Richard Drury

We previously covered Netflix, Inc. (NASDAQ:NFLX) (NEOE:NFLX:CA) in April 2024, discussing why it remained a Buy after the market’s over-reaction to the new subscriber reporting standard and the overall tech market declines nearing the Q1’24 earnings season.

Despite the maturing streaming business, the company’s inherent profitability and robust shareholder returns continued to demonstrate its long-term investment thesis, with market leaders rarely coming cheap.

Since then, NFLX has already recorded an excellent return of +9.6%, outperforming the wider market at +8.5%.

Even so, we are reiterating our Buy rating here, thanks to the recent pullback arising from the supposed FQ3’24 guidance miss, since the bottom-line expansion continues to imply robust advertising monetization efforts.

With the market trends still promising and NFLX continuing to grow its streaming market share, we maintain our belief that market leaders may never come cheap after all.

NFLX’s Investment Thesis Looks Even More Compelling Upon Its Successful Ad Monetization

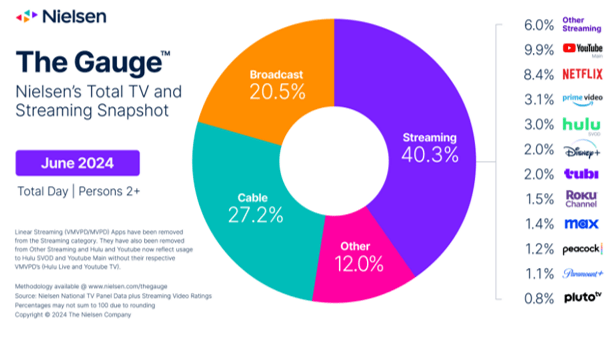

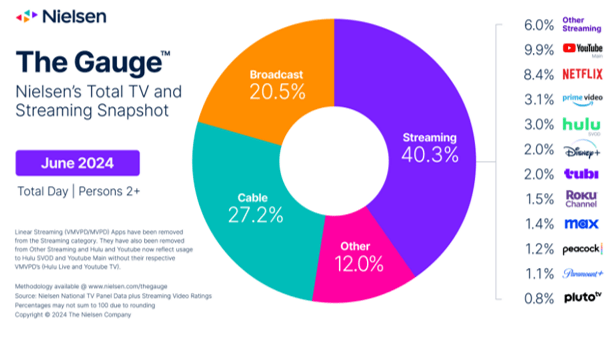

Shift In TV Viewing

Nielsen

As of June 2024, NFLX continues to gain in streaming share to 8.4% (+0.8 points MoM/ +0.2 YoY), up from the 8.1% reported in the last article in March 2024).

Combined with the growing overall streaming share of 40.3% (+1.5 points MoM/ +2.6 YoY), it is apparent that the secular transition from TV Media to streaming is still ongoing.

This also explains why NFLX continues to report double beat FQ2’24 earnings call, along with growing global streaming paid memberships to 277.65M (+8.05M QoQ/ +39.26M YoY) significantly aided by the stable overall ARPU of $11.47 (-1% QoQ/ inline YoY).

At the same time, we believe that the market’s over-reaction to the supposedly softer FQ3’24 revenue guidance of $9.73B (+1.7% QoQ/ +13.9% YoY) and adj EPS guidance of $5.10 (+4.5% QoQ/ +36.7% YoY) have been unwarranted indeed.

This is especially since NFLX’s bottom-line numbers continue to imply excellent advertising-tier monetization, as highlighted by the management in the recent FQ2’24 earnings call (highlighted in bold for clarity):

Just over 18 months since launch, we continue to scale our ads tier, which now accounts for over 45% of all signups in our ads markets. Its attractiveness ($6.99 a month in the US, with two streams, high definition and downloads) — coupled with the phasing out of our Basic plan in the UK and Canada, which we will now start in the US and France — has increased our ads member base by 34% sequentially in Q2. (Netflix)

At the same time, NFLX continues to hike their FY2024 revenue guidance to +14.5% YoY growth and operating margin guidance to 26% (+5 points YoY), partly attributed to improved FX rates, higher than the original guidance of +14% YoY/ 22.5% (+1.5 points YoY) offered in the FQ4’23 earnings call.

It is apparent from these numbers that the advertising market trend remains robust with NFLX continuing to gain advertising dollar share, with the ROKU management also hinting that they expect advertising revenue growth to continue improving on a QoQ and YoY basis.

The same has been highlighted by multiple streaming giants, with Alphabet (GOOG) highlighting that “YouTube ads revenues were up 21% year-on-year” in Q1’24, with Disney (DIS) also reporting a pretty healthy advertising market.

With the secular trend still robust, we believe that NFLX has executed brilliantly, especially since the management is looking to test its new and improved in-house ad tech platform in Canada in H2’24 with a global launch expected in 2025.

Combined with its promising results thus far and the projected expansion in its advertising partners over the next few quarters, we believe that the streaming giant remains well positioned to “achieve critical ad subscriber scale” with “advertising likely to be a key component of its longer-term revenue and profit growth.”

These factors continue to validate our conclusion in our previous article, in which the NFLX management recognizes that its next growth opportunity lies in the advertising market.

This is attributed to the maturing subscriber growth and the recent removal of Basic ad-free subscription tier plan at $11.99, which in our opinion, replaced with the ad-supported tier plan at $6.99 – with it offering greater economy for subscribers and improved growth opportunities for the streaming company.

At the same time, NFLX has attempted to enter the sports streaming/ comedy live segments while appealing to other target audiences, attributed to the recent/ projected launch of:

- The Roast of Tom Brady in May 2024,

- the Jake Paul and Mike Tyson boxing match in November 2024,

- the weekly WWE programming from 2025 onwards, and

- Christmas Day NFL games in 2024,

implying the management’s determination to grow its subscriber base beyond its existing numbers, while tapping into the booming sports streaming market.

Therefore, for so long as the company records consistent top/ bottom line growth ahead, we believe that it continues to offer a compelling investment thesis

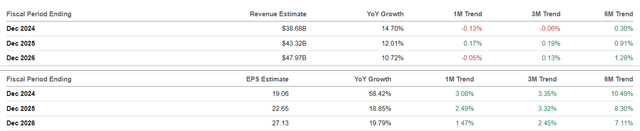

The Consensus Forward Estimates

The same has been observed in the raised consensus forward estimates, with NFLX expected to generate a top/ bottom-line growth at a CAGR of +12.5%/ +31.1% through FY2026.

This is compared to the previous estimates of +12%/ +28.2%, while building upon the historical expansion of +21.1%/ +60.9% between FY2016 and FY2023, respectively.

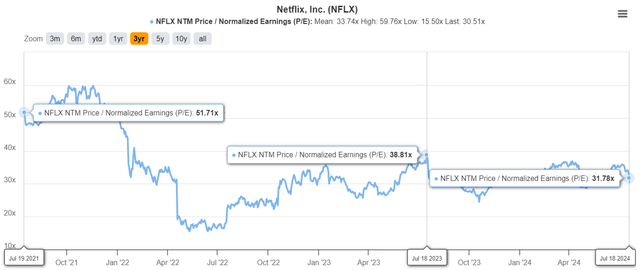

NFLX Valuations

The raised profitable growth estimates are also why we believe that NFLX remains cheap at FWD P/E valuations of 31.78x, compared to its 1Y mean of 32.03x and the 5Y average of 44.03x.

Even when compared to its streaming giant peers, such as Alphabet’s YouTube at FWD P/E valuations of 23.70x with the projected adj EPS growth at a CAGR of +19.4% through FY2026, Amazon’s Prime (AMZN) at 40.30x/ +37.4%, Disney’s Disney+ at 20.28x/ +17.6%, it is apparent that NFLX remains cheaply valued for its accelerated growth projections.

So, Is NFLX Stock A Buy, Sell, or Hold?

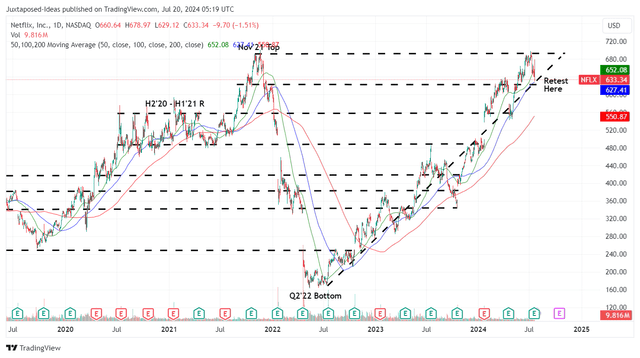

NFLX 5Y Stock Price

For now, NFLX has charted an extremely satisfying upward rally from the Q2’23 bottom, with the stock currently retesting the previous November 2021 trading ranges.

For context, we had offered a fair value estimate of $458 in our last article, based on the LTM adj EPS of $14.41 (+54.9% sequentially) and the 1Y P/E mean of 31.79x. This is on top of the long-term price target of $834.10, based on the consensus FY2026 adj EPS to $26.24.

For now, based on the higher LTM adj EPS of $16.00 (+70.3% sequentially) and the same P/E mean of ~31x, it is apparent that NFLX continues to trade higher than our raised fair value estimates of $496.

Even so, there remains an excellent upside potential of +32.7% to our raised long-term price target of $841, based on the consensus’ raised FY2026 adj EPS estimates of $27.13 (+3.3%), significantly aided by the recent pullback over the market’s over reaction to the supposedly softer FQ3’24 guidance.

Despite the lower Free Cash Flow generation attributed to the intensified content investments, the management continues to return value to its long-term shareholders with 11.84M or 2.6% of its float already retired over the LTM.

As a result of the still attractive risk/ reward ratio, we continue to reiterate NFLX as a Buy.

Based on the stock’s historical trading pattern, we believe that the Q2’24 bottom of $620s may hold, with a breach from current levels unlikely – barring any drastic events.

As a result, we believe that interested investors may still add at current levels, since the streaming market leader is unlikely to ever come cheap, or fairly valued in this case.