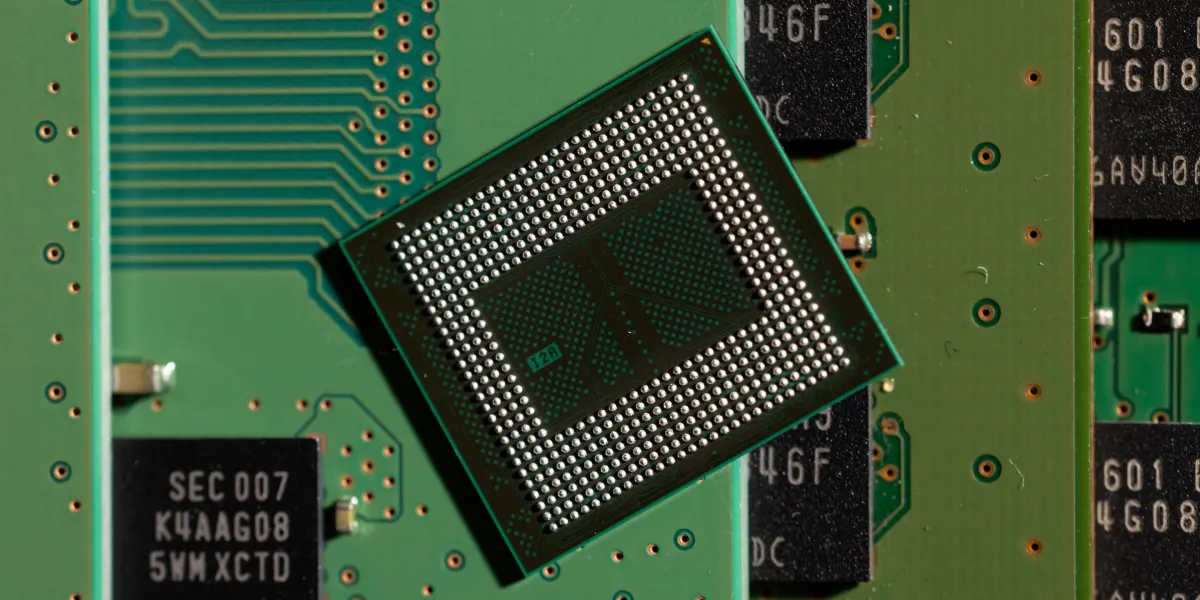

{Hardware} is rising as a key AI development space. For large tech corporations with the cash and expertise to take action, growing in-house chips helps cut back dependence on exterior designers equivalent to Nvidia and Intel whereas additionally permitting companies to tailor their {hardware} particularly to their very own AI fashions, boosting efficiency and saving on vitality prices.

These in-house AI chips that Google and Meta simply introduced pose one of many first actual challenges to Nvidia’s dominant place within the AI {hardware} market. Nvidia controls more than 90% of the AI chips market, and demand for its industry-leading semiconductors is only increasing. But when Nvidia’s greatest clients begin making their very own chips as an alternative, its hovering share worth, up 87% because the begin of the yr, might undergo.

“From Meta’s point of view…it gives them a bargaining tool with Nvidia,” Edward Wilford, an analyst at tech consultancy Omdia, informed Fortune. “It lets Nvidia know that they’re not exclusive, [and] that they have other options. It’s hardware optimized for the AI that they are developing.”

Why does AI want new chips?

AI fashions require huge quantities of computing energy due to the massive quantity of knowledge required to coach the big language fashions behind them. Standard laptop chips merely aren’t able to processing the trillions of knowledge factors AI fashions are constructed upon, which has spawned a marketplace for AI-specific laptop chips, typically known as “cutting-edge” chips as a result of they’re probably the most highly effective units in the marketplace.

Semiconductor large Nvidia has dominated the nascent market: The wait checklist for Nvidia’s $30,000 flagship AI chip is months long, and demand has pushed its share worth up virtually 90% prior to now six months.

And rival chipmaker Intel is combating to remain aggressive. It just released its Gaudi 3 AI chip to compete immediately with Nvidia. AI builders—from Google and Microsoft right down to small startups—are all competing for scarce AI chips, restricted by manufacturing capability.

Why are tech corporations beginning to make their very own chips?

Each Nvidia and Intel can solely produce a restricted variety of chips as a result of they and the remainder of the business depend on Taiwanese producer TSMC to truly assemble their chip designs. With just one producer solidly within the sport, the manufacturing lead time for these cutting-edge chips is multiple months. That’s a key issue that led main gamers within the AI area, equivalent to Google and Meta, to resort to designing their very own chips. Alvin Ngyuen, a senior analyst at consulting agency Forrester, informed Fortune that chips designed by the likes of Google, Meta, and Amazon gained’t be as highly effective as Nvidia’s top-of-the-line choices—however that would profit the businesses by way of pace. They’ll be capable of produce them on much less specialised meeting strains with shorter wait occasions, he stated.

“If you have something that’s 10% less powerful but you can get it now, I’m buying that every day,” Ngyuen stated.

Even when the native AI chips Meta and Google are growing are much less highly effective than Nvidia’s cutting-edge AI chips, they might be higher tailor-made to the corporate’s particular AI platforms. Ngyuen stated that in-house chips designed for an organization’s personal AI platform might be extra environment friendly and save on prices by eliminating pointless capabilities.

“It’s like buying a car. Okay, you need an automatic transmission. But do you need the leather seats, or the heated massage seats?” Ngyuen stated.

“The benefit for us is that we can build a chip that can handle our specific workloads more efficiently,” Melanie Roe, a Meta spokesperson, wrote in an electronic mail to Fortune.

Nvidia’s top-of-the-line chips promote for about $25,000 apiece. They’re extraordinarily highly effective instruments, they usually’re designed to be good at a variety of functions, from coaching AI chatbots to producing photos to growing advice algorithms equivalent to those on TikTok and Instagram. Which means a barely much less highly effective, however extra tailor-made chip might be a greater match for an organization equivalent to Meta, for instance—which has invested in AI primarily for its advice algorithms, not consumer-facing chatbots.

“The Nvidia GPUs are excellent in AI data centers, but they are general purpose,” Brian Colello, fairness analysis lead at funding analysis agency Morningstar, informed Fortune. “There are likely certain workloads and certain models where a custom chip might be even better.”

The trillion-dollar query

Ngyuen stated that extra specialised in-house chips might have added advantages by advantage of their means to combine into current knowledge facilities. Nvidia chips consume a lot of power, and they give off a lot of heat and noise—a lot in order that tech corporations could also be compelled to revamp or transfer their knowledge facilities to combine soundproofing and liquid cooling. Much less highly effective native chips, which devour much less vitality and launch much less warmth, might resolve that drawback.

AI chips developed by Meta and Google are long-term bets. Ngyuen estimated that these chips took roughly a yr and a half to develop, and it’ll possible be months earlier than they’re applied at a big scale. For the foreseeable future, the complete AI world will proceed to rely closely on Nvidia (and, to a lesser extent, Intel) for its computing {hardware} wants. Certainly, Mark Zuckerberg recently announced that Meta was on monitor to personal 350,000 Nvidia chips by the tip of this yr (the corporate’s set to spend around $18 billion on chips by then.) However motion away from outsourcing computing energy and towards native chip design might loosen Nvidia’s chokehold in the marketplace.

“The trillion-dollar question for Nvidia’s valuation is the threat of these in-house chips,” Colello stated. “If these in-house chips significantly reduce the reliance on Nvidia, there’s probably downside to Nvidia’s stock from here. This development is not surprising, but the execution of it over the next few years is the key valuation question in our mind.”