Meta has shared another solid performance report, with the corporate posting a 25% year-over-year enhance in income, and an enormous 201% soar in internet earnings year-over-year for the three month interval.

Regardless of many questions round its Metaverse imaginative and prescient, in addition to the obvious decline in recognition of Fb, and its considerably questionable early efforts to faucet into the evolving AI race, Meta continues to be the powerhouse of the social media sector, and stays in a powerful place to capitalize on rising alternatives.

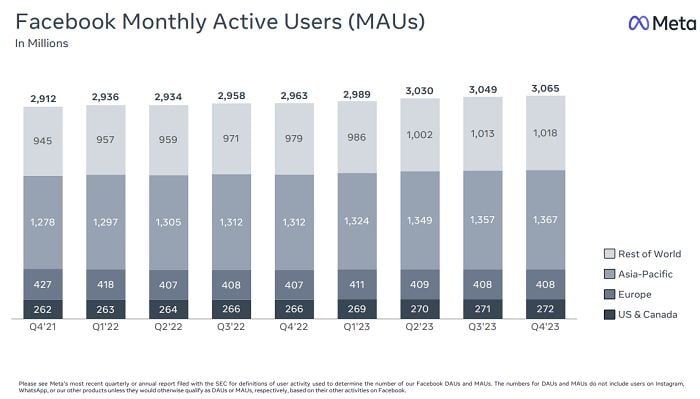

First off, on customers, Fb’s day by day lively consumer depend rose to 2.11 billion on common for December, up 6% year-over-year.

Actually, the truth that Fb’s nonetheless including customers is wonderful, because it needs to be reaching saturation level in lots of markets. That’s very true in North America, the place Fb added 2 million extra customers.

The demise of Fb has been tremendously exaggerated, and whereas I’d additionally wish to see time spent stats, in an effort to perceive precisely how these 2 billion+ customers are partaking within the app, Meta did report final yr that user time on Facebook is also rising, because of extra AI beneficial content material being injected into consumer feeds.

The platform stays a vital connector, and it’s additionally nonetheless rising at strong charges in rising markets, which can be mirrored in its month-to-month consumer stats.

As you may see, virtually all of Fb’s consumer development is coming within the Asia Pacific and “Other” segments. That’ll assist to place the platform for additional success as these markets evolve.

However this report would be the final time that we get Fb-specific utilization stats, with Meta CFO Susan Li additionally confirming the corporate will solely be sharing its app “Family” collective consumer stats any more. Meta’s Household consumer counts incorporate distinctive consumer information throughout Fb, Instagram, Messenger, and WhatsApp.

It’s simple to lose sight of simply how important that determine is. The inhabitants of the whole world is round 8 billion, and with 1.4 billion folks in China, the place Meta’s apps usually are not out there, meaning that almost all of people that can entry a Meta app are doing so frequently.

Fb stays a key advert consideration because of this, as a result of so many individuals examine into the app every single day to make amends for the most recent information from family and friends. Certain, TikTok now takes up lots of consideration, however Meta’s platforms stay dominant within the total market.

By way of income, Meta purchased in $40 billion for the quarter, bringing its complete to $134 billion for the yr.

As you may see, Meta continues to be closely reliant on the U.S. and European markets, however its different areas are growing, with its vacation outcomes reflecting its ongoing advert system enhancements, resulting in elevated advertiser demand.

Which ends up in this attention-grabbing be aware for Fb advertisers:

“In the fourth quarter of 2023, ad impressions delivered across our Family of Apps increased by 21% year-over-year and the average price per ad increased by 2% year-over-year. For the full year 2023, ad impressions increased by 28% year-over-year and the average price per ad decreased by 9% year-over-year.”

Extra advertisements, in additional locations implies that the general prices scale back, although it’s value noting that Meta noticed a rise in common value per advert in This autumn. That’s doubtless on account of increased total demand for the vacations, however nonetheless, value noting.

On one other entrance, its longer-term metaverse plan stays expensive.

Meta did report a rise in gross sales from its Actuality Labs VR division for the quarter, rising to $1.07 billion. However its value of improvement stays excessive, with total Actuality Labs funding at $5.7 billion for the interval.

That implies that, in complete, Meta spent over $17 billion on VR improvement for the total yr, eclipsing its earlier report of $13.7 billion in VR investment in 2022.

So whereas gross sales of its new Quest 3 headset are rising, and the most recent model of its Ray Ban Tales glasses are gaining traction, it’s nonetheless a good distance from earning profits from its future bets.

Besides, there are constructive alerts, with Meta particularly noting that the rise in Actuality Labs income was because of elevated gross sales of Quest 3 models over the vacation season.

And with Meta additionally lately including mobile connectivity for its metaverse atmosphere, enabling non-VR customers to have interaction in VR experiences, that ought to assist to plant extra seeds for the following stage, whereas Meta’s additionally finally planning to combine generative AI into its VR world constructing instruments, which might additional personalize its immersive choices.

Additionally value noting right here is the variance in earnings in its non-advertising consumption, which, in important half, would mirror the efficiency of its Meta Verified subscription program.

Meta launched its paid verification bundle to U.S. users in March, so the outcomes of these gross sales could be mirrored on this component from Q2 onwards. Meta’s “Other” consumption elevated by over $100 million between Q2 and This autumn, which might recommend that, at a primary estimate, Meta has offered round 6 million paid verification subscriptions.

Meta hasn’t launched any particular information on this, however the rising numbers right here recommend that its verification gross sales are within the thousands and thousands. Which can assist to convey much more cash into its coffers, although that at 6 million, that might nonetheless solely equate to lower than 0.5% of its total consumer base.

There are lots of good indicators for Meta on this report, a lot in order that even with the VR losses nonetheless being so excessive, its shares have seen an enormous enhance, as constructive sentiment across the firm will increase.

The storyline final yr was that Meta was shedding billions on Zuckerberg’s metaverse dream, however now, as that imaginative and prescient begins to make clear, and its advert enterprise will get again on monitor, the narrative round Meta is altering as soon as once more.

A robust outcome, sturdy forecasts, and extra enhancements coming.