Rates of interest have plateaued at ranges not seen in current historical past, which implies that startups and tech corporations are possible working in a enterprise local weather not seen lately: an elevated however steady rate of interest surroundings. This rise in rates of interest has primarily influenced the shift to a more difficult surroundings for startups over the previous 18 months, impacting the whole lot from VC/fundraising to top-line progress to day by day working prices. As we step into 2024, the query on everybody’s thoughts relating to rates of interest is, How will we plan for the long run? I like to recommend that corporations deal with three issues: (1) the return on funding (ROI) of innovation, (2) capital conservation, and (3) danger administration.

Return on funding

By way of emphasizing the ROI of innovation, progress continues to be paramount at tech corporations, however they should develop in a method that brings an ROI and finally yields money flows. Of their early years, most tech corporations are financed by enterprise capital, particularly designed to fund enterprises that lose cash initially, taking important dangers (and large losses) to finally notice outsize earnings.

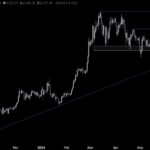

The rate of interest trajectory has been extra steady over the previous few months.

This affair continues to be true right now, and excessive progress is the first indicator of a younger firm’s capability to ultimately generate important future money flows. That is true in all rate of interest environments. Nonetheless, the nuance is that with larger charges, the worth of future money flows is discounted at the next price (value much less right now), so the relative worth of big outsized future returns versus present losses is extra muted.

The rate of interest trajectory has been extra steady over the previous few months. At this elevated however not astronomical stage, tech leaders ought to proceed to emphasise funding and tasks that can drive progress. Nonetheless, they need to accomplish that with extra visibility — and tighter timelines to appreciate the advantages. Particularly, this implies funding tasks (usually in product builds) with clear — at minimal — medium-term (six to 18 months) paths to growing income and/or decreasing prices.

This doesn’t imply ignoring tasks that affect solely person expertise; these are at all times related, nevertheless it means, for instance, being clear on how that person expertise enchancment will drive product engagement that, in flip, strikes a fascinating metric (which in flip possible impacts income or value). Explicitly state that metric motion and maintain the venture leaders accountable for it.