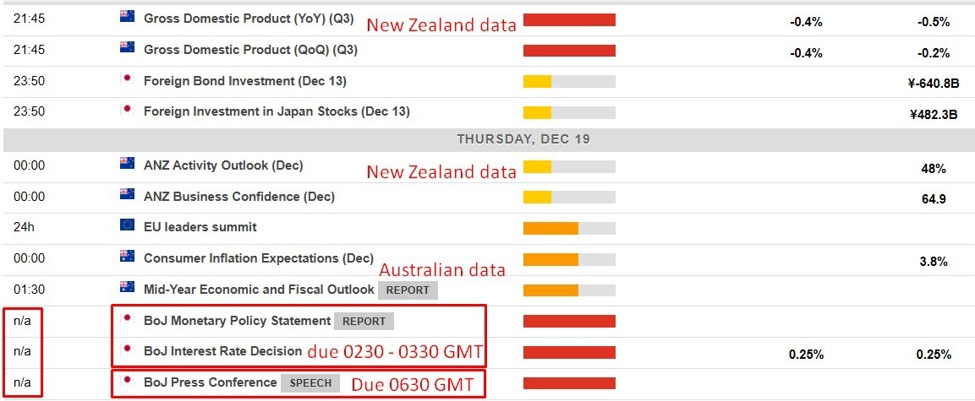

Economic growth data for Q3 2024 is due from New Zealand at 2145 GMT, which is 1645 US Eastern time.

New Zealand’s economic performance in the first half of 2024 was modest, with slight fluctuations in GDP.

First Quarter (Q1) 2024:

- GDP Growth: The economy experienced a 0.2% increase in GDP during the March 2024 quarter, rebounding from a 0.1% decline in the December 2023 quarter.

Second Quarter (Q2) 2024:

-

GDP Contraction: In the June 2024 quarter, GDP contracted by 0.2%, with per capita GDP decreasing by 0.5%.

-

Annual Perspective: For the year ending June 2024, GDP declined by 0.5%, and per capita GDP fell by 2.7%.

-

Sector Performance: The contraction was attributed to declines in several major industries, including retail trade, accommodation, agriculture, forestry, fishing, and wholesale trade.

Q3 data is expected to show continuing contraction, despite the Reserve Bank of New Zealand (RBNZ) implementing a series of interest rate cuts, reducing the Official Cash Rate (OCR) from 5.5% in August to 4.25% by November, and now to 4.25% in December. The impact on Q3 2024 GDP data is likely to be limited due to inherent policy transmission lags and concurrent economic challenges. The full benefits of these monetary policy adjustments are expected to materialize in subsequent quarters.

Economists suggest that the September quarter may represent the low point of the current economic cycle. There is optimism for a modest recovery in the December quarter, with expectations of more robust growth emerging in 2025 as the effects of the RBNZ’s monetary easing become more pronounced. The anticipated recovery is expected to be supported by increased consumer spending and business investment, spurred by lower borrowing costs.

***

More:

-

Immediate Effects: The transmission of monetary policy to the broader economy typically involves a lag. Given that the most recent rate cuts occurred during Q3, their full impact may not be immediately evident in the GDP figures for this quarter. However, early indicators suggest that sectors sensitive to interest rates, such as construction and manufacturing, have begun to stabilize.

-

Sectoral Performance: Despite the rate cuts, the economy faced challenges in Q3. Analysts anticipated a contraction of approximately 0.4% in GDP for the September quarter, with declines observed in construction, wholesale trade, and manufacturing. These sectors were adversely affected by an energy crunch during the winter months, which compounded existing economic pressures.

-

Consumer Spending and Business Investment: While lower interest rates are designed to encourage spending and investment, the immediate response from consumers and businesses has been cautious. High levels of household debt and global economic uncertainties have led to restrained expenditure, potentially dampening the short-term stimulative effect of the rate cuts.