Neilson Barnard

This text is a part of a sequence that gives an ongoing evaluation of the modifications made to Carl Icahn’s 13F portfolio on a quarterly foundation. It’s based mostly on Icahn’s regulatory 13F Form filed on 11/14/2023. Please go to our Tracking Carl Icahn’s Portfolio sequence to get an thought of his funding philosophy and our previous update for the fund’s strikes throughout Q2 2023.

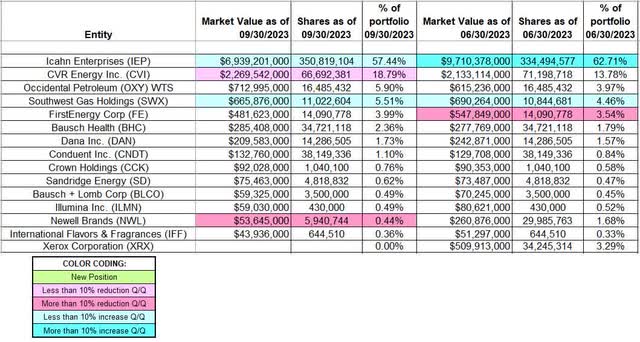

The variety of holdings within the 13F submitting decreased this quarter from 15 to 14. The highest 5 holdings within the submitting are Icahn Enterprises, CVR Power, Occidental Petroleum warrants, Southwest Gasoline Holdings, and FirstEnergy.

Carl Icahn is greatest recognized for constructing sizable stakes in companies after which pushing for modifications to extend shareholder worth. To study extra about his investing fashion and philosophy take a look at here.

Be aware: Icahn’s 13F can’t be thought of a list of his holdings. Carl Icahn is almost all proprietor of Icahn Enterprises (NASDAQ:IEP) which holds a number of of the companies and the entities in flip maintain IEP. His 13F is a consolidated report. IEP Investor Presentation (Slide 5) has particulars of the enterprise construction.

Stake Disposals:

Xerox Company (XRX): XRX was a 3.29% of the portfolio place established in This autumn 2015 at costs between $24 and $32. The 4 quarters via Q2 2021 had seen a roughly one-third stake improve. Their total value foundation was ~$25 they usually had a ~22% possession stake within the enterprise. The stake was offered again to the corporate at $15.84 per share as per a 2021 settlement. The inventory is now at $15.04.

Be aware 1: In December 2017, Icahn launched a proxy battle nominating 4 new board members in an effort to cease the Xerox-Fujifilm deal introduced earlier. In Might 2020, Xerox scrapped the take care of Fujifilm in a settlement with Icahn and Darwin Deason (one other activist alongside Icahn).

Be aware 2: Icahn’s activism earned him three board seats in 2016. Xerox spun off Conduent and that transaction closed in January 2017. That was adopted by a 1:4 inventory cut up in June. The costs quoted above are adjusted for these two transactions.

Stake Decreases:

CVR Power (CVI): CVI is a prime three ~19% of the 13F portfolio place first bought in This autumn 2011. The majority of the present place (71.2M shares: ~71% of the entire enterprise) was bought via a $30 per share tender provide in H1 2012. This quarter noticed a ~6% trimming at a mean worth of ~$35.20 per share. The inventory at the moment trades at $30.09.

Be aware 1: Two MLPs have been carved out because the 2012 tender: CVR Refining the refining portion and CVR Companions (UAN) the nitrogen fertilizer unit. CVR Power had majority possession stake in each. In August 2015, CVR Companions agreed to merge with Rentech Nitrogen. Q2 2018 noticed a young provide whereby new CVR Power shares have been exchanged for CVRR at a valuation of $24.26 per widespread unit (0.6335 shares of CVI for one CVRR). ~22M new shares have been issued.

Be aware 2: Their ~$30 implied cost-basis is vastly overstated resulting from carve-outs and particular dividends paid out over time.

Newell Manufacturers (NWL): NWL is now a really small 0.44% of the portfolio place. It was established in Q1 2018 at a cost-basis of $27.40 per share. The inventory is now at $8.42. Q2 2018 noticed a ~10% stake improve at costs between $23 and $28 and that was adopted by a ~15% improve subsequent quarter at costs between $20.50 and $28. There was a ~25% discount in Q1 2022 at $25.86 per share in a repurchase settlement with the corporate. That was adopted by ~9% promoting throughout Q1 2023. That was adopted by a ~80% promoting this quarter at costs between $8.61 and $11.09.

Be aware: In April 2019, rival activist Starboard Worth got here to an settlement with Carl Icahn for management of Newell’s board.

Stake Will increase:

Icahn Enterprises (IEP): IEP place has seen constant will increase over time. The place measurement elevated from ~98M shares to ~102M shares in 2013, to ~109M shares in 2014, to ~117M shares in 2015, to ~130M shares in 2016, to ~158M shares in 2017, 175.4M in 2018, 197M in 2019, 222M shares in 2020, 257M shares in 2021, 300M shares in 2022, and 351M shares as of Q3 2023. The inventory at the moment trades at $16.33.

Be aware 1: In Might, IEP inventory worth dropped sharply following a brief report from Hindenburg Analysis.

Be aware 2: The stake improve over time is primarily resulting from them taking the dividend consideration in further shares reasonably than money. The dividend was minimize by 50% to $1 per unit in early August.

Southwest Gasoline Holdings (SWX): SWX is a 5.51% of the portfolio place established over the 2 quarters via Q3 2021 at costs between ~$63 and ~$72. There was a ~75% stake improve throughout Q3 2022 via a young provide at $82.50 per share. That was adopted by a ~60% additional improve throughout Q1 2023 at costs between ~$59 and ~$67. The inventory at the moment trades at $61.03. There was a minor ~3% stake improve final quarter and a ~2% improve this quarter.

Be aware 1: They’ve a 15.4% possession stake within the enterprise.

Be aware 2: The place was made public in an October 2022 regulatory filing once they mentioned they have been against Southwest’s acquisition of Questar Pipeline, Dominion Power’s (D) transportation and storage enterprise.

Saved Regular:

Occidental Petroleum (OXY) wts: The ~6% of the portfolio place was established in Q3 2020 when 19.3M warrants (strike 22, 8/3/2027 expiry) have been bought for ~$2.75 per warrant. The stake noticed a ~20% promoting in Q3 2021. There have been minor will increase within the 5 quarters via Q1 2023. The warrants at the moment commerce at $34.94.

Be aware: Additionally they had a big place within the widespread inventory of OXY however that was offered in Q1 2022.

FirstEnergy (FE): FE is a ~4% of the portfolio place bought in Q1 2021 at costs between ~$29.50 and ~$35.60 and the inventory at the moment trades at $37.08. There was a ~25% promoting final quarter at costs between ~$37 and ~$42.

Bausch Well being (BHC): The two.36% of the portfolio BHC place was bought in This autumn 2020 at costs between ~$15.30 and ~$21 and elevated by ~575% subsequent quarter at costs between ~$21.25 and ~$34.40. The inventory at the moment trades properly beneath their buy worth ranges at $7.30.

Be aware: They personal 34.7M shares (~10% of the enterprise). Two Icahn nominees are on the board.

Dana (DAN): The 1.73% DAN stake was established in This autumn 2020 at costs between ~$13.25 and ~$20 and elevated by ~200% subsequent quarter at costs between ~$19 and ~$27. Q3 2021 additionally noticed a ~20% stake improve at costs between $20.90 and $24.60. The inventory at the moment trades at $13.67.

Be aware: Icahn controls ~10% of Dana Inc.

Conduent (CNDT): The small 1.10% portfolio stake happened because of Conduent’s spinoff from Xerox which closed in January 2017. Phrases referred to as for Xerox shareholders to obtain Conduent shares within the ratio of 1:5. Icahn owned 99M shares of Xerox for which he acquired 19.8M shares of Conduent. CNDT began buying and selling at ~$15 and at the moment goes for $3.23. Q2 2019 noticed a ~60% stake improve at round $9 per share. That was adopted by a ~20% improve in This autumn 2019 at ~$6.50 per share.

Be aware: Their possession curiosity in Conduent is at ~18% of the enterprise.

Crown Holdings (CCK): CCK is a 0.76% of the portfolio stake established throughout Q3 2022 at costs between ~$80 and ~$102 and the inventory at the moment trades at $88.53.

Be aware 1: Regulatory filings because the quarter ended present them beneficially proudly owning ~6M shares (~5% of the enterprise). This consists of ahead contracts at an mixture worth of $75 per share.

Be aware 2: A director appointment and nomination settlement was reached in January for the corporate’s 2023 election.

SandRidge Power (SD): SD is a 0.62% of the portfolio activist stake established in This autumn 2017 at costs between $16 and $21 and the inventory is now at $13.98.

Be aware: Icahn has a ~13.5% possession stake within the enterprise. He lobbied the board and succeeded in ending the Bonanza Creek acquisition on December 28, 2017. In June 2018, Icahn gained management of SandRidge’s board by profitable a proxy battle.

Bausch + Lomb (BLCO): BLCO is a derivative from Bausch Well being that began buying and selling in Might final yr at ~$18 per share. The inventory at the moment trades at $15.66. In June 2022, two nominees of Icahn joined the board.

Illumina (ILMN): ILMN is a small 0.49% of the portfolio stake established throughout Q1 2023 at costs between ~$194 and ~$233 and the inventory at the moment trades at ~$113.

Be aware: Icahn launched a proxy battle and succeeded in ousting board Chairman John Thompson in Might. The CEO Francis deSouza additionally resigned in June. In October, Icahn filed a lawsuit for damages and to take away board members for violating fiduciary duties.

Worldwide Flavors & Fragrances (IFF): IFF is a really small 0.27% of the portfolio stake established in Q1 2022 at costs between ~$116 and ~$150 and the inventory at the moment trades properly beneath that vary at $76.82.

Be aware: Icahn additionally owns ~90% of Viskase Firms (OTCPK:VKSC). He’s additionally recognized to have a place in Fannie/Freddie (OTCQB:FNMA) (OTCQB:FMCC).

The spreadsheet beneath highlights modifications to Icahn’s 13F inventory holdings in Q3 2023:

Carl Icahn’s Portfolio – Q3 2023 13F Report Q/Q Comparability (John Vincent (creator))

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.

![An Overview of Facebook’s Audience [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/11/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9mYWNlYm9va19kZW1vXzMucG5n.webp-600x435.webp)