The Tokyo-based Monex Group intends to additional strengthen its digital asset choices to institutional traders by way of the 3iQ acquisition.

Monex Group Inc, a holding monetary firm primarily based in Japan with operations around the globe, will purchase Canada-based crypto asset supervisor 3iQ Digital Holdings Inc for an undisclosed quantity. In accordance with the announcement, 3iQ will collaborate with Coincheck Inc, a Japanese cryptocurrency trade with totally different merchandise out there that was acquired by Monex Group again in 2018 for about $33.4 million, to bolster the digital asset choices centered on institutional traders. Moreover, the partnership will entail enhanced liquidity for the 1.8 million Coincheck prospects already invested within the cryptocurrency trade.

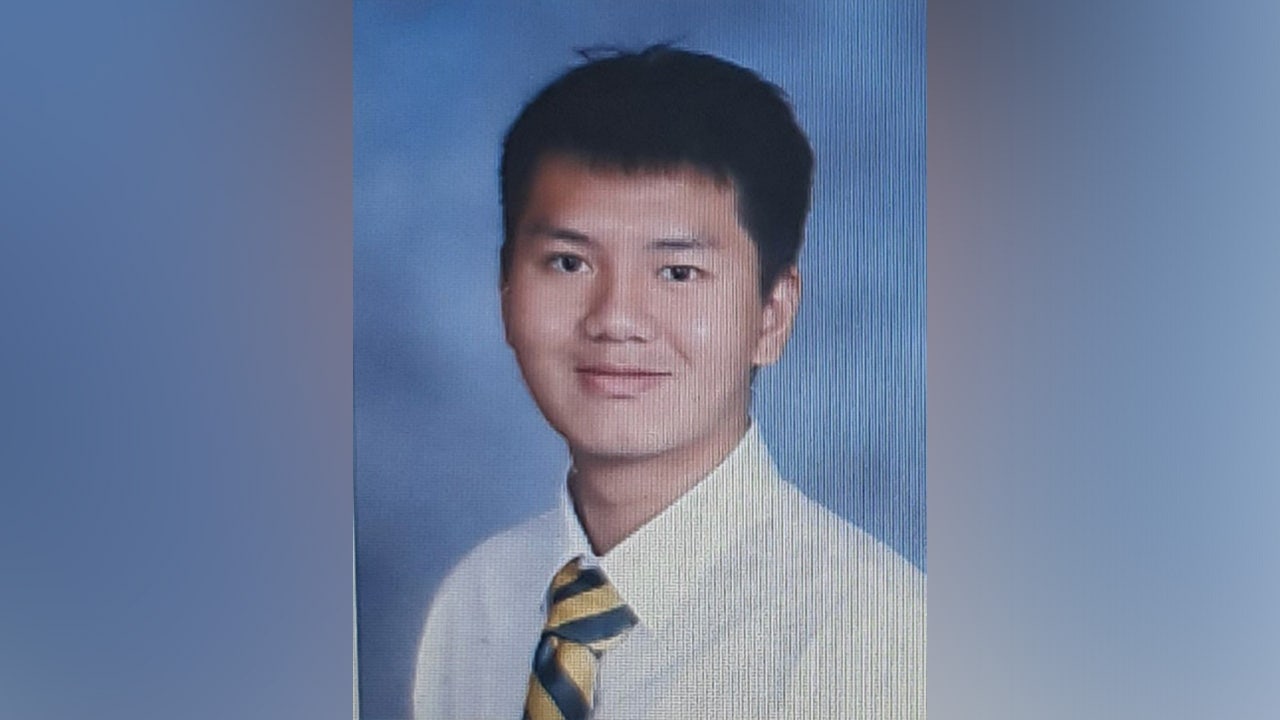

Frederick T. Pye, Chairman and CEO of 3iQ, expressed his assist for the groundbreaking initiative that’s geared in direction of reshaping the web3 and digital property trade. Furthermore, 3iQ has specialised in tailor-made merchandise for institutional traders looking for to faucet into the cryptocurrency market.

“This partnership is not just about growth; it’s a thrilling leap towards realizing our dream. We’ve always been passionate about bringing regulated, innovative digital asset products to investors worldwide, and now, with Monex Group, we can turbocharge this mission,” Pye famous.

Related sentiments have been echoed by Yuko Seimei, the Chief Govt Officer of Monex Group, who insisted that the collaboration between the 2 entities will streamline the mass adoption of digital property. Furthermore, the Japanese authorities has already enacted notable clear crypto laws to welcome worldwide traders to faucet into the native rising demand.

“Our long-term strategy is to strengthen our asset management business, and by welcoming 3iQ to our group, we aim to achieve high growth by capturing the crypto asset management needs of institutional investors and crypto asset exchanges around the world, which are expected to grow in the future,” Seimei noted.

Market Implications of the 3iQ Acquisition by Monex Group

The Monex Group was impressed by the truth that 3iQ’s Bitcoin and Ethereum exchange-traded funds (ETFs) on the Toronto Inventory Change have considerably grown since their inception. Notably, the 3iQ Bitcoin ETF (TSX: BTCQ) traded round CA$ 9.11 on Friday, down roughly 2 p.c within the final 24 hours. Nonetheless, the BTCQ fund has registered greater than 124 p.c features year-to-date, following the spectacular Bitcoin efficiency. Different notable funds provided by 3iQ embody the 3iQ Ether Staking Fund and the 3iQ World Cryptoasset Fund.

The acquisition of 3iQ will play an enormous function in bolstering revenues for Monex Group and its inventory market. Furthermore, 3iQ has launched extra merchandise – together with the not too long ago unveiled 3iQ Managed Account Platform (QMAP) – which are geared in direction of enabling the seamless adoption of digital property by institutional traders. In accordance with the newest market knowledge, Monex Group inventory has gained about 70 p.c because the calendar flipped in January.