taikrixel

NextEra Vitality (NYSE:NEE) traders have underperformed the S&P 500 (SPX) (SPY) over the previous 12 months, however its strong execution amid a difficult macroeconomic backdrop. I last updated NEE traders in December 2023, assessing the potential of an additional restoration as rates of interest declined from their October 2023 highs. Nonetheless, NEE Bulls misplaced momentum because the market reassessed its optimism concerning the Fed’s price lower cadence. Given the resilience of the US economic system, investors must temper their preliminary expectations of six cuts, suggesting the Fed will not likely shift to a decrease gear in its upcoming March assembly.

NextEra Vitality posted a strong efficiency at NEE’s fourth-quarter earnings launch in late January 2024. It has continued progressing in its core Florida Energy & Mild or FPL utilities enterprise. Accordingly, FPL posted an “increase in adjusted EPS by 22 cents.” Moreover, its ROCE has remained secure at 12.5% whereas it added extra photo voltaic initiatives to its price base, benefiting its push towards renewable vitality. As well as, NextEra additionally posted “a record year of new renewables and storage origination” in NextEra Vitality Sources or NER. The NER enterprise is NextEra’s pure-play clear vitality portfolio, specializing in wind, photo voltaic, and battery storage alternatives. However the difficult 12 months for utilities and renewable vitality firms, NER added about 9K megawatts to its backlog, bolstering its long-term technique.

NextEra Vitality registered an adjusted EPS of $3.17 for FY23, up 9.3%. It marked a big deceleration from FY22’s 13.7% progress. NextEra administration’s ahead steering suggests progress is predicted to sluggish additional this 12 months however stays according to its long-term outlook. Accordingly, NextEra anticipates its adjusted EPS to extend to a midpoint metric of $3.33 in FY24. Nonetheless, the corporate clarified that it anticipates delivering “at or near the top of NEE’s adjusted earnings per share expectations ranges in each year through 2026.”

Consequently, NextEra Vitality thinks there’s enough earnings visibility over the medium time period. It is pivotal towards sustaining the boldness of its dividend traders, because it telegraphed a ten% YoY enhance in dividends per share. Whereas its ahead dividend yield of three.7% is comparatively enticing in comparison with its 10Y common of two.7%, it is a lot much less interesting when in comparison with the 2Y (US2Y), because it final printed 4.54%. Therefore, I assessed that NEE’s near-term thesis would possible rely in the marketplace’s confidence in a faster-than-anticipated price lower, bettering the relative enchantment of its proposition.

Regardless of that, NextEra Energy remains a long-term secular play into sustainable renewable vitality era, supported by its core FPL enterprise. It’s well-primed to learn from the surge in vitality demand from generative AI attributed to the insatiable information facilities. Due to this fact, I assessed that NEE’s scale and experience ought to place it effectively in using the long-term restoration. With NEE valued at an adjusted ahead EBITDA a number of of 12.7x, it is nonetheless markedly decrease than its 10Y common of 13.8x, bolstering its relative enchantment.

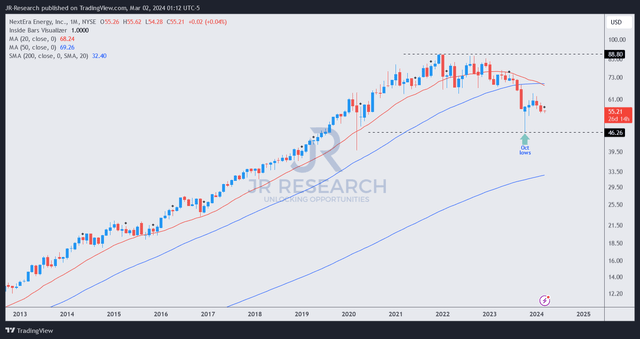

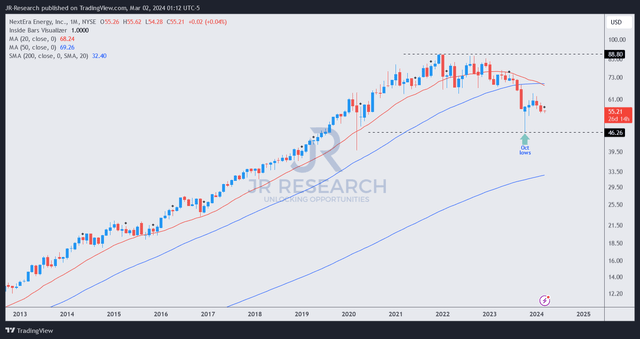

NEE value chart (long-term, month-to-month, adjusted for dividends) (TradingView)

As seen above, NEE’s value motion means that its October 2023 lows have been well-defended by dip-buyers on the $46 stage. Nonetheless, the early restoration towards December 2023 has misplaced momentum because the 10Y (US10Y) bottomed out. Due to this fact, it seems that NEE’s shopping for sentiments are nonetheless influenced by the extent and extent of the Fed’s price cuts. With the Fed anticipated to supply its outlook this month, I assessed near-term sentiments on NEE are anticipated to stay unsure and risky.

Nonetheless, I am assured that NEE’s comparatively enticing valuation and constructive value motion predicated on its October long-term backside ought to entice sturdy shopping for assist on the present ranges.

Ranking: Preserve Purchase.

Necessary word: Traders are reminded to do their due diligence and never depend on the data offered as monetary recommendation. Please at all times apply impartial considering and word that the score will not be meant to time a particular entry/exit on the level of writing except in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a important hole in our view? Noticed one thing vital that we did not? Agree or disagree? Remark under with the purpose of serving to everybody in the neighborhood to study higher!