The logic of voluntary carbon credits has always been simple: Companies finance projects to avoid the release of carbon dioxide or remove it from the atmosphere, thereby offsetting the climate impact of their own emissions. Over time, this can help decarbonize hard-to-abate industries.

In practice, however, the voluntary carbon market has long suffered from a lack of transparency and verification. On close inspection, many projects turned out to be worthless, or even counterproductive, which raised concerns about “greenwashing.”

Recently, global leaders have started looking at carbon credits more favorably, for three big reasons. There is a growing realization that the world cannot achieve its climate goals without them. Carbon credits can help unlock climate finance and investment for developing countries, and thus deliver economic and social benefits that go well beyond reducing emissions. And now, we have the data, models, and technology to strengthen carbon-market integrity and provide the clarity that companies and investors demand.

As political and business leaders prepare for the United Nations COP29 climate summit in Azerbaijan, it is worth examining the potential of carbon credits in greater detail.

Limiting global temperature rises

Scientists believe the world must limit global temperature rise to 1.5 degrees Celsius above pre-industrial levels to prevent its most damaging effects. At the very least, they say, we must keep warming to 2 degrees Celsius.

Meeting those ambitions would require total greenhouse-gas emissions to fall below 2019 levels by 2030 either by 28% (to limit temperature rises to two degrees) or 42% (to limit the increase to 1.5 degrees), according to a new report from the UN Environment Program.

Today, even if all countries fully implemented their conditional national climate pledges under the Paris Agreement—which they are not on track to do—emissions would decline by only 10%.

Meanwhile, as of May 31, just 11% of listed companies were aligned with a 1.5-degree pathway—and more than 60% of listed companies were not even aligned with a two-degree pathway, based on their emissions trajectory, according to the MSCI Sustainability Institute’s Net-Zero Tracker.

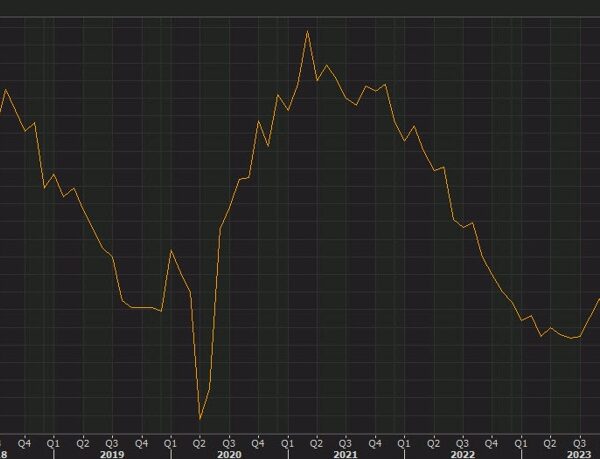

These numbers underscore the urgency of expanding the voluntary carbon market, which is currently valued at only $2 billion globally.

Skeptics have denounced carbon credits as a “license to pollute,” arguing that they allow companies to sidestep meaningful emissions reductions. That’s not true. In fact, companies that use material quantities of carbon credits are, on average, decarbonizing at twice the rate of companies that do not use carbon credits, according to our 2023 study of more than 4,000 global firms.

In other words, carbon credits are not discouraging serious climate action—they are incentivizing serious climate action.

Enlarging the voluntary carbon market could therefore help accelerate global progress, especially for high-emissions sectors that are otherwise difficult to decarbonize, such as heavy industry and transportation.

For perspective, MSCI Carbon Markets researchers have estimated that the world needs an additional $90 billion of investment in carbon-credit projects by 2030 to hit the 1.5-degree target.

Supporting an equitable transition

The quantity of investment is only part of the challenge. Rich countries must also support an equitable transition for the global South.

More than 2 billion people around the world still do not have access to clean cooking fuels, which is a major cause of deforestation, and more than 3 million people die every year from indoor air pollution caused by cooking smoke, according to the UN. In addition, 685 million people still do not have access to electricity.

Without much fanfare, carbon credit projects have helped mitigate these problems. Last year in Nairobi, for example, the Regional Voluntary Carbon Market Company hosted the biggest-ever carbon-credit auction, where more than 2 million metric tons of credits were sold to finance programs such as clean cooking in Kenya and Rwanda, along with clean energy in Egypt and South Africa.

This past May, more than 1,000 government and private-sector delegates met in Paris and committed a further $2.2 billion for clean-cooking projects in Africa and signed the Clean Cooking Declaration. However, they also stressed the importance of using only “high integrity” credits while addressing stubborn “quality concerns.”

Promoting carbon-market integrity

Verifying carbon credit integrity remains a difficult task, but we now have the tools to make it easier, including new methodologies, standards, and technologies for evaluating individual projects and confirming emissions reductions. By harnessing these tools, researchers can scrutinize carbon credit projects more rigorously, measuring their total climate, environmental, and socioeconomic impact and highlighting possible risks. They can also rely on a series of multilateral rules and guidelines, such as the G7 Principles of High Integrity Carbon Markets adopted in Japan last year. All of this can make carbon credits a more effective vehicle for reducing emissions and improving human welfare.

Despite persistent challenges, there is an emerging consensus that carbon credits are essential to reaching net-zero emissions. Strengthening the voluntary carbon market must be a top priority for global leaders at COP29 and beyond.

More must-read commentary published by Fortune:

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

A newsletter for the boldest, brightest leaders:

CEO Daily is your weekday morning dossier on the news, trends, and chatter business leaders need to know.

Sign up here.