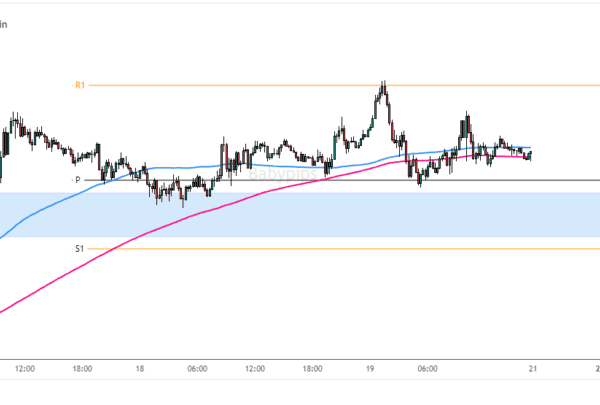

Regardless of decentralized exchanges (DEXs) rising as pivotal gamers within the crypto world, current reports point out a major shift of their market share relative to centralized exchanges (CEXs). Based on the most recent evaluation by crypto analytics agency Kaiko, DEX buying and selling volumes skilled a notable improve in November, reaching $29 billion.

This resurgence marks a restoration from the multi-year low noticed in September, but it stays a stark distinction to the all-time excessive of roughly $124 billion recorded in Might 2021, based on Kaiko.

The Shift In Crypto Market Share: DEX Vs. CEX

The rise in DEX buying and selling quantity, whereas substantial, appears much less influenced by main platforms equivalent to Uniswap and Curve on the Ethereum blockchain and PancakeSwap on the BNB Chain, which have proven a comparatively unrushed development tempo.

The fluctuating dynamics between decentralized and centralized exchanges are evident out there share information. In November 2020, the crypto business reached its peak public curiosity in decentralized finance (DeFi), with DEXs capturing a ten% market share of the general alternate quantity.

Nonetheless, this determine has seen a gradual decline, dropping from 5% in January 2023 to only 3% in November of the identical 12 months. This lower in market share turns into extra obvious when inspecting particular exchanges.

As an illustration, Uniswap, the most important DEX, holds a market share of about 40% relative to Coinbase, a number one CEX. This comparability, whereas exhibiting Uniswap’s significance, additionally highlights the hole that also exists between decentralized and centralized alternate fashions.

In the meantime, Binance‘s spot market share has declined from 55% at the beginning of the 12 months to 30.1% this month, based on CCData,

Binance’s Declining Share And DOJ’s Intense Oversight

The decline in Binance’s spot market share is a vital issue to contemplate. This modification, seems to be significantly pushed by regulatory challenges and the authorized points confronted by its former CEO Changpeng Zhao.

Lately, the US Division of Justice (DOJ) gained intensive oversight over Binance following the $4.3 billion settlement. Former SEC Chief of Web Enforcement John Reed Stark make clear this growth in an X publish, noting that the US authorities now holds important management over Binance’s operations.

Breaking Information: A Binance Double Whammy. 1) Newly Unsealed US DOJ Filings May Imply the Finish of Binance; and a pair of) SEC Information Supplemental Pleading Towards Binance, Strengthening the SEC Binance Lawsuit Exponentially

There’s been a flurry of newly launched Binance-related filings… pic.twitter.com/igN2I9Y7cP

— John Reed Stark (@JohnReedStark) December 9, 2023

This stage of scrutiny, described as unprecedented, signifies that Binance is required to implement rigorous compliance measures throughout its insurance policies, procedures, and inside controls, impacting each its buyer and third-party relationships.

Featured picture from Unsplash, Chart from TradingView