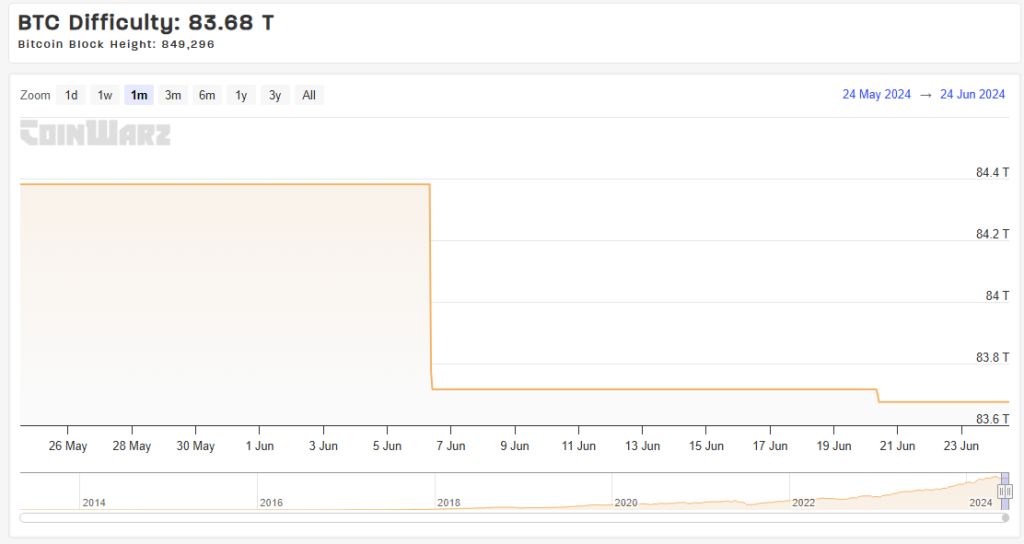

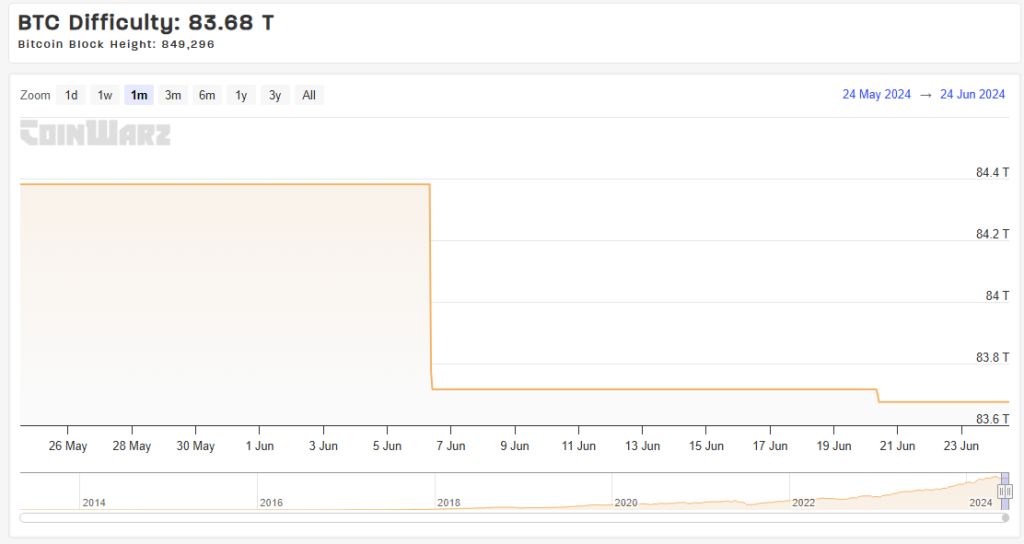

The winds of change are howling through the Bitcoin blockchain. Since the April 19th halving, a pre-programmed event that cuts miner rewards in half, the digital gold rush has hit a snag.

Miners, the lifeblood of the network tasked with verifying transactions and securing the blockchain, are facing a harsh reality – their revenue has been slashed in half. This drop, coupled with record-low revenue per terahash per second (TH/s), has triggered a miner exodus, impacting Bitcoin’s price and network security.

The Great Hash Exodus: A Threat Or Opportunity?

The immediate consequence has been a mass exodus of miners, particularly those with less efficient rigs. Data from IntoTheBlock shows miners selling over 30,000 BTC, valued at nearly $2 billion, since June alone. This fire sale has undoubtedly contributed to Bitcoin’s price slump, which currently sits around $61,140 after failing to breach the $69,000 resistance zone in the past two weeks.

🚨 Bitcoin miners have sold over 30k BTC (~$2B) since June, the fastest pace in over a year. The recent halving has tightened margins, prompting this sell-off. pic.twitter.com/dy289bu7p4

— IntoTheBlock (@intotheblock) June 22, 2024

Source: IntoTheBlock

However, the impact on network security remains a point of contention. Some analysts view the exodus as a necessary shakeout. The halving was a known event. It forces the network to become more efficient. Weaker miners are weeded out, and the overall security of the network strengthens as long as remaining miners can stay profitable.

Source: CoinWarz

This sentiment is echoed by industry giants like MicroStrategy, the business intelligence firm that recently doubled down on Bitcoin by purchasing an additional 11,900 BTC during the price dip. MicroStrategy CEO Michael Saylor sees the halving as a long-term bullish signal, “The fundamental value proposition of Bitcoin is unchanged. Scarcity remains king, and institutional adoption continues to rise.”

Bitcoin: Balancing Efficiency With Sustainability

The exodus raises concerns about the environmental impact of Bitcoin mining. Less efficient rigs, often powered by fossil fuels, are being sidelined. However, the remaining miners, operating larger, more efficient facilities, might require even more energy to maintain the network’s security. This could negate the environmental benefits of the exodus.

The Institutional Influx: Boon Or Bane?

Indeed, institutional investment has been a bright spot for Bitcoin. Blackrock, the world’s largest asset manager, has surpassed $20 billion in Bitcoin assets under management in just the past month. This surge in institutional capital is a far cry from the early days of Bitcoin, where retail investors dominated the market.

The coming weeks will be crucial for Bitcoin. The potential approval of Ethereum ETFs could reignite investor interest and propel the entire cryptocurrency market forward. However, continued miner capitulation and outflows from Bitcoin ETFs could put further downward pressure on the price.

Featured image from Energize Leadership, chart from TradingView