Zorica Nastasic/E+ via Getty Images

Intro

We wrote about Movado Group, Inc. (NYSE:MOV) on two occasions in 2020 as we awaited a long-term buying opportunity in the international watch distributor. The company attracted us at the time because of its ability to maintain profitability, its keen valuation (especially concerning its assets) & strong balance sheet boasting plenty of cash and minimal debt.

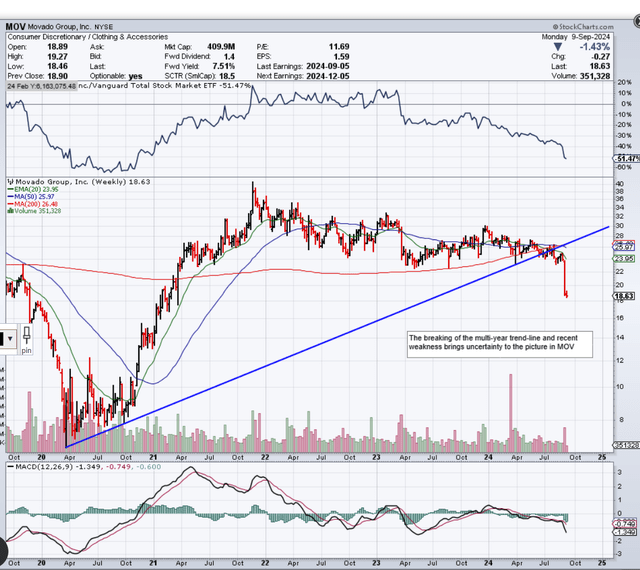

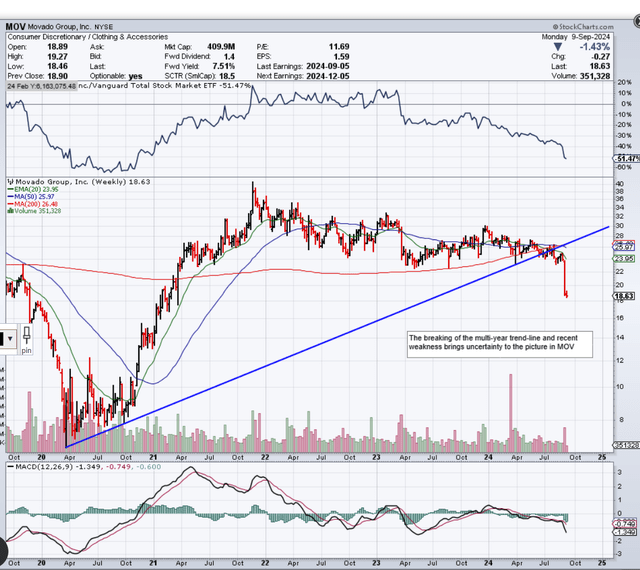

As we see from Movado’s intermediate chart below, shares began to accelerate to the upside in late 2020 which eventually resulted in shares surpassing $40 a share in late 2021. Investors who rode this trend in 2020 & 2021 made excellent gains but the performance of MOV has left a lot to be desired over the past 34 months or so since the cyclical top.

Furthermore, given the fact the dividend was reinstated in 2021 & has remained ever since may mean that investors have decided to ride out this current downtrend, all the while collecting generous distributions. For example, management decided to pay out $1 a share to qualifying shareholders in April of last year but this also did not stop the bleeding.

The worrying trend now from a technical standpoint is that shares have broken below the long-term ascending trend line. What essentially led up to this change in trend was negative growth & a poor outlook to boot. The company’s most recent second-quarter earnings numbers for fiscal 2025 (announced on the 5th of September this year) underscored the company’s worrying fundamentals in that the gross margin contraction & earnings miss led to a lowering of full-year guidance. Given the lack of underside technical support, it will be interesting to see where shares can finally bottom & begin consolidating once more.

Therefore, technicals aside, since MOV pays out an above-average dividend, let’s use a popular discount model to see if we can stamp an accurate valuation on this stock.

MOV Intermediate Technicals (Stockcharts.com)

Dividend Discount Model

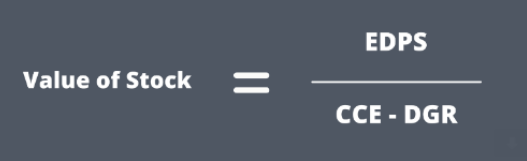

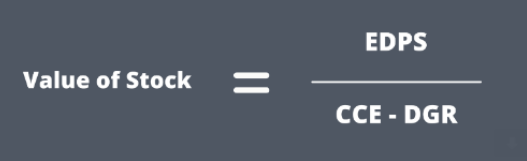

The formula we will be using is the following.

Dividend Discount Model (Wallstreetmojo.com)

EDPS is noted as ‘Expected Dividend Per Share’, CCE means ‘Cost Of Equity’ & DGR stands for ‘Dividend Growth Rate’. At present Movado’s forward yield comes in at $1.40 per share which corresponds to a dividend yield of approximately 7.5%. To calculate a sustained ‘Dividend Growth Rate’ in MOV, we first go to the GAAP dividend payout ratio to see if net earnings are covering the present payout.

Over the past four quarters, Movado has generated $36.1 million in GAAP earnings, of which $31 million was paid out in dividend distributions over the same time frame. This means the dividend is currently covered, although the payout ratio of 85.87% is well above average and leaves little room for investment from internally generated earnings.

To calculate our sustained ‘DGR’, we multiply the ‘retention ratio’ by the company’s return on equity. This makes sense as the retention ratio (14.13%) is the percentage of net profit which is essentially retained to grow the business whilst ROE (7.19%) is the reported return on the company’s equity which is in other words Movado’s net assets. Therefore, by multiplying ROE by the retention ratio, we get a ‘Dividend Growth Rate’ of 1.02%. Suffice it to say, given the subdued dividend growth rate, our forward-looking ‘EDPS’ comes in at a fractionally higher $1.43 per share.

Cost Of Equity

A company’s cost of equity is a popular metric used in financial modeling, as it denotes the rate of return shareholders expect from a respective investment. By discounting the current value of Movado’s profits, one can get a solid read on the ‘hurdle rate’ which must be overcome for solid investment to be made in the stock. As we see from the formula below,

Cost of equity = Risk-Free Rate + (Beta) x (Equity Risk Premium)

where we use the 10-year US treasury yield (3.7%) as the ‘risk-free rate’, 1.02 for ‘Beta’ & 4.6% for ‘Equity Risk Premium (4.6%). Equity Risk premium is denoted as the difference between the risk-free rate & the expected return in MOV. We use a third-party calculation for this specific number – Damodaran equity risk premium.

Therefore, MOV’s cost of equity = 3.7% + (1.02)(4.6%) = 8.39%.

A red flag here straight away is the fact that our calculated cost of equity (8.39%) comes in higher than Movado’s return on equity (7.19%). This means Movado is actually destroying shareholder value at present because the returns that are being made trail the returns demanded by the company’s equity investors.

Therefore, when we plug all of our values into our original formula above, we get Value of Movado = $1.43 / 0.0839 – 0.0102 = $19.40 a share.

Learnings

Considering the calculated valuation price above comes in approximately 4% above the prevailing share price of Movado, we recommend investors reflect on the following.

- Recent marketing investments (Concerning ambassadors & brand building efforts) have consequently impacted earnings. If sustained growth can come from these investments (which management believes so due to increased inventory), the valuation of MOV will increase as a result.

- Movado continues to trade off a sound base with shares trading under book value (P/B of 0.84), no debt & almost $200 million of cash on the balance sheet at the end of Q2.

- The technicals, however, are not pointing to a hard bottom any time soon and the margin of safety (4%) remains too small to risk capital at this stage.

Conclusion

To sum up, although Movado remains profitable & continues to run a sound balance sheet where book value continues to surpass the company’s market cap by some margin, near-term downside risk remains. Awaiting further developments. We look forward to continued coverage.