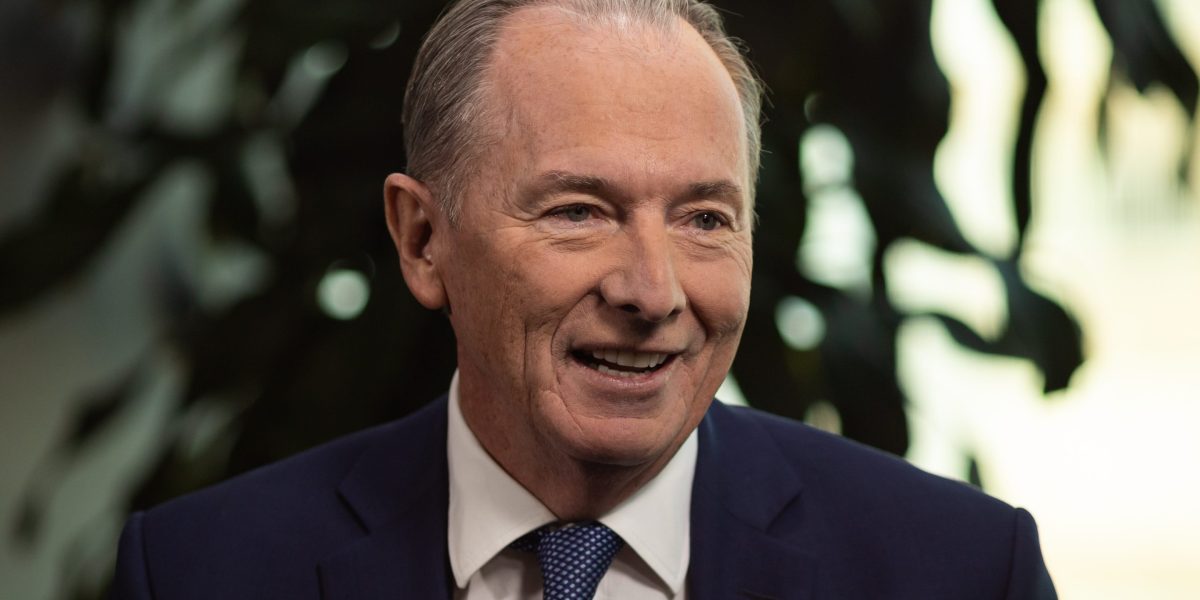

This week marks the fruits of an unusually clean government transition for a Wall Road financial institution, as Morgan Stanley’s new CEO Ted Decide stepped into his new position after outgoing chief James Gorman left.

The choice, which was introduced in Could, was hailed as a mannequin transition as a result of it concerned little inner turmoil and averted the infighting that may typically accompany company succession. Decide took over from Gorman on New 12 months’s day, with Gorman staying on as government chairman.

“I do not want to be CEO anymore,” Gorman informed the Financial Times. “I’ve loved it. I’ve loved all of it. I’ve done it for 14 years, that’s enough.”

Gorman is already adjusting to his new downsized position. As CEO, at the start of every yr, he would make a handwritten listing of his priorities for the 12 months forward. When requested throughout a Bloomberg interview earlier this week how that listing would possibly change now that he’s government chairman and had stepped away from overseeing Morgan Stanley’s day-to-day operations, Gorman replied: “I didn’t write it this year.”

Whereas now not a chief government, Gorman will proceed serving in high company posts along with his Morgan Stanley government chairmanship, having been named to Disney’s board. In that position, Gorman might help Disney with ultimately discovering a successor for its CEO, Bob Iger. Disney has struggled with doing so in recent times, resulting in Iger’s returning for a second time as CEO in November 2022 after his successor, Bob Chapek, faltered.

Gorman introduced his intention to step down in Could, saying he would accomplish that throughout the subsequent 12 months. In October, Morgan Stanley introduced that Decide, who was then co-president, would succeed Gorman at the start of this yr.

Throughout an nearly decade and a half tenure, Gorman turned Morgan Stanley into the envy of Wall Street. The financial institution weathered the uncertainty and public mistrust engendered by the 2008 monetary disaster, outgrew nearly all of its European opponents similar to Credit score Suisse, Barclays, and Deutsche Bank, and made a number of big-money acquisitions to diversify from its buying and selling and funding banking companies.

Since January 2010, when Gorman was appointed, Morgan Stanley’s inventory has greater than tripled from round $30, to $92.39 as of Thursday. The financial institution’s annual web revenues additionally soared from $16.4 billion in Gorman’s first yr to $53.7 billion in 2022, the final full yr of monetary data accessible.

In his Monetary Instances interview, Gorman rated his Morgan Stanley CEO tenure as an A–. Going increased can be “immodest,” whereas going any decrease can be “false modesty,” he informed the newspaper in December.

A lot of Morgan Stanley’s new progress may be attributed to Gorman’s early efforts to increase the financial institution’s wealth and asset administration enterprise, which have been beforehand afterthoughts to its main banking and buying and selling efforts. He nonetheless believes wealth and asset administration is essential to rising Morgan Stanley internationally.

“There are a lot of wealthy people in the world,” he mentioned within the Bloomberg interview.

As he mirrored on his time at Morgan Stanley, Gorman exuded confidence.

“It might sound immodest but I don’t think we made a lot of mistakes,” he informed Bloomberg.

But underneath his watch, Morgan Stanley needed to pay a number of giant fines following regulatory investigations. The most important got here in 2022 when the financial institution agreed to pay $200 million to U.S. regulators after a few of its staff engaged in improper file retaining after they mentioned trades outdoors of sanctioned communications channels. Only a month later the SEC fined Morgan Stanley once more as a part of a $35 million settlement for failing to correctly shield the information of 15 million prospects.

Moreover, Morgan Stanley lost $911 million when the household workplace of Archegos Capital Administration went underneath after it couldn’t cowl a collection of margin calls, which triggered a fireplace sale. Morgan Stanley, realizing Archegos was about to break down, needed to promote blocks of shares at a loss to mitigate the harm to its personal steadiness sheet. And like many traders, the financial institution has suffered a whole lot of thousands and thousands of {dollars} in losses on business actual property loans within the aftermath of the pandemic.

As a substitute, Gorman prefers to deal with the wins, citing the acquisitions that enabled the financial institution’s asset and wealth administration push. In February 2020, simply weeks earlier than the pandemic struck the U.S., Morgan Stanley purchased brokerage app E-Commerce for $13 billion. “I think they’re jealous,” Gorman mentioned of different Wall Road banks that missed out on the deal. Undaunted by the pandemic, Gorman continued his buying spree in October 2020, buying investment firm Eaton Vance for $7 billion.

“I felt back then that we had to act, and we had to act aggressively,” he mentioned of his early days as CEO and his turnaround plan. “And I knew that whatever we chose to do there would be critics. That didn’t bother me one little bit.”

Regardless of the raft of profitable enterprise selections Morgan Stanley did take some hits in Gorman’s 14 years within the job. Morgan Stanley lost about $911 million when the household workplace Archegos Capital Administration went underneath after it couldn’t cowl a collection of margin calls, which triggered a fireplace sale. And like many traders, it confronted some heavy losses in any of its workplace actual property property within the aftermath of the pandemic.