AI is a focus once again in Meta’s Q2 earnings announcement, which has seen the company post solid increases in both users and revenue in the period.

First off, on users, Meta’s “Family Daily Active People” increased to 3.27 billion in Q2, up 7% year-over-year.

As you can see in this graph, Meta added 30 million more users across its apps in the period, though we don’t know exactly where these users were active.

That’s because Meta now only reports its “Family” performance results, which incorporates users across Facebook, Instagram, Messenger and WhatsApp into a single measure. So we don’t have a specific breakdown of each, and therefore can’t report on those trends, but we do know that WhatsApp has seen a surge in U.S. usage of late.

Facebook and Instagram usage has been propped up by Meta’s evolving AI recommendations, which have seen more and more video clips from profiles that you don’t follow appearing in your feed. That’s annoyed some users, who are unhappy that they’re seeing these random updates, and not the posts from the accounts they’ve chosen to follow, but the numbers show that people are spending more time in each app as a result of being shown enticing video clips, based on your interests.

So whether you like them or not, they’re here to stay, while its Twitter-like Threads app has also continued to steadily gain traction among more user groups.

In terms of revenue, Meta brought in $39.07 billion for the quarter, an increase of 22% year-over-year.

A good sign for Meta is that it’s increasing its revenue intake in its key markets (U.S. and Europe), while also growing in new regions, as more people sign up. I guess, the negative of WhatsApp growing is that it provides fewer ad opportunities, but Meta’s clearly supplementing that with more revenue potential in its other apps.

Meta also reports that total ad impressions delivered across its apps increased by 10% year-over-year, while the average price per ad also rose by 10%.

So more ads, a higher prices, reflecting ongoing demand, which suggests that Meta’s going to be in good shape for some time yet. Which will also enable it to keep investing in AI and VR, where it’s still sinking billions of dollars.

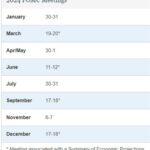

As you can see in this listing, Meta lost another $4.5 billion in its Reality Labs VR division in the period, as it continues to invest in both VR and AI projects. That puts it at a higher loss rate than it had last year, when it sunk a record $17 billion into the same.

Meta’s total costs and expenses rose 7% in Q2 to $24.22 billion, with its new AI datacentre weighing down its results.

So Meta’s still investing heavily into the future of the business, and its metaverse vision, based in VR, is still weighing down its current performance. And while Meta’s VR headsets are selling steadily, they’re not a must-have item as yet, while its Ray Ban Stories glasses are also gaining momentum, as an early connector to its tech.

But it remains to be seen how Meta will be able to incorporate its various long-term bets into a more cohesive platform at some stage.

The major opportunity, as I see it at least, is for Meta to integrate generative AI into VR creation, enabling users to build entire virtual worlds by simply speaking them into existence. Right now, VR is restrictive, due to the technical requirements of development, but if Meta’s able to simplify this, and offer more people a way into VR creation, that could significantly boost interest in its metaverse vision, by enabling anyone to create with more immersive tech.

That could be the thing that really boosts VR take-up, while its coming AR glasses also promise to be more practical, and popular, that Apple’s VisionPro headset.

Indeed, Meta’s also now looking to invest around $5 billion into EssilorLuxottica, the make of Ray Ban sunglasses, in order to ensure that competitors can’t utilize the same stylistic frames, while also securing a valuable distribution pathway for its coming AR offering.

The path to success in this respect is becoming more clear, but it will require ongoing investment for some time yet.

And while that will weigh down Meta’s current results, it’ll also pave the way for future opportunities, which should see investors come along for the ride.

Essentially, at this stage, I wouldn’t be betting against Zuck and Co. getting their various projects to merge into line. And while AI chatbots are not, I don’t think, the right way to go for Meta’s apps, a lot of these innovations are about shifting behaviors gradually, in alignment with what’s coming. So even if you personally don’t see the value of AI bots, maybe, the next generation of Facebook and IG users will.

There’s a lot to like about Meta’s numbers, and a lot to indicate future success on various fronts, though it’s not all clear as yet. There will also, of course, be continued regulatory concerns and challenges that Zuck and his team will need to navigate.

But based on this report, you can see why Zuck seems more relaxed with the future direction of the company.