Robert Way

By Breakingviews

Walt Disney (DIS) is under attack for being a monopoly. If only it had that much pricing power. Two recent arrangements showcase the $160 billion media giant trying to exercise control of its content. The trouble for Disney is that competition is steep, and customers have plenty of other places to go.

On Sunday, DirecTV users could not access any of the Magic Kingdom’s channels, including broadcast station ABC and sports network ESPN. The pay-TV provider and Disney are locked in a licensing dispute that has impacted some 11 million subscribers just before the National Football League kicks off its opening matchup on Thursday.

The heart of the fight is over a practice in the media business known as bundling. Effectively, DirecTV is accusing Disney of forcing the distributor to carry all its 16 channels, regardless of how many people watch them, passing the price to the consumers. For instance, less than 40% of DirectTV customers view Disney’s sports content, yet 85% of subscribers are charged for it.

It’s not the only hurdle that Disney has encountered over negotiating the cost of its shows. In August, a U.S. judge temporarily blocked a sports streaming service from the Mouse House, Warner Bros. Discovery (WBD) and Fox (FOX). The three networks had teamed up to agree that they’d only distribute certain sports games over the new venture, Venu.

That Disney needed a consortium of partners is instructive. Locking arms with similar media companies shows the business needs to operate collectively in order to keep others from competing. But that’s because the TV ecosystem is quickly melting away. Consumers are rejecting pricey pay packages that pass the cost of licensing content onto the viewer. At its 2009 peak, some 90% of U.S. households took a cable subscription, according to MoffettNathanson. At the end of second quarter this year, it dropped to approximately 50%.

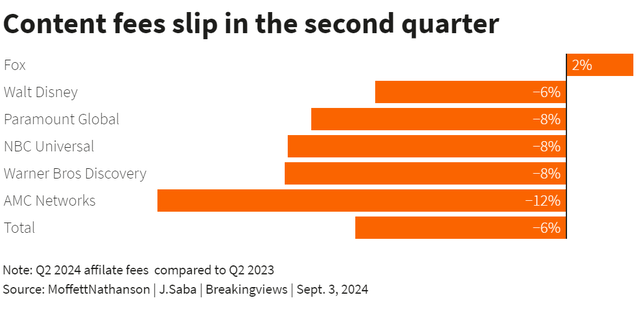

People are confronted with a dizzying array of streaming packages from Netflix (NFLX) to Disney+ to HBO Max that allow consumers to pick and choose what they want to watch. DirecTV desires to offer choice, flexibility, and tailored costs. And Disney is negotiating outside of its pricing power: fees that it and peers collect from licensing TV shows from cable distributors dropped 6% in the second quarter this year compared to the same period last year, MoffettNathanson reckons. Monopolies work best if they exist.

Context News

Walt Disney pulled its channels from DirecTV on Sept. 1. The pay-TV satellite provider and the media company could not come to terms on content licensing agreements for programming including from broadcast station ABC and sports network ESPN. DirecTV said in a statement that Disney demanded in its new contract DirecTV must waive all claims that Disney’s behavior is anticompetitive. Additionally, DirecTV alleges that Disney is making consumers pay for channels they don’t want. Disney executives Alan Bergman, Dana Walden and Jimmy Pitaro said in a statement to Reuters, “While we are open to offering DirecTV flexibility and terms which we’ve extended to other distributors, we will not enter into an agreement that undervalues our portfolio of television channels and programs.” Separately, a U.S. judge on Aug. 16 temporarily blocked the launch of a new sports streaming service from Disney, Fox and Warner Bros Discovery over potential monopolistic behavior.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.