Eoneren

NN Group (OTCPK:NNGRY) has recently reported its H1 2024 earnings, which were positive, supporting its good income appeal for long-term investors.

As I’ve covered in a previous article, I see NN Group as a good income play in the European insurance sector due to an attractive combination of a high-dividend yield and cheap valuation. As the company has released a couple of weeks ago its earnings related to the first semester of 2024, I think it’s now a good time to update its financial performance and investment case, to see if it remains a good income pick for long-term investors.

H1 2024 Earnings Analysis

NN Group reported a positive operating performance during the first half of 2024 (H1 2024), being in the right direction to reach its business targets set for 2025.

During H1 2024, Annual Premium Equivalent (APE) sales increased by 15% YoY to €451 million and the value of new business (VNB) was up by 21% YoY to €137 million, showing that its commercial momentum is quite good across its business, which bodes well for earnings growth ahead. This good sales performance was broad-based across operating segments, even though protection remains its largest business unit, followed by unit-linked and pension products.

Its operating result was €1.3 billion in the first half of the year, slightly down compared to the same period of last year, driven by its domestic operation both in the life and non-life segments, driven by lower technical margin in the life segment and higher claims in the P&C business.

Due to slightly lower results, its operating capital generation declined by 4% YoY to €959 million in H1 2024, a drop that is justified by lower operating capital in the non-life segment in the Netherlands due to higher claims costs. This was related to large fire claims in the first semester of this year, which resulted in a 27% drop in operating capital in H1 2024. Despite this setback, NN Group’s strong commercial performance bodes well for higher operating capital in the coming quarters, supported NN decision to revise upwards its organic capital generation in 2025 by €100 million, now expecting to reach €1.9 billion during the next year.

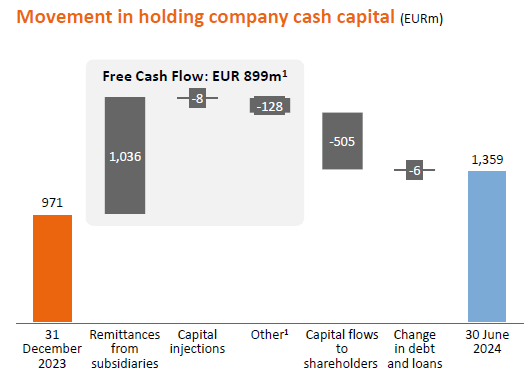

Despite a lower operating result, NN Group’s net profit in H1 2024 increased by 11% YoY due to lower special items, and its free cash flows increased by 8% YoY to nearly €900 million.

Due to its strong cash flows and slightly higher remittances from operating subsidiaries to the holding company level, its cash position increased to €1.36 billion at the end of June, even after returning more than €500 million to shareholders during H1 2024. This shows that its organic cash flow generation is quite good and is more than enough to finance capital returns, which shows NN Group has a strong business model that is highly cash generative.

Cash at holding level (NN Group)

In addition to a good cash flow generation capacity, its capital returns policy is also supported by its capital position, given that is Solvency II ratio was 192% at the end of last June, being quite close to the top of its target range of 150-200% over the medium term.

This means NN has a solid capital position and can deliver an attractive shareholder remuneration policy, as it doesn’t need to retain much earnings. Indeed, this has been its strategy, delivering a growing dividend and performing share buybacks over the past few years.

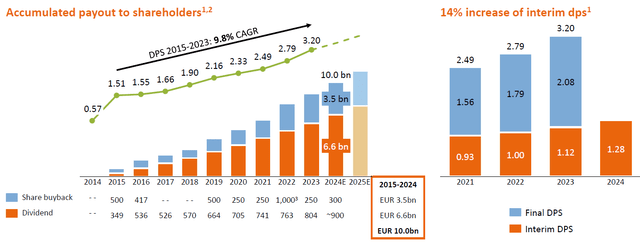

Its last annual dividend was €3.20 per share, representing an annual increase of 14.7%, while its most recent interim dividend was increased by 14% to €1.28 per share. Thus its annual dividend related to 2024 earnings is likely to grow by double-digit to about €3.65 per share. At its current share price, this leads to a forward dividend yield of about 8.2%, which is quite attractive for income investors.

However, according to analysts’ estimates, NN Group is expected to grow its annual dividend only to around €3.42 per share, representing an annual increase of only 7%, which seems quite conservative in my opinion. Therefore, the company seems to have some room to beat market expectations regarding its dividend, which can be a positive catalyst for a higher share price in the coming months.

Regarding its dividend sustainability, based on market estimates for its EPS in 2024, its dividend payout ratio is expected to be about 60% if its dividend is €3.65 per share, which is an acceptable ratio for a mature company like NN Group, thus its dividend seems to be safe, and the company can easily maintain a growing dividend trend without putting its dividend sustainability in jeopardy.

Beyond dividends, NN has also made share repurchases in recent years, which enhances its total capital returns, aiming to perform share buybacks of about €300 million per year. This represents more than 2% of its current market value, which means NN Group’s goal is to return about 10% of its current market value to shareholders, showing that providing an attractive shareholder remuneration is a key management goal like it has done over the past few years.

Another positive step for NN Group’s dividend sustainability is related to its real estate investments, which was to some extent a case of concern due to the cyclical slowdown in the real estate market. However, there are positive signs of a rebound in the sector, especially now that interest rates have started to come down in Europe in recent months. Supported by positive market dynamics in the Netherlands and slightly lower rates, NN Group’s real investment portfolio reported a valuation uplift in H1 2024, mainly supported by residential properties in the Netherlands.

This is justified by the tight supply demand situation in the country, which generally speaking has a lack of available homes to accommodate the strong demand for housing, plus new construction has slowed down due to higher rates over the past couple of years, leading to higher rents and property prices across the country.

While in 2023 its real estate portfolio declined in value by about 10% and this was a headwind for earnings growth, during the first semester of the year its portfolio increased in value by 0.6%, and further valuation uplifts are expected over the next few quarters, supported by increasing residential prices and interest rates cuts.

Regarding its valuation, NN Group is currently trading at about 0.65x book value, a valuation that is practically unchanged compared to when I last covered it. This is among the cheapest in the European insurance sector, which seems to be quite undemanding considering NN Group’s good fundamentals and high-dividend yield. Indeed, compared to its closest peers Ageas (OTCPK:AGESY) and ASR Nederland (OTCPK:ARNNY) the company seems to be quite undervalued, given that both its peers trade above book value.

Regarding its main risks, investors should be aware that insurance companies are exposed to several risks, like natural catastrophes, that can have a negative impact on their profitability, but the major risk I see in the short term for NN Group’s capital position and its dividend is interest rate risk.

Indeed, given its business profile and exposure to long duration liabilities, NN Group’s capital position has negative sensitivity to declining rates, with a decline of 50 bps in the interest rate curve impacting its solvency ratio negatively by two percentage points. However, this seems to be a manageable sensitivity as the company made a large reinsurance operation recently to reduce its interest rate risk, thus while a declining interest rate environment is not positive for its capital ratio, its dividend seems to be safe over the coming years.

Regarding its main risks, investors should be aware that insurance companies are exposed to several risks, like natural catastrophes, that can have a negative impact on their profitability, but the major risk I see in the short term for NN Group’s capital position and its dividend is interest rate risk.

Indeed, given its business profile and exposure to long duration liabilities, NN Group’s capital position has negative sensitivity to declining rates, with a decline of 50 bps in the interest rate curve impacting its solvency ratio negatively by two percentage points. However, this seems to be a manageable sensitivity as the company made a large reinsurance operation recently to reduce its interest rate risk, thus while a declining interest rate environment is not positive for its capital ratio, its dividend seems to be safe over the coming years.

Conclusion

NN Group has reported a positive operating performance during the first semester of 2024, boding well to reach its business goals in 2025. This is clearly supportive for its capital returns strategy, which continues to be the most attractive feature of its investment case. On top of that, its shares appear to be undervalued in the European insurance sector, making NN Group an interesting income pick over the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.