Prapat Aowsakorn/iStock Editorial through Getty Photographs

Introduction

On June 16, 2023, we revealed a comparative article between Realty Revenue (O) and NNN REIT (NYSE:NNN) and whereas each shares had been really helpful, the article concluded that Realty Revenue supplied a greater worth on the time. NNN is down about 3.55% from the time of the publication of that earlier article and we take this chance to assessment our evaluation in gentle of the present macroeconomic circumstances. On this article, we begin by taking a look at how rates of interest have an effect on REITs normally phrases. We define the present atmosphere that NNN operates in and infer how this may influence their efficiency. We then drill down and quantify how a lot worth NNN is ready to create within the present financial local weather. We assessment their capitalization price, or cap price, and evaluate this with their present price of capital. We then transfer to measure how a lot of the worth created accrues to fairness traders of NNN’s inventory and evaluate this with an unbiased estimate of truthful worth for the shares. All through the article, we join salient facets of NNN’s enterprise mannequin with the quantitative metrics employed. When applicable, we spotlight variations with Realty Revenue, a key competitor. On the finish, a conclusion is introduced and an funding suggestion supplied.

4 Methods Curiosity Charges Have an effect on REITs

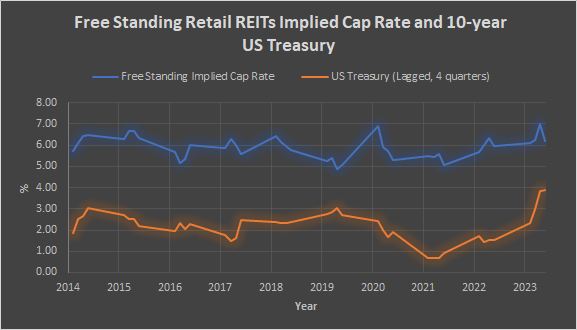

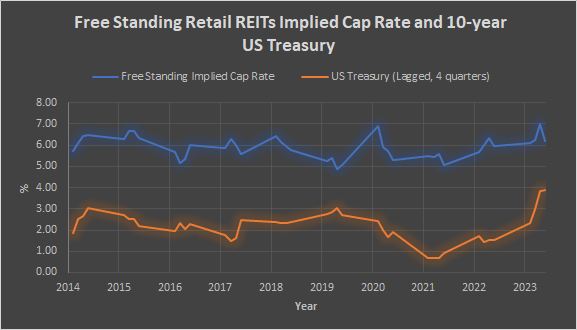

Please check out Exhibit 1 which presents the unfold between the Implied Cap Charge of the Free Standing Retail Subsector and the US 10-year Treasury from 2014 to 2023 utilizing quarterly durations. The figures for the US 10-year Treasury are lagged 4 quarters. We discovered the next predictive energy with the lag and interpret it to imply that it takes a few 12 months for change in rates of interest to have an effect on the cap charges.

Exhibit 1: Unfold between 10-year Treasury and Implied Cap Charges. Supply: St. Louis Fed and Nareit.

The common unfold between the US 10-year Treasury and the implied cap price through the interval was 373 foundation factors. For This fall, 2023, that unfold was solely 233 foundation factors. Having a narrower-than-usual unfold is a headwind for REITs. Buyers may doubtlessly shift their allocation from REITs into safer and comparatively high-yielding fixed-income investments which might have the impact of miserable the inventory worth of REITs. For instance, from January 2014 to December 2023 utilizing month-to-month time durations, the dividend yield of the FTSE Nareit Fairness Free Standing Index was, on common, 96 foundation factors above the efficient yield of the ICE BofA BBB US Corporate Index. In February of this 12 months, the yield differential was solely 16 foundation factors.

One other potential situation with increased rates of interest is when it comes time to refinance debt. REITs, by advantage of their authorized construction, are required to distribute 90% of taxable earnings annually and are due to this fact depending on exterior capital to finance development. In an rising rate of interest atmosphere, debt should be refinanced at the next price. As Kevin Habicht, NNN’s CFO, identified within the recent earnings call, there’s a $350 million of three.9% debt coming due in June. Changing that debt with a ten-year issuance would in all probability have a mid-5% price. This one refinance will unlikely make a cloth influence on NNN’s working efficiency, however the longer rates of interest keep elevated, the extra debt that was issued at a decrease rate of interest regime should be refinanced on the increased price.

The third motive that rates of interest influence REITs has to do with the expectations of the extent of future charges. If the expectation is that rates of interest will start to reasonable later this 12 months, then sellers of actual property might resolve to attend till later within the 12 months when financing is extra accessible and consequently extra patrons are lively out there. The CME FedWatch Tool has a 61.8% likelihood of a 25-basis minimize for the June twelfth FOMC Assembly.

One other potential headwind for REIT acquisition exercise in 2024 versus 2023 is that in 2023 many regional banks weren’t deploying capital as a result of they had been coping with their very own disaster which was additionally brought on by rates of interest. Increased rates of interest decreased the worth of the belongings on their books. Many regional banks adopted a posture of preserving capital fairly than deploying capital. Right here is NNN’s CEO Steve Horn commenting on the problem:

…the 2024 pipeline at present is just not as massive as 2023, however 2023 was a historic excessive for us, and that was a results of the banking market the place our tenants on the regional banks weren’t deploying capital, so that they got here to us for cash. So, we had a extremely sturdy 12 months in 2023.”

I’m not going to say 2024 is going to be a larger opportunity in 2023 because the regional banks are starting to lend a little bit more.”

A last motive that rates of interest might influence a REIT’s efficiency is that REIT tenants are themselves affected by increased charges. Increased curiosity expense reduces profitability and free money circulation. This final motive might be not going to have a lot influence on NNN as a result of their tenants are in comparatively sound form. When the gathering of rental earnings from a tenant is deemed not possible, the tenant is switched to money foundation for accounting functions. For 2023, 5% of NNN’s annual base lease was on money foundation. That is down from 7% in every of 2022 and 2021. Additionally, deferred lease agreements that had been negotiated with tenants through the Covid-19 pandemic are being fulfilled by tenants on schedule.

Supply: NNN REIT Annual Supplemental Data for 2023, This fall 2023 Earnings Name.

Now that now we have a basic thought of the macroeconomic setting that NNN operates in, allow us to quantify the worth that their enterprise mannequin is ready to generate at present.

Unfold Investor

NNN owns 3,532 properties with an combination gross leasable area of about 36 million sq. ft positioned in 49 states. As of year-end, 99% of the properties leased with a weighted common lease time period of 10.1 years. NNN leases the property on a triple-net foundation which requires the tenant to pay all utilities and taxes related to the property and keep the inside and exterior of the property. In essence, NNN is a selection investor. They acquire capital from collectors and traders and put that capital to make use of by buying actual property belongings and leasing them out on a triple-net foundation. What makes this enterprise mannequin work is that if NNN can entry debt and fairness markets and finance the acquisition of actual property at a decrease price than the rental earnings earned. NNN earns an financial revenue that’s the distinction between the lease earned and the fee to amass the true property for which the lease is generated. For us to guage the well being of their enterprise, we want some measure of this financial revenue or unfold. The broader, the higher. For a REIT, this unfold might be estimated because the distinction between the cap price and the price of capital. The cap price is usually the web working earnings divided by the asset worth and the price of capital is the price of debt financing and the price of fairness financing in proportion to how a lot of every is utilized by the enterprise.

Allow us to consider every of those.

Supply: NNN REIT 10-K for 2023

Cap Charge

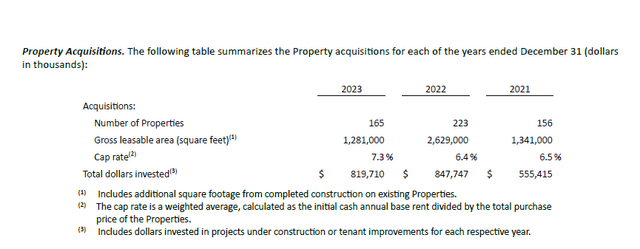

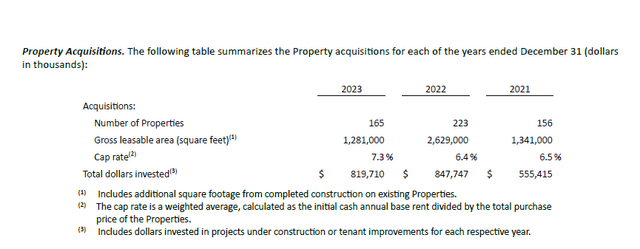

Please check out Exhibit 2 presents NNN REITs property acquisitions for 2021 by way of 2023. Clearly, NNN has adjusted their acquisition cap charges to replicate the macro image. If we solely contemplate This fall 2023 as disclosed within the earnings name, NNN deployed $270 million in 40 properties at an preliminary cap price of seven.6%. We will use this estimate because the cap price NNN is ready to obtain at present. For NNN to create worth in immediately’s market, their price of capital have to be lower than 7.6%.

Exhibit 2: NNN Cap Charges. NNN REIT 10-Ok for 2023

Price of Capital: Debt

NNN enjoys an funding grade BBB+ long-term issuer score from Customary & Poor’s and a Baa1 score from Moody’s. A agency’s credit standing is concentrated on its credit score danger. And credit score danger has to do with assessing the obligor’s capability to make promised principal and curiosity funds in accordance with the bond indenture. NNN has a 5.6% be aware that’s buying and selling at a premium to par that matures in October 2033. The be aware exchanged fingers on April third at a yield of 5.53%. We will use this as our estimate of NNN’s price of debt. Ought to NNN require to faucet debt markets immediately, that is probably the fee they’ll incur for debt financing. Please check out Desk 1 for particulars.

| Desk 1: Issuer Score and Price of Debt | ||

| Description | Score/Yield | Outlook/Maturity |

| Customary & Poor’s | BBB+ | Steady |

| Moody’s | Baa1 | Steady |

| 5.6% Observe | 5.53% | October, 2033 |

Supply: NNN REIT Institutional Investor Replace, February 2024.

Price of Capital: Fairness

There are completely different strategies and philosophies round calculating the price of fairness. We use the Capital Asset Pricing Mannequin (CAPM) wherein we basically add a selection to the risk-free price and scale the unfold by the beta statistic of the actual inventory. Allow us to assessment this in some element. Please check out Desk 2.

| Desk 2: Price of Fairness | |

| β | 1.00 |

| Danger-free price | 4.35% |

| Fairness danger premium | 3.73% |

| Price of fairness | 8.08% |

Supply: www.cnbc.com

The beta statistic is a measure of systematic danger. It’s measured by regressing the returns of the inventory towards the market. The inventory’s beta is a measure of danger that’s of a unique dimension than the credit score danger measured as a part of the estimate of the price of debt. The emphasis with beta is how the degrees of debt and the variability of the income stream impacts the inventory worth in relation to the market as a complete. On this specific case, the market is represented by the FTSE Nareit Fairness Free Standing Index for which NNN REIT is a constituent. I’ve carried out a regression on the month-to-month returns of NNN’s inventory towards that of the index and have provide you with a beta of 1.0 which isn’t shocking given that it’s the second largest constituent.

For the risk-free price, I take advantage of the US 10-year Treasury which is a generally used proxy for the risk-free price.

The fairness danger premium is solely the 373-basis level unfold noticed between the implied cap price of the Free Standing Retail subsector and 10-year Treasury as talked about on the high of the article. It’s a measure of the premium required by traders over the 10-year Treasury given the chance profile of the asset class.

Now that now we have the price of debt and the price of fairness financing, we now weigh every supply of capital in proportion to how a lot of every is used within the enterprise. NNN doesn’t have any most popular shares excellent. Please take a look at Desk 3 for NNN’s capital construction.

| Desk 3: Capital Construction | ||

| Type of Capital | Worth($ hundreds of thousands) | Weight |

| Fairness market capitalization | $ 4,361 | 41.98% |

| Whole debt | $ 6,026 | 58.02% |

| Whole | $ 10,387 | 100% |

We now have the inputs we have to estimate NNN’s weighted common price of capital. Please see Desk 4.

| Desk 4: Weighted Common Price of Capital (WACC) | |

| Weight of debt | 58.02% |

| Weight of fairness | 41.98% |

| Price of debt | 5.53% |

| Price of fairness | 8.08% |

| WACC | 6.60% |

The tax defend usually included within the calculation of the WACC is ignored as a result of REITs don’t pay taxes on the company degree.

In Desk 5, we calculate the distinction between NNN’s cap price and the weighted common price of capital. This unfold is a measure of how a lot financial revenue NNN is ready to generate given their working atmosphere and their price of capital. NNN is ready to generate an financial revenue of 100 foundation factors.

| Desk 5: Cap Charge Minus WACC | |

| Cap Charge | 7.60% |

| WACC | 6.60% |

| Distinction | 1.00% |

Producing 100 foundation factors of worth within the present atmosphere is an excellent quantity. As a tough comparability, I not too long ago calculated Realty Income’s worth creation to be 86 foundation factors. It additionally exceeds the 35 foundation factors of worth generated on the time of the earlier article. There are caveats and differing assumptions employed in every article, so a exact differential wouldn’t be applicable. Having stated that, in my opinion, it’s truthful to say that NNN in all probability creates extra worth as a enterprise than Realty Revenue at present and that it creates extra worth immediately than in June 2023..

Creating worth as a enterprise is a crucial however not a adequate motive to think about an funding within the inventory. It’s simply as necessary to ask “To whom does that value accrue to?” Administration? Mounted earnings holders? Fairness traders?

To reply this query, we revisit the price of fairness calculation we carried out after we estimated the price of capital.

We estimated the price of fairness utilizing CAPM which is a statistical methodology of ascertaining the price of fairness. There are different strategies to calculate the price of fairness. Additionally, price of fairness is the terminology used from the corporate’s perspective. It’s the price for them to acquire fairness capital. From an investor’s perspective, the price of fairness is the required price of return. And for a lot of traders, notably REIT traders, the required price of return has two elements: the present dividend yield and the expansion price of the dividends.

Please check out Desk 6 which presents NNN’s whole return as a mixture of the present dividend yield and the expansion price of the dividends.

| Desk 6: Whole Return | |

| Dividend yield | 5.44% |

| 10-year dividend CAGR | 3.40% |

| Whole return | 8.84% |

Supply: Searching for Alpha

In Desk 7, we evaluate the entire return with the price of fairness calculated utilizing CAPM. The price of fairness on this case might be considered the chance price for investing within the inventory akin to a “hurdle rate”. The unfold of 76 foundation factors means that NNN’s inventory is priced with some margin of security.

| Desk 7: Whole Return Minus Price of Fairness | |

| Whole return | 8.84% |

| Price of fairness | 8.08% |

| Distinction | 0.76% |

Conclusion

Regardless of the macro headwinds, NNN was in a position to capitalize on alternatives in 2023. Their acquisition quantity was positively impacted by headwinds for regional banks. Whereas, they do face the prospect of refinancing debt at increased rates of interest as they arrive due, this can in all probability be offset by the optimistic tendencies in cap charges as evidenced by the 7.6% cap price achieved in This fall 2023 versus 7.3% for all of 2023. That is additionally properly above the ten-year common implied cap price of the subsector of 5.91%.

NNN has a proud 34-year historical past of dividend will increase. For these considering publicity to the Free Standing Retail area at an inexpensive worth with a shareholder oriented administration workforce on the helm, NNN’s inventory affords an excellent worth.