Wolterk

Shares of Mattel, Inc. (NASDAQ:MAT) have been a particularly poor performer over the past year, losing over 20% even as the market has rallied substantially. As the tailwind from the Barbie movie has faded, the extremely muted demand for toys has weighed on results. Shares briefly jumped Monday on M&A speculation, before giving back much of those gains Tuesday.

I last covered Mattel in October, mistakenly rating them a buy, and shares are down 20% since that recommendation. With toy demand staying weaker for longer and investors awaiting progress on monetization opportunities, now is a good time to revisit Mattel, given the just announced Q2 results.

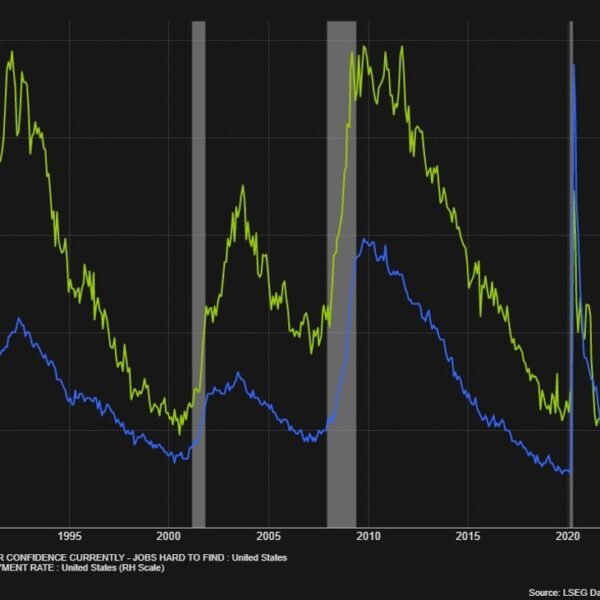

In the company’s second quarter, Mattel earned $0.19 in adjusted EPS as revenue declined by 1%. This result was up from $0.09 last year, and it also beat consensus by about $0.02. Sales activity continues to be fairly muted as end consumer demand is relatively soft, and retailers continue to aggressively manage inventory. That said, Mattel is making genuine progress in recapturing margin as cost initiatives take hold. Of course, toy demand is seasonally skewed with Q4 driving the lion’s share of activity, meaning the health of the consumer in a few months will be critical for results.

Toy demand remains muted

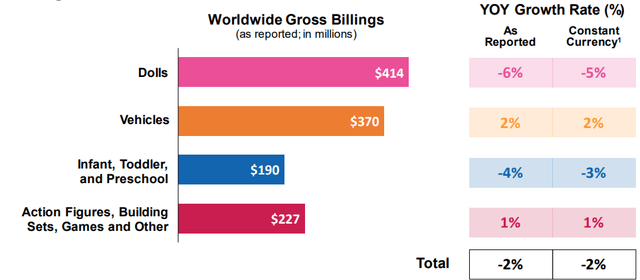

Overall, as you can see below, there was meaningful divergence among Mattel’s product categories, with dolls and toddler sales weak while vehicles and action figures showed modest growth. Overall, billings were down 2% from last year. Now, doll sales benefited last year from purchases by retailers anticipating the Barbie film, which likely explains much of that relative underperformance as 2023 sales were uniquely high. Infant & toddler sales have been persistently weak and remain an underperforming category.

One thing to emphasize is that Mattel largely recognizes revenue when it makes a sale to a retailer, not when the retailer makes a sale to a consumer. Interestingly, point-of-sales activity was comparable to last year. We are likely to continue to see retailers control inventory very tightly, which has been a theme over the past 18 months as retailers were caught with too much inventory in late 2022. With this destocking cycle persisting for 18+ months, we are likely near the end. Over the long-term, Mattel sales should match end consumer sales.

Mattel is not seeing that much geographic divergence, either. North America fell 3% to $646 million, while Latin America and EMEA were down 2% to $453 million. Asia was the bright spot, as it rose 4% to $101 million. However, at less than 10% of the business, strength has just a modest financial impact. The company expects a “modest” decline in toy demand, slightly better than its prior outlook.

Cost cuts are taking hold

Now, despite a modest decline in sales, adjusted EBITDA rose $23 million to $171 million. This was powered by meaningful margin expansion. Adjusted gross margins expanded 430bps to 49.2%. 120bps of this margin improvement came from its cost reduction program, 110bps of cost deflation, and 40bps from better inventory management. Mattel has been engaged in a multiyear cost-cutting effort given lackluster end-demand. Thus far, it has achieved $60 million in savings, with a $200 million goal by 2026.

I would note that Mattel has done an excellent job of managing its inventory. Inventory is down 20% from last year to $777 million. This is 19% better than sales, meaning it is moving its products much more quickly and no longer overproducing goods. This lean inventory helps to minimize costs, and even more importantly, it reduces the risk that Mattel will be left with too much product and forced to make price cuts and sacrifice margin.

Earnings were flattered by the fact that advertising spending was down $16 million to $74 million due to timing factors. Over the full year, Mattel expects advertising to largely track sales activity, so this positive variance explains the EPS beat vs. consensus and will not persist. Partially offsetting this, adjusted SG&A rose 11% to $361 million, and I expect that growth rate to slow as its cost-cutting program continues.

Cash trends are encouraging

One positive is that Mattel continues to improve its balance sheet. It carries $722 million of cash against $2.33 billion of debt. It now has 2.3x debt to EBITDA from 3.1x last year, and I view 2-2.5x as a healthy level of debt given the cyclicality of the business. Additionally, Mattel has maturities until 2026, reducing its interest rate risk.

So far this year, it has seen -$283 million in free cash flow due to a $418 million working capital outflow. Mattel’s cash flow is seasonal. It builds inventory during the year ahead of the Christmas season, and then begins to see a surge in cash flow as inventory comes down into year-end. Its free cash flow year-to-date is $116 million better than last year, given better margins and inventory control. The company also continues to repurchase $100 million in stock per quarter, reducing the share count by 3.6% over the past year.

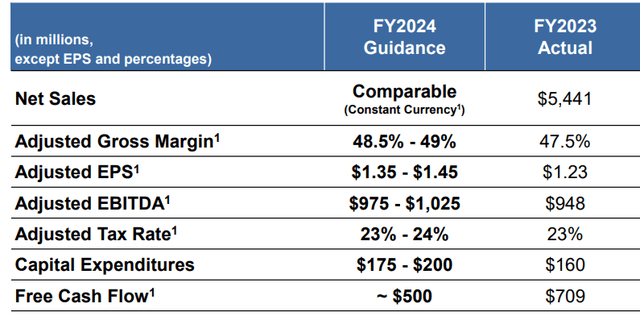

The outlook may be conservative

Alongside results, Mattel reiterated full-year guidance. Given it expects the toy environment to be slightly better than previously, I would have liked to see an upgrade. That said, management likely wants to err on the side of caution given a disproportionate amount of revenue comes late in the year. In my view, with inflation moderating and the Fed likely to begin lowering rates, we are likely to see discretionary spending stabilize if not improve slightly into year-end.

IP Licensing Takes Time to Deliver as PE Circles

Beyond toys, Mattel continues to push into IP licensing, hoping to replicate the success of the Barbie film. Over the medium term, I believe the Hot Wheels brand likely has the most potential commercial appeal, similar to how Disney (DIS) had success with its “Cars” franchise. More tactically, it is partnering with Amazon (AMZN) for a Masters of the Universe 2026 film and is launching an animated Barney’s World and Barbie show.

There have also been reports that private equity is looking at Mattel as an acquisition target. With the demand for content and quality franchises as high as ever, Mattel continues, in my view, to have horizontal expansion opportunities beyond physical toys and mobile games. Plus, successful film launches can spur further demand for toys, creating a virtuous circle. Ultimately, though, we will need to see Mattel launch new successful films and get a sequel to Barbie off the ground to prove this is more than a one-off.

With just an $8 billion enterprise value, potential IP upside does not seem to be captured in shares. With shares so beaten down, I do not expect Mattel management to be receptive to a PE-deal, but the prospects can help put a floor under shares. Given my view of modest growth this Christmas, I see Mattel earning $1.38-$1.48 this year with $500-550 million of free cash flow. I continue to view 16x earnings as a fair multiple, given the slow growth in the toy business but also the IP upside, which argues shares should be $23. Shares also have an 8% free cash flow yield, and with its balance sheet properly deleveraged, that will enable ongoing buybacks.

Conclusion

The slower recovery in toys and long-term nature of the IP build out has left Wall Street frustrated, but Mattel’s margin improvement is helping to drive solid EBITDA growth. Barring a recession that causes spending to fall further, I see about 20-25% of upside into the low-$20’s, and I would be a buyer.