Sakorn Sukkasemsakorn

Risky assets are not a good investment to prepare for the recession but these periods may allow a good entry point in the mentioned asset class. If the US economy will avoid the recession, we have to exploit declining rates, which have historically been positive for the stock market and small-cap companies are amongst the best performers in these conditions.

I tend to avoid investing and valuing companies like Net Power(NYSE:NPWR), but I personally appreciate the business opportunities and concepts, see potential, and add it to my portfolio. I will start with a short excursus about the technology and market, continuing with the recent quarter results, to verify that by now everything is going as planned; and to come up with a valuation using the real options model.

The market and competitive advantage

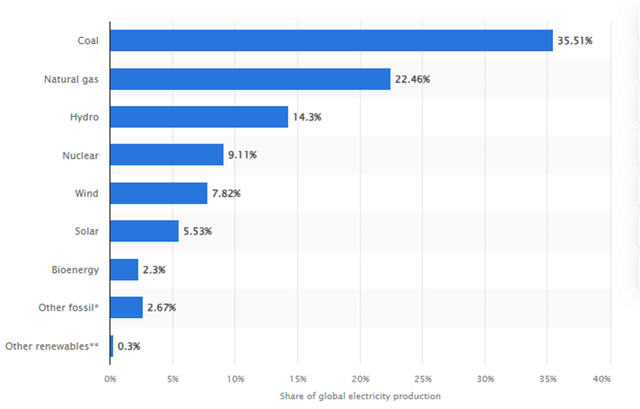

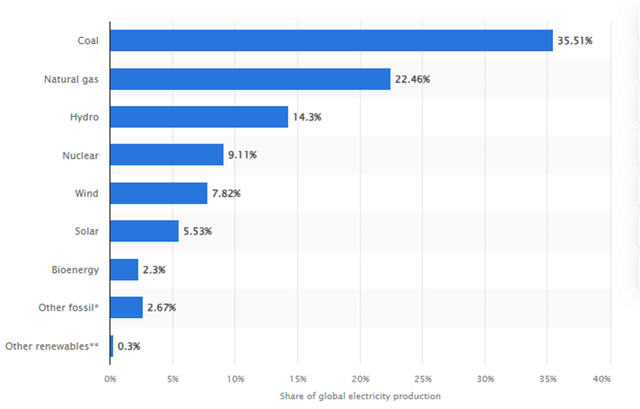

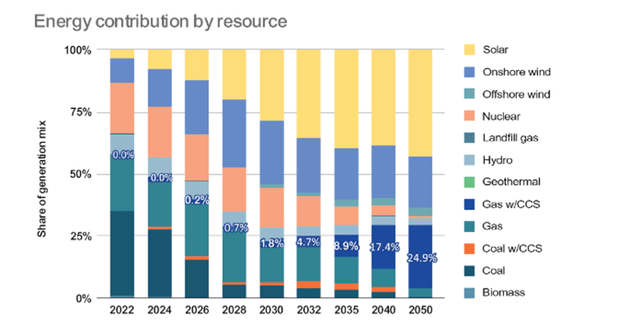

Share of Global electricity production (Statista)

Despite the increasing share of clean energy technology, thermal stations are prevailing in energy generation, with coal and natural gas plants having 2/3 of the market share. The efficiency of the stations increased in the coming years, but Natural Gas plants, for example, besides the energy, also produce a considerable amount of nitrogen oxides (NOx), while coal stations add also sulfur oxides (SOX), hydrargyrum and particulates that affect our health and environment. To fight this problem amongst others the Allam power cycle, named after the inventor and Nobel Peace Prize award winner Rodney John Allam, generates the electricity for fossil fuels with integrated carbon dioxide capture. To verify the theory, the Net Power 50MW demonstration plant was built where different parts were tested and all the statistical info was documented.

According to the research, comparing the Oxy-fuel cycles, the Allam cycle has the highest energetic efficiency (55.1%) and economic performance and relatively simple configuration, requiring a combustor and turbine. Moreover, the Cycle delivers power cleaner than post-combustion carbon capture form traditional gas power generation plants with lower LCOE.

The benefits of the Net Power Cycle:

- Clean: can capture CO2 at >97% rate and no NOx, SOx or particulate emissions to atmosphere;

- Reliable: targeted capacity factor of 92.5%;

- Low-Cost: $21-$40 $/MWh in the U.S.;

- Will utilize the existing infrastructure;

- Compact footprint: approximately 13 acres.

The company overview

NET Power was listed through merging with the Rice Acquisition Corp. II SPAC, beginning to trade in 2023 on NYSE. Usually, this doesn’t indicate a good investment, but this might be an exception. It is a new power plant that is working using the Allam-Fetvedt Power Cycle, which allows for significantly reducing CO2 emissions (almost to 0) and increases the efficiency of the power plant. Its goal is to give birth to low-cost “clean” and reliable electricity using a patented highly recuperative oxy-combustion process, combining two technologies:

• Oxy-combustion, a clean heat generation process in which fuel is mixed with oxygen such that the resulting byproducts from combustion consist of only water and pure CO2; and

• Supercritical CO2 power cycle, a closed or semi-closed loop process which replaces the air or steam used in most power cycles with recirculating CO2 at high pressure, as sCO2, producing power by expanding sCO2 continuously through a turbo expander.

The company already had a positive experience with its test power plant, achieving technology validation and now is in preparation to launch its first utility-scale plant anywhere between the second part of 2027 and first half of 2028.

The Company`s Business

Net Power business will be licensing its technology offering different plant designs form 25MW to industrial units of 300MW. Most of the parts have a patent (around 424) with long-term expiration. The first-generation utility-scale plant should demonstrate the working theory and targeting to capture around 97% of CO2

The first-generation must confirm its reliability in order to increase efficiency (stated by the cycle) to switch for Gen2.

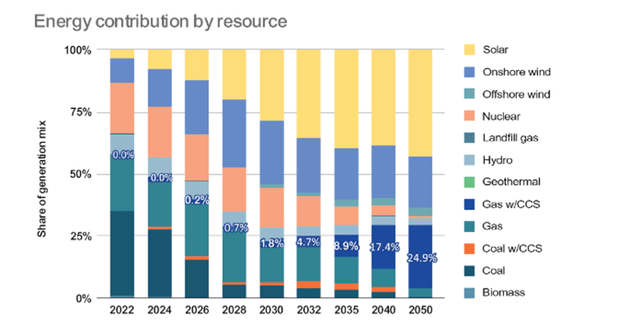

It is expected that by 2050 Net Power would supply -25% of total electricity demand and would be the preferred source of clean firm capacity.

Energy contribution by sources (DeSolve)

The recent quarter results

|

Year |

2.2024 |

1.2024 |

4.2023 |

3.2023 |

|

Cash and Cash equivalents |

405.15 |

428.60 |

536.90 |

545.20 |

|

Short-term investments |

100.00 |

100.00 |

100.00 |

100.00 |

|

Short-term Investments in securities, available-for-sale |

74.22 |

69.19 |

||

|

Long-term investments in securities available-for-sale |

27.43 |

27.79 |

||

|

Total |

606.80 |

625.58 |

636.90 |

645.20 |

|

EBITDA |

-24.81 |

-18.73 |

-22.20 |

-35.40 |

|

EBITDA monthly |

-8.27 |

-6.24 |

-7.40 |

-11.80 |

|

Cash runway (only cash and cash equivalents) |

49.00 |

68.66 |

72.55 |

46.20 |

|

Cash runway (Cash+short term investments in securities) |

70.06 |

95.77 |

86.07 |

54.68 |

|

Cash runway (Cash+ long and short-term investments in securities) |

73.38 |

100.22 |

86.07 |

54.68 |

In mln. of USD except cash runway numbers

Source: The author`s calculations using the company`s quarterly statements and SeekingAlpha data

Cash burn continued to rise with the cash and cash equivalents only runway equal to 49 months, but it maybe still enough taking into consideration that the company needs around 3 years to finish the plant. It has to be mentioned that the calculations do not include the interest income that company receives from the securities investing activities. If we will take into account long-term and short-term investments in available-for-sale securities, the cash runway is the further 70 months.

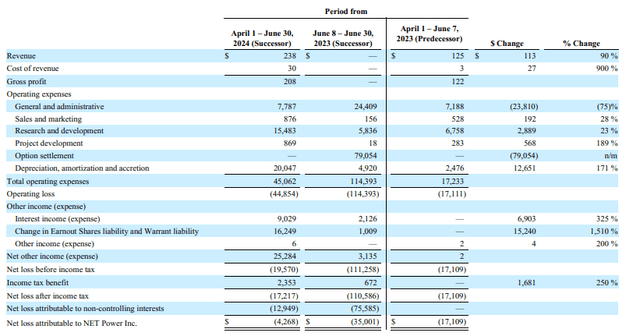

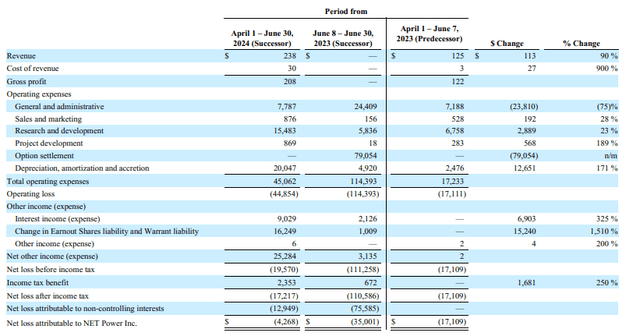

NPWR Income statements comparison (SEC filings)

The revenues increased by 90%, for the three latest months, this was due to sales in test data at the NPWR Demonstration Plant. The decrease in General and Administrative expenses is due to a higher base attributable to the Business Combination. The number of employees is increasing, resulting in higher marketing and sales costs. Project development expenses, as expected, increased as the company made further steps for the development of a utility-scale plant. The company is on track to commence testing.

Criticism of the cycle and risks

Besides some compliments, there is a criticism of the cycle. The first question that arose in my mind during the reading was CO2 sequestration, which is not an easy process requiring storage (with unknown long-term outcomes) and additional costs.

The second question is about the economics of the 300MW plant, which is not clear, and the quoted sentence from the SEC report “We believe that our current sources of liquidity on hand should be sufficient to fund our general corporate operating expenses as we work to commercialize our technology, but certain costs are not reasonably estimable at this time and we may require additional funding” doesn’t give a confidence as well.

Warrant holders and costs that will be paid by the company’s shares are posing risks for the dilution.

Lack of information concerning the test facility, with the growing rumors that even 50MW were never produced and problems with the turbine.

The patent will expire in 2030, close to the commercial date, which may allow competitors to enter and decrease the amount and value of the company’s license fees. The next risky part is components, the combustor and turbine have to be first of a kind which increases the risk of failures and may increase the time when the plant will be ready.

Valuation method

For the first time, I decided to use the real options method. It helps to value the project that doesn’t bring money yet but allows us to bring it in the future by exploiting the patent. The model allows input time frames, costs, and the future outcome for the company holding exclusivity in the product. This cash flows are valued as a call option contract with the Strike price equal to initial investments, Standard deviation equal to the industry SD 19.88%, project life of 4 years (as the plant is expected to be ready in 2028) and risk-free rate of 4% (US Treasury Yield). The outcome cash flow is calculated using the company’s presentations and a discount rate of 10% (suggested by the company in its PV calculations). The initial investments are extrapolated from the 50 MW plant ($140 mln).

Valuation results

| Stock Price= | 2605 | Risk-free rate= | 4% | |

| Strike Price= | 840 | Variance= | 0.03992 | |

| Expiration (in years) = | 4 | |||

| d1 = | 0.929995 | |||

| N(d1) = | 0.823813 | |||

| d2 = | 0.530395 | |||

| N(d2) = | 0.702081 | |||

| Value of the patent = | 287 | |||

| Value of Common Equity | 1017.5 | |||

| Number of shares outstanding | 72.6 | |||

| Price per share | $ 14.02 |

In mln. of USD except per share number

Valuation risks

The valuation is very sensitive to risk-free rate and time horizon and ability to achieve the required cash flow.

Cash flows were simulated using the forecasts from the presentations of the company and research from DeSolve LLC and REPEAT, any deviation may negatively or positively affect the valuation, despite the fact that I tried to use a pessimistic scenario.

The variance is the industry average for the past 3 years. The conditions of the option should be closely watched from time to time to adjust the valuation.

Due to the lack of information, initial investments were concluded from 50MW, the real costs may be lower or higher, affecting the valuation. The advantages of tax credit 45Q are not taken into consideration, this will further have a favorable effect on valuation.

Conclusion

Taking into consideration the current price (around $8 at the time of writing) and valuation calculations, there is a 69% upside potential, this allows me to assign a “Buy” rating, but not a “Strong Buy”, due to many questions and complexities that the company and shareholders will face as the company is on beginning to commercialization but the prospects seem to be bright if everything will happen as planned. If the steps will be confirming the company’s presentation the valuation is far beyond the stated price target. The last thing I have to mention is that it doesn’t mean that one has to enter with a noticeable share of the portfolio, manage your risks. The company has a long way to go to prove the technology and working model.