Henrik Sorensen

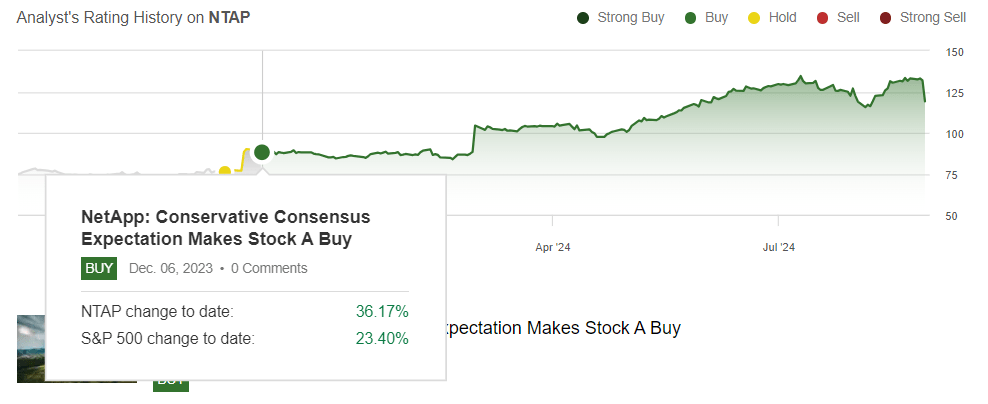

We’re downgrading NetApp (NASDAQ:NTAP) to a hold as we think the positives from the memory/storage recovery have been priced into the stock, with the stock valued near historical highs. We last upgraded NTAP to a buy when the stock was trading at $91 per share last December; now, the stock is trading at $120 and reached a high of ~$135. We think our positive thesis of NAND flash strength and demand recovery played out, driving NTAP’s outperformance over the past three quarters. Over the past four quarters, NTAP has beaten EPS estimates three times, and revenue estimates four times at the same time that memory prices recovered in 1H24, confirming our belief that the positives from the demand-supply regaining balance and price recovery have been priced into the stock. We downgraded Micron (MU) earlier this month, and now NTAP follows.

Seeking Alpha

We’re recommending investors reduce exposure to memory/storage names in the back end of the year, as we believe the memory/storage recovery has been priced into the peer group. Trend Force actually reported in late June that “NAND Flash prices saw a robust rebound as manufacturers kept production in check during the first half, helping them regain profitability.” This statement is later followed by, “However, with a noticeable ramp-up in production and sluggish retail demand, wafer spot prices have dropped significantly. Some wafer prices are now over 20% below contract prices, casting doubts on the sustainability of future price hikes.” We’re more conservative on NTAP in 2H24, as we don’t see any clear near-term catalysts for end-demand recovery. Hence, we see a limited upside surprise from NTAP.

1Q25 Review & 2Q25 Preview

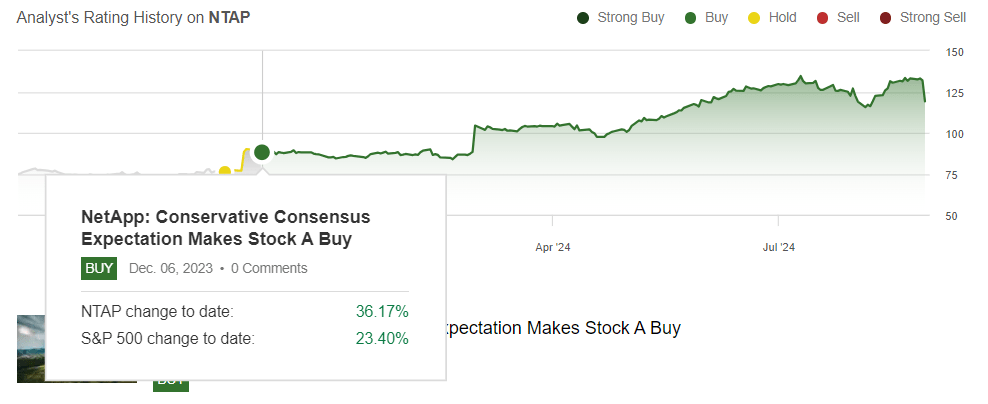

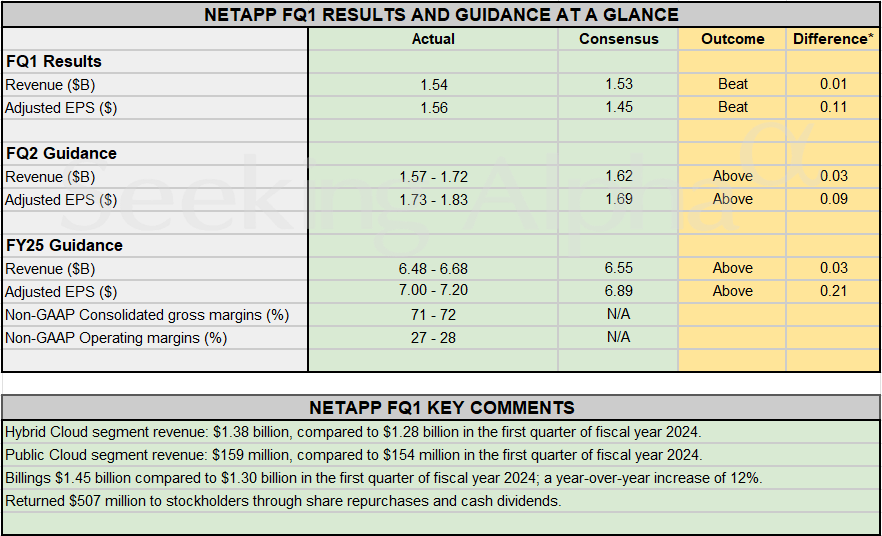

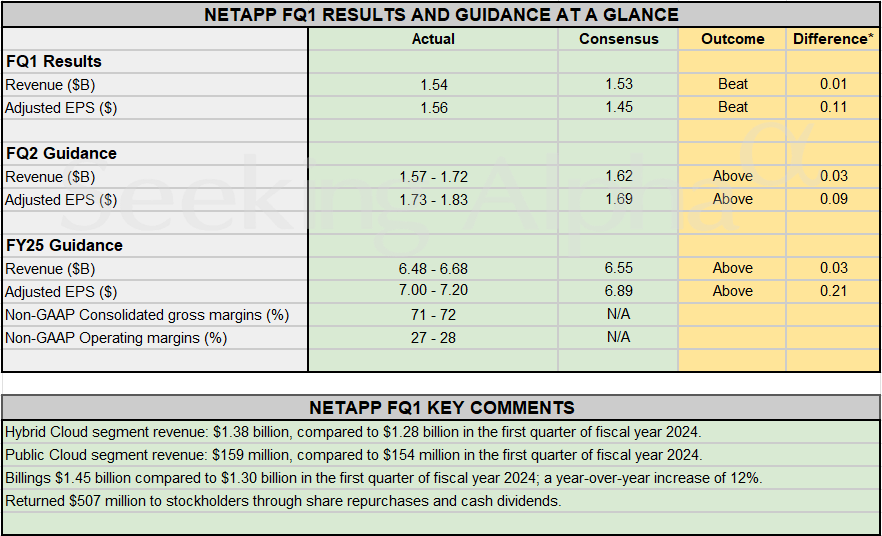

NTAP’s business is that it “provides a wide range of storage-related products and services for storing and managing data both on-premises and in the cloud,” with major exposure to the Flash market. The company reported its first quarter of FY2025 earlier this week, announcing revenue of $1.54B, slightly beating consensus at $1.53 and adjusted EPS of $1.56 versus consensus of $1.45. Management now guides for revenue of $1.57B to $1.72B in Q2, compared to a consensus of $1.62B. Investors didn’t react too well to the results in spite of management increasing FY revenue and profit guide to the range of $6.48B-$6.68B for FY25 revenue, compared to a consensus of $6.55B. Net revenue came in at $1.54B for the quarter, ahead of $1.43B in a year ago quarter, representing an 8% Y/Y increase, and billings were up 11.5% Y/Y to $1.45B but noticeably down from $1.8B in 4Q24.

For the quarter, NTAP reported hybrid cloud revenue of $1.38B and public cloud revenue of $159M, both up Y/Y but with the former down Q/Q from $1.5B last quarter. The focus is really on the all-flash ARR, which was up 21% Y/Y to 3.4B but down from $3.6B a quarter prior in spite of the introduction of the “new AFF A-series family of high-performance all-flash arrays” used on GenAI workloads. The company is maintaining strong margins near all-time highs, with 1Q25 consolidated gross margins coming in at 72%, and is guiding for Q2 consolidated gross margin to be 71% to 72%. We emphasize management’s outlook on the stock because we think it’ll help determine whether the company outperforms or does not, depending on how high expectations are. Our previous positive sentiment on NTAP played out so well partially because of the conservative outlook for the company; now we’re seeing an opposite scenario where expectations are higher, but the likelihood of an end-demand environment that can support the outperformance is lower.

The following chart outlines NTAP’s results and guidance from 1QFY25.

Seeking Alpha

Additionally, NTAP derives a little over half of its total revenue by geography from the Americas, making it more sustainable in the U.S. end-demand environment. We think it’ll be at least three quarters after the Fed’s potential interest rate cut that we’ll see a healthier end-demand environment materialize.

Valuation & Word on Wall Street

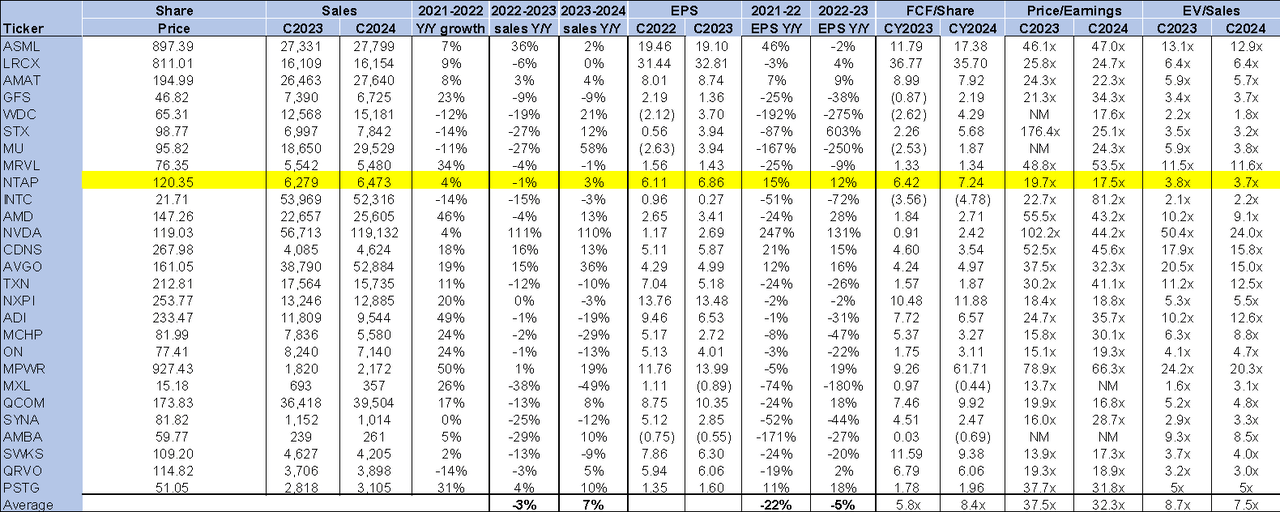

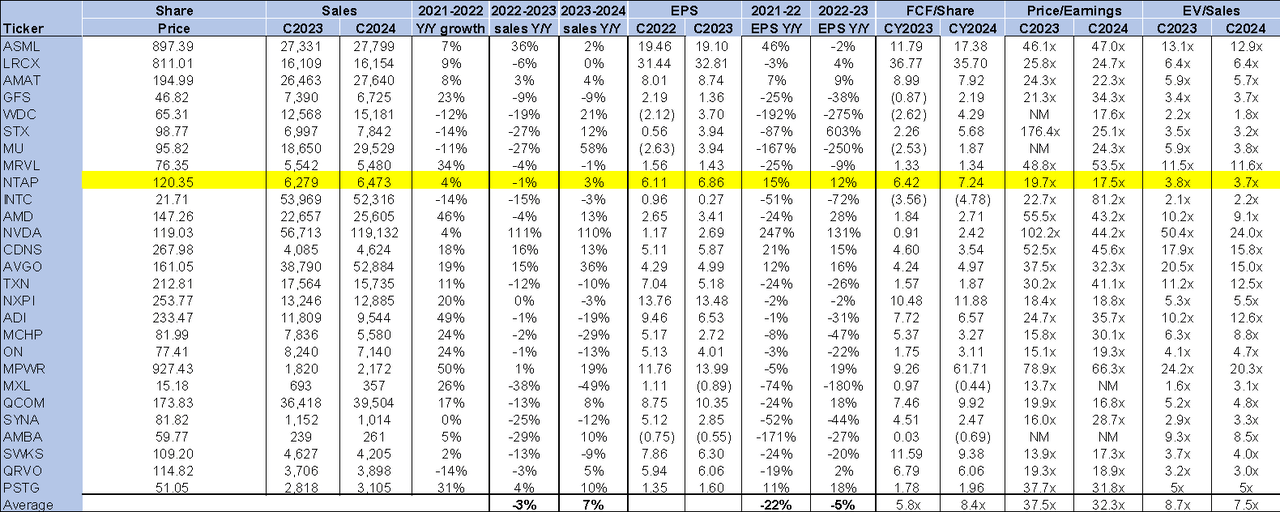

NTAP is relatively cheap compared to the peer group. On a P/E basis, the stock is trading at 17.5x C2024, compared to a peer group average of 32.2x and a ratio of 15.3x when we last wrote on the stock in December. The EV/Sales ratio is more similar to that of NTAP trading at 3.7x C2024 versus a group average of 7.5x and a previous ratio of 3.0. We don’t think this valuation is a bargain for the stock’s near-term risks. We recommend investors stay on the sidelines because we don’t see the stock outperforming the S&P 500 in the second half of the year.

The following chart outlines NTAP’s valuation against the peer group average.

TechStockPros

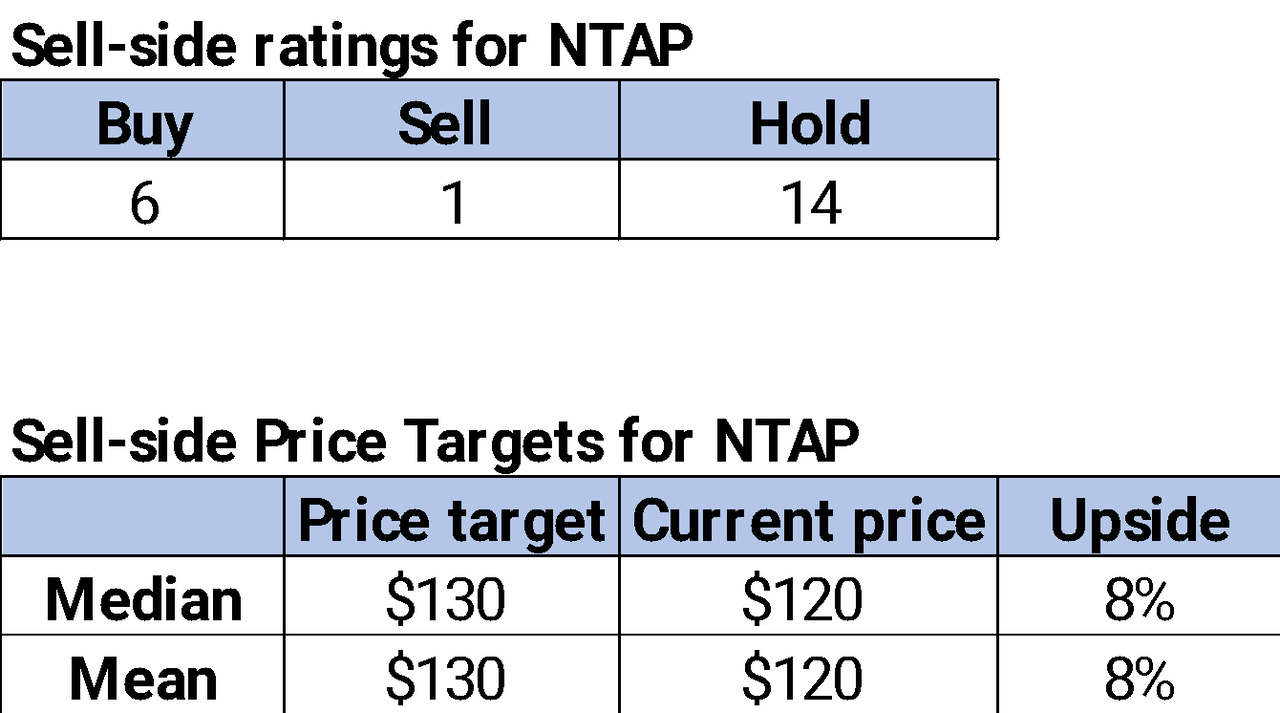

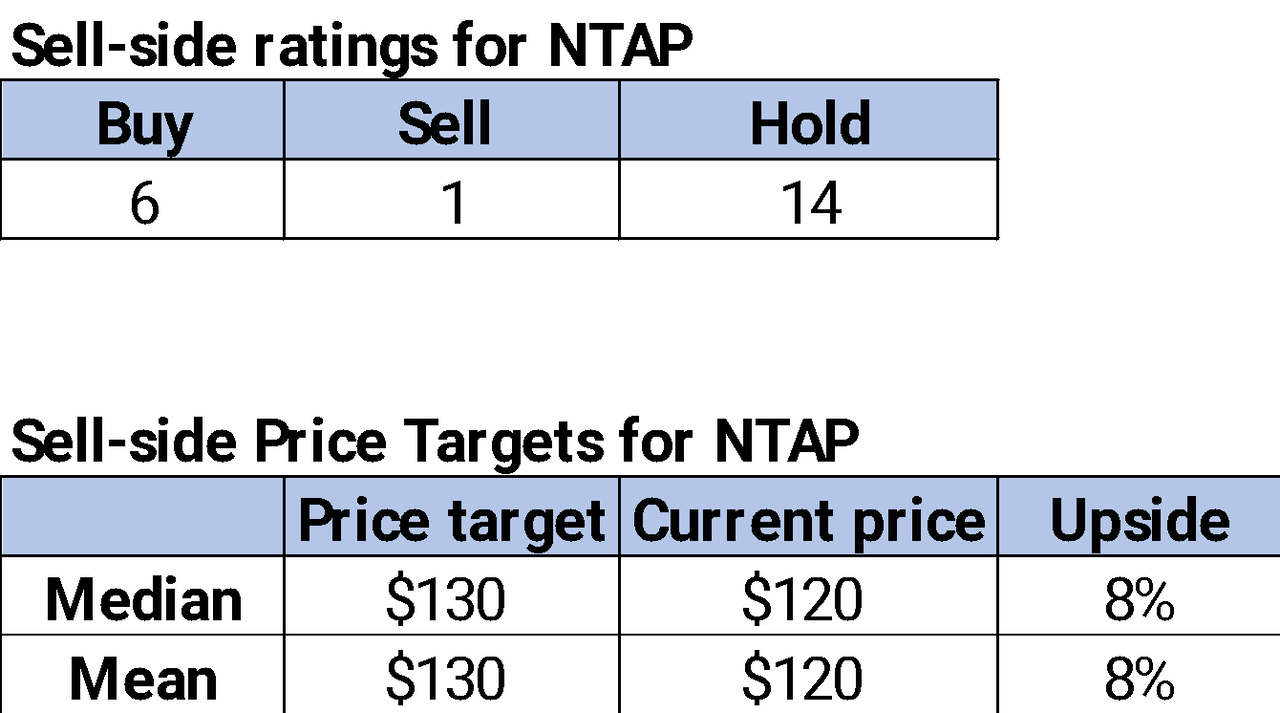

Wall Street shares our more cautious sentiment on NTAP. Of the 21 analysts covering the stock, six are buy-rated, 14 are hold-rated, and the remaining one is sell-rated; interestingly, this is the exact same as it was at the time of our December note. Turning to the sell-side price targets, the stock is priced at $120 per share, with a median and mean price target of $130 for a potential 8% upside.

The following chart outlines sell-side ratings and price targets on the stock.

TechStockPros

What to do with the stock?

We expect NTAP to have a limited near-term upside and hence recommend that investors stay on the sidelines into 2QFY25. We think the stock will be an in-line performer. We believe that what management referred to on the call as the “rate of innovation in the software applications that drive AI” remains intact, the AI TAM opportunity is growing, and NTAP’s all-flash portfolio is well positioned within it. Our concern is about a lack of a near-term catalyst to support outperformance in 2H24, considering the positives of the recovery got priced in, recognized by the raised outlook and stock price over the past three quarters. We recommend investors stay on the sidelines until we see a turnaround in spot prices, which may happen towards mid-2025 as industry revenue from NAND flash is expected to grow 29% in 2025, reviving capex and cost pressure. We’ll change the stock back to a buy once we see the price data points to support the next leg of outperformance.