AzmanJaka

Medpace (NASDAQ:MEDP) is a fast-growing medical analysis group, targeted on small biopharma prospects, and continues to be founder-led by CEO August Troendle. All through the final yr, notably small biopharma firms more and more confronted financing points as a result of macroeconomic slowdown and rising curiosity setting. Moreover, we noticed loaded inventories and subsequently a normalization for gear producers. For Medpace buyers, particularly the rising uncertainty about its key purchasers was a priority. Nonetheless, the corporate responded that the requests for proposals (RFPs) at the moment have been the second highest they ever had. I recited the CEO August Troendle in my last article on Medpace about its Q3 outcomes, the place he described the corporate’s enterprise setting as “schizophrenic”, stating:

So we’re seeing nice enterprise setting and a horrible enterprise setting. So I do not know. It is simply sort of schizophrenic.

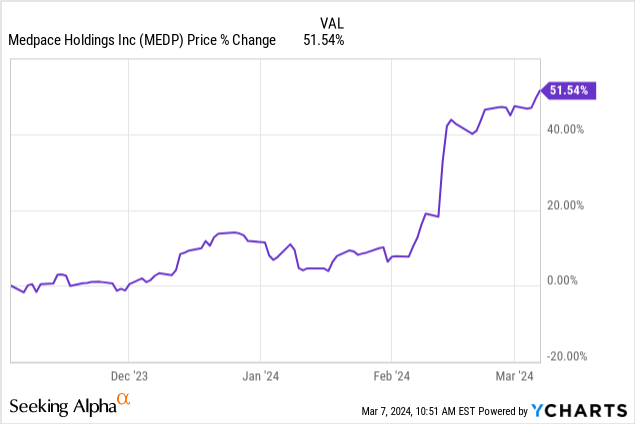

Now that we now have seen the This fall outcomes, Mr. Market appears to be very assured within the former, sending the top off greater than 50% because the time of the article’s posting. And certainly, the outcomes have been exceptional. Nonetheless, seeing the corporate’s valuation explode so shortly begs the query of whether or not we’re past momentum and into one other mania.

Let’s have a look!

Working Efficiency

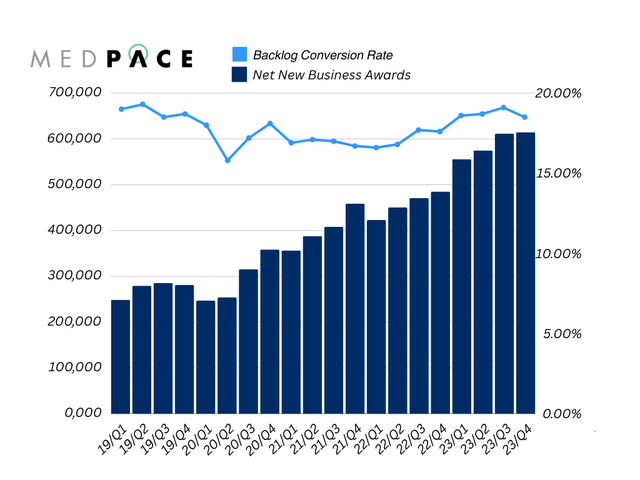

The final yr marked once more a brand new file excessive for the corporate as gross sales elevated by 26.5% and 29% in This fall and FY23, respectively, amounting to a complete of $1.89 billion. Within the present setting, these outcomes are exceptional and exhibit the resilience of Medpace’s backlog. Within the final quarter, the web new enterprise awards that have been added to the corporate’s backlog have been equal to $615 million, a rise of 26.7% YoY in comparison with the final yr, whereas the quarter’s backlog conversion charge remained robust at 18.5%.

Internet New Enterprise Awards and Conversion Price (Personal Illustration)

With regard to the corporate’s steerage for 2023 as outlined within the previous article, we at the moment are in a position to say that Medpace delivered on all measures from high to backside line, the place the web revenue even got here out higher than anticipated with a rise of 15.3% in 2023. For current shareholders, EPS delivered even higher with a rise of twenty-two% through the full yr as a result of opportunistic share repurchase program that went on through the first half of 2023.

Additionally it is noteworthy that the EBITDA margin declined to 19.2% (20.4%) within the final quarter, primarily because of a 43% improve in reimbursable bills. This isn’t stunning given the earlier steerage, however these outcomes are nonetheless above pre-pandemic ranges. So, general, an awesome quarter for Medpace, which definitely contributed to the current market run. Thus, it’s price mentioning that the underlying market setting appears to be recovering general, which boosts the imaginative and prescient of Medpace’s administration. Throughout the newest earnings call, CEO August Troendle commented on the present setting and truly referred to his earlier statements that I discussed at first.

I feel I stated final quarter that issues have been sort of stepping into quite a lot of completely different instructions directly, sort of very quick however unreadable. Lot of problem and quite a lot of a really robust enterprise setting. […] I feel issues are bettering from a funding standpoint. A variety of put in tasks at the moment are shifting ahead, issues that we thought have been sort of simply held up with weren’t going to get financing or beginning to transfer. So I feel we’re — it is nonetheless a post-volatile interval, and there could also be extra volatility however I feel we’re increasingly seeing a pattern in the direction of enchancment on the funding aspect and mission development aspect.

With a income share of 78%, small biopharma firms with annual gross sales beneath $250 million are the important thing issue for Medpace’s ongoing success story. Due to this fact, seeing the funding and mission setting enhance is superb information, though Medpace hasn’t considerably suffered but. Additionally through the newest quarter, Troendle commented, the corporate’s cancellations have been “in a good range”, which, after all, is benefitting the web new enterprise awards and the anticipated conversion.

Competitors

Mentioning the present setting for CROs, I need to fill in an replace on the aggressive panorama. One of many preliminary assumptions behind the funding case for Medpace was the prospect of additional market share profitable, which was notably profitable through the newest trade slowdown. Medpace appears to have a excessive win charge of promising tasks that assure the resilience of the underlying money flows for the corporate. August Troendle said accordingly:

Yeah, our win charge has been excellent the final two quarters, above the sort of the long-term pattern. So that appears good. I do not — these items do bounce round although. And I have a look at — you need to have a look at share, I have a look at income. And that is the one manner I understand how to have a look at it. Folks have backlog other ways and conversion is a significant component. And I do not know what it means to be share acquire to place up a book-to-bill. So I simply have a look at income and income pattern over time. And look, we’re rising at — organically at multiples of the typical of the remainder of the trade. So I simply — we’re clearly doing job by way of taking share.

So let’s check out the competitors by way of income:

| Income Progress in 2023 | Medpace | IQVIA | ICON | Fortrea (Steering) |

| This fall | 26% | 2.6% | 4.1% | – |

| FY23 |

28.9% |

4.1% | 4.6% | -0.7% – 1.1% |

| FY24 steerage | 14% – 17% | 3% – 4% | 3% – 8% | – |

Whereas we now have to think about that these firms are usually not totally comparable because of completely different sizes and repair choices, we are able to clearly distinguish that Medpace continued to achieve market share in 2023 at an excellent tempo.

Outlook for 2024

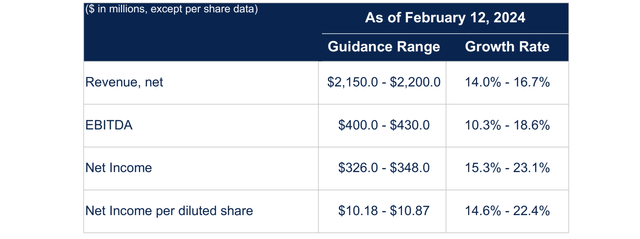

This aggressive benefit appears to carry on in 2024 acknowledged by the present outlooks from these firms. Medpace stayed with its steerage of full-year income between $2.15 and $2.2 billion, which represents a progress charge of 14% or 16.7%, respectively. These assumptions have gotten more and more higher, when in comparison with the present outlooks of the corporate’s closest friends. And whereas all firms are mentioning an enhancing market setting for the following yr, solely Medpace appears to haven’t any intention to decrease the market’s expectations in any respect. Accordingly, August Troendle said:

[…] we had a really uneven interval and fairly a little bit of cancellations and funding difficulties. And that is shifting away. Like I stated, I feel we see a transparent path within the final three, 4 months by way of tasks beginning to set up, and that makes us very optimistic. These — once more, these items take fairly some time to get to start out up and to get to income burned. I imply, these are a number of quarters for issues to maneuver ahead however that does make us really feel extra optimistic on the go-forward subsequent yr, et cetera.

Moreover, Medpace raised the EBITDA outlook for 2024 a bit, so it is now anticipated to be between $400 to $430 million as an alternative of $390 to $415 million as guided beforehand. This is able to end in an EBITDA margin within the vary of 18.6% to 19.5%, which is near the present degree of profitability and subsequently represents a backside for the normalization of the EBITDA margin.

Steering 2024 (This fall Presentation)

Total Ideas

These days, Medpace offered one other stellar efficiency in a reasonably unsure setting that was notably pushed by a macroeconomic slowdown and growing funding problems with biopharma firms. One may have thought that particularly these conditions will carry Medpace’s persevering with momentum to fall as the corporate closely depends on small and mid-sized biopharma firms. The specialization of Medpace and the main target in the direction of oncologic- and metabolic-related therapeutical areas have, nevertheless, preserved the corporate from struggling with the trade. These outcomes and the clear communication and fervour of the administration are growing my conviction into the long-term outperformance of the corporate in comparison with the general trade. And whereas some individuals are elevating considerations because of current information of August Troendle promoting shares, I might argue that he is nonetheless proudly owning about 20.8% of the full excellent shares, which in worth would nonetheless equal greater than 3,300x his annual base wage on the present share value.

Money Move

Having put Medpace’s present state of affairs into perspective, we are able to now proceed with an up to date evaluation of its skill to generate money stream.

To research an organization’s skill to generate money stream, I focus totally on its free money stream. Regardless of the same old calculation (OCF – CapEx = FCF), I modify the working money stream for adjustments in internet working capital and the bills for stock-based compensation.

Within the case of Medpace, the calculation for FY23 appears like this:

| in $ million | |

| Working Money Move | 433.37 |

| – Inventory-based Compensation | 20.52 |

| – Modifications in NWC | 106.49 |

| Adj. Working Money Move | 306.36 |

| – Capital Expenditures | 36.45 |

| Free Money stream (excl. NWC) | 269.91 |

| Free Money stream (incl. NWC) | 376.40 |

Within the earlier 12-month interval, Medpace generated roughly $269.9 million of free money stream, in keeping with my “normalized” calculation. Nonetheless, my normal process is sort of diverging from the precise money after capex that Medpace gathered through the yr, as this may be $396.92 million. The numerous distinction between these numbers is especially attributable to the enterprise mannequin of Medpace, as purchasers probably pay money upon cost schedule earlier than the companies are being acknowledged. Due to this fact, these superior billings are inflicting an precise money stream that’s together with excellent companies, so I adjusted them. Nonetheless, it stays a noteworthy benefit of the enterprise mannequin to have the ability to acquire money upfront as an alternative of getting a protracted money conversion cycle. Together with these inflows, Medpace achieved a free money stream conversion of 109% in 2023, which is including to the elemental resilience.

Nonetheless, I’ll stick with my process and exclude these working capital adjustments and stock-based compensation bills to acquire a sustainable and complete image of the free money stream.

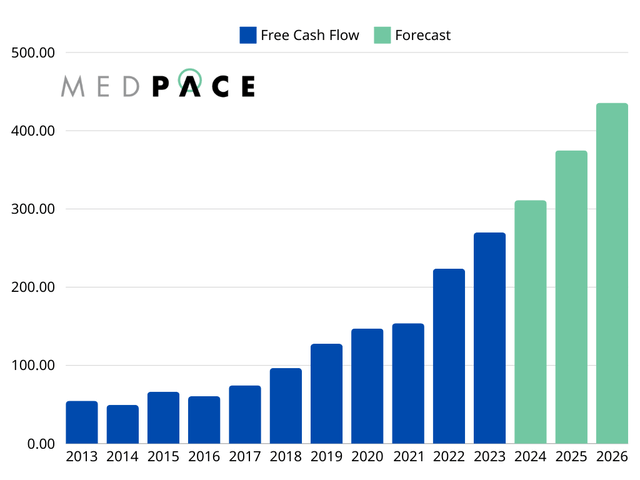

Free Cashflow, 2013-2026 (Personal Illustration)

During the last 10 years, Medpace has elevated its FCF and EBITDA at a CAGR of 17.29% and 15.55%, respectively, displaying an growing money conversion even excluding the working capital adjustments talked about earlier. In 2023, the corporate transformed 74% of its EBITDA into FCF, which is barely decrease than the typical charge during the last years. Going ahead, I assumed a FCF conversion of 75% and utilized it to the corporate’s steerage and analysts’ expectations for EBITDA. Based on these assumptions, Medpace is anticipated to develop its FCF at a CAGR of 17.3% within the subsequent three years, which is surprisingly just like the historic compounding charge. Moreover, we are able to discover an growing optimism available in the market’s expectations, because the anticipated progress charge equalled 15% in my final article. Nonetheless, as the corporate’s steerage for 2024 proposed a income progress of 14% to 16.7%, we are able to already assume that these expectations are getting nearer to the optimistic state of affairs, whereas certainly implying a little bit of margin enlargement.

Valuation

So, having reconsidered the underlying money technology of the enterprise from the angle of its homeowners, we are able to lastly rethink the present valuation.

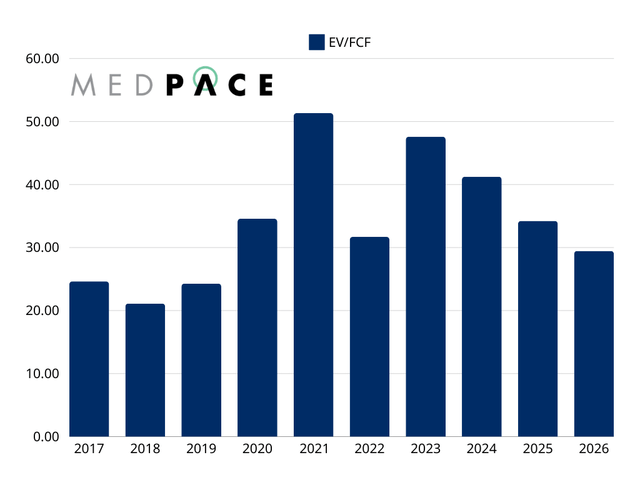

EV/FCF, 2017-2026e (Personal Illustration)

On the present share value of $405.65, Medpace is valued at a market cap and enterprise worth of $12.91 billion and $12.83 billion, respectively. Contemplating the sooner calculated free money stream of $269.91 million, we’re deriving at a present EV/FCF a number of of 47.58x, which is fairly large even for a fast-growing firm. Nonetheless, as said earlier, this may be a really conservative method. Utilizing the “actual” money stream after SBC and capex, Medpace could be at the moment buying and selling at “only” 34.1x FCF, which is possibly a bit extra cheap. The promising outlook for the enterprise would however point out that Medpace will develop into this valuation reasonably shortly.

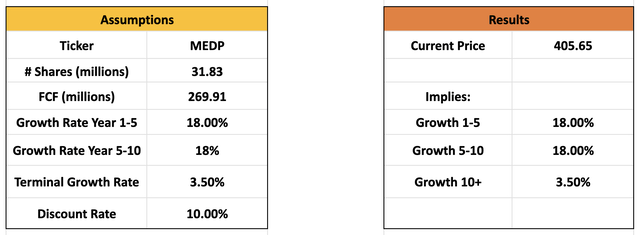

Inverse DCF (Personal Illustration)

The inverse DCF mannequin demonstrates precisely these ideas. When utilizing the extra conservative FCF excl. the working capital adjustments, we’re acquiring a CAGR of 18% for the following 10 years, which might be required for Medpace to develop into its present valuation. Doubtlessly, that is the easiest way to visualise the modified market sentiment relating to the long run prospects of the corporate. In November of final yr, we have already calculated the inverse DCF, which resulted in a 15% progress charge for the primary 5 years, adopted by 10% for the years 5-10. In fact, altering the FCF calculation or the expansion charge past the following 10 years would possible decrease my consequence, however would additionally embody the next threat of failure.

Conclusion

Since writing about Medpace in final November, the corporate reported its full-year outcomes that when once more crashed the market expectations, resulting in an outstanding share value efficiency since then. As well as, the corporate reaffirmed its earlier outlook and raised its anticipated EBITDA margin, signaling an trade restoration and a promising progress path forward. The most recent outcomes have definitely boosted the market’s notion of the corporate, which is most seen within the sharply elevated progress charge required by an inverse DCF mannequin. Based on the calculations, Medpace is at the moment maximizing its honest valuation, leaving much less room for operational errors or stunning occasions. In different phrases, the market is at the moment operating forward of the underlying enterprise.

That stated, I might suggest to maintain the corporate on the watch checklist because the excessive volatility of Medpace’s share value has repeatedly opened up alternatives up to now. As I am already invested considerably within the firm, I am simply maintain my place with an elevated conviction because of these magnificent outcomes. The continuing acquire of market share within the medical analysis trade and the projected progress charges are positively noteworthy and rationalizes many of the share value appreciation – at the moment no mania in sight.