Justin Sullivan

Microsoft’s valuation implies AI potential can defy gravity

In case you imagine within the pursuit of development at any price, this text shouldn’t be for you. The fundamental premise of this text’s thesis is that valuation ALWAYS issues. Underneath this premise, I will clarify A) why Microsoft’s (NASDAQ:MSFT) valuation is way above its truthful value even underneath essentially the most aggressive assumptions, and B) subsequently, why the worth volatility attributable to the OpenAI-Altman drama provides a wonderful exit level.

My rule #1 in investing is that this: there is no such thing as a certain factor. The closest “sure thing” we will get is treasury bonds, whose charges function the gravity for ALL asset valuation, which means MSFT and its AI potential aren’t any exceptions. Within the the rest of this text, I’ll present that MSFT’s present costs are pushing its valuation to a stage that appears to defy this straightforward notion.

The Altman-OpenAI Volatility

Let me begin with a quick recap of the OpenAI-Altman drama – from my perspective. Loads of different authors have already analyzed the causes and potential impacts of those developments. Thus, my objective right here is to not repeat what they’ve coated earlier than already. My objective is to argue that the market response has priced in all of the potential constructive outcomes of those developments whereas ignoring all of the unfavourable prospects.

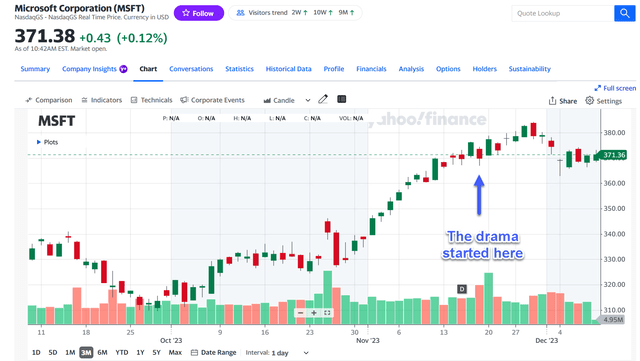

As such, I’ll solely present a really temporary account of the occasion for readers new to it whereas primarily concentrating on deciphering the market responses. The drama began on Nov. 17, 2023, when OpenAI CEO Sam Altman was ousted by the board of administrators unexpectedly (see the subsequent chart under). MSFT shortly provided a brand new house for Altman, along with many different OpenAI executives and staff. Then only some days later, OpenAI rehired Altman again to be the CEO.

The market response to those developments has been fairly constructive as seen within the chart under. MSFT inventory costs rallied from round $370 on Nov. 17 to an all-time peak of round $384 per share in a couple of days. Such a rally added greater than $100B of market cap to MSFT’s valuation, and the height value stage translated right into a P/E of just about 37x on a TTM foundation. There are in fact good causes for such optimism. For instance, when these occasions WERE unfolding, it was actually a chance that MSFT may primarily purchase the OpenAI workforce (or at the very least the vast majority of it) with out paying the market value. Nevertheless, with Altman returning to OpenAI, the chances for this state of affairs have virtually diminished to zero. But I gained’t be shocked if different new developments set off massive value actions (say, push its value again to the $383 stage) once more within the close to future. I don’t suppose the drama is over but with so many key personnel modifications and a brand new board.

And subsequent, I’ll clarify why such potential value volatility provides glorious exit alternatives for shareholders.

MSFT’s valuation

As an example how good these value ranges are as exit factors, right here I analyze MSFT’s truthful worth underneath a few of the most aggressive assumptions in my thoughts. I’ll apply a easy dividend low cost mannequin. As a result of its lengthy and secure dividend document, its dividends are essentially the most dependable approximations for its true financial earnings in the long run.

As anybody who has used any discounted money circulation mannequin is aware of, the secret’s all within the low cost charges and the expansion charges. By massaging these charges, you may just about justify any valuation between zero and infinity. So right here I’ll choose these parameters with the least quantity of massaging within the following approach.

For the low cost charges, I’ll simply use the risk-free charges approximated by the present 10-year treasury charges (about 4.2% on the time of this writing). Charges with shorter durations are considerably larger. In case you purchase into Buffett’s pondering, the risk-free charges ought to solely be used for companies whose compounding energy is near certainty. I don’t suppose MSFT’s AI future (or simply AI future basically) is anyplace near certainty at this level. So utilizing the risk-free charges because the low cost charges is a really aggressive assumption for my part.

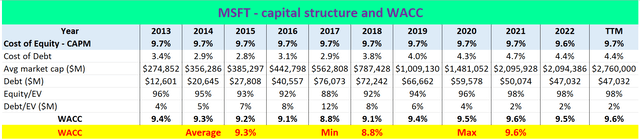

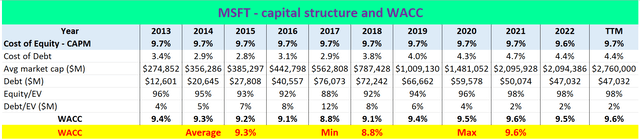

To additional illustrate how aggressive the belief is, I additionally estimated MSFT’s common price of capital (the so-called WACC, weight common price of capital) as proven under. My calculations had been primarily based on the capital asset pricing mannequin (“CAPM”), a mannequin most analysts used for an estimation of the low cost charges. As seen, in keeping with this mannequin, MSFT’s WACC has been averaging round 9.3% previously, and therefore so ought to its low cost charges. I’m not saying that the CAPM mannequin provides the “right” reply. That could be a entire new dialogue. I simply wish to contextualize how a lot optimism is baked in my following calculations by utilizing 4.2% because the low cost fee.

Creator primarily based on Looking for Alpha knowledge

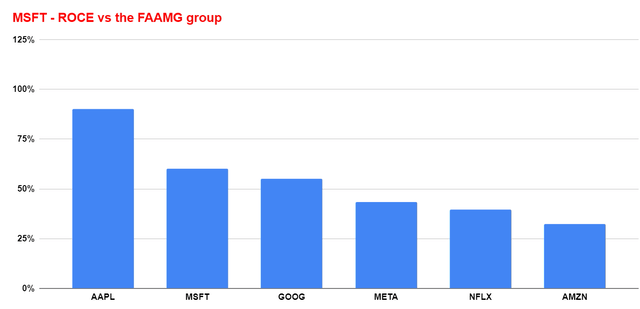

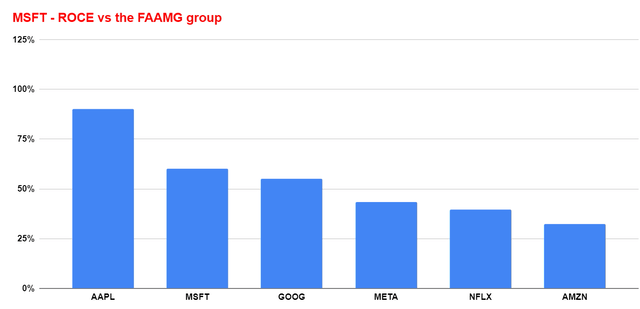

Now, for the terminal development charges, my estimates had been fashioned by its common return on capital employed (ROCE, as proven within the chart under) and in addition its common reinvestment fee. Its ROCE has been round 66% and it’s certainly towards the upper finish even amongst overachievers just like the FAANG group. Its reinvestment charges have been round 5% on common lately and in addition occur to be the typical for main tech corporations. As such, the terminal development fee is ~3.30% (66% ROCE x 5% reinvestment fee = 3.30%). Word since that is the terminal fee, I’m by default assuming its present stage of ROCE and reinvestment fee could be sustained indefinitely, which can be a really aggressive assumption given how shortly the tech panorama modifications.

Creator primarily based on Looking for Alpha knowledge

What’s left now could be to easily plug within the numbers to the low cost mannequin. With its TTM dividend of $2.8 per share, MSFT’s truthful valuation seems to be ~$311 primarily based on the above low cost charges and development charges ($2.8/(4.2% – 3.3%)).

As I’m typing these strains, its market value was $373, translating into a large premium of about 20% above the truthful value even with all of the aggressive assumptions baked in. If any value volatility pushes the worth again to $383 (which is probably going for my part), the premium can be greater than 23%. Higher than 20%, however not by that a lot.

Different dangers and last ideas

There are actually upside dangers. As one of the vital debated shares on the SA platform, many of the upside dangers have been eloquently analyzed by the MSFT bulls (excessive ROCE, capital-light mannequin, et al). I don’t suppose it’s an exaggeration to say that MSFT continues to be a wonderful enterprise with none of the AI stuff.

Right here I’ll entertain one upside danger that’s much less talked about and extra related to my explicit strategy used on this article. The chance-free charges, the gravity of all property valuation, can change itself. My evaluation above used 4.2%, the present 10-year treasury fee, because the low cost fee. In case you’re interested by what treasury charges would have the ability to justify MSFT’s present value, basic math would present the reply to be ~4.0% when you repeat the low cost mannequin with the opposite inputs I used above. It’s actually a chance that risk-free charges can drop to the 4% stage and thus is an upside danger.

All instructed, the present treasury charges are above 4% (and much above 4% when you select to have a look at shorter-term charges as a substitute of 10-year charges). Whether or not/when charges can return to 4% is unsure, and whether or not it may possibly stabilize at 4% is much more unsure. As such, MSFT’s present value stage is already a great exit level underneath present situations for my part. If any new developments within the aftermath of the latest drama set off extra upside value volatility, I actually gained’t advocate potential traders to chase its shares out of concern of lacking out.