pixelfit

Funding Thesis

A various and well-structured dividend portfolio ought to characteristic several types of firms: encompassing firms with excessive dividend yields, firms recognized for constant dividend development, and development firms.

Dividend development firms are notably necessary since they will be just like the engine of your funding portfolio, making certain that you just enhance your dividend earnings to a big quantity year-over-year.

By means of the strategic choice of dividend development firms that pay sustainable dividends, you possibly can receive wonderful funding outcomes via the year-over-year dividend enhancements of the chosen firms, notably when committing to a long-term funding method.

In as we speak’s article, I’ve chosen 10 dividend development firms which might function key-drivers of your funding portfolio. Their potential lies in constantly elevating your annual dividend earnings at a horny development charge.

These dividend development firms don’t solely stand out for his or her robust dividend development charges, additionally they have a horny Valuation (9 from the ten chosen firms have a P/E [FWD] Ratio under 30). Along with that, the chosen firms have a comparatively low Payout Ratio (6 of the ten exhibit a Payout Ratio under 30%), suggesting potential for future dividend enhancements.

Furthermore, these firms have important aggressive benefits, a robust aggressive place inside their respective trade, a sturdy monetary well being, and a promising development trajectory for the foreseeable future.

First, I wish to clarify the choice course of for my high dividend development shares of the month of December. Since I’ve already defined this choice course of in a previous article, you possibly can skip the next description written in italics, in case you are already conversant in the choice course of.

First step of the Choice Course of: Evaluation of the Monetary Ratios

In a primary step, firms should meet the next necessities to be a part of a pre-selection amongst which I’ll choose the highest dividend development shares of the month:

- Market Capitalization > $10B [changed from $15B]

- Common Dividend Development Charge over the previous 5 Years > 5%

- Dividend Yield [FWD] > 0%

- P/E [FWD] Ratio < 50

- EBIT Margin [TTM] > 5% or Internet Revenue Margin [TTM] > 5%

- Return on Fairness > 5% [changed from 8%]

I think about these metrics talked about above necessary so as to show you how to to make effectively based funding choices and to extend the likelihood of constructing good funding choices.

A comparatively excessive Dividend Development Charge of greater than 5% over the previous 5 years ensures to extend the likelihood that the corporate will be capable to elevate its Dividend to a big quantity within the following years.

A P/E [FWD] Ratio of lower than 50 contributes to the truth that the expansion expectations which can be priced into the inventory value of the corporate you purpose to put money into usually are not terribly excessive. This helps you that you just run much less danger of the share value lowering considerably in a short-period of time in case that development expectations for the corporate usually are not met. This may contribute that can assist you to guard you from shedding a big sum of money in a brief time period.

An EBIT Margin or Internet Revenue Margin of greater than 5% and a Return of Fairness of greater than 5% [changed from 8%] assist to filter out firms which can be worthwhile.

Second Step of the Choice Course of: Evaluation of the Aggressive Benefits

In a second step, the businesses’ aggressive benefits (for instance: model picture, innovation, expertise, economies of scale, and so forth.) are analyzed so as to make a good narrower choice. I think about it to be notably necessary for firms to have robust aggressive benefits so as to stand in opposition to the competitors in the long run. Firms with out robust aggressive benefits have a better likelihood to go bankrupt at some point, representing a robust danger for traders to lose their invested cash.

Third Step of the Choice Course of: The Valuation of the Firms

Within the third step of the choice course of, I’ll dive deeper into the Valuation of the businesses.

With a purpose to conduct the Valuation technique of the businesses, I take advantage of totally different strategies and standards, for instance, the businesses’ present Valuation as based on my DCF Mannequin, the anticipated compound annual charge of return as based on my DCF Mannequin and/or a deeper evaluation of the businesses’ P/E [FWD] Ratio. These metrics ought to function a further filter to pick out solely firms that at present have a horny Valuation, serving to you to establish firms which can be at the least pretty valued.

The Fourth and Remaining Step of the Choice Course of: Diversification over Industries and International locations

In a fourth and final step of the choice course of, I’ve established the next guidelines for my high picks of the months choice: so as to show you how to to diversify your funding portfolio, a most of two firms needs to be from the identical trade. Along with that, there needs to be at the least one choose that’s from an organization that’s based mostly exterior of the US, serving as a further geographical diversification.

My Prime 10 Dividend Development Firms to Spend money on for December 2023

- Comcast (NASDAQ:CMCSA)

- PepsiCo (NASDAQ:PEP)

- The Toronto-Dominion Financial institution (NYSE:TD)(TSX:TD:CA)

- Restaurant Manufacturers Worldwide (NYSE:QSR)

- UnitedHealth Group (NYSE:UNH)

- BlackRock (NYSE:BLK)

- Apple (NASDAQ:AAPL)

- Microsoft (NASDAQ:MSFT)

- Visa (NYSE:V)

- Financial institution of America (NYSE:BAC)

Overview of the Chosen Dividend Development Shares to Spend money on for December 2023

|

BLK |

AAPL |

MSFT |

V |

BAC |

CMCSA |

PEP |

TD |

QSR |

UNH |

|

|

Firm Title |

BlackRock |

Apple |

Microsoft |

Visa |

Financial institution of America |

Comcast |

PepsiCo |

The Toronto-Dominion Financial institution |

Restaurant Manufacturers Worldwide |

UnitedHealth Group |

|

Sector |

Financials |

Data Know-how |

Data Know-how |

Financials |

Financials |

Communication Companies |

Shopper Staples |

Financials |

Shopper Discretionary |

Well being Care |

|

Trade |

Asset Administration and Custody Banks |

Know-how {Hardware}, Storage and Peripherals |

Methods Software program |

Transaction & Fee Processing Companies |

Diversified Banks |

Cable and Satellite tv for pc |

Gentle Drinks & Non-alcoholic Drinks |

Diversified Banks |

Eating places |

Managed Well being Care |

|

Market Cap |

112.53B |

2.95T |

2.74T |

510.98B |

243.90B |

173.40B |

235.30B |

108.78B |

32.54B |

507.12B |

|

Dividend Yield [FWD] |

2.64% |

0.51% |

0.81% |

0.82% |

3.11% |

2.69% |

2.99% |

4.95% |

3.01% |

1.37% |

|

Dividend Yield [TTM] |

2.63% |

0.50% |

0.76% |

0.73% |

2.99% |

2.65% |

2.92% |

4.68% |

2.99% |

1.33% |

|

Payout Ratio |

53.66% |

15.36% |

26.70% |

21.35% |

25.21% |

28.86% |

64.31% |

47.11% |

68.01% |

29.05% |

|

Dividend Development 3 Yr [CAGR] |

11.90% |

5.57% |

10.11% |

15.30% |

8.51% |

8.20% |

7.12% |

7.18% |

2.06% |

14.71% |

|

Dividend Development 5 Yr [CAGR] |

11.78% |

6.15% |

10.16% |

16.27% |

11.24% |

9.40% |

6.63% |

6.88% |

7.02% |

16.14% |

|

P/E [FWD] |

20.93 |

28.96 |

33.07 |

26.11 |

9.12 |

11.98 |

22.88 |

11.02 |

25.11 |

23.1 |

|

Internet Revenue Margin |

30.66% |

25.31% |

35.31% |

52.90% |

31.52% |

12.53% |

9.05% |

22.67% |

13.22% |

6.02% |

|

24M Beta |

1.52 |

1.24 |

1.14 |

0.97 |

1.14 |

0.79 |

0.48 |

0.91 |

0.59 |

0.45 |

Supply: Looking for Alpha

PepsiCo

PepsiCo was based in 1898 and at present employs 315,000 folks. Among the many firm’s aggressive benefits are its broadly diversified product portfolio, robust model picture, and massive Profitability (EBIT Margin [TTM] of 14.59% and Return on Frequent Fairness of 43.88%).

The corporate at present pays a Dividend Yield [FWD] of two.99%. What makes PepsiCo much more engaging for traders is its reasonable Payout Ratio of 64.31% and its 5 12 months Dividend Development Charge [CAGR] of 6.63%.

These metrics make the corporate engaging for dividend earnings and dividend development traders and I’m satisfied that PepsiCo may very well be a wonderful alternative for The Dividend Income Accelerator Portfolio. The corporate is on my watchlist and I plan so as to add it within the coming weeks.

PepsiCo’s attraction to traders is additional enhanced by its low 24M Beta Issue of 0.48, which demonstrates that it may show you how to cut back portfolio volatility.

PepsiCo at present has a P/E [FWD] Ratio of twenty-two.28, which is barely under its common over the previous 5 years (24.49), suggesting that the corporate is at the least pretty valued.

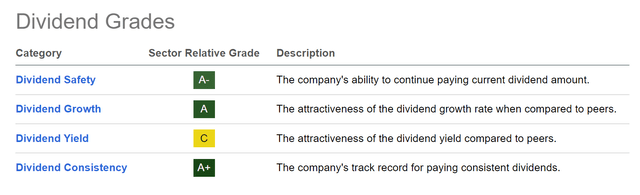

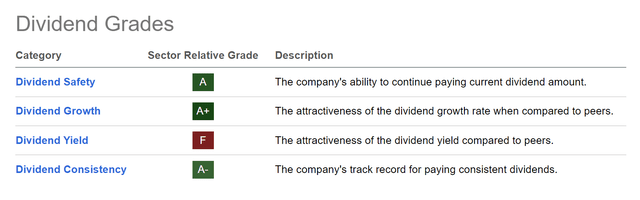

The Looking for Alpha Dividend Grades additional underline that PepsiCo is a wonderful match for each dividend earnings and dividend development traders. The corporate receives an A+ score for Dividend Consistency, an A for Dividend Development, and an A- for Dividend Security.

I consider that PepsiCo is the marginally extra engaging alternative for dividend development traders when in comparison with competitor Coca-Cola (NYSE:KO), on account of its broader product portfolio, larger dividend development charges (its 3 12 months Dividend Development Charge [CAGR] stands at 7.12%, whereas Coca-Cola’s is 3.91%), and its barely decrease Payout Ratio (64.31% in comparison with 68.68%), offering the corporate with extra potential to boost its dividend within the years to return.

Comcast

Comcast operates within the Cable and Satellite tv for pc Trade and was based in 1963.

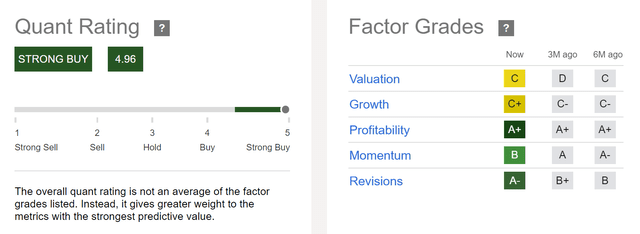

In response to the Looking for Alpha Quant Ranking, Comcast is at present a robust purchase. The corporate additionally has a horny score from the Looking for Alpha Issue Grades: rated with an A+ for Profitability, an A- for Revisions, and a B, for Momentum. For Development, the corporate receives a C+, and for Valuation, a C. These metrics have strengthened my perception to incorporate Comcast on this checklist of dividend development firms to contemplate investing in.

Along with the above, it may be highlighted that Comcast presently has a horny Valuation. Its P/E [FWD] Ratio of 11.57 stands 32.05% under its common from the previous 5 years, suggesting the corporate’s undervaluation.

Comcast’s present Dividend Yield [FWD] of two.79% and its 10 12 months Dividend Development Charge [CAGR] of 11.80% make it a wonderful choose for dividend development traders.

The Toronto-Dominion Financial institution

The Toronto-Dominion Financial institution is a Toronto, Canada, based mostly financial institution based again in 1855, and presently has a Market Capitalization of $108.37B.

The Canadian financial institution has proven a 3 12 months Dividend Development Charge [CAGR] of 6.02% and at present pays shareholders a Dividend Yield [FWD] of 4.99%.

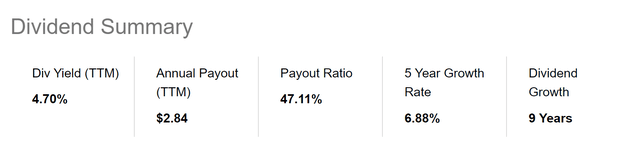

The metrics under additional underline the financial institution’s engaging dividend.

This combination of dividend earnings and dividend development demonstrates that the financial institution is an interesting choice for dividend earnings and dividend development traders. For a similar causes, the corporate is on my checklist for potential inclusion into The Dividend Revenue Accelerator Portfolio.

Presently, I think about the Toronto-Dominion Financial institution to be undervalued, underscored by the truth that its present P/E [FWD] Ratio of 10.94 stands barely under its common from the previous 5 years (11.60).

Restaurant Manufacturers Worldwide

Based in 1954, Restaurant Manufacturers Worldwide is a quick-service restaurant company based mostly in Canada.

I think about the corporate to be at present pretty valued, evinced by the corporate’s P/E [FWD] Ratio of 25.05, which is simply barely above its common from the previous 5 years (23.86).

The corporate’s present Dividend Yield [FWD] is 3.00% whereas it has proven a 5 12 months Dividend Development Charge [CAGR] of seven.02%, indicating that it combines dividend earnings and dividend development.

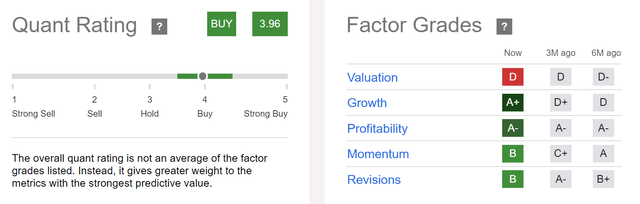

Restaurant Manufacturers Worldwide receives robust scores from the Looking for Alpha Quant Ranking and from the Looking for Alpha Issue Grades. In response to the Looking for Alpha Quant Ranking, Restaurant Manufacturers Worldwide is at present rated with a purchase. Regarding the Looking for Alpha Issue Grades, it may be highlighted that the corporate receives an A+ score for Development, an A- for Profitability, and a B for Momentum and Revisions.

When in comparison with competitor McDonald’s (NYSE:MCD), we are able to see that Restaurant Manufacturers Worldwide pays the marginally larger Dividend Yield [FWD] (3.01% in comparison with 2.33%). The corporate has additionally proven the marginally larger Income Development Charge [FWD] (8.70% in comparison with 5.28%).

Nonetheless, in the case of Profitability, I see McDonald’s as superior: the corporate’s EBIT Margin [TTM] stands at 46.02% (in comparison with Restaurant Manufacturers Worldwide’s 30.97%).

UnitedHealth Group

UnitedHealth Group operates as a diversified health care company. The corporate, which was based in 1977, has 400,000 staff and a present market capitalization of $508.27B.

I think about UnitedHealth Group as being at present undervalued. That is demonstrated by the corporate’s P/E [FWD] Ratio of 23.18, which is 14.76% under the Sector Median.

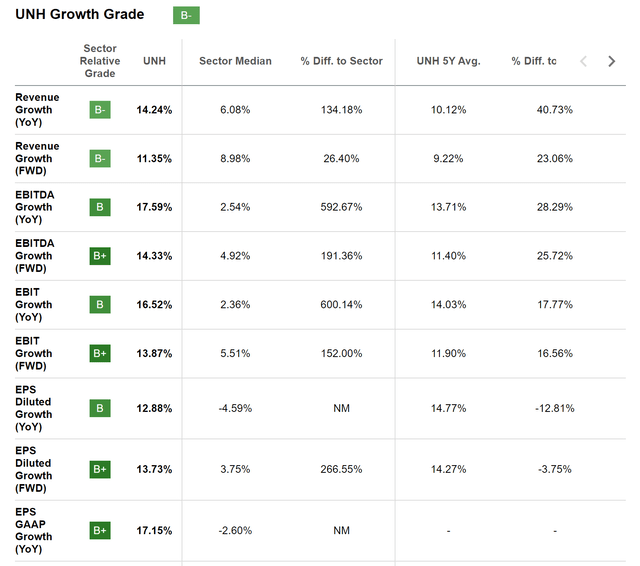

Completely different metrics point out that the corporate is especially engaging for these traders looking for dividend development: UnitedHealth Group pays a Dividend Yield [FWD] of 1.37%, has proven a Dividend Development Charge [CAGR] of 16.14% over the previous 5 years, and at present has a Payout Ratio of 29.05%, suggesting robust potential for future dividend enhancements.

I’ve additionally included the corporate into my watchlist for potential incorporation into The Dividend Revenue Accelerator Portfolio, since I consider it might align with its funding method.

The metrics under additional underline that the corporate is on observe in the case of development.

BlackRock

From my perspective, BlackRock, is a wonderful buy-and-hold-investment from which you’ll be able to profit enormously because of the firm’s engaging Dividend Yield (Dividend Yield [FWD] of two.67%) together with its Dividend Development Charges (10 12 months Dividend Development Charge [CAGR] of 11.52%).

The one motive I’ve nonetheless not added BlackRock to The Dividend Revenue Accelerator Portfolio is as a result of, via the funding in Schwab U.S. Dividend Fairness ETF (NYSEARCA:SCHD) (BlackRock at present represents 3.68% of this ETF), the portfolio is already invested within the firm.

My plan is to include BlackRock into the portfolio after attaining a broader diversification, making certain that the corporate’s share of the general portfolio doesn’t grow to be disproportionally excessive, thereby making certain a diminished company-specific focus danger for the portfolio. Over the long run, I plan to make use of BlackRock as a key firm to efficiently implement the funding method of The Dividend Revenue Accelerator Portfolio.

Presently, I consider that BlackRock is pretty valued, which is evinced by the corporate’s P/E [FWD] Ratio of 20.73, which is simply barely above its common from the previous 5 years (19.44).

Apple

Apple stays by far the biggest place of my private funding portfolio (at present representing 20.56% of the general portfolio) and the corporate is presently the second largest place of The Dividend Revenue Accelerator Portfolio, representing 5.07%. Inside The Dividend Revenue Accelerator Portfolio, Apple solely lies behind Financial institution of America, which accounts for five.26% of the general portfolio.

Apple’s Free Money Circulate Yield [TTM] at present stands at 3.27%, serving traders as an indicator of the corporate’s engaging danger/reward profile.

Apple’s Dividend Development Charge [CAGR] over the previous 10 years stands at 8.47%. That is a horny metric for dividend development traders notably when contemplating Apple’s low Payout Ratio of solely 15.36% together with its massive share buyback program, which additionally advantages shareholders.

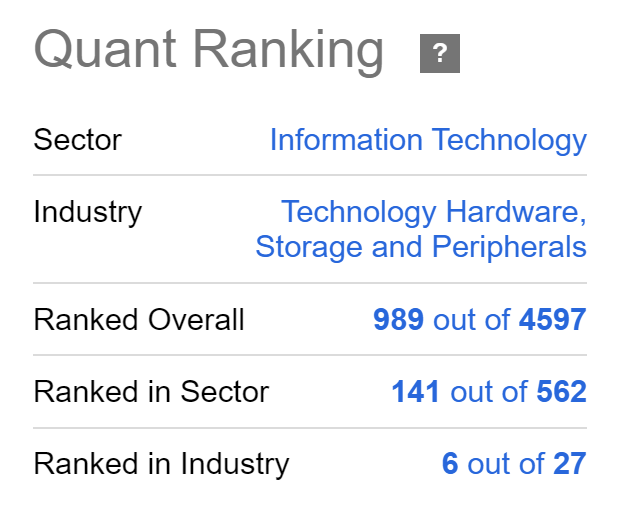

Contemplating the Looking for Alpha Quant Rating, Apple is at present at quantity 6 (out of 27) throughout the Know-how {Hardware}, Storage and Peripherals Trade, whereas it’s ranked 141st (out of 562) throughout the Data Know-how Sector.

Supply: Looking for Alpha

Financial institution of America

In a earlier article, I defined why I made a decision to include Financial institution of America into The Dividend Revenue Accelerator Portfolio, by which the U.S. financial institution at present represents the biggest place (5.26%):

Why I Chose Bank of America Over Competitors For The Dividend Income Accelerator Portfolio

The U.S. financial institution not solely has a horny Valuation (P/E [FWD] Ratio of 9.05, which stands 22.72% under its common from the previous 5 years), it’s also a horny alternative when it comes to Profitability (Aa1 credit standing from Moody’s and Internet Revenue Margin of 31.52%), and combines dividend earnings (Dividend Yield [FWD] of three.14%) with dividend development (5 12 months Dividend Development Charge [CAGR] of 11.24%). This metrics recommend that the financial institution is a perfect choose for dividend earnings and dividend development traders.

When in comparison with rivals equivalent to JPMorgan (NYSE:JPM) and Wells Fargo (NYSE:WFC), it may be highlighted that Financial institution of America has proven larger dividend development charges: whereas Financial institution of America’s 5 12 months Dividend Development Charge [CAGR] is 11.24%, JPMorgan’s is 10.31% and Wells Fargo’s is -4.54%, evidencing that Financial institution of America is a high choose in the case of dividend development.

Microsoft

I nonetheless haven’t included Microsoft into The Dividend Revenue Accelerator Portfolio, however the firm is on my watchlist for potential incorporation.

One of many foremost explanation why I nonetheless have not included the corporate is that I’ve beforehand prioritized firms that may pay larger Dividend Yields and that may moreover contribute to lowering portfolio volatility, thus making certain a diminished danger stage from the start on.

Within the coming weeks and months, nonetheless, I plan to include Microsoft into The Dividend Revenue Accelerator Portfolio.

Nonetheless, when doing so, I’ll make sure that the corporate’s proportion of the general portfolio won’t grow to be too excessive, on account of its barely elevated Valuation.

At the moment, Microsoft has a P/E [FWD] Ratio of 33.38, which stands 11.27% above its common from the previous 5 years (which is 30.00). Nonetheless, I nonetheless consider that the corporate just isn’t overvalued, notably on account of its robust development prospects. Microsoft has proven a Income Development Charge [FWD] of 11.75%, which is considerably above the one of many Sector Median (8.24%).

Microsoft’s 3 12 months Dividend Development Charge [CAGR] of 10.11% additional underscores my confidence that the corporate is a wonderful alternative for this checklist of dividend development firms to contemplate investing in.

Visa

I’m satisfied that Visa is without doubt one of the greatest dividend development firms that traders can select to put money into. This assertion is underlined by the truth that Visa is among the many largest positions of my private funding portfolio (presently representing 6.32%), and I’ve plans to include the corporate into The Dividend Revenue Accelerator Portfolio sooner or later.

Nonetheless, I plan to include Visa after attaining a broader diversification throughout sectors, because the Financials Sector presently represents by far the biggest sector of the portfolio, as I defined in better element in one among my earlier articles:

How To Build A High-Potential Dividend Portfolio Combining Dividend Income With Dividend Growth

Visa has some traits that make it such a horny alternative for dividend development traders: it has robust aggressive benefits, an infinite monetary well being (underscored by its Return on Fairness [TTM] of 48.34% and its EBITDA Margin [TTM] of 70.04%), a comparatively low Payout Ratio (21.35%), and it has spectacular metrics in the case of development and dividend development: its EPS Diluted Development [FWD] stands at 14.24% and its 5 12 months Dividend Development Charge [CAGR] is 16.27%.

Visa’s P/E [FWD] Ratio of 26.16 signifies that the corporate is at present undervalued, since it’s 18.61% under its common from the previous 5 years.

The Looking for Alpha Dividend Grades, which yow will discover under, underline that Visa is a wonderful alternative for dividend development traders, given the corporate’s A+ score for Dividend Development, A for Dividend Security, and A- for Dividend Consistency.

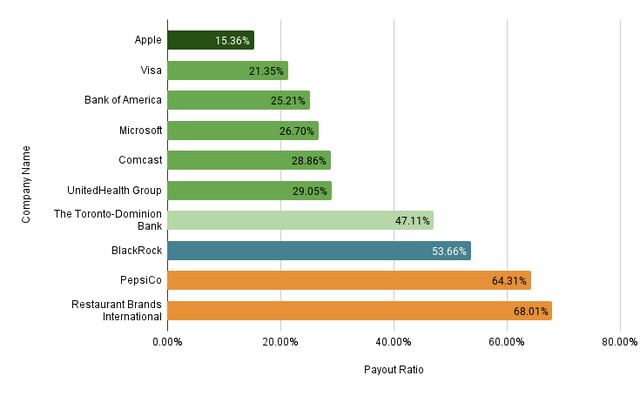

Overview of the Dividend Development Charges and Payout Ratios of The Chosen 10 Dividend Development Firms

Contemplating the ten firms I’ve offered in as we speak’s article, Visa has the best 3 12 months Dividend Development Charge [CAGR] (with 15.30%), adopted by UnitedHealth Group (14.71%), BlackRock (11.90%), and Microsoft (10.11%).

Supply: The Creator, information from Looking for Alpha![3 Year Dividend Growth Rate [CAGR]](https://static.seekingalpha.com/uploads/2023/12/8/55029283-17020465745056627.png)

![3 Year Dividend Growth Rate [CAGR]](https://static.seekingalpha.com/uploads/2023/12/8/55029283-17020465745056627.png)

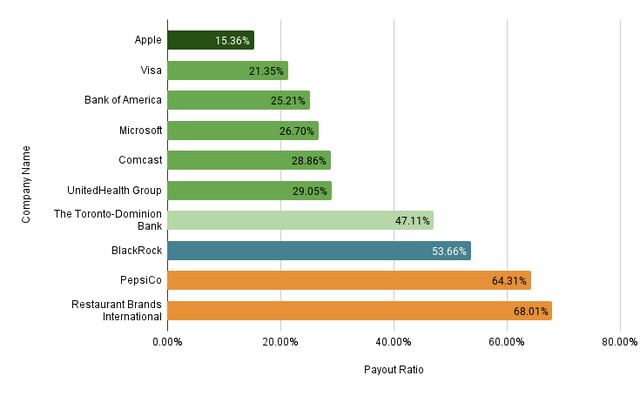

The chart under demonstrates that, out of the chosen firms, Apple has the bottom Payout Ratio (15.36%), adopted by Visa (21.35%), Financial institution of America (25.21%), Microsoft (26.70%), and Comcast (28.86%).

What makes Visa notably engaging for traders is its mixture of a excessive 3 12 months Dividend Development Charge [CAGR] (15.30%) with a low Payout Ratio (21.35%), indicating a robust potential for future dividend development. This underscores my suggestion to chubby Visa in a long-term funding portfolio with a deal with dividend development.

Supply: The Creator, information from Looking for Alpha

PepsiCo and Restaurant Manufacturers Worldwide, nonetheless, have a considerably decrease potential for future dividend development, which is indicated via their decrease 3 12 months Dividend Development Charges [CAGR] (7.12% and a couple of.06% respectively) and reasonable Payout Ratios (64.31% and 68.01% respectively).

Nonetheless, these two firms can considerably contribute to lowering the volatility of your funding portfolio, evidenced via their low 24M Beta Issue of 0.48 and 0.59 respectively. Because of this, they will also be necessary items of your funding portfolio.

Conclusion

To maximise the potential optimistic results of investing in dividend development firms, a long-term funding method is essential for traders.

The identification of firms with robust aggressive benefits is elementary. Solely these with robust aggressive benefits can stand out in opposition to opponents over the long run, making certain that you just profit from the total potential of dividend development firms.

In as we speak’s article, I’ve launched you to 10 dividend development firms which have proven robust outcomes when it comes to dividend development lately. Furthermore, they’ve a horny Valuation (9 of the ten chosen firms have a P/E [FWD] Ratio under 30), their development outlook within the foreseeable future is optimistic, and so they have important aggressive benefits, along with a robust monetary well being (6 of the ten chosen firms have a Internet Revenue Margin above 20%).

I consider that every of the offered firms can act like an engine of your funding portfolio, making certain that your further earnings will increase at a horny charge year-over-year.

An important technique for traders to maximise their advantages when investing is to incorporate each excessive dividend yield and dividend development firms of their portfolio. This method means that you can produce a direct earnings whereas additionally enhancing future earnings.

Creator’s notice: I’d admire listening to your opinion on this choice of dividend development firms. Do you personal any of those picks or plan to amass them? Are any of the chosen picks in your watch checklist? What are at present your favourite dividend development shares to contemplate in your funding portfolio?