Because the authorized debate continues over whether or not gross sales of cryptocurrencies represent securities, all eyes have been on a courtroom case involving a Coinbase worker sharing insider data along with his brother and a buddy. Whereas the primary defendant, former Coinbase worker Ishan Wahi, and his brother have reached settlements with each the Division of Justice and the Securities and Exchange Commission, the buddy—Sameer Ramani—stays at massive.

On Friday, a federal decide within the Western District Courtroom of Washington issued a ruling within the case in opposition to Ramani. The ruling, which agreed partially to the SEC’s request for a default judgment, may have severe implications for each Ramani and the broader crypto business.

Within the determination, Choose Tana Lin dominated that the case fell beneath the SEC’s jurisdiction as a result of the crypto belongings at challenge had been securities, although they had been traded on Coinbase, a secondary market. As courts grapple with the query of when crypto belongings are securities, the choice is the strongest determination but by a federal decide to help Chair Gary Gensler’s argument that the overwhelming majority of the business’s exercise falls beneath its remit.

Howey and its discontents

For the reason that rise of cryptocurrencies like Bitcoin and Ether, regulators have wrestled with easy methods to classify digital belongings. Ought to they fall beneath the class of securities like bonds and shares, or commodities like gold and wheat?

At present, the one cryptocurrency with regulatory readability is Bitcoin, which the Commodity Futures Buying and selling Fee declared to be a commodity in 2015. Different belongings have remained in a grey zone. In consequence, when exchanges like Coinbase provide cryptocurrencies for buying and selling, they’ve operated beneath authorized danger, regardless of declaring their perception that crypto belongings ought to fall beneath a special regulatory class.

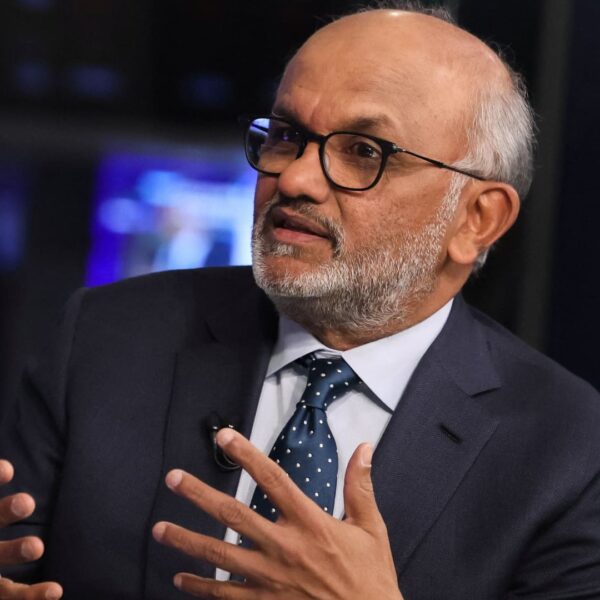

Beginning with SEC Chair Jay Clayton, and persevering with beneath Gensler, the SEC has pursued a marketing campaign of enforcement actions in opposition to crypto companies, arguing the companies are issuing or promoting unregistered securities. With high-profile instances in opposition to firms like Ripple, Coinbase, and Binance, the SEC has sought to increase its jurisdiction over the overwhelming majority of crypto belongings, making the most of an absence of legislative motion in Congress.

Federal judges within the varied instances have to this point taken totally different stances on the securities query, including to the uncertainty. In July, Choose Analisa Torres within the Southern District of New York sent shockwaves by way of the business when she issued a ruling on the long-awaited Ripple case, arguing that direct gross sales of its XRP token to institutional traders like hedge funds constituted unregistered securities, whereas secondary gross sales on platforms like exchanges didn’t.

Later that month, Choose Jed Rakoff, additionally of the Southern District of New York, disagreed along with her logic. In a ruling denying a movement to dismiss by the defendants, a crypto agency known as Terraform Labs, he wrote that he rejected the method.

“The Court declines to draw a distinction between these coins based on their manner of sale, such that coins sold directly to institutional investors are considered securities and those sold through secondary market transactions to retail investors are not,” he wrote.

In December, Rakoff ruled in favor of the SEC and agreed that 4 crypto tokens supplied by Terraform Labs constituted unregistered securities.

The matter has grown extra sophisticated in two high-profile lawsuits introduced by the SEC in opposition to main crypto exchanges, Coinbase and Binance. Not like Ripple and Terraform Labs, the query with the 2 exchanges hinges solely on the buying and selling of tokens on their venues, moderately than the issuance.

Beneath U.S. case legislation, the definition of a safety is drawn from a Supreme Courtroom precedent known as the Howey check, which outlined a safety because the funding of cash in a typical enterprise with the expectation of income derived from the efforts of others. Each firms have sought to dismiss the instances, with their legal professionals arguing that beneath Howey, securities should embody an precise funding contract, which doesn’t exist when buying crypto belongings on an alternate. A 3rd alternate, Kraken, employed the identical logic when looking for to dismiss its personal lawsuit by the SEC. Judges have but to rule on the motions by Coinbase and Binance, and a listening to for Kraken’s movement is scheduled for June.

Insider buying and selling

The SEC’s Coinbase insider buying and selling lawsuit is a extra sophisticated case as a result of not one of the defendants are crypto companies, however as a substitute, people accused of utilizing insider data for private acquire.

In two instances introduced by the SEC and Division of Justice, prosecutors argued {that a} Coinbase worker, Ishan Wahi, shared confidential data along with his brother and buddy, who had been in a position to internet greater than $1.5 million in trades.

From the start, the SEC’s lawsuit has drawn concern from the crypto business. To ascertain jurisdiction for the case, the SEC argued that the defendants had been buying and selling unregistered securities on Coinbase—on this occasion, little-known tokens akin to AMP and DDX, and never main cryptocurrencies like Ether and Solana. Distinguished crypto companies together with Coinbase and Paradigm filed “friend of the court” briefs to problem the SEC.

Wahi and his brother settled with each the SEC and the DOJ, avoiding the chance of a decide ruling within the SEC’s favor on the query of the safety standing of the tokens. That wasn’t the case with their buddy, Ramani, who the SEC believes to be in India, main the company to hunt a default judgment on the case.

On Friday, Lin dominated in favor of the SEC, agreeing that gross sales of the crypto belongings constituted securities, even when bought on secondary markets. In her determination, she argued that the tokens had been broadly promoted by issuers, due to this fact creating an expectation of elevated worth. Moreover, the issuers facilitated buying and selling on secondary buying and selling markets like Coinbase.

“The Court’s analysis remains the same even to the extent Ramani traded tokens on the

secondary market,” Lin wrote, arguing that the promotional statements apply equally to tokens purchased by an investor, whether or not straight from an issuer or on a buying and selling platform. “Each issuer continued to make such representation regarding the profitability of their tokens even as the tokens were traded on secondary markets.”

In consequence, Lin dominated that each crypto asset that Ramani bought and traded constituted funding contracts. Not like Rakoff’s ruling within the Terraform case, Lin’s determination is critical as a result of it entails secondary transactions, moderately than gross sales straight from an issuer. On the similar time, as a result of it was a default judgment, there was no protection offered by the alternative facet, as with the SEC’s lawsuits in opposition to the most important crypto exchanges.

Notably, the lawsuit is within the Western District Courtroom of Washington, which is in the identical appeals circuit because the Kraken lawsuit, which is being litigated within the Northern District Courtroom of California. If one of many instances is appealed to the circuit courtroom, the ruling from the three-judge panel will doubtless apply to the opposite case. Regardless, as a result of a number of lawsuits are being heard in numerous circuits throughout the nation, the query of whether or not crypto belongings represent securities is more likely to make its strategy to the Supreme Courtroom.

A spokesperson for the SEC, Ramani, and Ramani’s lawyer didn’t instantly reply to a request for remark.