- The Fed has great sources of information even with the government shutdown.

- Next year is a long way off in terms of monetary policy.

- So far seen both labor supply and demand for workers declining at about the same pace.

- The breakeven rate for monthly jobs is lower than it was and hard to assess right now.

- Suspect the breakeven rate is lower than 75K per month.

- Would not want to step on a productivity boom

- the Fed should explore what productivity growth can be.

- Muted tariff inflation so far is a testament to business creativity in managing costs.

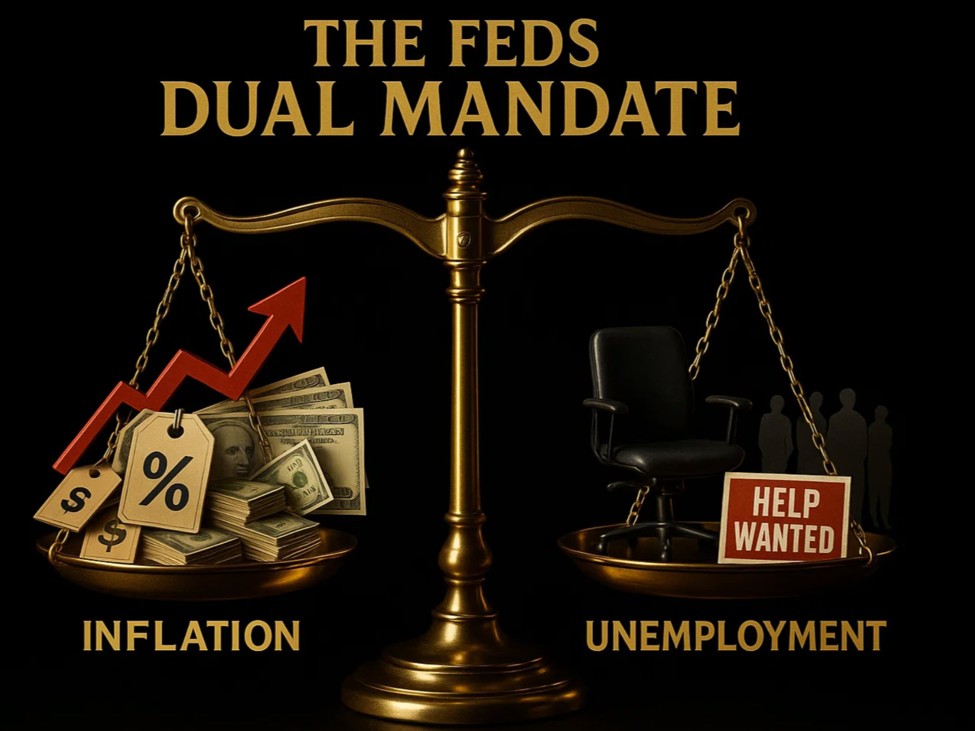

- Do not see the type of demand conditions that would turn a series of supply shocks into persistent inflation.

- The Fed will have to fields way to the neutral rate.

- Growth right now is strong, but hard to see how that is sustained.

- If inflation shows a burst the Fed would have to react

- Market expectations are generally more reliable than household surveys on inflation expectations.

More dovish comments from Chicago Fed Pres. Paulson

This article was written by Greg Michalowski at investinglive.com.