To this point, issues have escalated over using cryptocurrency by sanctioned teams and terrorist organizations, as revealed within the newest “2024 Crypto Crime Report” by main blockchain analytics firm Chainalysis.

The report unveiled that over $24.2 billion of illegal crypto transactions occurred in 2023, with a good portion linked to entities topic to “sanctions or involved in terrorist activities.”

The Position Of Sanctioned Entities And Terrorist Organizations

In keeping with the report, regardless of a lower in general illicit transaction volume in comparison with earlier years, there was a considerable improve within the proportion of funds attributed to sanctioned or terrorist-linked recipients.

Roughly 61.5% of complete illicit transaction quantity in 2023 was related to these entities, underscoring the regarding development.

The report disclosed that sanctioned entities, together with North Korean hacking teams and US-designated terrorist organizations like Hezbollah, proceed to leverage digital foreign money for fundraising functions. Andrew Fierman, head of sanctions technique at Chainalysis added:

Actors topic to sanctions are sometimes minimize off from worldwide conventional monetary methods, and crypto can turn out to be an tried different mechanism to retailer, ship, and obtain funds.

Organizations just like the crypto “mixer” Twister Money and Garantex emerged as important recipients of illicit funds all through 2023, regardless of dealing with sanctions from regulatory our bodies.

In the meantime, based on the report, sanctions have demonstrated efficacy in curbing the circulate of digital foreign money funds, with notable reductions noticed following their imposition.

In regards to the challenges posed by illicit digital foreign money exercise, the report disclosed that efforts to hint and seize these funds have turn out to be more and more “sophisticated.”

Fierman famous:

The clear nature of cryptocurrency mixed with blockchain analytics offers a useful forensic software that empowers governments to determine, hint, and disrupt the circulate of funds – one thing that isn’t attainable with different types of worth switch, particularly money.

Regardless, terrorist organizations persist of their makes an attempt to use digital foreign money for fundraising, deploying intricate networks of exchanges and repair suppliers to obscure their actions.

A Recap Of 2023’s Crypto Safety Challenges

In keeping with a current report from De.FI, a Web3 safety agency overseeing the REKT database, 2023 proved to be a pivotal 12 months within the cryptocurrency realm, with hackers orchestrating heists totaling approximately $2 billion.

This sum of losses, accrued throughout numerous incidents, underscores persistent vulnerabilities inside the decentralized finance (DeFi) panorama. Supporting this evaluation, TRM Labs reported that by mid-December 2023, digital foreign money thefts had amounted to $1.7 billion, marking a lower from the earlier 12 months.

Noteworthy breaches focused platforms akin to Atomic Pockets, BonqDAO, Multichain, and Poloniex, exacerbating the challenges confronting the trade.

Past these particular person incidents, Chainalysis additionally underscored the broader susceptibility of the cryptocurrency sector to cyberattacks, shedding mild on the “overarching” safety issues inside the trade.

In the meantime, aside from cyberattacks, digital foreign money have additionally been implicated in different illicit actions such because the sale of unlawful merchandise. In a separate incident, the workplace of the US Lawyer, led by Philip R. Sellinger, pursued a “civil forfeiture action” aimed at reclaiming $54 million in cryptocurrency.

This substantial quantity is straight related to a bootleg narcotics distribution community working on the darknet, based in New Jersey.

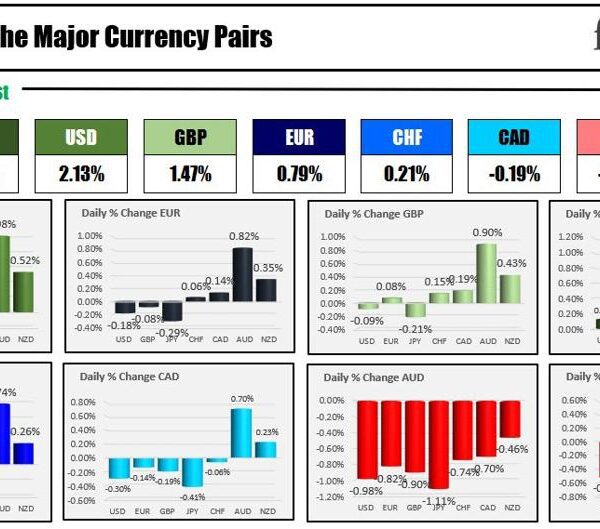

Featured picture from Unsplash, Chart from TradingView