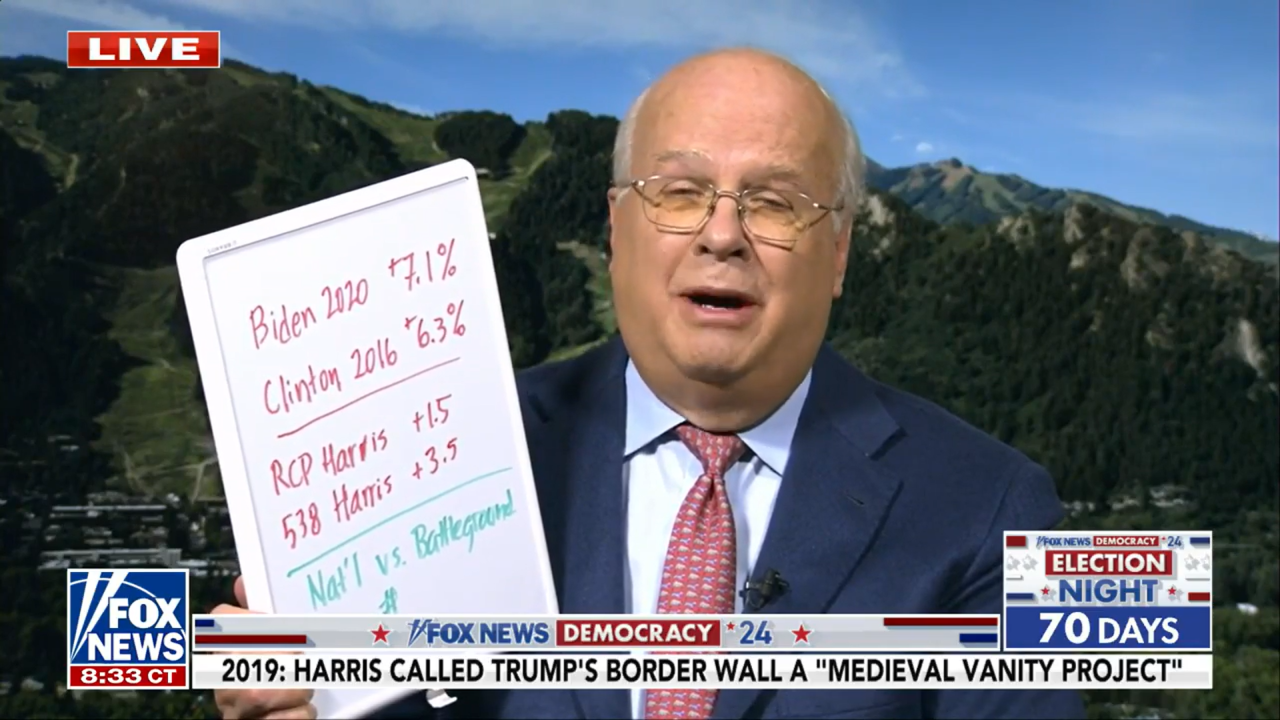

Stock heatmap by FinViz.com Wed, 28 Aug 2024 13:46:10 GMT

Insights into Today’s Stock Market: A Palette of Mixed Performances

Today’s stock market offers a vibrant mix of advances and retreats across various sectors, presenting a complex landscape for traders and investors alike. This analysis draws heavily on the latest stock market heatmap to guide you through the sectors and stocks that are shaping the market dynamics today.

🏦Financial Sector: Minor shifts with potential implications

The financial sector sees a slightly mixed performance with icons like JPMorgan Chase (JPM) slightly down by 0.08% and Visa (V) up by 0.22%. These subtle movements may suggest caution among investors, perhaps reflecting wider economic cues or sector-specific developments.

🔬Healthcare: Stability with a dash of volatility

The healthcare sector shows a notable stabilization with UnitedHealth (UNH) marking a modest increase of 0.39%. However, the pharmaceutical subsection displays some volatility, with Lilly (LLY) experiencing a dip of 0.62%. Such disparities emphasize the sector’s current complexity and the critical need for investors to stay informed about regulatory and market changes.

🛠️Industrials: A mixed bag but overall optimism

Industrials show resilience with The Home Depot (HD) edging up by 0.12%, indicating steady consumer demand. However, the aerospace sector experiences slight declines with companies like General Electric (GE) declining by 0.36%, perhaps due to macroeconomic factors or industry-specific challenges.

👓Technology: Varied performances hint at investor hesitancy

In technology, we see a nuanced picture – Apple (AAPL) is up by 0.38%, while Advanced Micro Devices (AMD) and Nvidia (NVDA) experience small declines. This variation may suggest that investors are weighing news and fundamentals differently across companies, reflecting ongoing uncertainty in tech investments.

📊Overall Market Mood

The overall market mood today appears cautiously optimistic with pockets of robust performance, particularly in consumer cyclical sectors highlighted by Amazon’s (AMZN) gain (+0.19%). However, the presence of red in sectors like energy and basic materials suggests that concerns over global economic health remain.

Strategic Recommendations

Investors may consider revisiting their risk profiles, particularly in tech and healthcare, where the day’s activity reveals mixed signals. The stability in consumer sectors might offer safer harbors for now. Keeping a close eye on industrial stocks could also uncover potential opportunities if consumer confidence continues to hold. As the landscape evolves, aligning strategies closely with sector-specific trends will be crucial.

For a deeper dive into the nuances of today’s market and strategic tips tailored to these conditions, keep up with the comprehensive insights at ForexLive.com.