Meta has published its first earnings report of 2025, showing an increase in overall users, and a strengthening in its ad business, solidifying its core, and enabling it to continue betting on next-level experiments that will ensure its ongoing relevance.

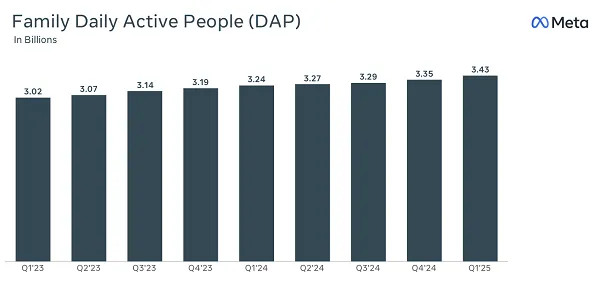

First off, on usage. Meta added an additional 80 million users across its Family of Apps in Q1 (quarter-over-quarter), taking it up to 3.43 billion users on average in March 2025.

It’s a little annoying that we don’t get the app breakdown that we used to, in terms of how many users each app has. But in overall growth terms, Meta continues to add more and more users, as it branches into new markets, and sees broader adoption of Facebook, Instagram, Messenger, and WhatsApp.

And now Threads as well.

Threads is up to 320 million users, and we may get an update on this as part of Meta’s earnings call, adding another string to Meta’s bow in this respect.

To put this in perspective, 3.43 billion represents around 40% of the entire global population. And when you factor in kids under 13, who can’t use most of Meta’s apps, and regions where its apps aren’t available (like China), that is a staggeringly high level of market reach for any single company.

Which is also why Meta’s ad business remains so strong, because no one offers the breadth of coverage that Meta can.

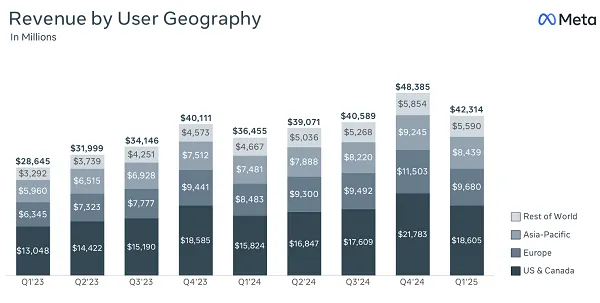

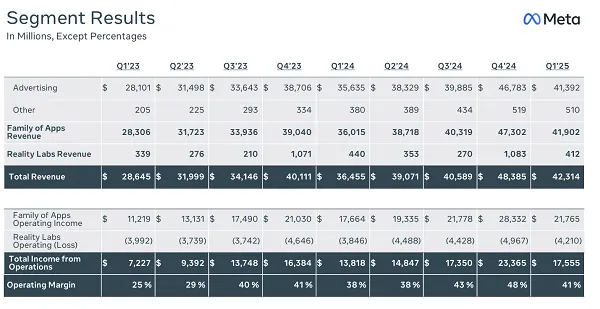

On that front, Meta brought in $42.31 billion for Q1, an increase of 16% year-over-year.

Another huge result, though it is also worth noting that its Reality Labs revenue, the department responsible for its wearables, including its Ray Ban smart glasses, saw a decline in revenue on Q1 last year.

Meta’s Ray Bans are rising in popularity, with the addition of AI features helping to propel them to another level. As such, I expect that this number will rise again throughout the year, but it is worth noting that Meta’s still working on making real money from its wearables division.

Its development of new technology is also costing a lot. Meta’s total costs and expenses for Q1 were $24.76 billion, an increase of 9% year-over-year, while its capital expenditures (which includes the development of its growing AI infrastructure) reached $13.69 billion.

Meta’s set to spend big time on AI datacenters and connective elements, as it looks to lead the AI race, while it’s also building its VR metaverse at the same time, as well as AR glasses, and more.

All of this will continue to keep Meta’s costs high, which is why it needs to keep growing its ad business, in order to fuel its next-level plans.

On that element, Meta also reports that ad impressions were up 5% year-over-year, while its average price per ad increased by 10%.

It’s a solid structure for development, with its core ad business enabling ongoing investment, and right now, it definitely seems like Meta’s on the right track to go from strength to strength, while also remaining agile enough to adjust to whatever big tech shifts come its way.

I mean, it kind of showed that with AI. Meta’s been developing its own AI elements for over a decade, but as soon as OpenAI went public with ChatGPT, every other platform had to scramble to catch up, and ensure that they’re own AI projects remained relevant.

Meta was able to do this better than anyone else, and it’s now arguably in the best position to capitalize on the opportunities of gen AI.

But that was a big shift. Meta changed focus from the metaverse, and the next stage of digital connection, and re-aligned around AI, as sort of a middle step in its broader plan. It’s now embedded that as a key step, while still maintaining focus on its bigger end goal, in VR engagement, and it’s amazing to see just how adaptable such a huge company can still be in the face of these shifts.

Which is another reason why Meta remains a strong bet, and the most likely winner in the longer term, on all fronts that it’s working on. It has a stronger underlying business foundation, larger scale, and more resources than virtually any other company.

And its ad business continues to grow, expanding its value on this front.