Microsoft is testing it 200 hour moving average

Microsoft’s shares are on the run to the upside today after a series of positive catalysts.

- The company extended its partnership with OpenAI, reinforcing its leadership in AI investments tied to ChatGPT and Azure.

- It also settled with the European Commission on long-running antitrust issues related to Teams, easing regulatory pressure by offering Office 365 without Teams and improving data portability.

- Finally, Microsoft and OpenAI signed an MoU to redefine their partnership as OpenAI transitions toward a for-profit model, with both sides expected to hold about 30% stakes.

Together, these developments boosted investor confidence and lifted the stock.

Shares are currently up $11.06 or 2.21% to $512.03

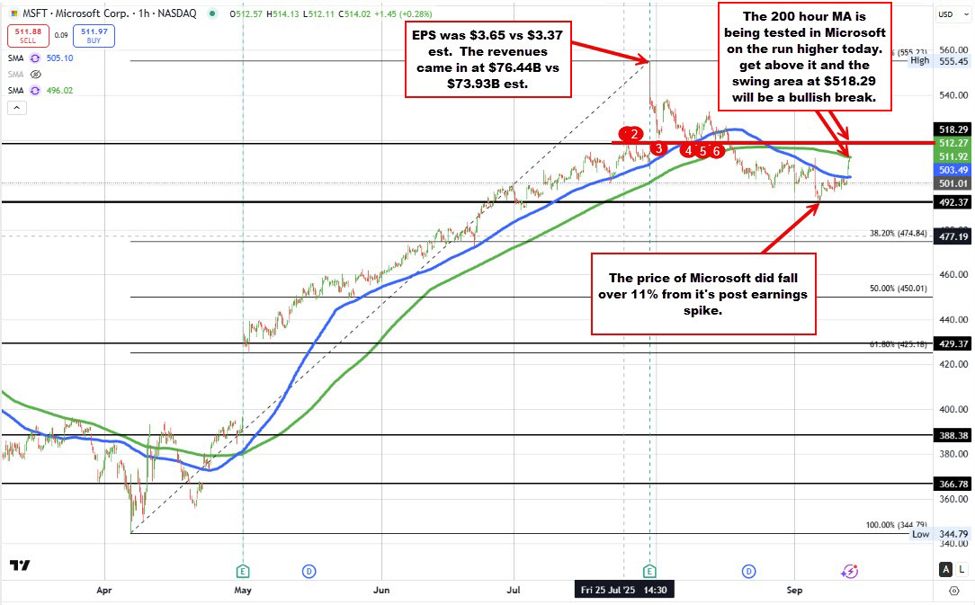

Technically, Microsoft’s price has reclaimed its 100-hour moving average at $503.49 and is now testing the 200-hour moving average at $512.27. So far, today’s high has reached $512.45, just above that key resistance. A sustained break above the 200-hour moving average would signal further upside momentum, with the next target at the swing level of $518.29.

That level capped rallies on July 25 and July 29, just before the stock gapped higher on its earnings release. Microsoft went on to set an all-time high at $555.23 on earnings day but has since retraced, falling 11.2% to a low of $492.37 last Friday. On the move off of the high, initial buyers did lean against the $518.29 level increasing its importance today and going forward.