simpson33

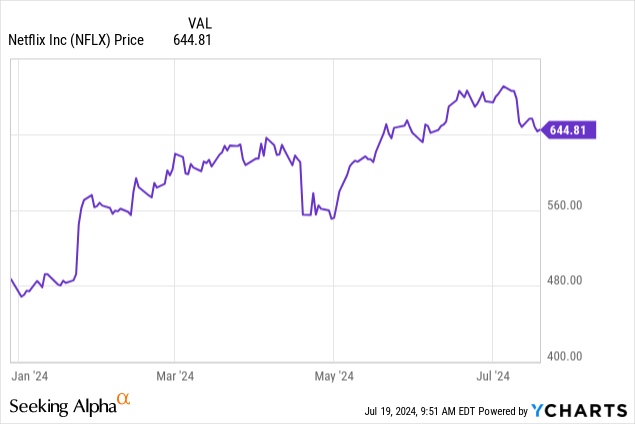

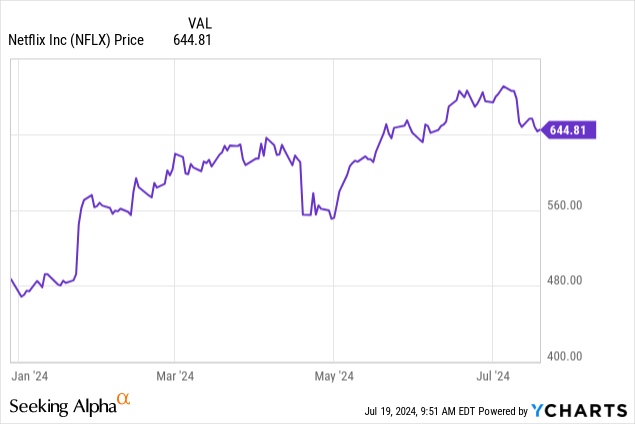

Barely a few months ago, investors were fretting over Netflix’s (NASDAQ:NFLX) (NEOE:NFLX:CA) decision to stop subscriber reporting. Today, the stock is sitting near YTD highs as the market might be wondering if subscriber counts truly matter when Netflix’s revenue and margins continue to see massive improvements quarter over quarter.

Not only are growth metrics accelerating, but Netflix also continues to gain additional market share: both against other streamers as well as against all U.S. TV streaming (now at 8.4% of U.S. TV time, versus 8.1% last quarter). The company’s recent Q2 results were the fifth straight quarter of acceleration, driven both by pricing gains and successful subscriber adds. It’s a great time, in my view, for investors to re-assess the bull case in Netflix.

I last wrote a bullish opinion on Netflix in April, as the stock was still digesting the post-Q1 earnings news (which showed tremendous results, but also came with the shocking news to stop subscriber count reporting). Since then, the company has continued to see accelerating growth, while its recent decision to sunset the $11.99 basic ad-free plan in the US and the UK may fuel additional upward shift in consumer pricing. With this in mind, I remain quite bullish on Netflix’s prospects throughout the remainder of the year.

Several core catalysts here are worth mentioning. First: Netflix is tremendously broadening its addressable market by putting more firepower behind its ad-based plans. The company notes that advertising memberships grew a stunning 34% quarter-over-quarter in Q2. The company notes as well that in markets where ad-supported plans are available, nearly half of new signups are signing up for ad-based plans. While it’s certainly possible that ad-based plans are down-selling some full subscribers into cheaper plans, I’m of the view that the cheaper $6.99/month options increases Netflix’s overall subscriber pool and revenue base, helping the company to compete with in the legion of streaming wars as all of Netflix’s major competitors now also have similarly-priced, ad-based plans. I’d argue as well that the company’s decision to eliminate its cheaper $11.99 price tier increases price gap between ad-free and ad-supported memberships, and makes the latter’s user base more likely to be incremental adds. And it’s not just about appealing to new subscribers either: the company has been improving its appeal to advertisers, working with ratings measurement firms like Lucid and Kantar to help encourage more Netflix ad spending.

The second tailwind is content diversification. We’ve already talked about how Netflix has continued to expand its original programming overseas, supercharging new subscriber sign-ups beyond the United States. But the company is also expanding into televising live experiences, with the addition of a Jake Paul vs. Mike Tyson boxing match being featured later this year. More and more live content like this will continue to give Netflix an edge over its competition, some of whom have sports offerings of their own. Netflix is also bolstering its offering in gaming, tying in some of its popular original titles like Squid Game into video game formats.

To me, here are the other core pieces of the bullish thesis for Netflix:

- Global powerhouse in streaming with something for everyone. Netflix’s content slate is arguably the most diverse and most broadly appealing across all of its competitors. The company has gone global with its original content programming, and for Netflix titles to win Emmy and Oscars honors is no longer out of the norm.

- Password sharing crackdown and price increases didn’t produce the deep churn that many bears were expecting. We’re still getting subscriber counts through FY25, and even though Netflix cracked down on password sharing last year, the company is still growing global memberships across all markets, producing double-digit revenue growth. This is also despite price increases across Netflix’s most common plans.

- Tremendously profitable. Netflix may spend a lot on content, But the company’s near-30% operating margins speak to a business that has achieved significant operating leverage on its content and technology outlays.

Especially with revenue growth continuing to accelerate, Netflix’s stock will only continue to rise.

Q2 download

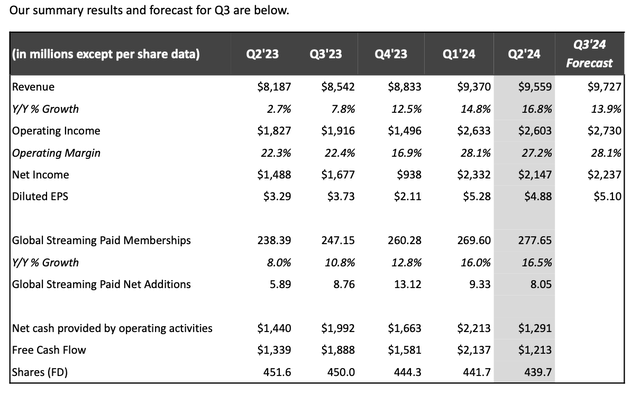

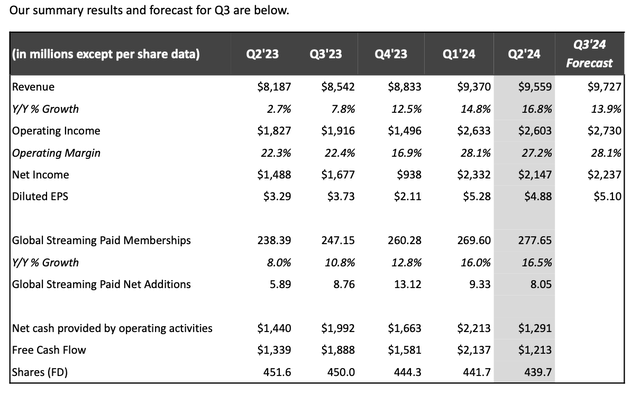

Let’s now go through Netflix’s latest quarterly results in greater detail. The Q2 earnings highlights are shown below:

Netflix Q2 results (Netflix Q2 shareholder letter)

The company’s Q2 revenue clocked in at $9.56 billion, growing 16.8% y/y and accelerating over Q1’s growth rate by a full 200bps. And as can be seen above, subscriber growth is still quite healthy, clocking in at 8.05 million net adds (fairly evenly distributed across geographic regions: 1.45 million in the U.S. and Canada, 2.24 million in EMEA, 1.53 million in Latin America, and 2.83 million in Asia Pacific). Notably, net adds were up 37% y/y despite higher pricing.

Subscriber strength was driven by the popularity of Netflix’s slate. The second quarter brought the long-awaited third season of Netflix’s Bridgerton series which delivered nearly 100 million views. The company had several big international hits as well, with British show Baby Reindeer getting 88 million views, popular in both England and India.

It’s worth noting as well that foreign currency continues to be a large headwind for Netflix, despite starting an FX hedging program earlier this year. On a constant-currency basis, revenue growth in Q2 would have been 21% y/y, weighed down primarily by the sharp devaluation of the Argentine peso. Note that for Q3, Netflix is guiding to 13.9% y/y growth on an as-reported basis, but on an FX neutral basis it’s expecting 19% y/y growth: stronger than this quarter’s reported growth rates. Management also boosted its full-year FY24 outlook to a range of 14-15%, up one point on the low end from a prior view of 13-15%.

The company isn’t shirking its profitability obligations, either. Operating margins improved 490bps y/y to 27.2%, and Netflix is still calling for further improvement in Q3 to 28.1% (+570bps y/y).

Valuation and key takeaways

The biggest risk to Netflix as a stock, in my view, is valuation: as the company’s YTD rally has rendered the stock on the expensive side against forward-looking estimates. Wall Street is currently pegging FY25 EPS at $20.45 for the company, representing 21% y/y growth versus current-year EPS estimates of $16.85.

So at current share prices near $645, Netflix trades at 32x FY25 P/E. Now, considering the company grew EPS at an 48% clip in its most recent quarter (and is guiding to 37% EPS growth in Q3, wherein Netflix typically has a tendency to beat the initial forecast). But in my view, Netflix’s premium valuation – no matter how deserved or in-line with other mega-cap growth tech – will be an eyesore for the stock if the broader market turns south, which I think is a big risk with the S&P 500 hovering around 5,600.

All in all, however, I view Netflix as a multi-year horizon investment. The company’s gains in streaming share are a testament to the prowess of its content slate, and financially Netflix has never looked healthier with both accelerating revenue and operating margin gains. Stay long here.