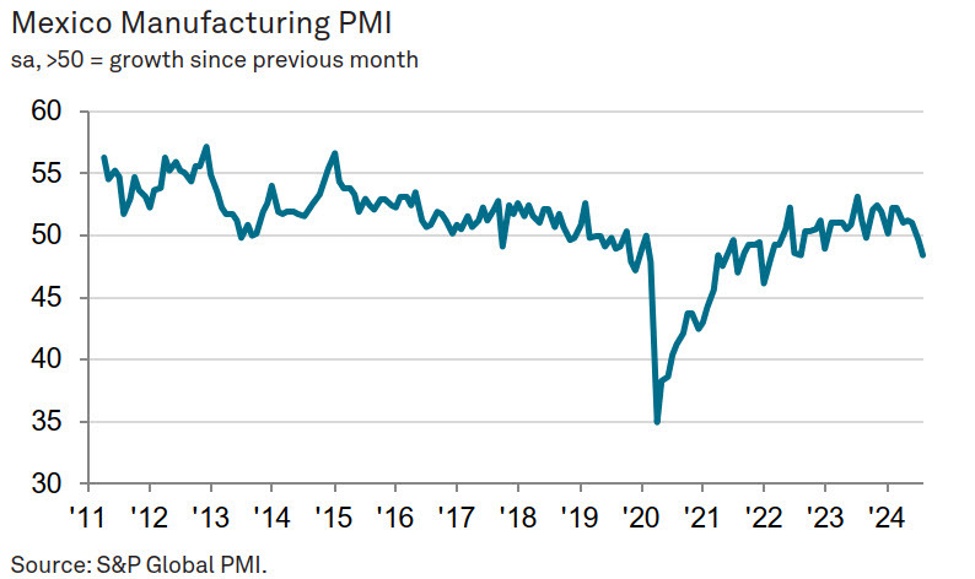

- PMI falls to 48.5, lowest since August 2022

- New orders and production decline accelerates

- Cost inflation hits 21-month high, driven by raw material shortages and peso depreciation

- Job shedding continues for fourth straight month

- Employment decreased for the fourth month

- Export sales saw a substantial drop, particularly from US customers

The Mexican manufacturing sector took another hit in August, with the S&P Global Mexico Manufacturing PMI dropping to 48.5 from 49.0 in July. It’s not a great sign for the global economy, though there are people willing to bet that we’re at the bottom of the global growth cycle in light of looming rate cuts.

Pollyanna De Lima, Economics Associate Director at

S&P Global Market Intelligence, said:

“August proved to be another difficult month for Mexican

manufacturers, with firms trimming output, employment

and stocks due to subdued sales in both the domestic

and international markets. Total order book volumes

dropped to the greatest extent in two years, boding ill

for near-term production prospects.

“Confidence regarding the 12-month outlook for output

took a hit, as companies became increasingly concerned

about intense competition from China and highway

insecurity. Panellists also displayed a high degree of

uncertainty regarding domestic public policy and market

conditions in the US. Combined with demand weakness,

subdued optimism could restrict investment.

“Another obstacle encountered by firms was a further

sharp increase in purchasing costs, as peso depreciation

and material shortages at suppliers meant that they paid

more for items like electronic components, foodstuff,

packaging and steel. Despite cost pressures climbing

to their highest in nearly two years, charge inflation

remained contained as several companies left their fees

unchanged due to demand retrenchment.”