ArtistGNDphotography

In a late May 2024 Seeking Alpha article on the VanEck Agribusiness ETF (NYSEARCA:MOO), I concluded:

A move above the December 2023 $77.63 high could ignite a significant rally in MOO. Grain and oilseed have been under pressure since the 2022 highs. Gold, silver, copper, and soft commodities, and the recent consolidation in grains are signs that the bearish trend could end sooner than later. MOO is a bargain at its current price level, and higher highs are on the horizon.

MOO was trading at the $72.88 per share level on May 28, 2024. On August 6, the shares were lower at around $68.50, but the ETF’s blended dividend continues to pay shareholders while they patiently wait for a recovery and capital gains.

The case for agribusiness over the coming years – Inflation, de-dollarization, demographics, war

Agribusiness is the industry, enterprises, and related businesses that impact supply chains in agriculture and the bioeconomy. While agricultural commodities feed a growing world, they have also become energy sources as ethanol and biodiesel fuels require corn, sugar, soybeans, and other agricultural products.

Agribusinesses are critical for the global economy but face significant roadblocks that have increased costs. Inflation erodes the value of money and causes production and manufacturing costs to rise. The geopolitical shift threatens the U.S. dollar’s role as the world’s reserve currency. The world’s population has increased to over the eight billion level, causing the demand side of the equation for agricultural products to grow. Wars in Ukraine and the Middle East create logistical nightmares, as trade sanctions and other factors interfere with transporting the commodities that feed and increasingly power the world. Ukraine and Russia are Europe’s breadbasket, and the Middle East is a leading traditional energy production hub.

Agribusiness is a diversified business

Agribusiness includes the companies that produce and process agricultural products into food and fuel. Meanwhile, equipment manufacturers, seed, fertilizer, and animal and plant health products are pick-and-shovel agribusiness companies.

Agribusiness is the commercial side of agriculture that supports the distribution of farm-based goods. Value and supply chains linking products and services meeting consumer demand from farm to table and farm to fuel pumps are agribusinesses that feed and power people worldwide.

The MOO ETF owns shares in the leading agriculture-related companies

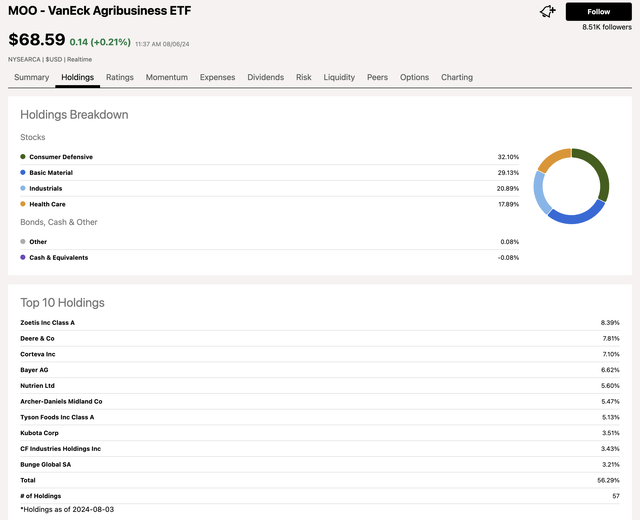

The top holdings of the VanEck Agribusiness ETF product include:

Top Holdings of the MOO ETF Product (Seeking Alpha)

At just under $68.60 per share, MOO is a liquid ETF product with nearly $690 million in assets under management. MOO trades an average of 52,274 shares daily and charges a 0.53% management fee. The $2.24 blended premium translates to a 3.27% yield, higher than the yield of the leading U.S. stock market indices. Meanwhile, the dividend covers the ETF’s expense ratio for MOO shareholders in around two months.

The holdings reflect the diversified group of agribusinesses.

A bearish trend since the 2022 high – SA ETF Grades highlight dividends

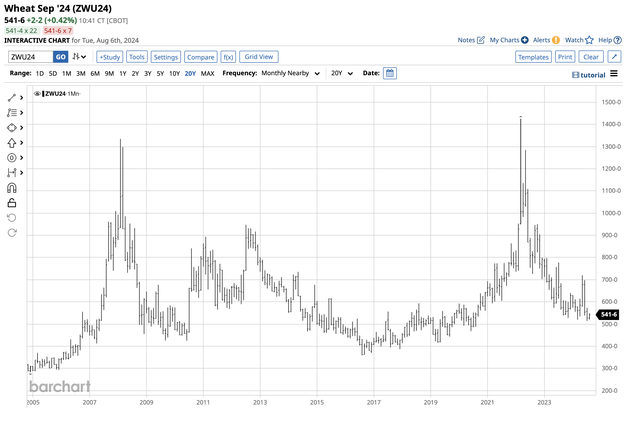

MOO reached a record $109.19 high in April 2022 when the war in Ukraine sent corn and soybean prices within pennies of the 2012 record higher and CBOT wheat to a record peak.

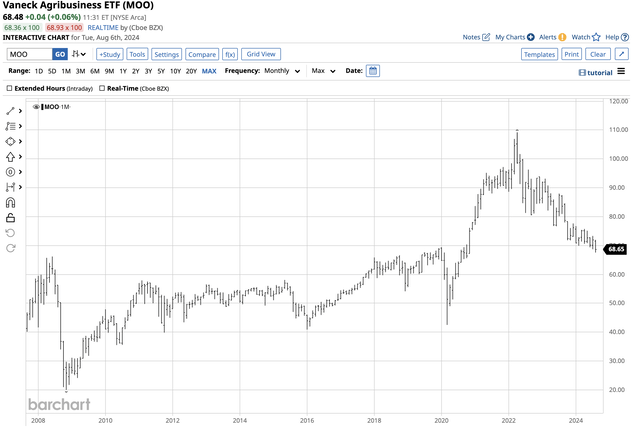

Long-Term Chart of the MOO ETF Product (Barchart)

The monthly chart highlights that the MOO ETF more than doubled from the pandemic-inspired 2020 $42.52 low to the 2022 high. Since then, MOO has made lower highs and lower lows, reflecting the declines in corn, soybean, and wheat prices. However, inflation has kept input and other agribusiness prices high, which could cause grain and oilseed markets to establish bottoms and turn higher.

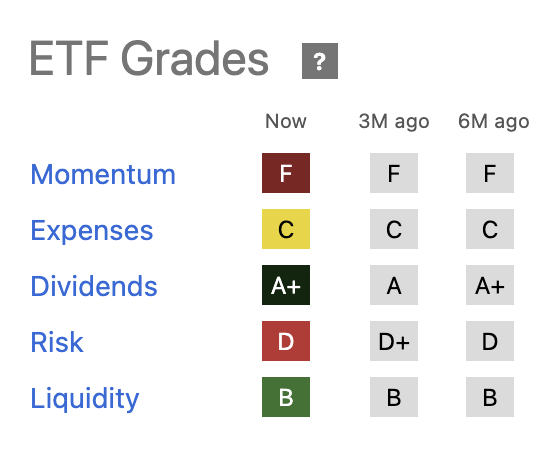

MOO: Seeking Alpha ETF Grades (Seeking Alpha)

The chart highlights that Seeking Alpha ETF Grades reflect the bearish price action in MOO’s price momentum, with a failing grade. Expenses or management fees at a C are a passing grade, while risk at a D also reflects the price action in agricultural commodities. Liquidity has been steady at a B, while dividends at an A+ receive the highest possible grade.

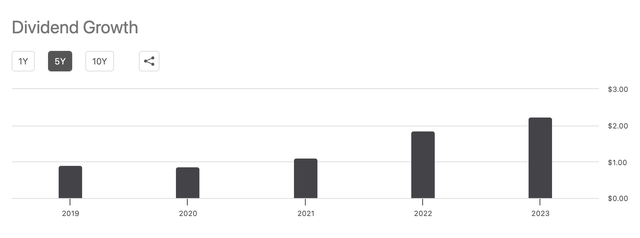

MOO Dividend Yield (Seeking Alpha)

The dividend yield has exhibited impressive growth since 2022.

MOO Dividend Growth (Seeking Alpha)

Dividend growth has been equally impressive, increasing from the 2020 low and exceeding the 2014 high in 2022 and 2023.

A scaled-down approach is contrarian but could offer substantial profits

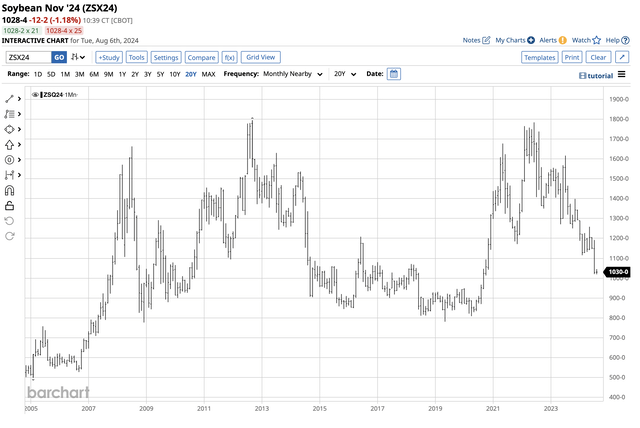

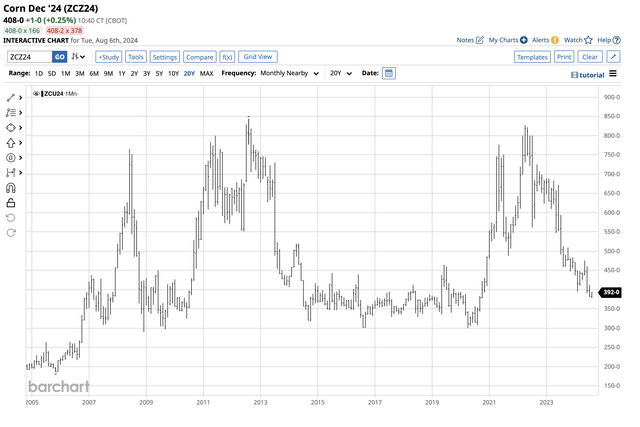

The bearish price action in the MOO ETF reflects declines in the leading grain and oilseed prices.

Monthly CBOT Soybean Futures Chart (Barchart)

Soybean futures have dropped from the $17.84 2022 high to below $10.30 per bushel.

Monthly CBOT Corn Futures Chart (Barchart)

Corn futures have declined from the 2022 $8.27 high to under half that price.

Monthly CBOT Wheat Futures Chart (Barchart)

CBOT soft red winter wheat futures have plunged from a record peak of $14.2525 in 2022 to the $5.40 per bushel level.

Commodities are cyclical assets, with prices rising to levels where the elasticity of demand causes demand to drop, inventories to rise, and prices to turn lower. Meanwhile, they fall to levels where demand increases, inventories decline, and prices find bottoms and turn higher. The current price levels in the soybean, corn, and wheat markets suggest they are closer to bottoms as production costs have increased to levels where production becomes uneconomic, causing future shortages. Significant bottoms in the leading grain and oilseed markets will likely cause a similar price bottom in the MOO ETF.

It is virtually impossible to pick bottoms in any asset, and agricultural commodities are no exception. However, the price action over the past two years suggests that the agricultural markets are at levels that favor significant bottoms. I favor a long position in the MOO ETF, leaving plenty of room to add on further declines. Feeding and powering the world with agricultural products is not an option but a necessity. The agribusinesses that support crop production are critical. Geopolitical turmoil, de-dollarization, inflation, and demographics are compelling reasons to add MOO to portfolios.