grandriver

Final summer time, I wrote a chunk overlaying Matador Assets (NYSE:MTDR) titled “Matador Resources: Oil Growth with a Near-Term Upside Catalyst,” ranking the inventory a powerful purchase.

My thesis was easy.

Final April, MTDR acquired privately held Advance Vitality Companions for $1.6 billion, rising its acreage within the northern Delaware Basin, the western a part of the Permian Foundation that features acreage in each west Texas and New Mexico. I anticipated that deal, plus natural progress from its present operations, to energy sturdy oil-focused manufacturing progress for MTDR, sustaining its place as one of many fastest-growing shale producers within the US.

Final July I additionally anticipated MTDR to proceed to outperform its steerage by way of manufacturing progress, prices and capital effectivity.

Lastly, I created a reduced money stream (DCF) mannequin of free money flows for the inventory over the subsequent few years, utilizing this mannequin to derive my worth goal of $66, up about 25% from the buying and selling worth on the time.

General, my bullish money for MTDR proved prescient:

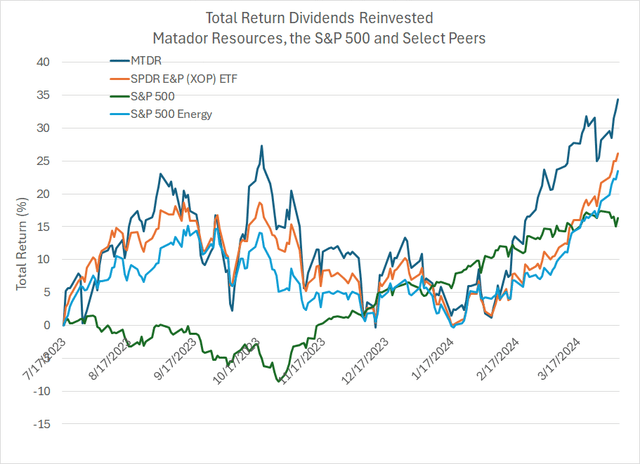

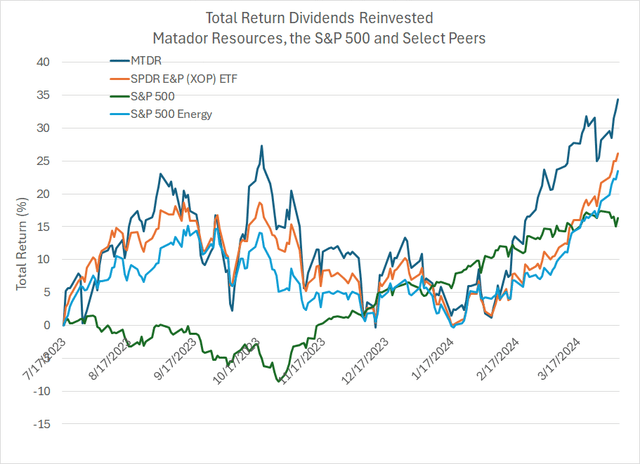

MTDR Complete Return In comparison with Friends (Bloomberg)

In line with Bloomberg, MTDR is up 34.3% on a dividends-reinvested foundation from the article’s publication on July 17, 2023, by way of the shut on Friday, April 5th in comparison with a complete return of 26.12% for the broadly adopted SPDR S&P Oil & Fuel Exploration & Manufacturing ETF (XOP), round 16.4% for the S&P 500 and 23.5% for the S&P 500 Vitality Index.

With the inventory performing nicely and buying and selling above my erstwhile goal worth, it’s time to replace my mannequin and reassess MTDR’s prospects.

Let’s begin with this:

An Oil Progress Chief

MTDR stays a standout by way of general manufacturing progress, significantly relating to crude oil.

Have a look:

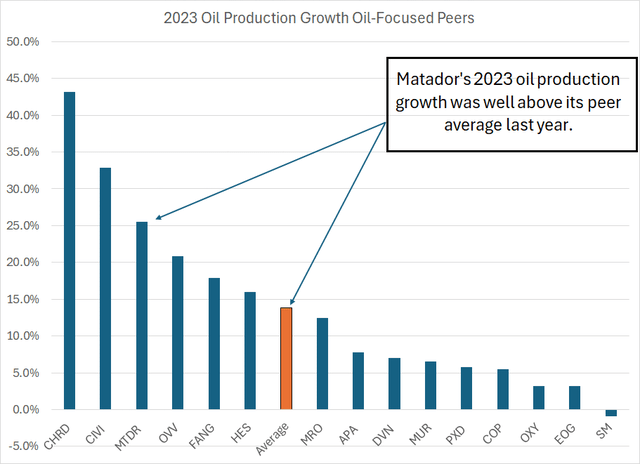

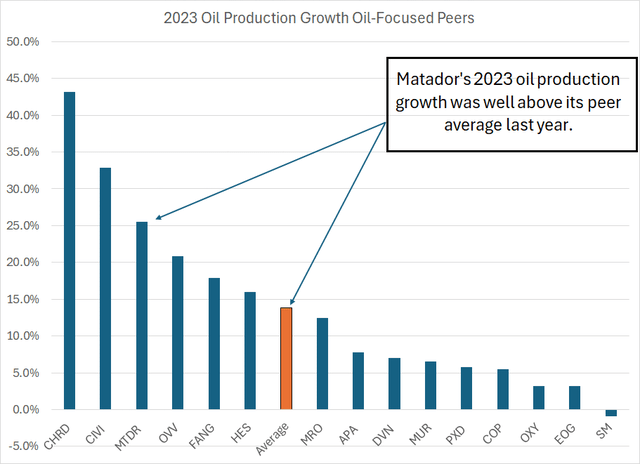

2023 Oil Manufacturing Progress Choose E&Ps (Bloomberg)

This chart exhibits whole 2023 oil manufacturing progress – crude oil, not barrels of oil equal – for MTDR and 15 of its friends. To decide on the peer group, I examined exploration and manufacturing (E&Ps) firms with a present market capitalization over $4 Billion, greater than half of whole manufacturing from liquids and full-year 2022 manufacturing of fifty,000 bbl/day of oil or extra.

As you possibly can see, MTDR’s 2023 oil manufacturing progress of 25.5% ranks it within the prime tier of its peer group.

Furthermore, as I’ll clarify in only a second, the midpoint of MTDR’s newest steerage for 2024, included as a part of the corporate’s Q4 2023 earnings results and convention name presentation on February 20th anticipates 2024 oil manufacturing progress of 23.2%.

Advance Skepticism

MTDR announced the Advance acquisition on January 24, 2023, and buyers initially cheered the transfer.

Have a look:

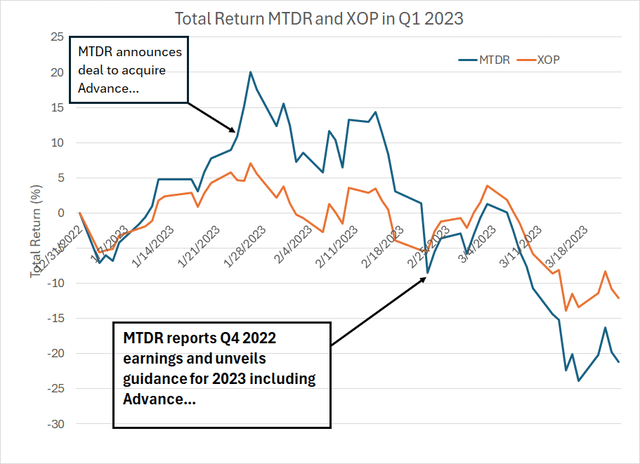

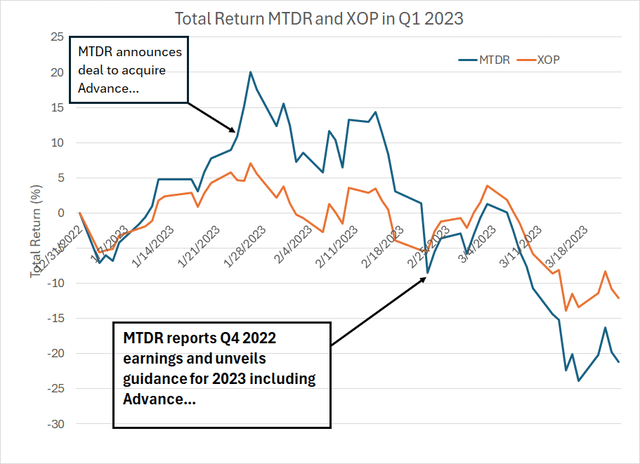

Complete Return MTDR and XOP in Q1 2023 (Bloomberg)

This chart exhibits the efficiency of each MTDR and the industry-benchmark XOP exchange-traded fund by way of the primary quarter of 2023 (final yr). As you possibly can see, each MTDR and XOP carried out nicely by way of January; nevertheless, MTDR handily outperformed its friends, rising as a lot as 20% early within the yr. Additionally observe that MTDR’s sturdy efficiency accelerated following administration’s announcement of the Advance deal on January 24th.

After January 2023, MTDR started to see some critical promoting stress due, partially to weak spot throughout the vitality {industry} seen within the pullback in XOP. There’s no denying the promoting stress in MTDR accelerated after the corporate reported Q4 2022 earnings on February 21, 2023 and issued more detailed guidance for the yr forward that included a primary have a look at the monetary influence of the Advance deal, assuming the deal closed in Q2 2023 (the deal did shut in April 2023).

In line with Bloomberg, MTDR shares plummeted virtually 9.8% within the buying and selling day following MTDR’s first have a look at 2023 steerage, on a session the place the {industry} was flat general with XOP declining simply over 0.1%.

A skim of MTDR’s Q4 2022 Conference Call reveals analysts on the decision had been clearly skeptical of the corporate’s plan to ramp up capital spending in H1 2023 to assist the mixing of the Advance acreage.

Particularly, on the Q&A portion of the decision, a number of analysts requested concerning the massive enhance in MTDR’s midstream CAPEX finances; midstream spending contains the construct out of infrastructure comparable to gathering pipelines – small diameter pipes that join particular person wells — and gasoline processing crops used to separate pure gasoline liquids like ethane, propane and butane from the uncooked gasoline stream.

Different analysts requested concerning the firm’s manufacturing steerage for 2023, together with the perceived lack of progress excluding Advance. In response to 1 such query, right here’s what the CEO needed to say:

Nicely, Leo, I can perceive that, since you’re not making an allowance for that after we’re doing the Advance deal, we’re shifting a few of our employees sources and rigs, and different ways in which we might have manufacturing. If we weren’t doing the Advance deal, it would not be flattish. You’ll have — our employees will likely be totally operated on drilling a few of our stock, which the standard of the rock in our stock is excellent and we bought over a decade value of stock.

So after we’ve been on the street, we have gotten stock questions, and we’ve got loads and we may’ve — we might be addressing that as a substitute of Advance, and connecting up the pipeline our Midstream system. So, we charge, once more, however I believe it is essential to look the standard of rock that we’re acquiring. And if we do not get hold of it now, we are going to by no means have an opportunity so as to add on adjoining to our acreage that form of high quality rock.

So, it will be like calling a soccer coach, hey, your operating again solely gained 50 yards this sport, since you’re by way of 5 landing passes. If the passes weren’t working, you’ll’ve used the operating sport extra. And we’re in that scenario. Happily, we bought Advance, so have a option to do in Advance or a few of our personal properties. Our properties are HBP, the place we’ll work within the Advance, significantly the place they’ve DUCs, as a result of that can speed up manufacturing coming off of that.

And so, taking a look at our asset base and our choices, it made sense to focus extra on Advance and bringing in much less of our stock. But when we did not have Advance, you’d see progress a lot better than the three% that you simply’re speaking about, and — however you are taking out a few rigs, places your deal with the brand new properties and benefiting from that chance to attach up your pipeline, we expect that is a greater program.

Supply: Matador Assets This fall 2022 Convention Name Transcript

Merely put, MTDR’s CEO, Joe Foran, notes that administration had been receiving “inventory questions” from Wall Avenue. Basically, which means some had been involved MTDR didn’t have satisfactory drilling places in its core Permian Basin play to assist drilling exercise and manufacturing progress for lengthy sufficient to maintain free money stream over the longer haul.

The Advance deal was one option to handle that perceived shortfall – MTDR was buying high-quality acreage within the northern Delaware Basin. Because the CEO famous, if MTDR didn’t make this deal at the moment, they may lose the chance.

That remark proved prescient as M&A exercise did warmth up throughout the Permian by way of 2023 together with Exxon Mobil’s (XOM) deal to acquire Pioneer Pure Assets (PXD) final fall, Occidental’s acquisition of CrownRock in December and Diamondback Vitality’s deal to buy privately held Permian operator Endeavor in February 2024.

Nevertheless, integrating a deal of this dimension requires capital spending (CAPEX) each on drilling wells within the new acreage in addition to spending on midstream infrastructure.

And, because the CEO intimates, if you divert spending from present property to new acreage, there’s prone to be some near-term hit to manufacturing. The upside was anticipated to be a powerful ramp in manufacturing and bettering capital effectivity – the quantity of CAPEX per BOE produced – into the second half of 2023 and early 2024.

It is a sample I’ve observed on a number of events over the previous few years — buyers, and Wall Avenue analysts, are hostile to any trace that an vitality agency is perhaps shedding self-discipline, overpaying for acquisitions or dealing with deteriorating capital effectivity.

Nevertheless, on this case, the Advance deal appears like , even transformational, transfer for MTDR:

The Deal Proves Out

Like most producers, MTDR updates its full-year steerage as a part of every quarterly earnings name in addition to offering extra colour on the outlook for the quarter forward.

So I examined every of MTDR’s calls and earnings presentations from This fall 2022 by way of This fall 2023 – the decision simply hosted in February 2024 – to sew collectively this desk displaying the evolution of steerage by way of 2023:

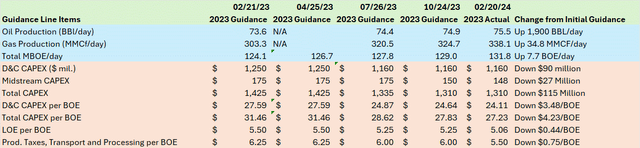

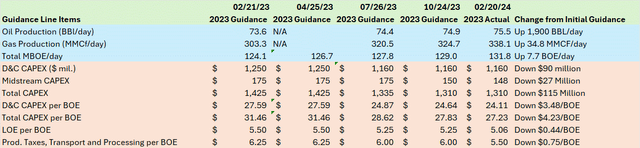

MTDR’s Steering Modifications By 2023 (MTDR Steering This fall 2022 by way of This fall 2023 Earnings Shows)

This desk is split into two color-codes components from prime to backside. The blue-shaded prime piece exhibits the evolution of MTDR’s steerage on manufacturing from the time of their This fall 2022 name hosted on February 21, 2023, by way of the precise outcomes for final yr offered as a part of their This fall 2023 name on February 20, 2024.

MTDR is a two-stream producer, which means that administration studies crude oil manufacturing and pure gasoline manufacturing; the corporate’s manufacturing of pure gasoline liquids (NGLs) like ethane, propane and butane is included within the pure gasoline determine. As I’ll clarify in a bit, this has the impact of boosting MTDR’s worth realization on pure gasoline, as a result of a few of these pure gasoline volumes are literally higher-value NGLs.

So, I’ve reported administration’s steerage for each 2023 oil and pure gasoline in addition to on a barrels of oil equal (BOE) foundation all through final yr.

The underside a part of the desk, shaded in purple, presents the corporate’s steerage on prices by way of final yr.

The time period D&C CAPEX refers to capital spending (CAPEX) on drilling and finishing new wells. Finishing is the method of fracturing a shale nicely and placing that nicely into manufacturing. In the meantime, Midstream CAPEX merely represents cash spent on constructing out midstream infrastructure like gathering pipelines – whole CAPEX is simply the sum of those two figures.

One of many objects I watch most intently for all producers is capital effectivity, which I’ve reported right here as capital spending (CAPEX) per barrel of oil equal manufacturing. That is the amount of cash a producer spends on CAPEX – primarily spending on drilling new wells – to provide a single barrel of oil equal. The decrease the higher – decrease numbers indicate an organization is spending capital extra effectively, producing extra oil whereas spending much less.

I’ve included each D&C CAPEX/BOE in addition to whole CAPEX per BOE.

Lease Working Bills (LOE) are the working prices of sustaining manufacturing from present wells. This distinction is essential – CAPEX primarily represents cash spent on new drilling exercise whereas LOE is cash spent to keep up manufacturing from present wells. MTDR supplies steerage on LOE by way of $/BOE, which I’ve offered right here.

Lastly, manufacturing taxes, transport and processing per BOE characterize the prices of shifting oil and gasoline volumes through pipeline, processing uncooked gasoline to take away NGLs and paying manufacturing taxes based mostly on the volumes of oil and gasoline produced. Once more, MTDR studies this on a $/BOE foundation, which I’ve included right here.

Two factors are fascinating for my part.

First, the corporate beat its preliminary February 2023 steerage on each one of many line objects I’ve offered. For instance, manufacturing of oil ended up about 1,900 bbl/day increased by way of 2023 than MTDR initially projected. That’s virtually 700,000 further barrels of oil on an annual foundation value about $60 million on the present quote.

Much more essential, the CAPEX effectivity issues that plagued MTDR by way of the primary half of 2023 proved overblown – D&C CAPEX got here in some $90 million under administration’s preliminary steerage whereas midstream CAPEX was about $27 million decrease than their authentic plan.

The Complete CAPEX per BOE line supplies a fantastic abstract of the monetary influence of each higher-than-forecast manufacturing and lower-than-expected prices by way of 2023 – CAPEX effectivity was some $4.23/BOE higher than that February 2023 steerage which catalyzed a close to 10% sell-off within the inventory.

That provides as much as vital extra free money stream. Certainly, if we multiply $4.23/BOE in financial savings by the corporate’s whole 2023 manufacturing of roughly 48.2 million BOE (131.8 MBOE/day on the desk) the constructive influence involves over $200 million for 2023 relative to administration’s preliminary outlook.

The opposite fascinating level to notice on this desk the timing of the shift in MTDR’s steerage.

As I already defined, MTDR’s shares bought off following administration’s preliminary steerage for 2023 in February. And, per Bloomberg, MTDR shares bought off 3.55% following their Q1 2023 steerage replace on April 25, 2023 primarily as a result of the corporate didn’t revise its 2023 steerage considerably.

Particularly, have a look at my desk above and also you’ll see that in April of final yr administration offered no updates to its February value steerage although it did say it anticipated general manufacturing on a BOE foundation to be close to the highest of the guided vary.

Certainly, it wasn’t till the July and October earnings calls that administration started to revise its outlook, elevating manufacturing forecasts and slicing CAPEX and price estimates. That possible explains why based on Bloomberg the inventory fell by way of the primary 7 months of 2023, underperforming the XOP fund by over 9%.

Then, solely following the corporate’s constructive steerage revisions in late July 2023 – one thing I anticipated in my article on MTDR on July 17th, the inventory has carried out nicely in absolute phrases and has outperformed the XOP.

This additionally underlines two key factors about MTDR.

First, the corporate’s administration staff tends to information conservatively after which adjusts their outlook over time as they acquire extra confidence within the outlook. Merely put, they wish to underpromise and overdeliver.

Second, as I outlined proper in the beginning of this piece, MTDR is way extra growth-focused than most of its friends. The corporate actually targets worthwhile progress in manufacturing – MTDR generated about $460 million in adjusted free money stream in 2023 – nevertheless, their technique of opportunistically reinvesting capital to develop output over time differs from a lot of their friends.

And that brings me to this:

A 2024 Free Money Stream Mannequin

I observe a easy strategy to valuing E&Ps like MTDR.

First, I create a fundamental free money value and manufacturing mannequin based mostly on administration’s newest steerage and I take advantage of that mannequin, and conservative commodity worth assumptions, to estimate the potential for that producer to generate free money stream over time.

I then use these free money stream estimates to derive a reduced money stream (DCF) goal for the inventory.

That’s how I derived my $66 goal worth for MTDR in my piece on MTDR final July. Extra not too long ago, I used an identical strategy to valuing EOG Assets (EOG) in “EOG Resources: Organic Growth at a Discount” in addition to Devon Vitality (DVN) in “Devon Energy: Turnaround Underway, Time to Buy (Rating Upgrade).”

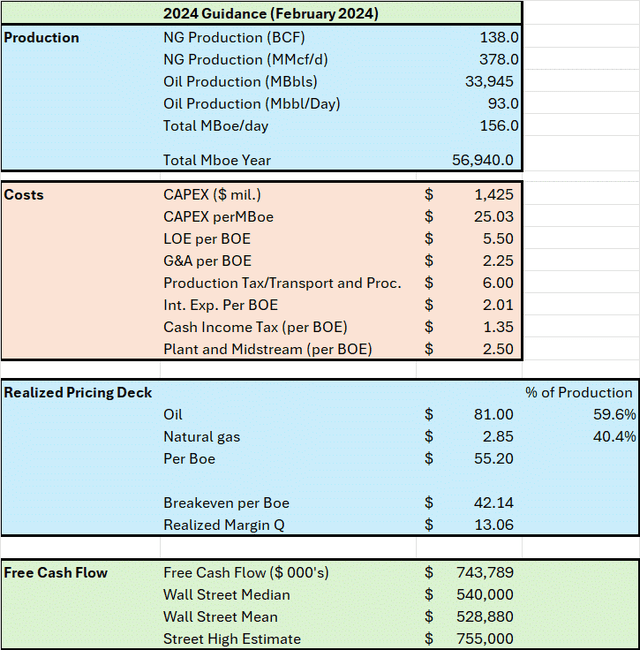

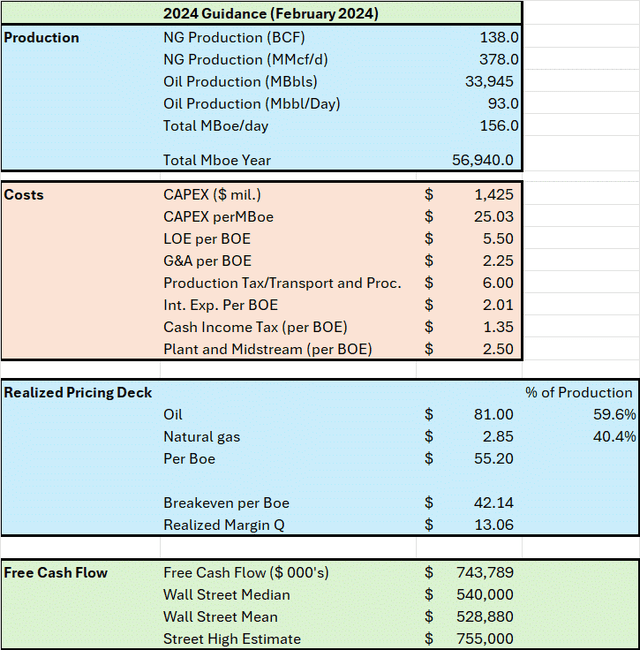

So, right here’s my mannequin for MTDR this yr:

Manufacturing and Money Stream Mannequin 2024 (MTDR 2024 Steering, Bloomberg)

This mannequin could be divided into 4 components from prime to backside.

The highest half exhibits MTDR’s manufacturing steerage for 2024. As I famous earlier, MTDR is a two-stream producer, providing steerage for oil manufacturing and gasoline manufacturing; volumes of NGLs produced are included within the gasoline portion of steerage.

Since MTDR is primarily a liquids producer (oil is about 60% of anticipated 2024 manufacturing) the corporate additionally studies manufacturing in barrels of oil equal phrases (BOE) utilizing the industry-standard conversion ratio of 6,000 cubic ft of pure gasoline equals 1 barrel of crude oil.

The entire numbers offered right here characterize the mid-point of administration’s steerage for 2024 of their This fall 2023 earnings presentation.

The second part right here is prices. I lined a few of the principal value line objects in my dialogue of the evolution of MTDR’s steerage by way of 2023. Nevertheless, the CAPEX listed right here of $1.425 billion is the overall determine, together with each drilling and completions (D&C) in addition to midstream.

I additionally lined LOE earlier in addition to manufacturing taxes, transport and processing whereas common and administrative (G&A) prices, curiosity expense and money earnings taxes are acquainted to many buyers as they’re frequent to most industries.

MTDR does have a midstream enterprise together with property it owns outright in addition to a 51% curiosity in a three way partnership known as San Mateo. A lot of the throughput by way of these property is attributable to MTDR, although the corporate does course of and transport volumes for third-party operators, producing some incremental income and money stream from its midstream enterprise.

In the price part, I included a line merchandise for “Plant and Midstream Services,” which represents the prices related to working these property.

All value line objects are quoted by way of $/BOE until in any other case labeled.

The third part represents my commodity worth estimates for 2024. For oil, I’m utilizing the typical every day closing worth for WTI year-to-date in addition to the calendar strip for the rest of 2024 — that is merely the typical worth of NYMEX WTI futures for supply within the months of Could by way of December 2024.

In Q1 2024, administration indicated it expects to promote its oil roughly in step with WTI – their precise steerage was $-0.50 to +$0.50/bbl in comparison with NYMEX WTI. So, my realized pricing estimate of $81 is solely the strip for WTI this yr, as I simply outlined.

Pure gasoline manufacturing contains NGLs volumes; which explains why administration steerage for gasoline worth realizations appears excessive – Q1 2024 steerage is for MTDR to earn +$0.50/mcf greater than the Nymex Henry Hub benchmark for gasoline. By conference 1,000 cubic ft of gasoline (1 mcf) is equal to 1 million BTUs (MMBtu), which is the pricing normal for NYMEX Henry Hub Fuel Futures.

So, to calculate my estimate for gasoline worth realizations, I merely used the typical every day shut for gasoline year-to-date and the present calendar strip for the months of Could to December 2024. That’s a easy common of the present worth of gasoline for supply in each month from Could to December 2024. Then I added $0.50/MMBtu to that estimate to mirror MTDR’s realization premium, yielding an estimate of $2.85/MMBtu (additionally $2.85/mcf).

As you possibly can see, we will create a pricing estimate for MTDR on a $/BOE foundation by multiplying these commodity pricing estimates by their share of MTDR’s manufacturing on the midpoint of 2024 steerage (the primary a part of the desk). Costs for pure gasoline are transformed to BOE utilizing the {industry} normal 6-to-1 conversion I outlined earlier.

The consequence: $55.20 per barrel of oil equal manufacturing in 2024.

The road merchandise labeled “Breakeven per BOE” is solely the sum of all of the per BOE prices I outlined within the prices part. The realized margin of $13.06 is my realized worth estimate of $55.20 per BOE much less the $42.14 in whole prices per BOE – that is the estimated revenue margin MTDR can earn per BOE produced this yr.

Lastly, I introduced all these estimates collectively within the remaining part of the mannequin.

Multiplying that margin per barrel of oil equal by the midpoint of administration’s 2024 manufacturing steerage yields whole free money stream for 2024 of about $744 million.

Word that my estimate is considerably increased than the Wall Avenue imply and median estimate per Bloomberg of about $529 and $540 million respectively. It’s barely lower than the very best estimate on the Avenue of $755 million in free money stream for 2024.

The primary motive for this seems to be commodity worth estimates. Again on the time administration issued its steerage in late February, West Texas Intermediate costs had been decrease than they’re at present, hovering within the mid to higher $70’s barrel in comparison with round $86/bbl proper now. In line with Bloomberg, the 12-month calendar strip – common worth of WTI futures for supply over the subsequent yr – was $75.11 when MTDR launched its quarterly outcomes in comparison with over $81/bbl at present.

If I cut back my WTI worth estimate from $81/bbl to $75/bbl, and maintain all manufacturing and price estimates fixed, my free money stream estimate would fall to $540 million proper in step with the Wall Avenue consensus.

Another level to notice. MTDR generates incremental earnings from its midstream unit in addition to by way of advertising and marketing operations – mainly shopping for and promoting commodities on behalf of third events. I’m ignoring this added tailwind in favor of a deal with the core E&P enterprise and since I are inclined to favor a extra conservative strategy to valuation – this midstream/advertising and marketing money stream uplift could be along with the money flows I’ve modeled above.

Longer-Time period Money Flows and Goal

As MTDR’s administration staff famous within the wake of their Advance acquisition one yr in the past, the corporate has stable manufacturing and capital effectivity momentum as we head into 2024.

A fast look on the mid-point of estimates I’ve offered exhibits anticipated 2024 manufacturing progress of 18.4% on a BOE foundation (156,000 BOE/day in 2024 vs. 131,800 in 2023) led by 23.2% progress in oil barrels (93,000 bbl/day in 2024 vs. 75,500 bbl/day in 2023).

What’s much more essential is the bugbear for Wall Avenue final yr, particularly capital effectivity.

The mid-point of MTDR’s whole CAPEX steerage for this yr is $1.425 billion, up about 8.8% from the $1.31 billion they spent in 2023. Nevertheless, since general manufacturing is rising at a sooner tempo than CAPEX, their whole CAPEX per BOE is projected to come back in a bit over $25/BOE in 2024 in comparison with $27.23/BOE in 2023.

Like most E&Ps, MTDR hasn’t provided steerage for 2025 but. Nevertheless, based on Bloomberg, the consensus on Wall Avenue is penciling in additional manufacturing upside of about 8.6% in 2025 for oil and 5.1% for pure gasoline.

That’s logical.

In any case, the midpoint of administration’s steerage for Q1 2024, offered alongside This fall 2023 outcomes and full-year 2024 steerage, was for whole manufacturing of 145,750 BOE/day. Additional, Q1 output was anticipated to be constrained to the tune of 5,500 BOE/day resulting from short-term upkeep points with third-party midstream infrastructure. Including again that manufacturing yields an ex-constraint Q1 2024 manufacturing stage of 151,250 BOE/day.

Administration additionally estimated a year-end 2024 exit charge of manufacturing within the 161,000 BOE/day vary.

So, the image right here is evident – MTDR expects regular quarterly progress in manufacturing sequentially by way of 2024, to a full yr common charge of 156,000 BOE/day from 131,800 final yr. That’s as a result of we’re beginning 2024 nicely under the anticipated full-year common (even excluding short-term constraints) and rising to exit the yr nicely above the full-year manufacturing common on a BOE/day foundation.

That, in flip, implies stable upward momentum to manufacturing into early 2025.

Additional, MTDR continues to be energetic in pursuing small bolt-on offers so as to add to its acreage and manufacturing inside its core Delaware Basin play. Throughout the Q&A portion of MTDR’s final quarterly convention name, CEO Joe Foran had this to say:

Sure. Neal, thanks for asking that query is, sure, the reply is sure. Final yr, in fact, Advance was our greatest deal ever and has drawn a number of consideration however our land group, our enterprise improvement group did one other 200 transactions. Most of them are — a few of them had been very, very small. A few of them had been a bit bigger. However they’re on the market, our land males, particularly on the market on a regular basis making offers, what the offers final couple of years have grown more and more. It is only a rationalization of property between firms. We — you commerce out of your non-op for anyone else’s non-occupant that you simply function. And so issues like which can be a bit orphans out by themselves.

So I believe these will come alongside. Firms are being very cooperative with one another. And these are small transactions that do not have that form of by themselves a giant materials influence. However within the mixture, they add up they usually make your operations that rather more environment friendly. So there’s an actual rationale to do this.

After which on the similar time, a few of the larger outfits are wanting to pay attention their property in a single space or one other. So these alternatives come up. After which you’ve personal fairness has all the time bought just a few issues popping out. So I believe it is going to proceed and Van’s group might need to say a phrase, however he has them on the market on the street rather a lot. And — they usually’ve — they’re constructing relationships and simply making an attempt to do issues that make sense for each side.

Supply: Q4 2023 Conference Call Transcript

The corporate typically refers to this as their “brick-by-brick” strategy. Merely put, along with the large offers like Advance, the corporate makes a number of smaller offers to choose up acreage in its core performs. Many of those offers are tiny; nevertheless, taken collectively, they add considerably to manufacturing every year. CEO Joe Foran additionally famous the frequency of those offers has been choosing up in the previous few years.

So, based mostly solely on momentum exiting 2024 and the corporate’s longstanding strategic of constructing quite a few smaller offers to reinforce manufacturing, the consensus outlook for added progress in manufacturing of 8.6% for oil and 5.1% for pure gasoline appears affordable.

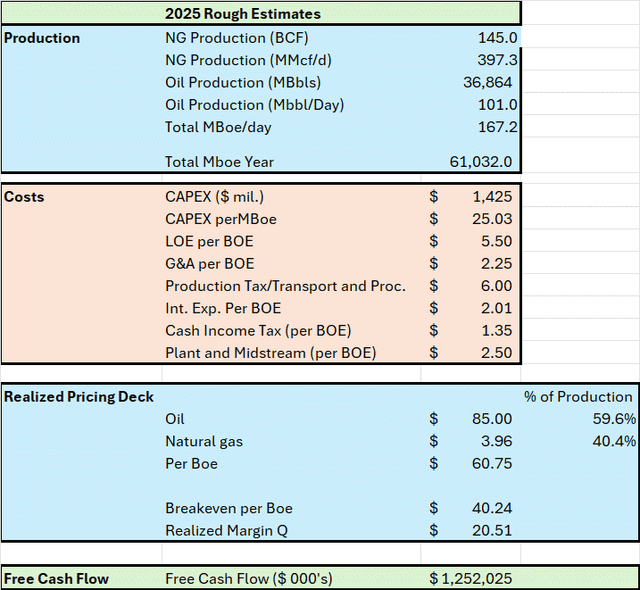

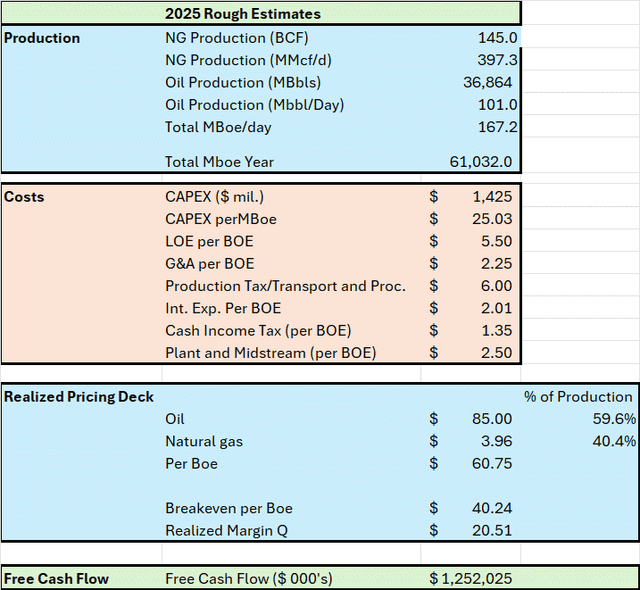

So, let’s have a look at what which may imply for 2025 free money stream:

MTDR Tough 2025 Free Money Stream Estimates (Bloomberg, Creator’s Estimates)

It is a tough estimate as a result of there’s a number of uncertainty about prices and CAPEX effectivity over time – on this case, I’ve held the CAPEX/BOE fixed on the 2024 steerage stage ($25/BOE produced) whereas elevating my manufacturing estimates for oil and gasoline by 8.6% and 5.1% respectively per Wall Avenue consensus. The result’s $1.526 billion in CAPEX for 2025.

For my realized pricing estimates, I’m utilizing $85/bbl WTI oil and NYMEX pure gasoline at $3.46/MMBtu. Whereas the latter might sound elevated given the present worth of gasoline sub-$2, per Bloomberg the 2025 calendar strip – the typical worth of gasoline for supply within the months of January by way of December 2025 is $3.46/MMBtu. I’m including $0.50/mcf to that worth realization to mirror NGLs volumes in step with 2024 expectations and steerage.

The tip result’s free money stream over $1.1 billion in 2025.

So, let’s take a shot at a worth goal for MTDR based mostly on these estimates:

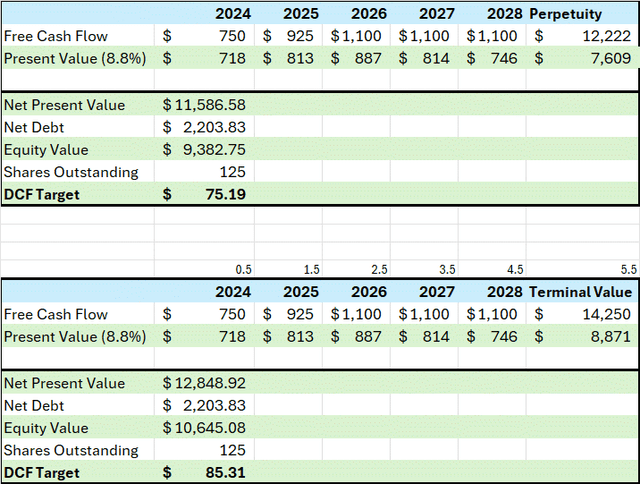

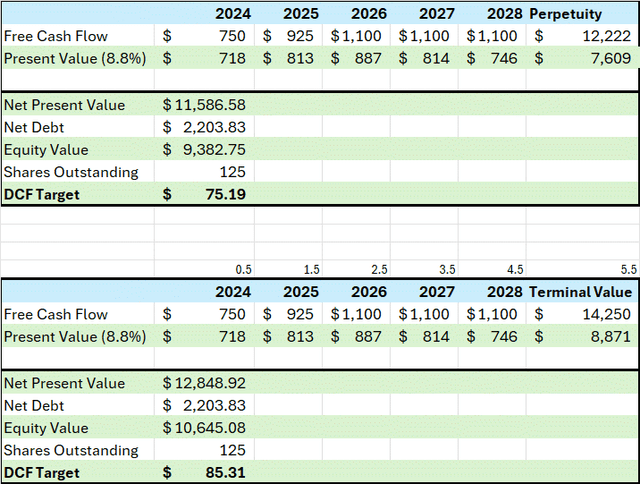

DCF Worth Targets for MTDR (Creator’s Estimates)

I’m utilizing two completely different methodologies to calculate a worth goal for MTDR based mostly on my free money stream estimates.

The highest DCF valuation approach makes use of a 2024 free money stream estimate of $750 million for MTDR as calculated earlier in addition to my $1.1 billion estimate for 2026. I’ve assumed 2025 is correct in the course of 2024 and 2026, implying it takes MTDR one further yr to step as much as that $1.1 billion free money stream run charge. I’m making that assumption simply to render the goal a bit extra on the conservative facet.

I then assume a $1.1 billion per yr free money stream estimate in perpetuity and I calculate the current worth all these money flows utilizing a 9% low cost charge. That 9% charge relies on the Bloomberg calculation of MTDR’s weighted common value of capital (WACC), which includes the precise value of excellent debt, and an fairness value based mostly on the historic volatility of MTDR inventory to the S&P 500.

The tip result’s a goal worth of $75.19, a small premium to the present quote.

The second DCF goal is derived utilizing a terminal a number of calculation. The money stream estimates are similar; nevertheless, the terminal worth relies on an enterprise worth to EBITDA a number of of 5.7 instances the consensus Wall Avenue estimate for EBITDA in 2026 of about $2.5 billion. I’m utilizing the 2026 consensus somewhat than 2028 for the easy motive that there aren’t many analysts publishing estimates for 2028 EBITDA for MTDR.

An EV to EBITDA a number of of 5.7 instances is a premium to MTDR’s present 4.9 instances based mostly on Bloomberg’s blended ahead 12-month EBITDA estimates. Nevertheless, it’s a reduction to EOG close to 6 instances, in step with FANG and solely a slight premium to DVN at 5.5 instances. MTDR is uncovered to the Permian identical to DVN, FANG and EOG and its manufacturing progress charge is increased. So, I imagine a a number of extra in step with friends is logical, if not conservative.

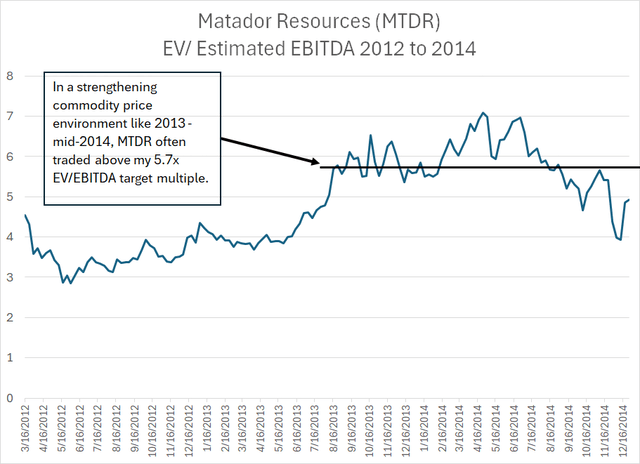

And check out this:

MTDR Assets EV/EBITDA 2012 to 2014 (Bloomberg)

Within the 2013 to mid-2014 period – the final time oil costs held above $80 to $85/bbl for a protracted interval – MTDR ceaselessly traded at valuations nicely above my 5.7x EV/EBITDA a number of.

So, based mostly on my second DCF calculation, I calculate a goal of greater than $85 for MTDR, a roughly 20% to 25% premium to the present worth.

I’d regard that first $75 goal as a valuation ground for MTDR and the upper $85 valuation as extra affordable. The primary motive is that when commodity costs are secure or rising – significantly oil – MTDR tends to have the ability to fetch increased valuations as buyers search an unhedged manufacturing progress story.

As I defined in my recent article on the US Oil Fund (USO) I proceed to have a constructive outlook for WTI oil costs over the subsequent few years. And As I defined in my latest piece on natural gas producer EQT Corp. (EQT) again in February, the outlook for US pure gasoline costs appears poised to brighten into 2025. Certainly, as famous earlier, the 2025 calendar strip worth for gasoline is simply shy of $3.50/MMBtu, a big premium to the present front-month worth.

Conclusion and Dangers

As with all E&Ps, the first dangers to MTDR contain lower-than-expected commodity costs.

My realized pricing estimates for MTDR over the longer-term are based mostly on $85/bbl WTI oil costs – really a reduction to the present quote – and the present pure gasoline calendar strip worth (precise present futures costs). So, I see that as conservative on each counts.

That mentioned, commodity costs are risky and, as I illustrated earlier, even a $5 or $6/bbl transfer in oil costs over the course of the yr can have a big influence on free money stream estimates — that is the principle motive my 2024 free money stream estimates are increased than the Wall Avenue consensus previous to the latest surge in oil.

From a company-specific perspective, I believe the largest danger for MTDR stays its differentiated technique. Most of MTDR’s friends have adopted a gradual manufacturing progress and capital return technique in recent times. For instance, DVN pays a big variable dividend based mostly on free money stream generated every quarter; based on Bloomberg, the payout over the previous 12 months tops 4.5%.

And EOG Assets (EOG) has a said plan to return 70% or extra of adjusted free money stream to shareholders through dividends and share buybacks as I clarify right here.

MTDR is completely different. The corporate’s present dividend is $0.20 per quarter, equal to a yield of about 1.2% on the present worth. Whereas the corporate has elevated its base dividend considerably because it was established at $0.025 per quarter in 2021, and I’d anticipated extra will increase later this yr, that’s nonetheless nicely under the peer-average yield.

And MTDR additionally hasn’t repurchased shares in latest quarters; certainly, on March 25th, the corporate really issued 5.25 million shares elevating virtually $350 million in capital partially to repay debt on its revolving credit score facility.

MTDR has deployed free money stream to repay debt, together with debt taken on to fund the Advance acquisition final yr, however it’s additionally reinvesting free money stream to develop through its “brick-by-brick” acquisition program.

It’s essential to grasp that MTDR’s progress technique differs from the growth-at-any-cost, debt-fueled shale drilling binge of the 2010 to 2018 period. As I outlined earlier, MTDR generates free money stream even with oil and gasoline costs nicely under the present quote – above I calculated that on a $/BOE foundation, MTDR would wish simply over $42/BOE to “breakeven” on a free money stream foundation.

Nevertheless, MTDR’s acutely aware choice to spend money on worthwhile, free money stream constructive progress is a distinct strategy than most of its friends.

This strategy is not going to attraction to all buyers – these primarily in dividend yields, for instance, could be much better off contemplating a few of the different names I’ve profiled right here currently, together with EOG and DVN referenced earlier.

Nevertheless, in a strengthening commodity worth setting, MTDR’s worthwhile progress technique has tended to outperform. Think about that, based on Bloomberg, MTDR shares had been up over 200% in 2021 in comparison with a 67% acquire within the XOP ETF whereas in 2022 the inventory jumped a further 56%, beating the XOP by 10.5 share factors.

MTDR is up considerably since I first profiled the inventory on Searching for Alpha final July and the inventory has handily outperformed its friends. Nevertheless, following the profitable integration of Advance and the latest rise in crude oil costs, I see extra upside to $85 per share.