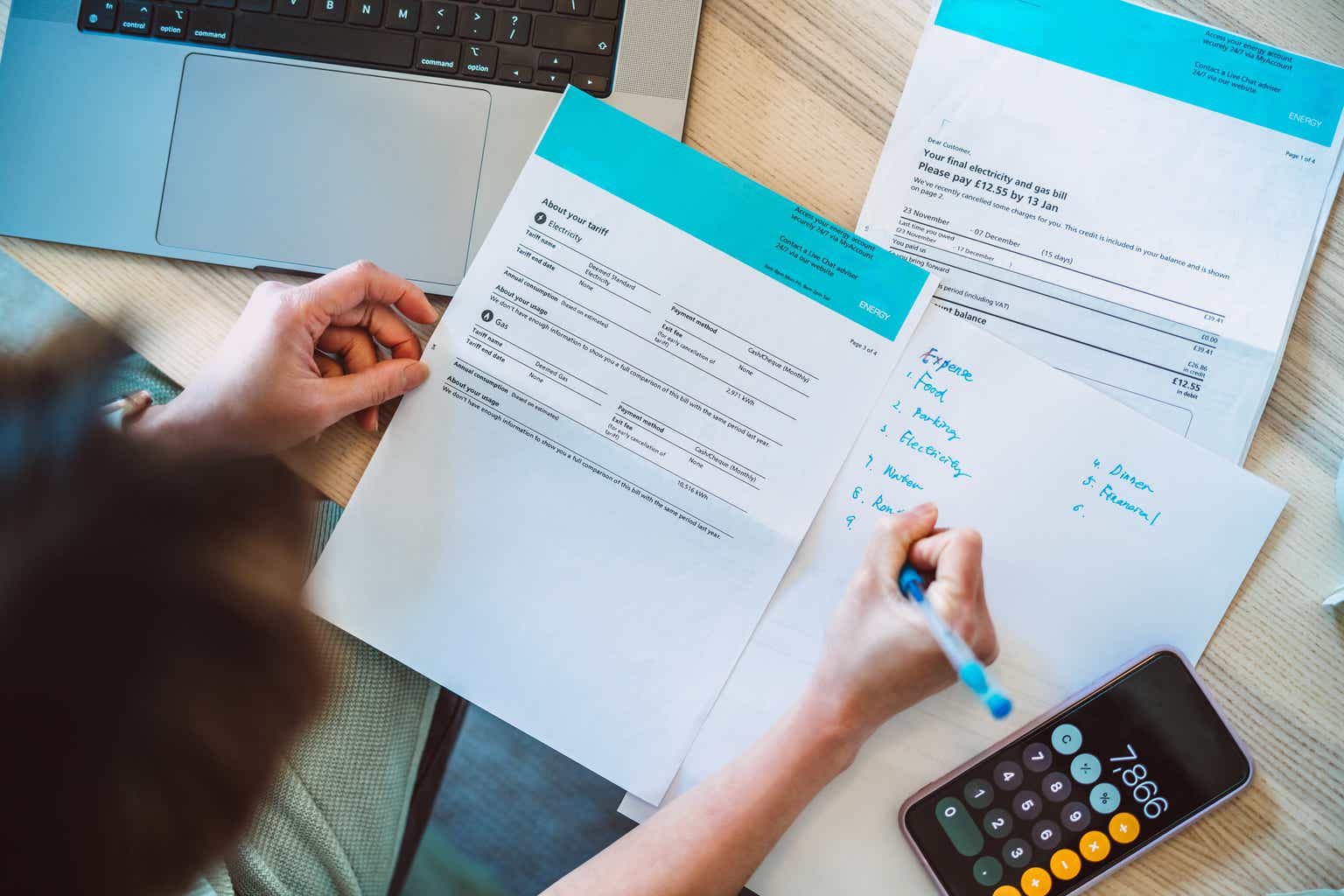

Images By Tang Ming Tung

Dear readers/followers,

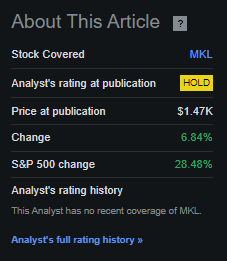

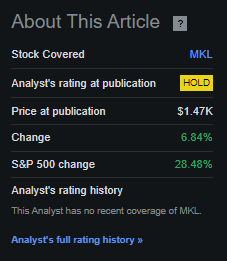

I did some coverage on Markel (NYSE:MKL) about 2.5 years ago at this point and gave the company – an insurance company in the vein of Berkshire (BRK.B) – a “Hold” rating. I also did not buy the company during that time, or any time since. Since doing that, I’ve mostly not looked up or kept track of Markel – you can only keep so many companies on your radar. But I came across my old article a few days back, so I figured it would be a decent time to give an update here. The company has underperformed the index and comparable businesses – which means that my rating of “Hold” was the right stance to take here.

Seeking Alpha Markel RoR (Seeking Alpha Markel RoR)

In this article, it’s time to look at what two years of development and results have done with Markel and the reason for this quite significant underperformance we’re seeing here. I invest quite prolifically in insurance and such businesses – and my typical insurance investment has a high or respectable yield, market position, good management, and above all, is cheap and with a good valuation upside.

So what makes Markel not worth investing in previously, and is it worth investing in now?

Markel Group – Updating for 2024 and beyond

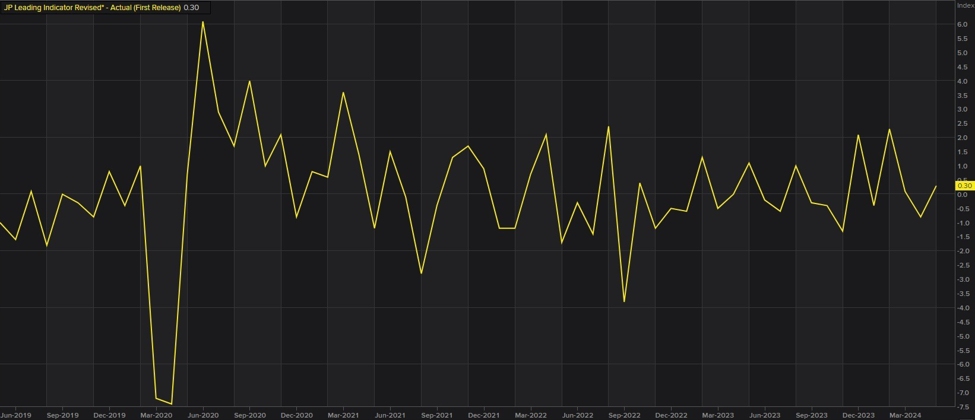

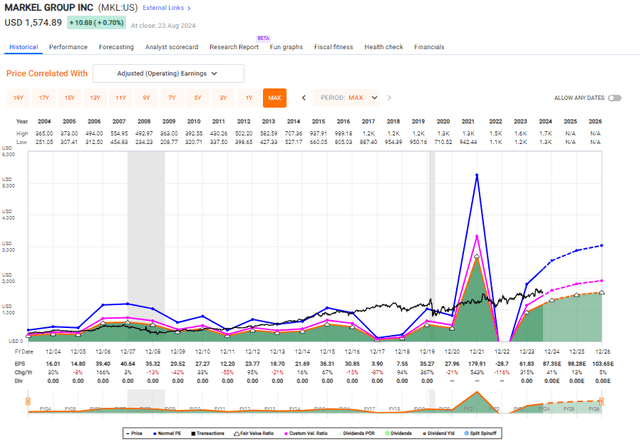

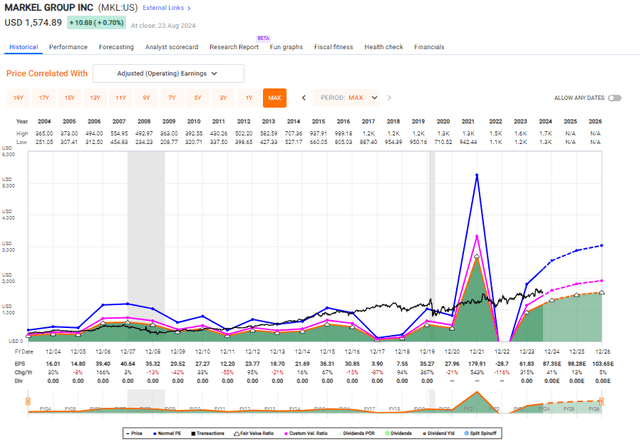

So, Markel is a BBB (investment-grade) rated insurance business. It’s not small – given that the company has a market cap of over $20B even at these valuations. One of the things we notice straight away when looking at the company’s earnings trends is an atypically high volatility. Some volatility is to be expected, but the lackluster EPS growth between 2004-2018 is noteworthy here, and worth presenting and showing to you.

Markel Group Adjusted EPS (F.A.S.T graphs)

The company likes being, by analysts, compared to Berkshire. Even I made that distinction in my last article, the truth is that it has only small similarities to this much bigger business. Berkshire does have some volatility in its operations, but Markel has far more. The historical accuracy for Markel is quite low, below 60% when looking at forecasting where the company might go. As you can see above (or me clarifying to you here), Markel does not pay a dividend. It never has, and I don’t consider it likely that it ever will. This in itself makes the company less interesting to me. I don’t consider no-dividend companies a complete no-go, but I am more careful with them because it means that the company has to provide capital appreciation to have any upside.

The positive for the company includes continued growth in book value, meaning that the company has and should deliver more capital appreciation.

The reason it does not pay a dividend is, among other things, that it considers itself capable of instead investing that capital better than dividends. It’s described as an insurance company, but it focuses more on investing excess in businesses in the vein of a PE business (private equity). The company owns a significant number of international insurance subsidiaries, which provide significant growth in revenue over time. But as you can see, we don’t look at revenues here necessarily, we look at earnings.

As I wrote in my last article over 2.5 years ago – this isn’t a business you buy into unless you mean to own it for a very long time, perhaps even for life. I wasn’t convinced that the company could give me the sort of performance I was looking for, so I didn’t buy shares – and looking back at the performance, this was the right choice to make.

The company, for the 2Q24 period, continued to grow in 1H24, with growth in underwriting profitability from a 1Q to 2Q period. This underwriting improvement is worth focusing on because the insurance industry is seeing pressures, specifically to underwriting, that Markel has managed to avoid. 2Q24 also saw good improvement in the venture operations business, with records both on the top and bottom line – which in the context of macro and sector here is also impressive.

The latest few years of disruptions also mean that Markel has not added any new businesses to its operations/portfolio for several years now – in either 2022 or 2023, but has started doing so again in 2024, resulting in growth in footprint and offerings, as the company typically does.

Valor Environmental is one of the latest moves that the company has made here, and Valor is a player in erosion control, stormwater management, and site services. With such transactions, the company is moving in line with trends, I’d say.

The company has also significantly increased the size and performance of its investment portfolio. 5 years ago, we were looking at $17.5B in investments minus debt, today we’re looking at over $28B, marking an increase of 61%. Operating income is up, underwriting income is up – everything is up.

So I do not want to give the image that Markel isn’t a good company – because it is. The company does return cash to shareholders through buybacks, which the company has done in significant amounts, given that over 5% of SO has been bought back in 4-5 years. We’ll also see this in valuation, but the market is viewing this company as worth significantly more now than a few years back, which I do believe is justified here.

How I can see that Markel works quite well is that the company is able to release reserves every quarter. This has been an ongoing trend since even before the IPO in 1984 – and something that speaks to Markel’s long-term quality and perspective is that much of the management has been there their entire professional life – with Mr. Gayner over 30 years. The company, like Berkshire, has a very low-risk tolerance. And while compared to Berkshire the debt is slightly higher, Markel still has sub-22% long-term debt to capital, which is one of the lowest in the industry here.

Markel markets itself as a “Holding company that holds things that most people won’t touch”. The company owns, invests, and works with “weird” businesses. In fact, a quote from the latest earnings call presents this fairly well, in my view.

So we’re 360 degrees open. We’ve talked to a lot of people. We’ve built a lot of relationships over the years. And as a consequence, our phone rings with interesting stuff. In fact, there was one business where somebody called me and literally his opening line was ” this business was so weird, I thought of you immediately”. So fortunately, we’ve developed and earned a reputation over the years. Our phones are ringing more today than they did for the last couple of years. So that’s why I’m excited and look forward to getting some things over the line.

(Source: Thomas Gayner, Markel 2Q24 earnings call)

With that clarified, and with the 2Q24 being rather good, let’s look at company valuation.

Markel Valuation – Tricky to evaluate outside of a lifetime ownership

The problem with Markel simply is that it doesn’t really “fit” my overall investment profile. While I do own businesses where I am open to keeping them my entire life, I don’t go out of my way to find lifetime ownership businesses that do not pay me a dividend. Markel has beaten the market average over the last 20 years, but not during the last 2-3. Part of this has to do with the pause in M&A, which is now over.

I would also say that despite the rise in price, the company is now more attractive than when I last covered it because the company has seen growth in EPS, and is expected to see more growth in earnings as well as book value for the next few years.

Valuation for the company clarifies this. 7 analysts follow Markel at this time, but only 2 of them are at a “BUY”, with the rest at a “HOLD” rating. The average target is $1,643, with a low of $1,400 and a high of nearly $2,000.

I cannot rightly call the company cheap here – not only due to earnings but also due to BV multiples, which is the better approach to take here with Markel. The company typically trades at a mean of 1.37x to book, with a 15-year low of around 0.95x and a high of about 1.9x. However, if you accept a premium to the company, let’s say 18-22x P/E, then there is upside here, and to the 21x P/E, that upside is also above 15% annually in terms of capital appreciation (Source: Paywalled F.A.S.T Graphs link).

As I said in my first piece, investing in this company requires a long-term sort of timeframe and perspective. I argue that perhaps over 10-20 years is required, and if you believe in the business model and in the management here (which I consider to be capable enough), then this company might be for you.

For me, it’s not that this is a bad company. It’s that other companies that I invest in, or could invest in, have “easier” upsides over 10% per year that I consider to be appealing. Because a portion of this return is paid out in the form of dividends, that’s also attractive to me because I like compounding through reinvestment. That’s not really possible with Markel.

That being said, I would be surprised if the Markel group went “negative” over the long term. This is a very well-managed business with upside, and it should be said that the CEO is actually a director at Coca-Cola (KO), which should show you something of how Markel management is being viewed in the company world.

But because it doesn’t really “work” with my criteria, here is how I currently view Markel.

Thesis

- Markel is a fundamentally solid insurance and investment company. Its holdings are appealing, and it has very aligned management with a solid track record and 20-year returns of over 700%, beating the market average.

- I would view Markel as a “BUY” at less than $1,350-$1,400, increasing my target here to reflect better results.

- Investing in Markel also, in my mind, necessitates a very long-term conservative holding assumption. This is not a stock to trade – but one to hold permanently. I am not ready to do so at this time.

- Based on this background, I view Markel as a “Hold”.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 3 out of my 5 criteria, making it a “Hold” here.