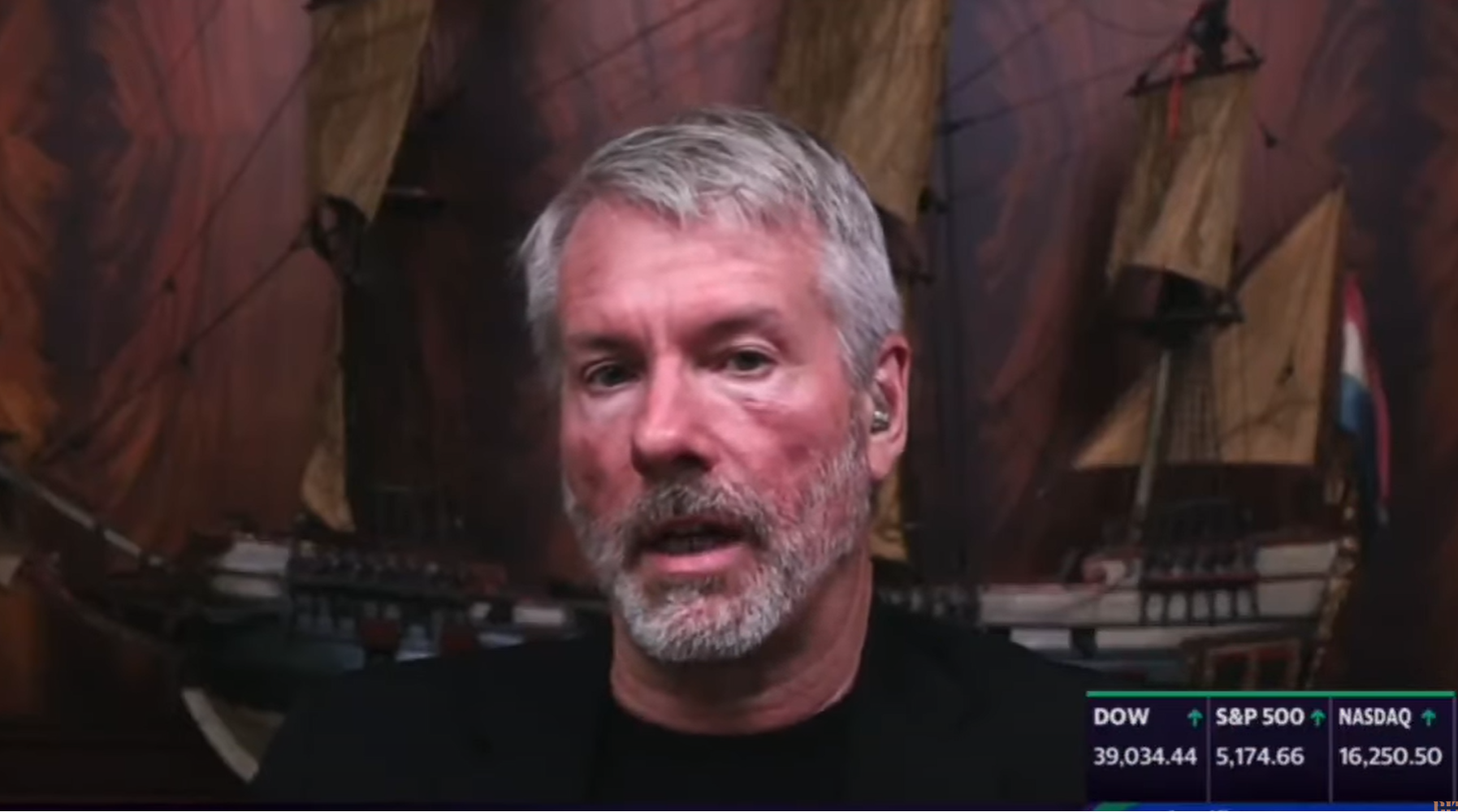

On Tuesday, MicroStrategy introduced the acquisition of an extra 9,245 BTC for roughly $623.0 million, utilizing proceeds from convertible notes and extra money. This buy brings the corporate’s complete holdings to 214,246 BTC. This determine represents greater than 1.0% of the entire 21 million Bitcoin that may ever exist, marking a big milestone for each MicroStrategy and the group at giant.

Michael Saylor, the CEO of MicroStrategy, shared the information on X (previously Twitter), stating, “MicroStrategy has acquired an additional 9,245 BTC for ~$623.0M using proceeds from convertible notes & excess cash for ~$67,382 per #bitcoin. As of 3/18/24, MSTR hodls 214,246 BTC acquired for ~$7.53B at average price of $35,160 per bitcoin.”

The funding for this vital acquisition got here from a non-public providing of convertible senior notes, which concluded with an upsized mixture principal quantity of $603.75 million. This providing attracted substantial curiosity, resulting in an oversubscription and the train of an possibility by preliminary purchasers to purchase an extra $78.75 million price of notes.

In line with MicroStrategy’s official press release, “The Offering, which included a 0.875% coupon and an approximately 40% conversion premium over the US composite volume weighted average price of MicroStrategy’s class A common stock, was well received in the marketplace.”

The convertible notes, due in 2031, provide flexibility to holders with rights for early repurchase and conversion into money, shares of MicroStrategy’s class A standard inventory, or a mix thereof below particular situations. This revolutionary monetary instrument displays MicroStrategy’s sophisticated approach to capital administration and its bullish outlook on Bitcoin.

The Bitcoin Group Reacts

The group has lauded MicroStrategy’s newest acquisition. Bitcoin Munger commented, “Saylor is like a kid in a candy store with this current dip. Still surprised that the market would give him this dip, but coins are moving from lettuce hands to diamond hands.”

Moreover, outstanding figures like Dylan LeClair and WhalePanda have acknowledged the corporate’s vital market place, with LeClair stating, “>1.0% of 21,000,000 Bitcoin. Congrats Saylor & MicroStrategy. Legendary,” and WhalePanda adding, “Saylor thanks you for your weak hands.”

MicroStrategy’s aggressive accumulation of BTC not solely demonstrates its confidence within the digital foreign money as a viable funding asset but additionally might have vital impression on market dynamics. This milestone of holding greater than 1% of all BTC’s in existence is a monumental step for Saylor.

Extra lately, Michael Saylor’s wager on BTC was in comparison with Nelson Bunker Hunt’s historic try to nook the silver market. Each invested closely with the conviction that their chosen asset (BTC for Saylor, silver for the Hunts) was undervalued and poised for vital appreciation. Every believed strongly sooner or later worth of their chosen asset, seeing it as a hedge in opposition to financial uncertainty and inflation.

#Bitcoin as a protest to fiscal absurdity, the flaw of analogizing industrial commodity squeezes of the previous, and the empowerment of self custody. pic.twitter.com/wJ0WBqLWYa

— Dylan LeClair 🟠 (@DylanLeClair_) March 13, 2024

In a current interview, Saylor proclaimed that he has no plans to promote BTC. “We think Bitcoin is the highest form of property, the apex property in the world, and it’s the best investment asset, so the end game is to acquire more Bitcoin. Whoever gets the most Bitcoin wins. There is no other end game,” Saylor stated.

At press time, BTC traded at $63,723.

Featured picture from YouTube / Yahoo Finance, chart from TradingView.com