MUFG are/were expecting a 15bp rate hike from the Bank of Japan this week.

But, in a note, they say that the lack of guidance from officials at the Bank is casting doubt on that call.

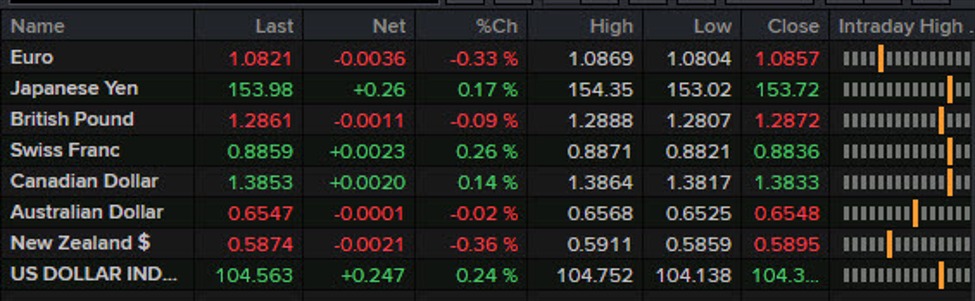

MUFG cite market expectations for a rate hike, and say that if a hike is not forthcoming the yen could fall again.

More ominously, for those looking for higher rates in Japan, MUFG add that if there is no rate hike this week then it could be December until there is another opportunity to hike, saying that the timing of any future rate rise would be complicated by

- September’s Japanese Liberal Democratic Party leadership election

- and November’s U.S. presidential election

- “As a result, the BOJ may not be in a position to hike again until December if they skip this week.”

—

The BoJ statement is due Wednesday, July 31, 2024.

Ueda speaks following the statement.