Adene Sanchez

By Jennifer Nash

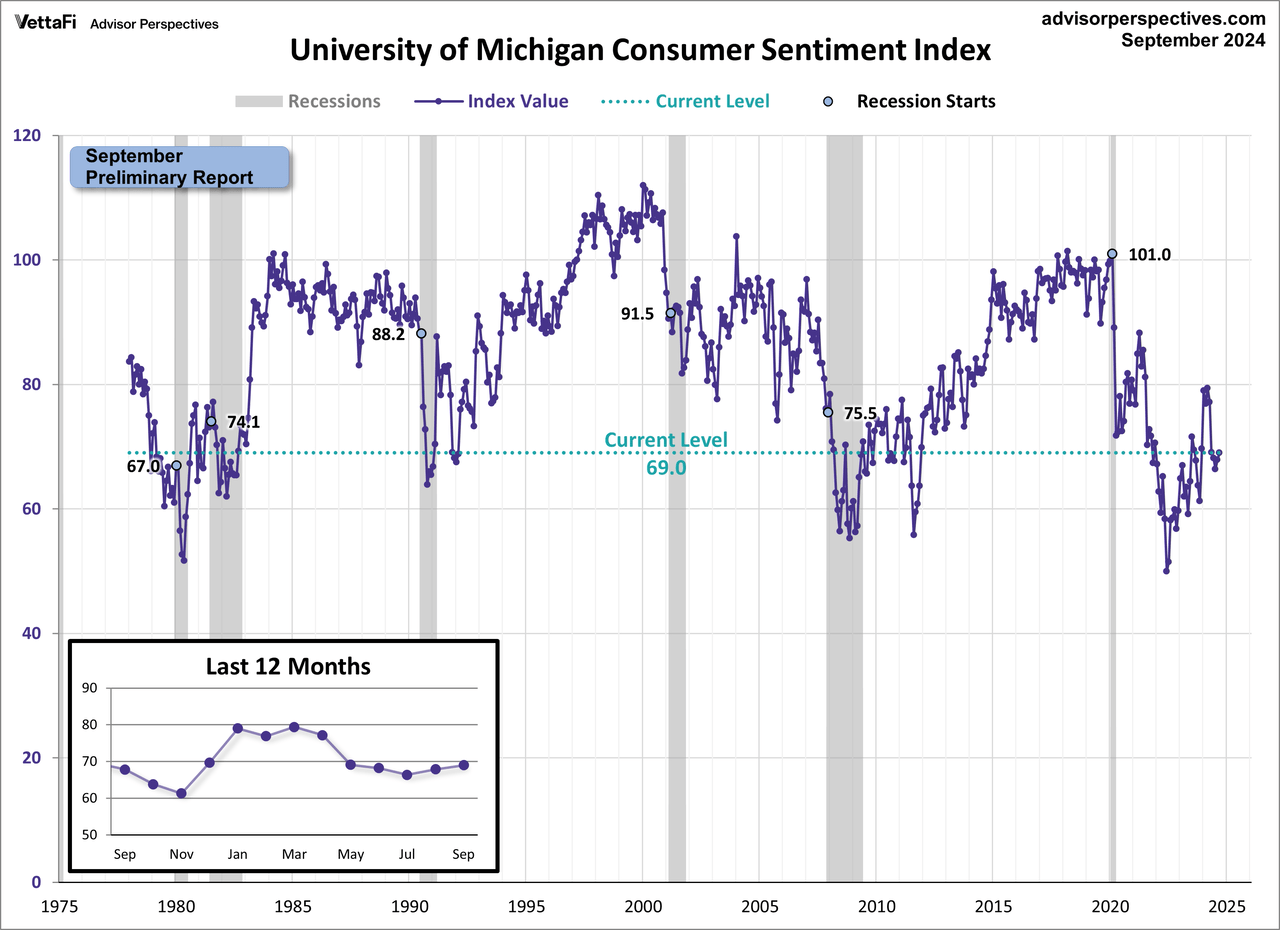

Consumer sentiment rose to its highest reading since May 2024, according to the preliminary September report for the Michigan Consumer Sentiment Index. The index rose 1.1 points (1.6%) from August’s final reading to 69.0. The latest reading was above the forecast of 68.3.

The Michigan Consumer Sentiment Index is a monthly survey of consumer confidence levels in the U.S. with regards to the economy, personal finances, business conditions, and buying conditions, conducted by the University of Michigan. There are two reports released each month; a preliminary report released mid-month and a final report released at the end of the month.

Joanne Hsu, the director of surveys, made the following comments:

Consumer sentiment rose to its highest reading since May 2024, increasing for the second consecutive month and lifting about 2% above August. The gain was led by an improvement in buying conditions for durables, driven by more favorable prices as perceived by consumers. Year-ahead expectations for personal finances and the economy both improved as well, despite a modest weakening in views of labor markets.Sentiment is now about 40% above its June 2022 low, though consumers remain guarded as the looming election continues to generate substantial uncertainty. A growing share of both Republicans and Democrats now anticipate a Harris win. Consistent with their divergent views of the implications of a Harris presidency for the economy, partisan gaps in sentiment inched up. Note that interviews for this release concluded prior to Tuesday’s debate; a more comprehensive look at election expectations will be released next week.

See the chart below for a long-term perspective on this widely watched indicator. We’ve highlighted the value of the index at the start of each recession and also included a callout to the most recent 12 months. The current level of 69.0 is below the index’s level at the start of 5 of the 6 recessions since the index’s inception.

To put today’s report into the larger historical context, since its beginning in 1978, consumer sentiment is 18.9% below its average reading (arithmetic mean) of 84.8 and 17.5% below its geometric mean of 83.7. The current index level is at the 15th percentile of the 561 monthly data points in this series.

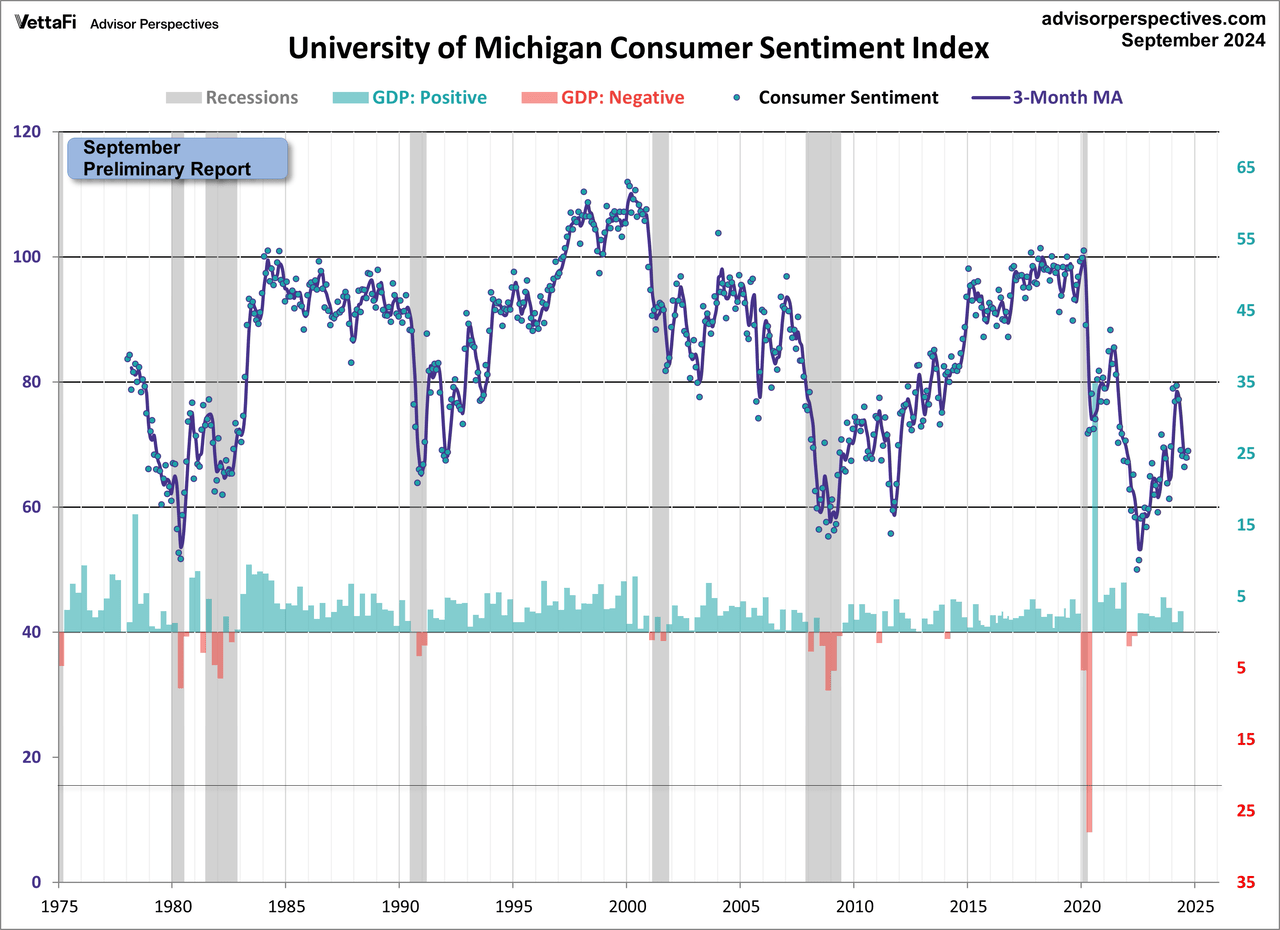

This indicator is somewhat volatile, with a 3.1 point absolute average monthly change. The latest data point saw a 1.1 point decrease from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average. The bottom half of the chart shows real GDP to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

Other Sentiment Indicators

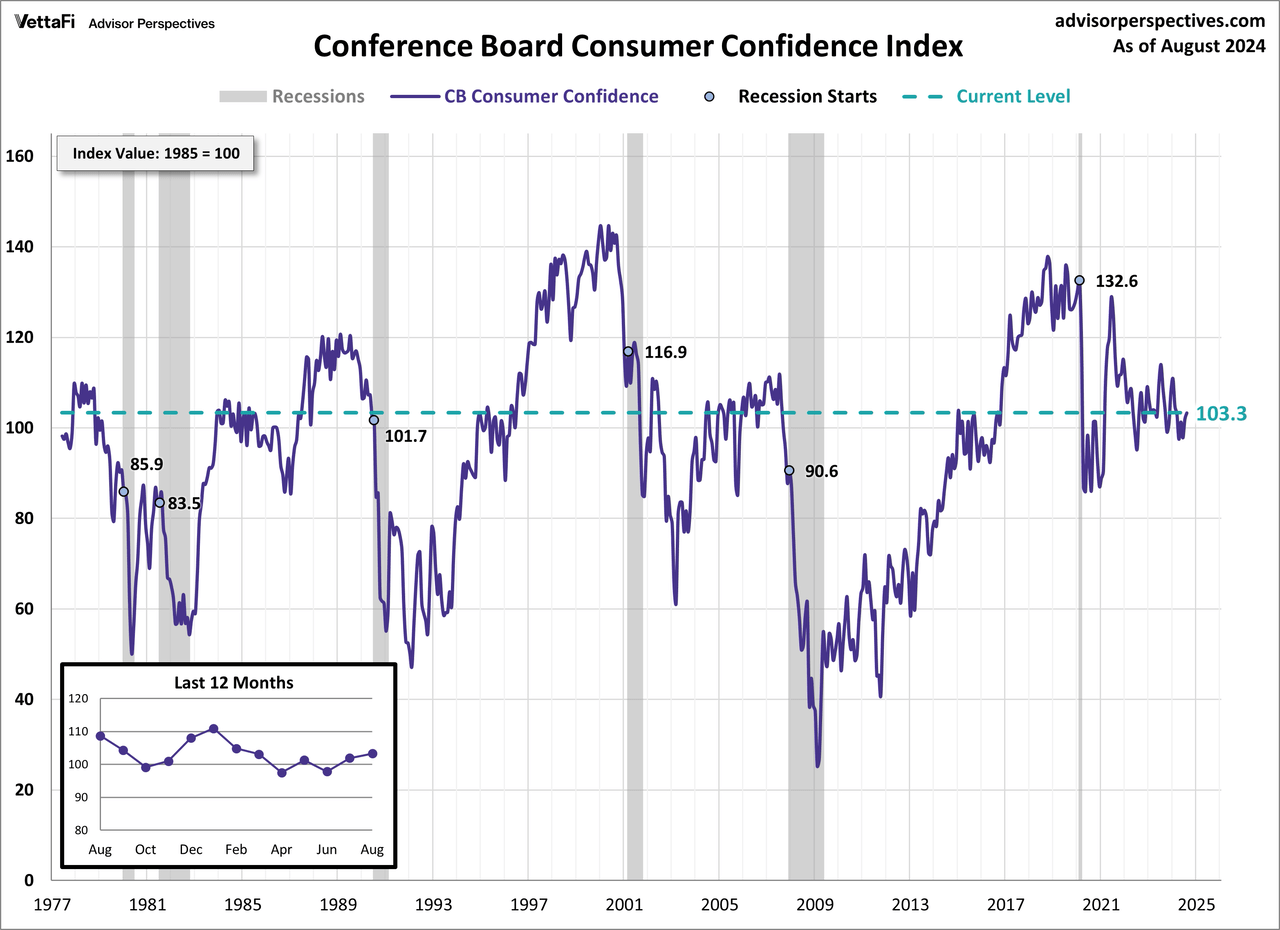

For an additional perspective on consumer attitudes, see the most recent Conference Board’s Consumer Confidence Index. Both indexes gauge consumer attitudes toward the current and future strength of the economy. However, the Consumer Confidence Index is more influenced by employment and labor market conditions while the Michigan Sentiment Index is more focused on household finances and the impact of inflation.

The Conference Board index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan index.

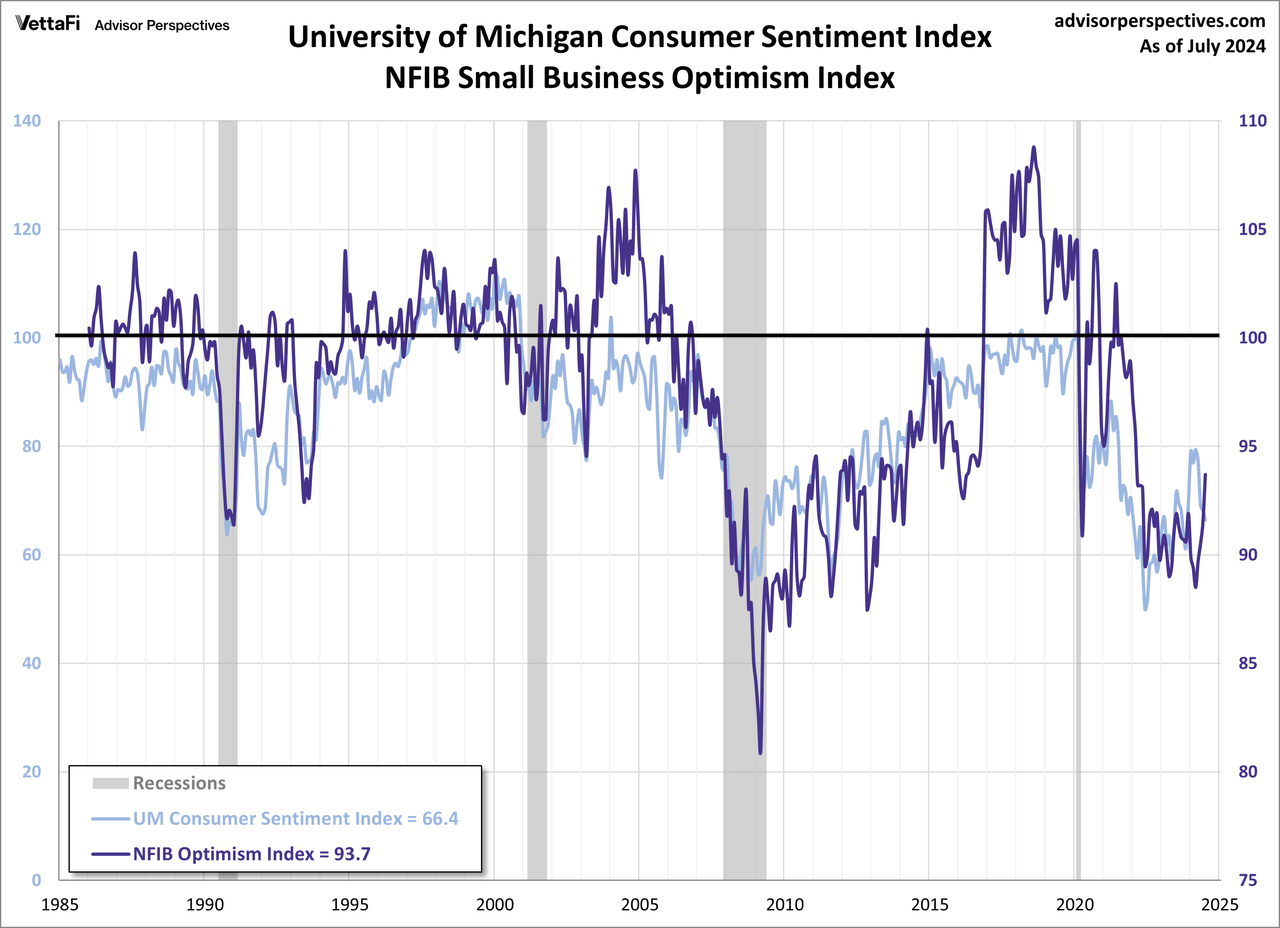

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB business optimism Index (monthly update here).

ETFs associated with sentiment include: Consumer Discretionary Select Sector SPDR Fund (XLY).

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.