3dfoto/iStock via Getty Images

MicroStrategy (NASDAQ:MSTR) is a long-lived tech company that has, in recent years, devoted its focus almost entirely to Bitcoin (BTC-USD). This has earned it a place in crypto indexes and ETFs. I first came across it while analyzing Bitwise Crypto Industry Innovators ETF (BITQ), which I covered again recently, but I wanted to focus more on MSTR specifically.

One of the few in that fund to report positive cash flows, it’s worth looking at what it’s doing right and if it’s something that can be done reliably for the long term. Overall, I find it to be a C corporation that functions like a managed BTC fund, hoping to generate good returns through BTC accumulation and supported by cash flows from BTC-related services.

Yet, the features of BTC make me wonder if this can reliably produce good, compounding returns to the long-term investors, and so I have only rated MSTR a Hold.

Bitcoin Development Company

Formed in 1989, MicroStrategy has a long history as a software developer, even being one of those notorious Dot Com stocks that saw a meteoric rise and crash during the bubble. Only for the last few years has it leveraged this background into a focus on BTC, and so I’ll reference the operating results of that period.

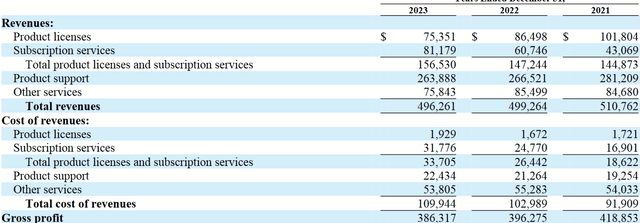

Income Statement (2023 Form 10K)

Over the last three reporting years, MSTR has had around $500M in revenue from its various lines of software and related services, typically at attractive gross margins.

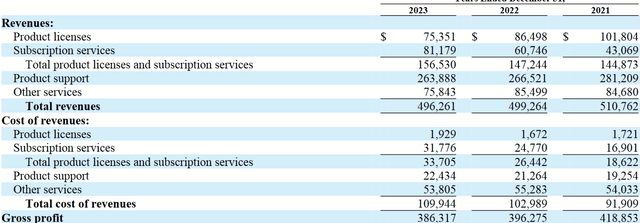

Income Statement (2023 Form 10K)

Seen above, their operating expenses have tended to push them into losses, but this largely owes to the impact of non-cash items.

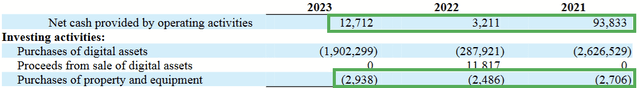

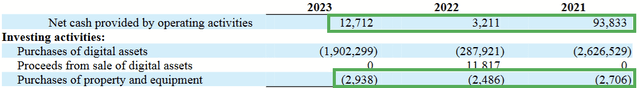

Cash Flow Statement (2023 Form 10K)

When we look to the cash flows, operating cash flow has exceeded capex, producing a positive free cash flow in the basic sense. We should, however, note the significant outflow on purchases of BTC (“digital assets”).

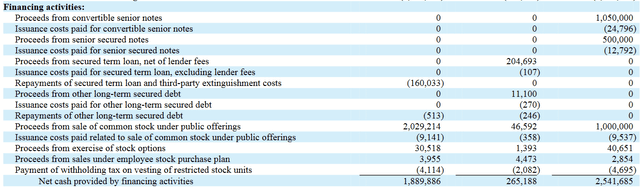

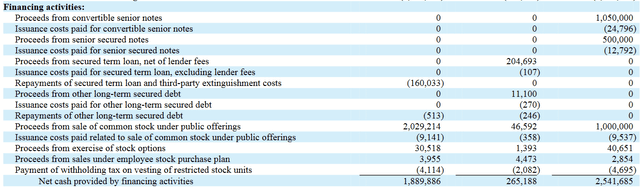

Cash Flow Statement (2023 Form 10K)

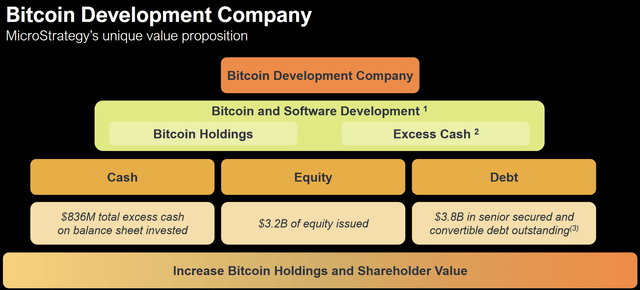

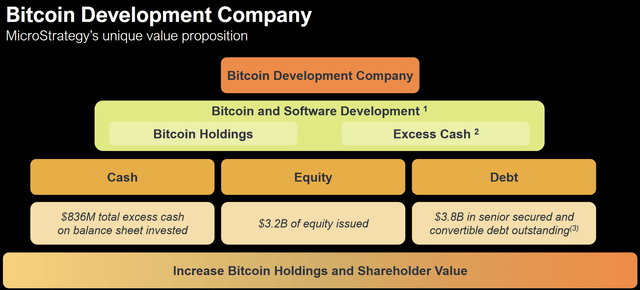

As a “Bitcoin development company,” MicroStrategy aspires to be an accumulator of BTC and to be a seller of software and services that will support the development of its mainstream use.

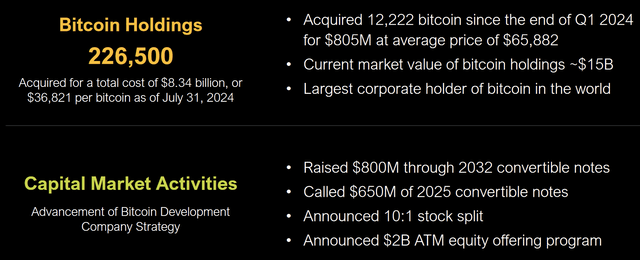

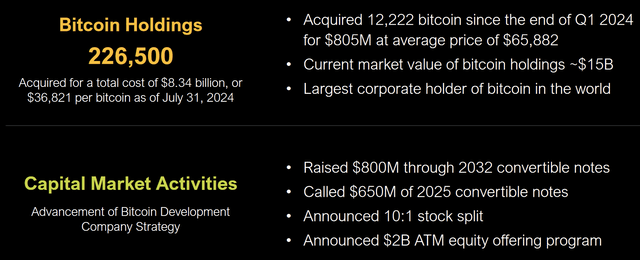

Q2 2024 Company Presentation

Warren Buffett’s Berkshire Hathaway (BRK.A)/(BRK.B) is a C-corp that uses its structure to invest in stocks, while also using the cash flows of its wholly owned businesses to support this capital allocation. One could say that valuing MSTR requires a similar approach to that of BRK: its value will depend on one’s appraisal of both the operations and the portfolio. BRK’s portfolio consists of many stocks, but MSTR’s is simply BTC, so much of this will depend on the future of the cryptocurrency itself.

BTC Portfolio

Where BTC ETFs allow one to invest in BTC through a normal brokerage account, the disadvantage is in the friction created by their expense ratios that compete against BTC’s appreciation over time. MSTR believes that it overcomes that disadvantage with the cash from its operations, as well as a calculated use of financing. Its main goal then is to accumulate BTC at a faster pace than it can dilute common shares.

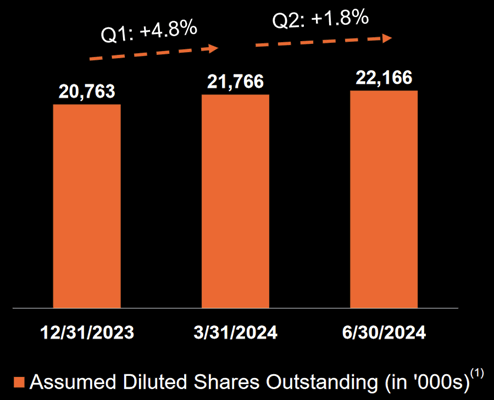

Q2 2024 Company Presentation

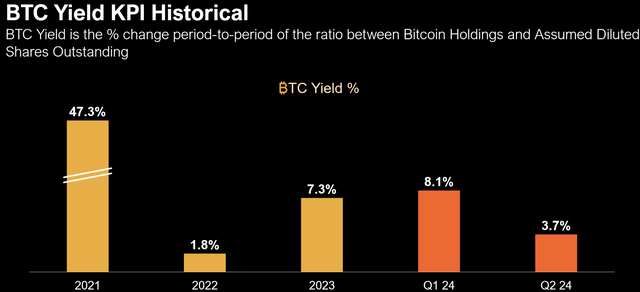

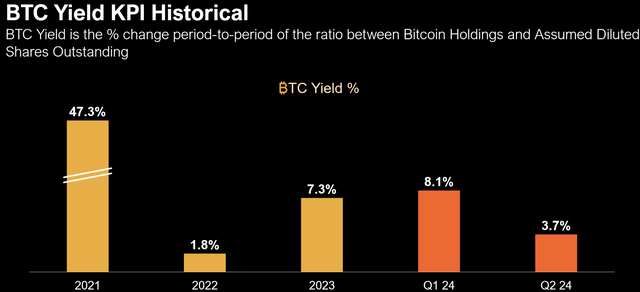

They have developed an internal metric called BTC Yield to express this, the rate of change between total BTC holdings and fully diluted shares outstanding. A positive yield indicates that they should be creating value, and the yield has been consistently positive so far.

Q2 2024 Company Presentation

At the end of Q2, they reported ₿226.5K, with an average cost basis of about $36.8K per coin. As the price of BTC has declined slightly since this was reported, they likely have something around $14 billion in market value of their portfolio now.

Review of Operations

MSTR’s software business isn’t purely BTC-focused, and its provides AI-powered analytics to a variety of industries.

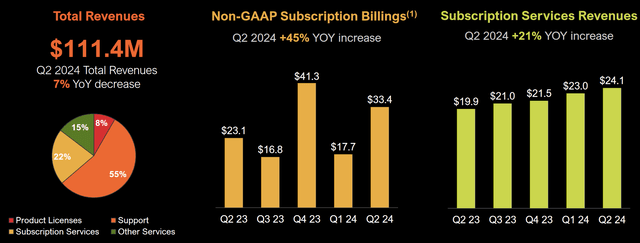

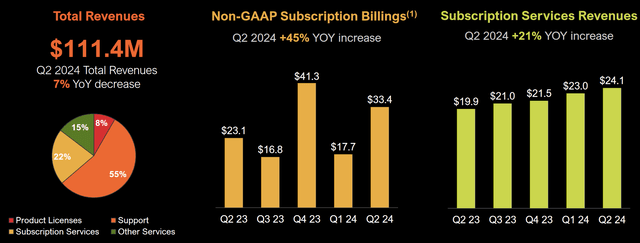

Q2 2024 Form 10Q

Revenues have recently been in a state of decline, as MicroStatregy is migrating more customers to its cloud platform, which monetizes on a subscription basis. The short-term impact therefore appears to be a reduction in revenue, with potential for higher cash flow in the long term as more customers convert to the cloud product.

Q2 2024 Form 10Q

Part of the impact is that operating cash flows (and thus free cash flow) are much lower for the business, year-over-year. Annualized, that comes to about $6M in FCF.

Future Outlook

In order to value this business, we need to sift through the different layers that affect it, such the operations, the portfolio, and then the capital structure.

2022 and 2023 Forms 10K

One of my concerns with the software business is that the cost of revenues for the cloud subscriptions are much higher than those for product licenses they are largely replacing. In addition to the dip in revenue mentioned before, this seems to be the other main reason why operating cash flows are down from $93.8M in 2021 to an annualized amount of $6M currently.

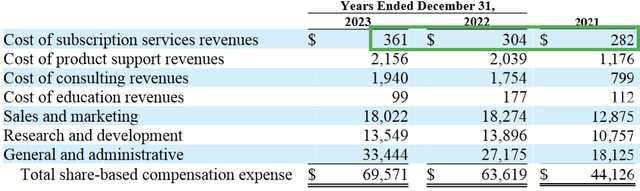

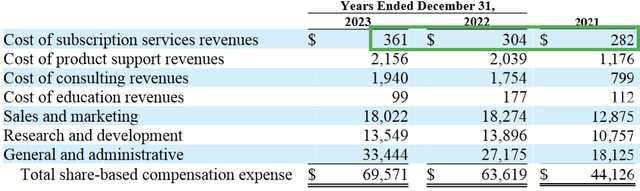

Stock-Based Compensation History (2022 and 2023 Forms 10K)

Looking at the last three years, almost none of this can be attributed to stock-based compensation, and so it appears to be a genuinely more expensive product. As AI-powered data analytics have typically shown significant demand by enterprises that use them, it’s curious why their subscription product isn’t priced more aggressively to account for this.

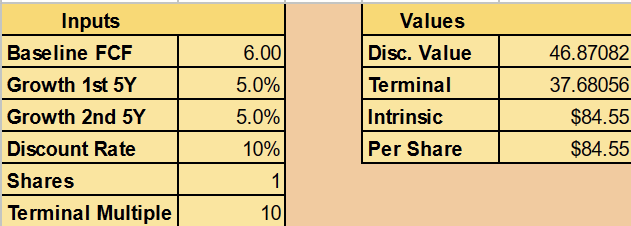

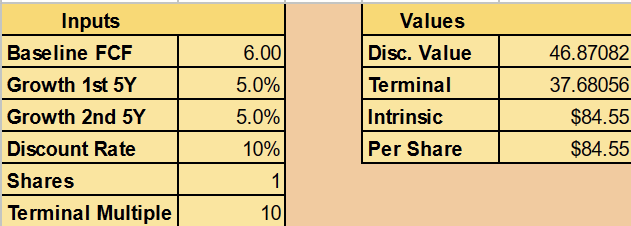

Author’s calculation

Even if we make positive assumptions, that free cash flow will enjoy at least single-digit growth over a decade (in spite of the decreased margins), a Discounted Cash Flow model (priced for a 10% discount rate to compare to the market) suggests the intrinsic value of the software business is about $84M.

Ambitious growth assumptions that allow for FCF to return to 2021 levels, as if costs might decline/halt as the subscriptions scale out, still get that into the hundreds of millions. As the BTC portfolio has a market value of about $14B, while MSTR’s market cap exceeds $25B, it’s just clear that the business operations are barely a consideration here. MSTR’s management of BTC is what counts.

So why the $11B premium to the BTC holdings? Executive Chairman Michael Saylor explained his thoughts to analysts in the Q2 earnings call, stating:

So, when you have an investment in bitcoin you’re not thinking about holding it for a short period of time and flipping it. Now, when you think about holding something for 30 years, or 40 years, and if you have a vehicle like a closed-in fund that charges 250 basis points as a fee; that looks like a negative BTC Yield of 2.5%. We have experience with those sort of things, and we’ve seen they trade at a discount to net asset value. Closed-in funds with a long fee on an asset you’re going to hold forever, they start to look like a multiple of the negative BTC Yield.

Saylor therefore seems to agree with me that MSTR functions like a fund, arguing that the premium is pricing in the value of the BTC yield.

Referring to Saylor’s remark about treating BTC as an investment asset, it does bring something up that gives me pause: the conflicting view on what BTC should be for the long term. Is it an investment asset, or is it a digital currency?

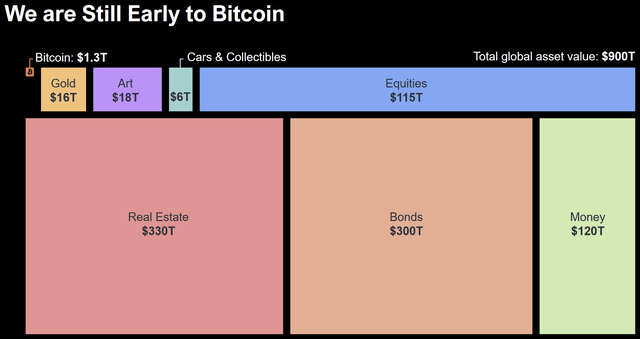

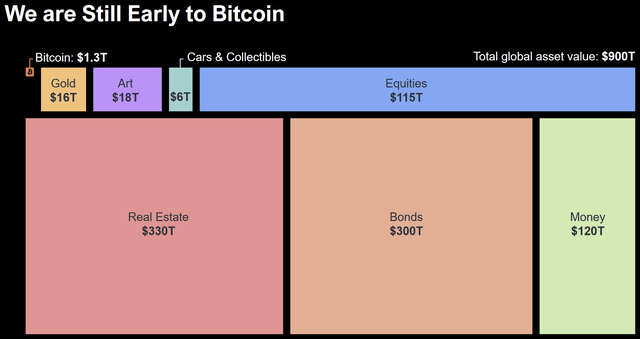

Q2 2024 Company Presentation

The company believes that BTC’s market cap, just over $1 trillion, has room to appreciate more, as global assets overall are valued at $900T. I’ll note that three of the four largest slices (equities, bonds, and real estate) account for assets that actually produce earnings and cash flow, while also offering hard assets as additional value or collateral. BTC lacks either of these qualities.

Gold, art, and cars/collectibles are also hard assets, and to varying degrees they actually have uses. This means that BTC competes most directly with fiat currency, the remaining $120T, as neither provide earnings or are anything unto themselves, merely currencies. I’ll quote the shareholder letter within their 2023 Annual Report, which explains their views on the superiority of BTC:

Now, many have focused more on the belief that Bitcoin is only valuable as a medium of exchange, and in that case, it’s very easy to say Bitcoin is slow and not a good medium of exchange like the dollar or the euro. However, if you look at all the wealth in the world today, only a small percentage of the world’s wealth is stored in immediately accessible mediums of exchange, such as cash or checking accounts, and those instruments don’t serve as good stores of value, particularly in inflationary times. Therefore, most wealth is actually in the form of some better store of value or useful capital, such as real property or stocks. When it comes to wealth preservation or capital appreciation then, this insight shifts the narrative away from medium of exchange to store of value and from digital currency to digital property. Because of its characteristics, we believe Bitcoin is a superior store of value, akin to digital gold or digital property, and just as records and CDs gave way to digital music, we believe gold and other traditional physical stores of value will give way to Bitcoin.

Penned by Saylor, he explicitly disagrees that BTC will function in the way that it is intended to function, as a currency. He thinks it’s better as a store of value. Part of the problem here is that so many people who hold BTC do so on the belief that will displace other fiat currencies. If that doesn’t happen, how does that affect demand and thus the price? My guess is that it would not be positively.

This is the problem with an asset like BTC. Its popularity is built on the simultaneous but often contradictory views that it can function as a currency in the short-term and as a store of value in the long-term, even though it lacks the traits of either.

Is this a prediction that BTC will fail and, with it, shares of MSTR? No, but it does make me question why I’d buy today at almost an 80% premium to the market value of the BTC holdings or settle for anything less than a GAAP undervaluation.

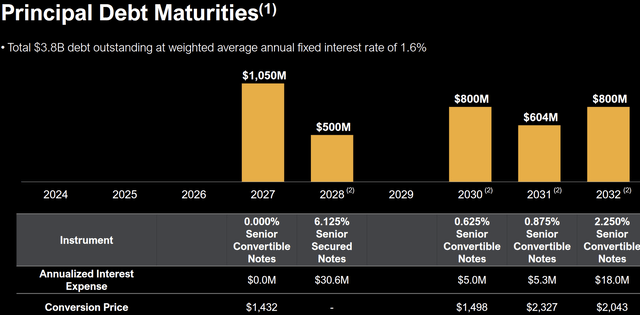

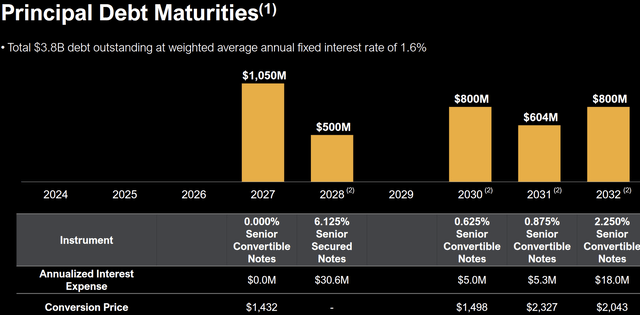

Q2 2024 Company Presentation

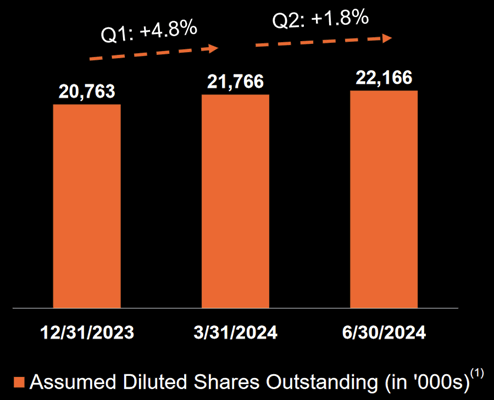

Finally, let’s consider the debt on hand and how that plays into things. Nearly all of this is convertible debt, with only the $500M due 2028 of the $3.7B in LT debt on its balance sheet being non-convertible. As the company has no problem with issuing equity, I suspect that any debt that isn’t converted will simply be repaid with more ATM equity offerings, assuming they can’t refinance. Thus, my main point is that I want to consider full potential dilution.

Q2 2024 Company Presentation

Across its Class A shares, Class B shares, and convertible notes, that comes to 22,166,000 “assumed diluted shares” as of Q2. Of course, if we remember the stock split they also announced, then we need to multiply that by 10.

While MSTR currently trades for about $132 on the market, a fair value for its $14B of BTC would be about $63 per share (if we assume MSTR’s strategy cannot close that gap).

Conclusion

MSTR’s market cap over $25B is well above the value of the BTC holdings, likely around the $14B level at current prices. Their operations only generate a few million in free cash flow each year and are insufficient to plug this value gap. MSTR’s premium to its BTC holdings therefore requires confidence that its price will increase over the long-term and at a high enough rate to make that premium attractive, along with belief that MSTR can continue to generate a positive BTC yield.

In my view, the company fails to establish why BTC will reliably perform as other assets do. Stocks and bonds have earnings that can compound. Gold and art physically exist and at least have some utility. Despite a boom of AI and the tech to create software that large customers can utilize, this is the path MicroStrategy has chosen.

Perhaps BTC (and MSTR with it) will continue to appreciate for some time. Yet, there’s nothing fundamental to the business to require this. In my opinion, only a discount to holdings makes sense as an alternative to buying BTC directly. With all these uncertainties, I consider this stock a Hold at best.