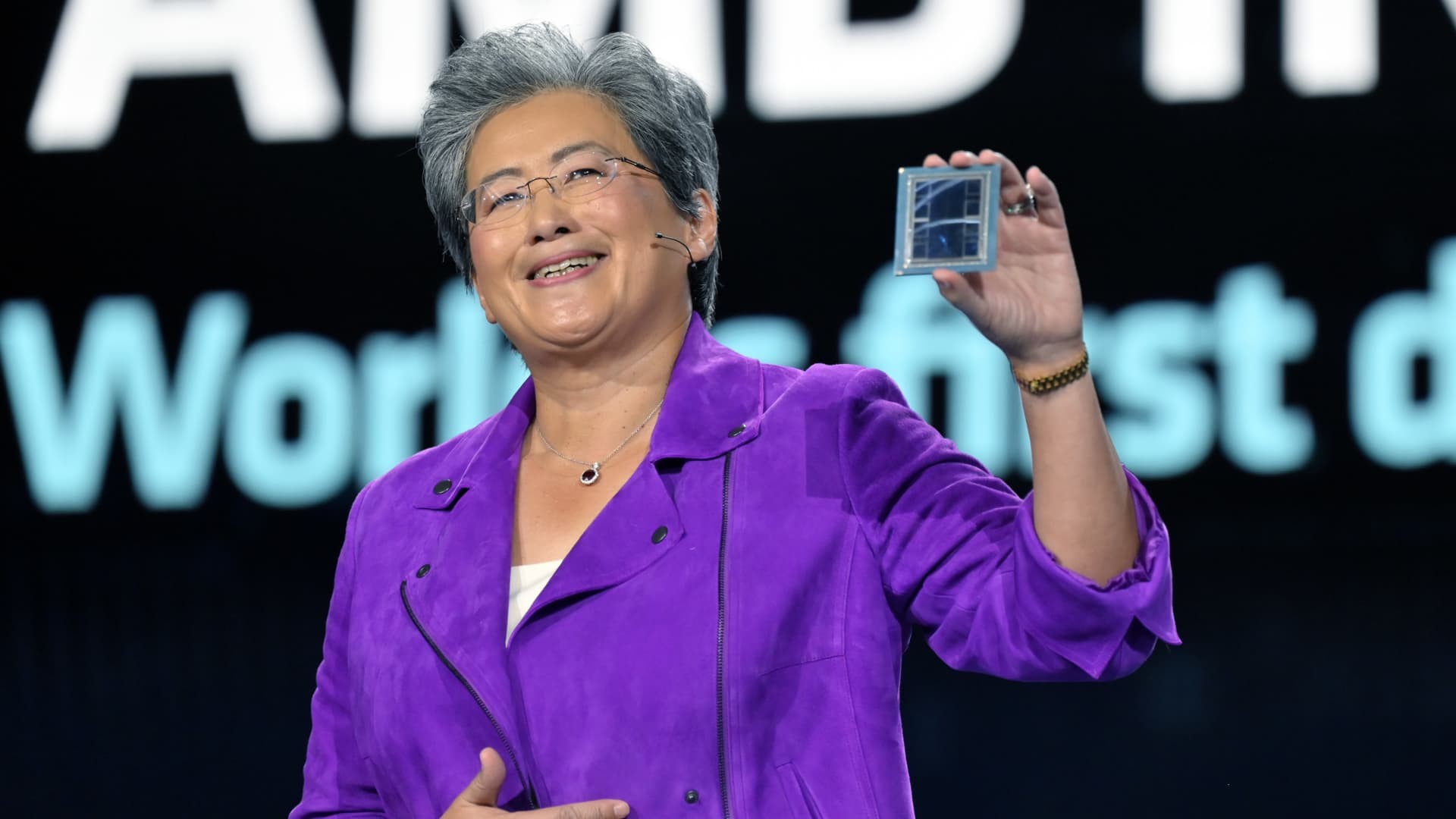

Lisa Su shows an AMD Intuition MI300 chip as she delivers a keynote deal with at CES 2023 in Las Vegas, Nevada, Jan. 4, 2023

David Becker | Getty Photographs

Meta, OpenAI, and Microsoft mentioned at an AMD investor occasion on Wednesday they may use AMD’s latest AI chip, the Intuition MI300X. It is the most important signal up to now that know-how corporations are looking for options to the costly Nvidia graphics processors which have been important for creating and deploying synthetic intelligence applications like OpenAI’s ChatGPT.

If AMD’s newest high-end chip is sweet sufficient for the know-how corporations and cloud service suppliers constructing and serving AI fashions when it begins delivery early subsequent 12 months, it may decrease prices for creating AI fashions, and put aggressive strain on Nvidia’s surging AI chip sales growth.

“All of the interest is in big iron and big GPUs for the cloud,” AMD CEO Lisa Su mentioned on Wednesday.

AMD says the MI300X is predicated on a brand new structure, which regularly results in vital efficiency positive factors. Its most distinctive characteristic is that it has 192GB of a cutting-edge, high-performance kind of reminiscence often known as HBM3, which transfers knowledge sooner and may match bigger AI fashions.

At an occasion for analysts on Wednesday, CEO Lisa Su straight in contrast its Intuition MI300X and the techniques constructed with it to Nvidia’s most important AI GPU, the H100.

“What this performance does is it just directly translates into a better user experience,” Su mentioned. “When you ask a model something, you’d like it to come back faster, especially as responses get more complicated.”

The primary query going through AMD is whether or not corporations which were constructing on Nvidia will make investments the money and time so as to add one other GPU provider. “It takes work to adopt AMD,” Su mentioned.

AMD on Wednesday informed buyers and companions that it had improved its software program suite referred to as ROCm to compete with Nvidia’s business customary CUDA software program, addressing a key shortcoming that had been one of many main the explanation why AI builders at the moment want Nvidia.

Value will even be necessary — AMD did not reveal pricing for the MI300X on Wednesday, however Nvidia’s can price round $40,000 for one chip, and Su informed reporters that AMD’s chip must price much less to buy and function than Nvidia with a purpose to persuade prospects to purchase it.

Who says they will the MI300X?

AMD MI300X accelerrator for synthetic intelligence.

On Wednesday, AMD mentioned it had already signed up a few of of the businesses most hungry for GPUs to make use of the chip. Meta and Microsoft had been the 2 largest purchasers of Nvidia H100 GPUs in 2023, based on a recent report from research firm Omidia.

Meta mentioned that it’ll use Intuition MI300X GPUs for AI inference workloads like processing AI stickers, picture enhancing, and working its assistant. Microsoft’s CTO Kevin Scott mentioned it could supply entry to MI300X chips by way of its Azure internet service. Oracle‘s cloud will even use the chips.

OpenAI mentioned it could assist AMD GPUs in certainly one of its software program merchandise referred to as Triton, which is not an enormous massive language mannequin like GPT, however is utilized in AI analysis to entry chip options.

AMD is not but forecasting huge gross sales for the chip but, solely projecting about $2 billion in complete knowledge middle GPU income in 2024. Nvidia reported over $14 billion in knowledge middle gross sales in the newest quarter alone, though that metric consists of different chips beside GPUs.

Nevertheless, AMD says that the full marketplace for AI GPUs may climb to $400 billion over the following 4 years, doubling the corporate’s earlier projection, displaying how excessive expectations and the way coveted high-end AI chips have develop into — and why the corporate is now focusing investor consideration on the product line. Su additionally recommended to reporters that AMD would not assume that it must beat Nvidia to do nicely available in the market.

“I think it’s clear to say that Nvidia has to be the vast majority of that right now,” Su informed reporters, referring to the AI chip market. “We believe it could be $400-billion-plus in 2027. And we could get a nice piece of that.”