Quick Facts:

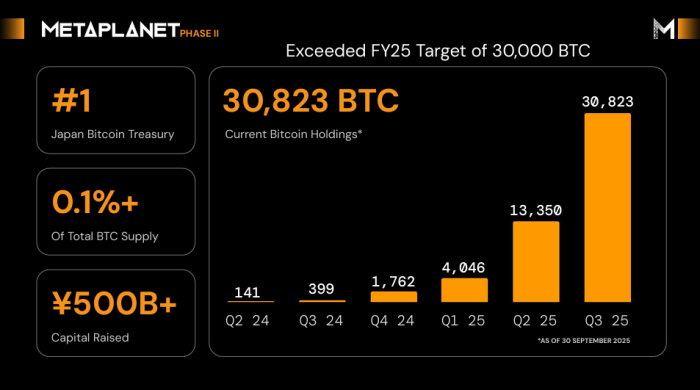

- 1️⃣ Japan’s Metaplanet has borrowed $100M against its existing Bitcoin holdings to buy even more BTC, a move that cements its status as ‘Asia’s MicroStrategy.’

- 2️⃣ The company now holds roughly 30,823 $BTC worth $3.2B, aiming for 210K $BTC (about 1% of Bitcoin’s total supply) by 2027.

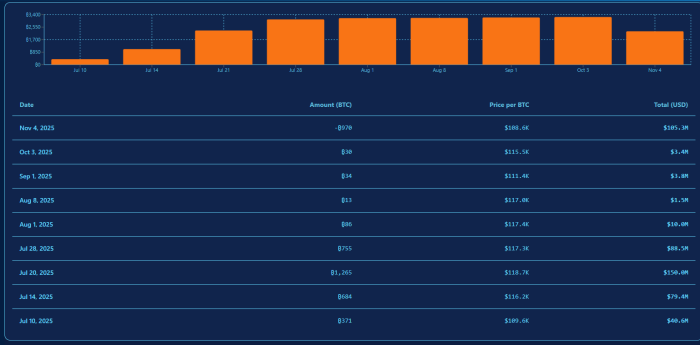

- 3️⃣ Bitcoin recently rebounded to $103K after falling below $100K for the first time since June.

- 4️⃣ Meanwhile, whales have poured $239K into the Bitcoin Hyper ($HYPER) presale in the last 24 hours as the project passes $26M.

Tokyo-based Metaplanet Inc. has ramped up its Bitcoin acquisition strategy, raising an additional $100 million secured against its existing crypto holdings. The firm is capitalizing on Bitcoin’s temporary weakness — with $BTC trading near $102,000 — to expand its long-term treasury position.

The move signals growing institutional confidence in Bitcoin as a reserve asset, even amid market turbulence.

It also sheds light on the next wave of infrastructure-driven projects, such as Bitcoin Hyper ($HYPER), which are attracting significant capital from whales seeking leveraged exposure to Bitcoin’s ecosystem without the balance-sheet risk.

Metaplanet’s Plan

In a recent shareholder notice, Metaplanet detailed its strategy, clarifying that while it’s leveraging existing Bitcoin reserves, the company is doing so within a conservative borrowing framework designed to account for market volatility.

The firm reaffirmed its commitment to avoiding excessive leverage and maintaining a disciplined balance between growth and risk exposure.

Currently, Metaplanet holds approximately 30,823 BTC, valued at around $3.2B at today’s market prices — a position that solidifies its reputation as one of Asia’s most aggressive corporate adopters of Bitcoin.

Metaplanet’s long-term ambition is to accumulate roughly 210K BTC by 2027, representing about 1% of Bitcoin’s total supply. If achieved, that would place the firm among the largest corporate holders of Bitcoin worldwide, with significant room for further scale.

Caution could be warranted. Borrowing against current holdings, with Bitcoin as collateral, leaves Metaplanet open to dramatic downward price moves and could force the liquidation of some of those holdings if Bitcoin’s price falls too far.

Bitcoin recently dipped below the $100K mark for the first time since June before rebounding and trading around $103K.

That’s roughly 18% below its record high of $126K a few weeks ago. Market stress has had its consequences: some companies are quietly reducing exposure. Sequans, formerly a top-30 Bitcoin Treasury, recently dropped out when it became one of the first $BTC treasuries to sell some of its holdings.

Still, investor sentiment isn’t entirely bearish. $BTC has already gone back up 1.5% in the past day, and many expect Bitcoin’s next directional move to climb to $115K rather than drop to $85K. With corporate treasuries, such as Metaplanet’s, stepping up their accumulation, the market may be entering a new phase.

One possible catalyst for new growth? Bitcoin Hyper ($HYPER), the newest Bitcoin Layer 2 upgrade, and one of the best crypto presales in 2025.

Bitcoin Hyper ($HYPER) – Fast, Dynamic Layer 2 for $BTC Transactions and DeFi

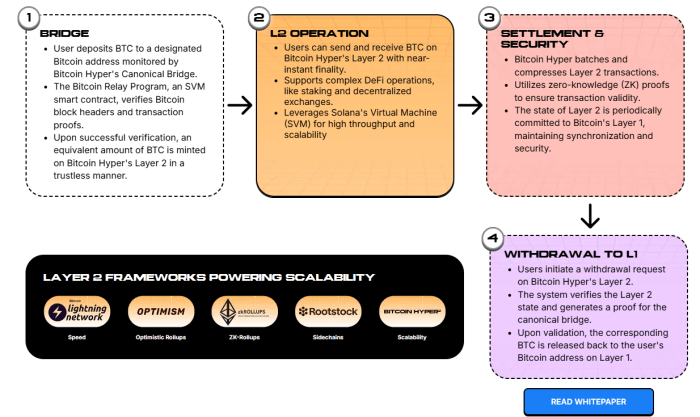

Bitcoin Hyper builds a next-gen scaling layer on top of the Bitcoin network, designed to improve transaction speeds, reduce fees, and unlock dApp and complex smart-contract capabilities for $BTC.

The Layer-2 works by leveraging the Solana Virtual Machine (SVM) for its Layer-2 execution environment, while anchoring ultimately to Bitcoin’s security. Users can bridge their BTC into the Bitcoin Hyper layer via a canonical trustless bridge, enabling faster transfers, staking, DeFi interactions, and more.

The project’s native token, $HYPER, functions as a utility and governance token for the system, used for gas fees, staking rewards, and ecosystem participation.

A token that unlocks $BTC’s power and stability with Solana’s DeFi-ready smart contract and fast transaction speeds is sure to draw lots of attention. So far, $HYPER has done just that – the presale is already past $26M. Over $239K of major whale purchases have flowed into the presale in just the past day.

Our price prediction indicates that $HYPER could reach $0.20 by the end of next year, up from its current price of $0.013225. That would deliver gains of 1400% to token holders who learn how to buy $HYPER now.

Visit the Bitcoin Hyper presale page for the latest.

Metaplanet’s $100M leverage-backed Bitcoin acquisition signals conviction, but Bitcoin Hyper’s rise could be an even stronger indication of future growth.

As always, do your own research. This isn’t financial advice.

Authored by Bogdan Patru for Bitcoinist — https://bitcoinist.com/metaplanet-to-buy-100m-more-bitcoin-as-whales-buy-239k-bitcoin-hyper

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.