Ethiopian startup eQub is the winner of the fintech pitch-off at 4YFN 2024, Cell World Congress’ startup occasion. TechCrunch was on the bottom in Barcelona to satisfy its enterprise growth lead Nahom Michael this week.

The startup’s identify is an Amharic word referring to an area type of peer-to-peer credit score, Michael mentioned. An Equb is a gaggle of people that be a part of forces to save cash, which is then distributed on a rotating foundation.

Often called a rotating financial savings and credit score affiliation, or ROSCAS, this financing modality is frequent in lots of nations, particularly throughout Africa, the place it’s used each for private and for enterprise loans; but it surely has but to enter the digital age.

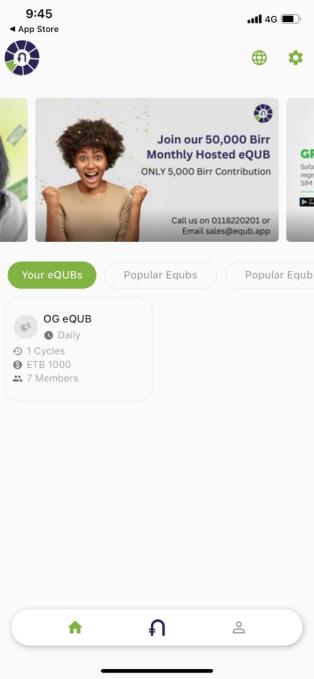

That’s the alternative that eQub desires to faucet. Beginning with an app, it targets customers among the many rising variety of Ethiopians who’ve financial institution accounts and cell phones, however restricted entry to credit score.

Making an Equb digital is an enchancment in itself: For eQub members with financial institution accounts, they will add cash with out having to go to an ATM. For eQub directors, it additionally means not having to cope with piles of money.

Comfort apart, eQub’s factors system can also be a means for customers to construct credit score historical past by exhibiting that they’re constant savers. In the long term, it might assist eQub broaden into BNPL, common loans and extra; however for now, it’s sticking to the unique ROSCAS mannequin: no collateral and no curiosity. As a substitute, it makes cash by charging a transaction price when cash will get taken out.

Within the traction slide of its pitch, Michael instructed the jury and viewers that the app had attracted some 25,000 customers since its launch, translating into 200 saving teams. He additionally confirmed TechCrunch that the app offers customers two choices: Both be a part of an present group, or be a part of a curated one generated by the startup.

Picture Credit: eQub

In each instances, eQub is taking measures to verify financial savings are safe. For self-managed teams, it does detailed KYC, which is already greater than conventional, offline Equbs. This is smart: these folks normally share private ties, which isn’t the case with curated eQubs.

However, Michael defined to TechCrunch by way of textual content, necessities “become rigorous” for such teams, “including Digital National ID, Employment letter or business license for proof of consistent income, 3 – 6 months bank statements, a digital agreement is also signed that allows us (eQub), to pursue legal action in case of such instances.”

Michael mentioned that the startup now has greater than 10 banking companions, an strategy that may additionally assist restrict dangers due to information sharing. There might be extra to come back: “recently, Michael said, “insurance companies have offered to create a special limited insurance policy for saving groups where defaults occur due to the death of an eQub member.”

As well as, the startup has 20 company companions as a part of its B2B2C technique: If workers of an organization already take part in Equbs, the app now offers the employer a method to make this digital.

Certainly one of its subsequent targets will probably be gig employees, a serious part of the workforce in sub-Saharan cities. eQub hopes to achieve 1 million of those customers by 2025. However whereas there’s built-in virality to the app, sooner development would require extra advertising and marketing, which is likely one of the the explanation why the corporate is in search of to lift a $500,000 pre-seed spherical. The visibility it obtained at MWC might assist it with this, but in addition with one other purpose: increasing into different nations within the close to future.