Final

Friday, the Nasdaq Composite pulled again as a sizzling US PPI report

weighed in the marketplace. The truth is, the Treasury yields rose, and the speed cuts

expectations acquired trimmed some extra as fears of stickier inflation began to

creeping in. The Fed members although carry on dismissing the most recent figures as

one thing anticipated and proceed to repeat that the disinflationary development

stays intact. This implies that the Fed isn’t even contemplating fee hikes

and within the worst-case state of affairs might simply delay fee cuts. The market may

proceed to love this so long as the financial information stays good. At this time the

market can be closed for the Presidents Day and can resume buying and selling tomorrow.

Nasdaq Composite Technical

Evaluation – Each day Timeframe

Nasdaq Composite Each day

On the each day chart, we will see that the Nasdaq

Composite final Friday fell into the shut following a sizzling US PPI report. The

worth is now close to the important thing trendline so we

can count on a retest the place the consumers will look to purchase into the dip to place

for a rally into the all-time excessive. The sellers, then again, will need

to see the value breaking decrease to invalidate the bullish setup and place

for a drop into the 15150 support.

Nasdaq Composite Technical

Evaluation – 4 hour Timeframe

Nasdaq Composite 4 hour

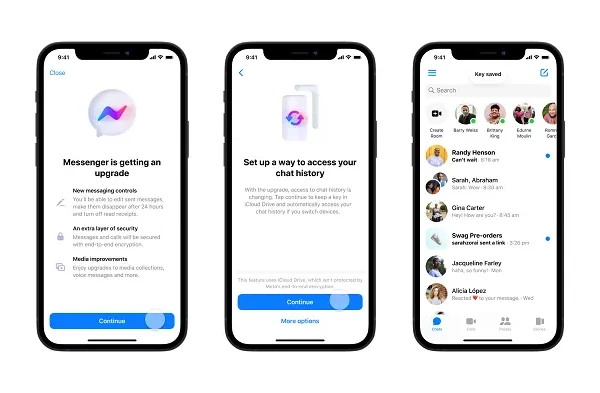

On the 4 hour chart, we will see that in addition to

the trendline we’ve additionally the confluence with

the 50% Fibonacci

retracement degree and the earlier resistance now

turned support. What occurs round this degree will

probably outline the place the market will go within the subsequent few weeks.

Nasdaq Composite Technical

Evaluation – 1 hour Timeframe

Nasdaq Composite 1 hour

On the 1 hour chart, we will see extra

carefully the current worth motion with the important thing assist zone across the trendline

marked by the inexperienced field. This offers us a fairly textbook buying and selling setup with the

consumers on the lookout for a bounce and a rally into the all-time excessive, and the sellers

on the lookout for a break and a drop into the following assist at 15150.

Upcoming

Occasions

This week is mainly empty on the info entrance with simply

the discharge of the FOMC Assembly Minutes on Wednesday adopted by the US Jobless

Claims and the US PMIs on Thursday.