New World Development Co. Chief Executive Officer Adrian Cheng has resigned, after the third-generation heir steered the Hong Kong property developer to its first annual loss in two decades.

Cheng will become a non-executive director effective today, the company said in a stock exchange filing on Thursday, confirming an earlier Bloomberg News report. Chief Operating Officer Ma Siu-Cheung will take the CEO role.

Cheng’s unexpected departure comes after the company amassed borrowings that made it the most debt-laden major developer in Hong Kong. His resignation adds to questions over succession at the family conglomerate, whose business also spans from jewelry to logistics.

Cheng, 44, will “devote more time on public services and other personal commitments,” the company said.

The move is rare in Hong Kong’s property industry, where the biggest players are all controlled by families that carefully plan their succession. Long assumed to be a favorite of the late patriarch Cheng Yu-Tung, Adrian had until recently been seen as the heir apparent of the business group led by billionaire Henry Cheng.

New World posted a net loss of HK$17.1 billion ($2.2 billion) for the financial year ended in June, a separate statement showed. The company had earlier warned of the loss, citing asset impairments, losses on investments and higher interest rates. New World’s woes have been compounded by a real estate slump as Hong Kong loses its allure as a financial hub.

Regardless of the outcome of the leadership drama, New World is likely to sell more assets to avoid a liquidity crunch, Bloomberg Intelligence analyst Patrick Wong said before the announcement.

“Its growing urgency to raise cash may prompt it to sell some Hong Kong properties on the cheap, a sign that it’s pushing hard to steady itself after heavy asset writedowns left its balance sheet reeling,” Wong wrote in a note.

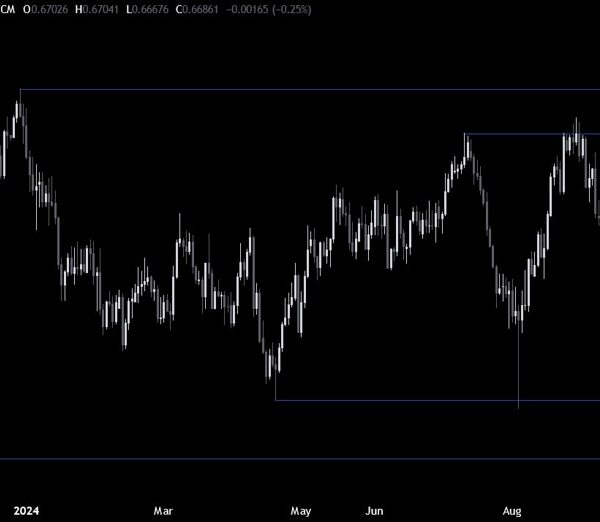

Shares of New World were suspended on Thursday before the announcements. The stock has underperformed its peers, sliding more than 30% since the beginning of the year, compared with the 12.8% decline in the Hang Seng Properties Index as of Wednesday’s close.

New World’s dollar bonds rose to over three-week highs on news of the leadership change. Its 8.625% note due in 2028 climbed 2.3 cents to 93.4 cents, according to Bloomberg-compiled prices. Its 2029 note gained 2.2 cents to 75.5 cents.

New World’s debt level—the highest among its rivals in the past few years—has become a concern for investors amid high borrowing costs and a weak property market. Its net debt to equity was 82.7% at the end of last year, compared with 41.4% at peer Henderson Land Development Co. and 21.2% at Sun Hung Kai Properties Ltd., according to Bloomberg Intelligence.

“We don’t think management change can fix the structural problems facing the company,” said Sam Wong, an equity analyst at Jefferies LLC. “NWD needs to repair its balance sheet in order to meaningfully turn around.” Margin pressure on the residential and retail sectors still cloud the outlook, he added.

But the revamp will likely boost investors’ confidence in the company, even if it doesn’t have a significant impact on its overall operations, according to Jeff Zhang, an analyst at Morningstar Inc. New leadership will likely accelerate debt repayments, he said.

Adrian Cheng joined the family’s flagship developer in 2007 as an executive director and soon helped lead the company before cementing his position as CEO in 2020.

A Harvard graduate with a stint at Goldman Sachs Group Inc. as an investment banker, Cheng has transformed the traditional property company into a brand with artsy apartment blocks and ambitious projects while accumulating heavy debt.

The Cheng family’s succession plan was thrown under the spotlight last year after Henry said he was still looking for a successor for the family’s conglomerate, shattering the previous assumption in the business world that Adrian would pick up the baton. The Chengs, valued at $23.6 billion, are among Asia’s wealthiest clans.